Get the free Invoice 2 template

Show details

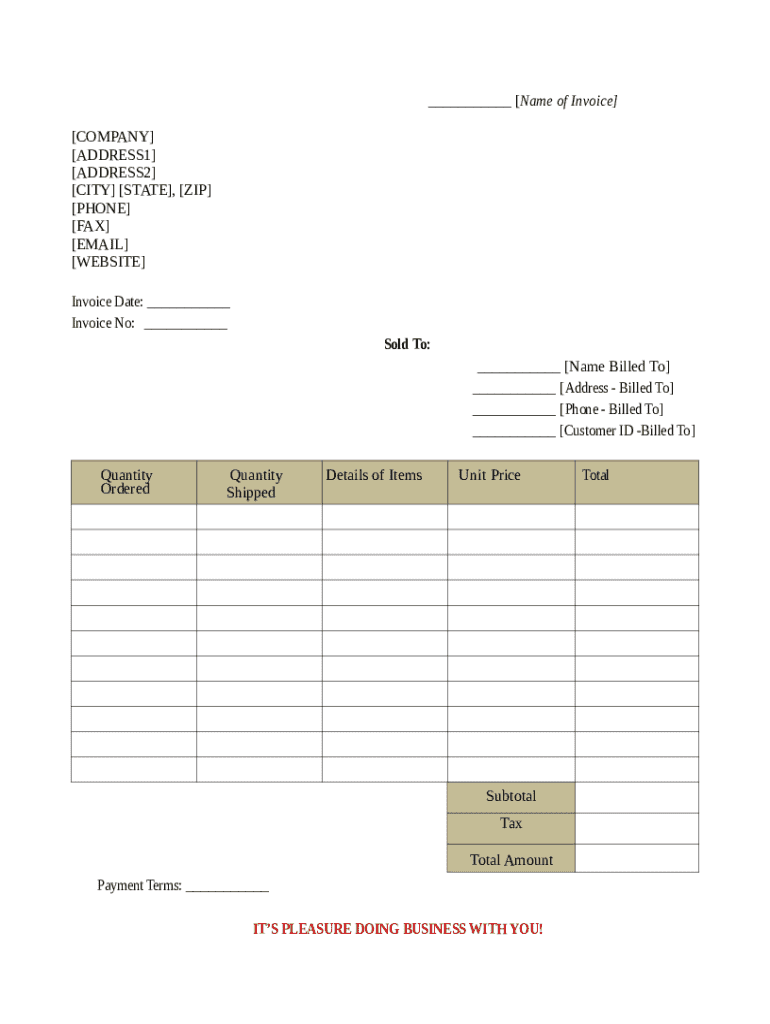

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is invoice 2

An invoice 2 is a detailed document used to request payment for goods or services provided, typically containing itemized charges, total amounts, and payment terms.

pdfFiller scores top ratings on review platforms

very helpful and easy to navigate

awesome product

EXCELLENT

so far it works wonderful.. I am on trial though. We will see if it worth it and will keep it.

perfectoo

Easiest form site

Who needs invoice 2 template?

Explore how professionals across industries use pdfFiller.

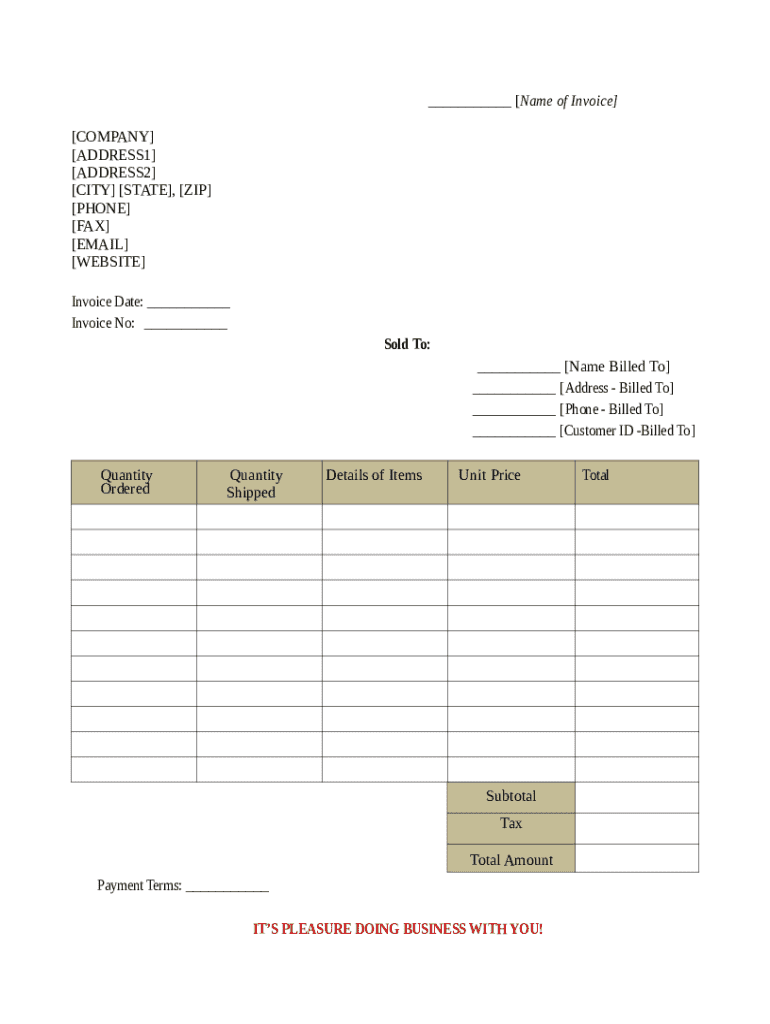

Comprehensive Guide to Filling Out an Invoice 2 Form

Filling out an invoice 2 form properly is essential for any business, whether large or small. This guide aims to provide you with all the information you need to navigate through the invoice creation process efficiently.

What is the purpose of an invoice?

An invoice serves as a detailed record of goods or services provided, along with their respective costs. It is important for both sellers and buyers as it outlines payment expectations and terms.

-

An invoice is a document issued by a seller to a buyer that specifies the amount and cost of products or services rendered. It acts as a request for payment.

-

There are various types of invoices, including pro forma, standard, and credit invoices, each used in different scenarios depending on the business transaction.

-

Digital invoices are more efficient, easily editable, and often include automated tracking of payments, reducing manual errors compared to traditional paper invoices.

What are the key components of an Invoice 2 Form?

Understanding the components of an Invoice 2 Form is crucial for effective invoice management. Each field plays a pivotal role in ensuring clarity and accuracy.

-

This includes company name, contact details, date, and invoice number, which are crucial for record-keeping and identification.

-

Listing quantities, unit prices, and total amounts helps both the service provider and client comprehend what they are paying for.

-

Clearly stating payment terms and conditions prevents disputes and sets expectations for how and when payment should be made.

How can fill out my Invoice 2 Form step-by-step?

A step-by-step approach can simplify the process of completing your Invoice 2 Form. Following a checklist ensures that you don't miss any necessary fields.

-

Start by filling in your company's name and contact information, followed by the client's details.

-

Detail the products or services offered, ensuring you provide accurate quantities and prices.

-

Be accurate in this section to avoid payment issues later. Include due dates, late fees, and payment methods.

How can use pdfFiller to create a professional invoice?

pdfFiller provides a variety of features that can enhance your invoice creation experience, making it easier to generate professional documents.

-

The platform allows users to create, edit, and manage invoices seamlessly, ensuring high-quality output.

-

Utilizing interactive tools can save time and improve efficiency when filling out the necessary information.

-

pdfFiller’s capabilities in eSigning and team collaboration streamline the approval process for invoices.

What are best practices for invoice management?

Effective invoice management is key to maintaining cash flow and ensuring a smooth operational process for your business.

-

Implementing a structured filing system for invoices aids in easy retrieval and tracking over time.

-

Sending invoices promptly and following-up on unpaid invoices significantly enhances the collection process.

-

Keeping accurate invoicing records helps in analyzing business efficiency and identifying areas for improvement.

What common mistakes should avoid when filling out an invoice?

Being aware of common errors in invoice completion can save both time and potential disputes with clients.

-

Common mistakes include incorrect amounts, missing fields, and inaccurate client information, which can lead to payment delays.

-

Always double-check details before sending invoices to clients to minimize disputes.

-

Establish a clear process for addressing invoicing mistakes if they arise to maintain good customer relations.

How to navigate customer service and support?

Navigating the customer service options available through pdfFiller can greatly enhance your invoice experience.

-

pdfFiller offers multiple customer service channels, providing assistance for invoice-related queries.

-

Users can conveniently find resources that address common issues through pdfFiller support channels.

-

Take full advantage of pdfFiller’s support channels to resolve any challenges you encounter.

How to fill out the invoice 2 template

-

1.Open the invoice 2 template in pdfFiller.

-

2.Enter your business name and contact information at the top of the document.

-

3.Fill in the client’s name and address in the appropriate fields.

-

4.List the products or services provided, including descriptions, quantities, and prices in the itemized section.

-

5.Calculate the subtotal by adding up all item amounts; ensure accuracy.

-

6.Include any taxes or fees applicable, and calculate the total amount due.

-

7.Define the payment terms, specifying due dates and acceptable payment methods.

-

8.Proofread the invoice for accuracy before sending.

-

9.Save the completed invoice and send it to your client either via email or a shared link.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.