Last updated on Feb 17, 2026

Get the free Assumption Agreement of Loan Payments template

Show details

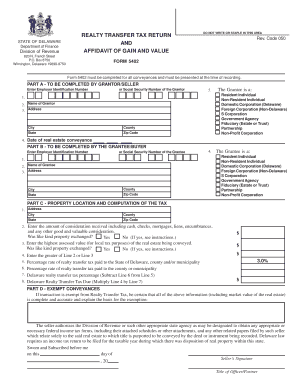

This form is an Assumption Agreement. The form provides that the grantee will assume a lien on property described in the agreement. The assumption will become effective on the date provided in the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is assumption agreement of loan

An assumption agreement of loan is a legal document that allows one party to take over the responsibility of a loan from another party.

pdfFiller scores top ratings on review platforms

It has made a world of difference in my job satisfaction.

I JUST GOT IT TODAY AND HAVE ALREADY FINISHED SEVERAL DOCUMENTS !

I definitely like the layout on the actual site, however, I do not like the way the emails look.

I received some paperwork that needed to be signed and sent back to sender in a timely manner. PDFfiller was the only way I could do this. I had no access to a printer or fax machine. I'm trying to learn all of the use of the PDFfiller. I am currently trying to learn how to download some of my saved papers and sign them, then send them out. I forgot how I did it yesterday.

I like the features but need to know more about it and have additional training

A desktop version would be nice so I could do this offline!

Who needs assumption agreement of loan?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Assumption Agreement of Loan Form

Filling out an assumption agreement of a loan form involves understanding the legalities surrounding the transfer of a loan obligation from one party to another. This comprehensive guide outlines the essential elements, instructions, and best practices necessary for completing this document correctly.

What is an assumption agreement?

An assumption agreement is a legal document that allows a buyer (grantee) to assume the financial obligations of a seller (grantor) under an existing loan. This process is often utilized in real estate transactions when property ownership is transferred. Understanding the roles of both parties involved, the grantor, and the grantee, is crucial for ensuring compliance with the loan's terms.

-

The party transferring their obligation or responsibilities under a loan.

-

The party assuming the loan obligations, usually as part of a property purchase.

-

A lien is a legal right or interest a lender has in the borrower's property, granted until the borrower’s debt obligation is satisfied.

What are the essential components of the assumption agreement?

The components of an assumption agreement provide structure and legality to the document. Key elements include the date of agreement, property details, and specifics related to the deed of trust. Additionally, understanding indemnification clauses is vital, as they outline the responsibilities each party has concerning legal claims or liabilities.

-

The official date when the assumption is recognized.

-

Information about the property involved in the loan transfer, including address and valuation.

-

Details regarding the collateral of the loan, including the lender's claims against the property.

-

All fiscal obligations, including principal balances and agreed-upon payment timelines.

-

Stipulations detailing which party is responsible for legal claims arising from the assumption.

How do fill out the assumption agreement form?

Completing an assumption agreement form requires careful gathering of necessary information. Begin by collecting property descriptions and verifying the identities of all parties involved. Each section of the form must reflect accurate information, including how monthly payments will be structured.

-

Collect necessary documentation, including property descriptions and parties' identities to ensure correct statements.

-

Follow specific guidance provided in the form to fill out each required field accurately.

-

Detail how monthly payments will be managed and documented to avoid miscommunication.

-

Double-check all entries to prevent legal issues from incomplete or incorrect documents.

Why do lenders matter in an assumption agreement?

Lenders play a crucial role in the assumption agreement process, particularly concerning consent. They must approve the transfer of obligations, and understanding when this consent is needed can significantly affect the outcome of the agreement.

-

Lender consent is essential for ensuring the new grantee is capable of fulfilling loan obligations.

-

In most cases, lenders require their approval to guarantee both parties' financial security.

-

Lender approval can affect loan terms and the overall acceptance of the agreement.

What are the notary requirements for validity?

A notary public plays a significant role in executing an assumption agreement, lending legal validity to the document. Familiarity with state-specific notary requirements is critical to ensure that the agreement holds up under legal scrutiny.

-

Notaries verify the identities of signatories and witness the signing of the document.

-

Notary laws vary by state; understanding these can prevent legal complications.

-

Failing to notarize can lead to disputes over the agreement's authenticity.

What common mistakes should avoid?

Completing the assumption agreement form can be tricky, and several common mistakes can hinder the process. Being mindful of where errors might surface can eliminate confusion and ensure a smoother transaction.

-

Leaving out essential fields like property details can invalidate the agreement.

-

Clearly defining indemnification responsibilities can prevent future liabilities.

-

Assuming quick lender responses can stall the entire process.

How can pdfFiller help manage completed agreements?

pdfFiller offers a variety of features designed to facilitate document management, especially once an assumption agreement is completed. The platform allows users to upload, collaborate, and finalize documents effortlessly through its cloud-based system.

-

Upload and manage all forms securely in the cloud for easy access.

-

Work with other parties using interactive tools within the platform.

-

Use secure e-signatures to finalize agreements promptly.

-

Implement effective filing systems to keep documents orderly and easily retrievable.

What is the legal framework surrounding loan assumptions?

Navigating the legal framework of loan assumptions is crucial for ensuring compliance and understanding risks. Each state has specific regulations guiding loan assumptions that must be adhered to avoid legal complications.

-

Each state has unique laws governing loan assumptions; understanding these is vital.

-

Defaulting on terms can lead to litigation or foreclosure.

-

Know the necessary compliance steps to avoid future disputes.

In conclusion, the assumption agreement of loan form is a critical document that requires careful attention to detail and adherence to legal standards. By understanding its components, the roles of involved parties, and utilizing tools such as pdfFiller, individuals can navigate the process efficiently.

How to fill out the assumption agreement of loan

-

1.Access pdfFiller and log in to your account.

-

2.Search for the 'assumption agreement of loan' template.

-

3.Open the template to start editing it.

-

4.Fill in the borrower's details including full name, address, and contact information.

-

5.Enter the original loan details such as loan number, outstanding balance, and lender’s name.

-

6.Specify the terms of the loan assumption, including interest rate and payment schedule.

-

7.Include any necessary signatory lines for all parties involved in the agreement.

-

8.Review the document for completeness and accuracy, ensuring all fields are filled in correctly.

-

9.Save your progress frequently to avoid losing your information.

-

10.When ready, download the document or send it for electronic signatures using pdfFiller's tools.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.