Get the free Simple Promissory Note for School template

Show details

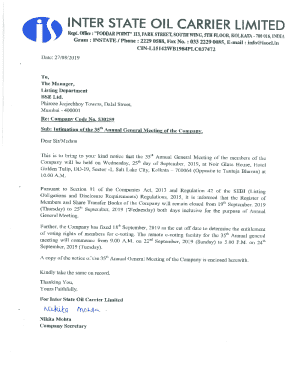

An assignment means the transfer of a property right or title to some particular person under an agreement, usually in writing.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is simple promissory note for

A simple promissory note is a written agreement in which one party promises to pay a specified sum to another party under agreed terms.

pdfFiller scores top ratings on review platforms

Super-easy to use and lots of great features!

It's been so helpful and has made life a breeze!

It has streamlined the process of billing insurance for our practice and cut the time it take to fill out the necessary paperwork down 80%.

Its good software but i found I had to keep going back through to make sure nothing had moved.

This is very helpful - lifesaver actually.

I do real estate & its perfect for the things I need, completing disclosures & sending out forms.

Who needs simple promissory note for?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to simple promissory note for form form

Creating a simple promissory note for form form is a straightforward process that anyone can undertake with the right guidance. This kind of document serves as a written promise to pay a specified amount of money at a certain time, making it essential in loan agreements or personal transactions. Knowing how to navigate this process will empower you to handle financial agreements effectively.

What is a simple assignment of promissory note?

A promissory note is a legal document in which one party (the maker) promises to pay a specific sum to another party (the payee) under agreed terms. The importance of this note lies in its role in formalizing the agreement and protecting the rights of both parties. The assignment process involves transferring the rights of the note from one party to another, which can have legal implications depending on the jurisdiction.

-

A promissory note is a legally binding document outlining a promise to repay a debt.

-

It safeguards the interests of lenders and borrowers by providing a formal record.

-

It is often used in personal loans, business transactions, or any debts that need documentation.

What are the components of a simple promissory note?

A well-crafted promissory note contains several essential elements that validate its legality and clarity. This includes the names and addresses of both the maker and payee, the principal amount being borrowed, the interest rate (if applicable), and the maturity date. Ensuring that these details are correctly stated is crucial, as discrepancies can lead to misunderstandings or legal issues.

-

Clearly list the borrower and lender's information to ascertain identity.

-

Specifying the exact amount is vital for clarity and legal enforcement.

-

Detail the interest rate and schedule for repayments.

How do you fill out a simple promissory note?

Filling out your promissory note accurately is key to avoid any future disputes. Start by entering the correct personal details of both the assignor (borrower) and the assignee (lender). It’s also important to clearly specify the note details including the amount borrowed, the repayment date, and the meeting terms to ensure all parameters are defined.

-

Accurately enter full names and addresses of both parties involved.

-

Clearly outline the total amount, date of repayment, and interest rates.

-

Check local laws and statutes to ensure your note adheres to regional regulations.

Why use pdfFiller for document management?

Utilizing pdfFiller can streamline the process of creating and managing your simple promissory note. This platform not only provides tools to fill out, edit, and sign your document, but it also offers collaboration features and cloud-based storage for easy access. The convenience of a fully integrated eSigning feature ensures your documents remain legally binding and secure.

-

Easily sign documents digitally, ensuring their validity without physical paperwork.

-

Allows multiple users to work on the document simultaneously, enhancing efficiency.

-

Keep your documents safely stored and accessible from any device or location.

What legal considerations should you know when using a simple promissory note?

Understanding the legal intricacies surrounding promissory notes is crucial for their enforceability. Generally, a promissory note is valid as long as it is executed properly, but issues can arise from incomplete information or misunderstood terms. Being aware of state-specific regulations can significantly impact how your note is interpreted and enforced legally.

-

A well-constructed promissory note is often enforceable in a court of law.

-

Incomplete notes or ambiguous terms can lead to disputes or legal challenges.

-

Each state may have unique requirements that could alter how notes are viewed.

What common mistakes should you avoid when creating a simple promissory note?

Errors in drafting a promissory note can lead to serious consequences. Common pitfalls include omitting essential details, using vague language, or failing to comply with legal requirements. Ensuring that you double-check all information before signing can prevent most issues.

-

Check for missing signatures, incorrect amounts, and vague terms.

-

Before finalizing, confirm all entered details correspond to the agreed terms.

-

Resources like pdfFiller can aid in reducing errors by providing templates and guidelines.

What are the next steps after completing your promissory note?

After filling out your simple promissory note, it’s essential to know what to do next. Safe storage of the document is critical for future reference, and understanding how to handle disputes or make changes post-signing is equally important. Utilizing the ongoing document management features of pdfFiller can help streamline these processes.

-

Store copies of your note in easily accessible but secure locations.

-

Be prepared to refer back to the note if any disagreements arise.

-

Continue using pdfFiller for any future edits or document requirements.

How to fill out the simple promissory note for

-

1.Open pdfFiller and select 'Create New Document' to start from a blank slate.

-

2.Search for 'simple promissory note' in the templates section to find a suitable format.

-

3.Once you've selected a template, begin by adding the date at the top of the document.

-

4.Fill in the names and addresses of both the lender and the borrower below the date.

-

5.Specify the amount being borrowed clearly in figures and words.

-

6.Next, describe the interest rate if applicable; ensure it's easy to understand.

-

7.Indicate the repayment terms, including when payments will be made and the total duration of the note.

-

8.If there are any penalties for late payments, detail these in this section.

-

9.Sign the document along with the lender's signature to make it official.

-

10.Once complete, save the document and review it to ensure all information is correct before distributing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.