Get the free pdffiller

Show details

This form is a general form of a revocable trust agreement. Trusts can be revocable or irrevocable. The revocable trust can be amended or discontinued at any time. An irrevocable trust cannot be modified

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is revocable trust for estate

A revocable trust for estate is a legal arrangement that allows a person to retain control over their assets during their lifetime while designating how those assets will be managed and distributed after their death.

pdfFiller scores top ratings on review platforms

This was very helpful in completing my assigned task

it's great - all the old forms that I needed I found - easy to use

A little combersome navigating but pretty good overall

Makes everything look professional that I send out.

I did not know about PDFfiller.com but once I found it and realized what great features were offered and how easy it was to navigate and use, I was definitely impressed. I love the features since I work a lot with PDF documents and now I can make corrections or additions without recreating the entire document.

PDFfiller makes my job much easier.

A little clunky moving back and forth through the document. other than that, it worked as promised. thanks

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Creating a Revocable Trust on pdfFiller

Creating a revocable trust can simplify estate management and asset distribution after death. In this comprehensive guide, we'll explore everything you need to know about completing a revocable trust for estate form form, how to utilize pdfFiller to make the process seamless, and the critical aspects of trust management.

What is a revocable trust?

A revocable trust, often referred to as a living trust, is a legal document that allows you to specify how your assets will be distributed during your lifetime and after your death. Unlike irrevocable trusts, revocable trusts can be modified or revoked entirely as long as the trustor is still alive, providing flexibility to adapt to changing circumstances.

-

This type of trust allows the creator to maintain control over the assets, making adjustments as needed.

-

Revocable trusts can be changed anytime, whereas irrevocable trusts generally cannot, providing different levels of asset protection and control.

-

Many believe that revocable trusts provide full asset protection, but they do not shield assets from creditors.

What are the benefits of establishing a revocable trust?

Establishing a revocable trust offers several advantages that can simplify estate management. First, it allows the trustor to modify the trust as personal or financial circumstances change, maintaining flexibility in planning. Second, it can lead to potential tax benefits and avoid the lengthy probate process.

-

A revocable trust allows changes to be made easily without the need for court intervention.

-

While revocable trusts are usually not tax-exempt, they can still help manage estate taxes effectively.

-

Assets within a revocable trust can pass directly to beneficiaries without undergoing probate, expediting access to funds.

What are the drawbacks and considerations?

While revocable trusts offer numerous benefits, there are also drawbacks to consider. Setting up such a trust requires careful planning and can involve costs. Moreover, because these trusts do not provide complete asset protection, they might not shield against creditors.

-

Creating a revocable trust can incur legal and administrative fees that some may find burdensome.

-

Assets in a revocable trust can still be accessed by creditors in case of financial troubles.

-

The trustor must regularly update the trust documentation and manage the assets, which can be time-consuming.

When is a revocable trust appropriate?

Revocable trusts can be highly beneficial in various scenarios, particularly where estate planning flexibility is necessary. Individuals who require control over their assets while preparing for future needs often find this option advantageous. Additionally, analyzing the differences between wills and trusts can help clarify the best choice for specific estate planning goals.

-

Ideal for families with complex assets or those wanting to avoid probate.

-

A revocable trust can provide more control than a will, especially regarding how and when assets are distributed.

-

Laws governing trusts can vary by state, necessitating awareness of local regulations.

What steps are involved in setting up a revocable trust?

Setting up a revocable trust typically involves several key steps to ensure proper documentation and execution. Begin by gathering necessary information, including details about the trustor and trustee, and choosing the right template that suits your needs from pdfFiller. Finally, fill out the trust form accurately and review it carefully before finalizing the agreement.

-

Collect relevant data such as names and addresses of the trustor, trustee, and beneficiaries.

-

Selecting an appropriate revocable trust template can simplify the process significantly.

-

Focus on key sections like the Trustor's name and trust estate details to ensure completeness.

-

Once filled, double-check for accuracy and completeness before signing.

What does a general form of a revocable trust agreement look like?

A typical revocable trust agreement consists of crucial fields and clauses that define the relationship between the trustor, trustee, and beneficiaries. It is important to understand the structure of the document to ensure it conforms to legal standards and meets your needs.

-

Includes Trustor, Trustee, and a comprehensive description of the trust estate.

-

Critical clauses such as Revocation and Amendment terms ensure the trustor retains control.

-

Examples of common situations may include trusts for minor children or specific asset distribution instructions.

How do you manage your revocable trust?

Post-establishment management of a revocable trust is an ongoing responsibility that requires attention and adjustment. The trustor must be prepared to maintain the trust, making updates as circumstances change. Understanding the trustee's responsibilities is critical for effective management.

-

Regularly updating the trust document is essential to reflect changes in assets or circumstances.

-

The trustor retains the right to amend or revoke the trust if needed, ensuring continuous control.

-

Trustees must manage the trust actively and ensure compliance with its terms.

When should you involve professionals?

Engaging professionals can make the creation and management of a revocable trust more efficient and compliant with legal requirements. Consulting with an attorney can help navigate complex legalese, while financial and tax advisors can offer valuable insights into asset management and implications for estate taxes.

-

A qualified attorney can provide tailored advice for trust creation, ensuring it meets all legal standards.

-

Financial advisors can help manage trust assets and ensure they align with your overall financial plan.

-

Engaging a tax professional is beneficial to understand potential estate tax implications and compliance.

How to utilize pdfFiller for document management

pdfFiller provides an excellent platform for editing and managing revocable trust documents. You can easily customize forms to fit your needs, and utilize collaboration features to ensure appropriate feedback and approvals. Its cloud-based capabilities allow for tracking changes and maintaining records conveniently.

-

The intuitive interface allows you to fill in and customize your revocable trust form with ease.

-

The platform provides tools for electronic signatures and team collaboration.

-

A cloud-based system ensures that all versions are saved, simplifying document management.

What are the state-specific regulations for revocable trusts?

Laws regarding revocable trusts can significantly vary by state, which is crucial to understand when setting one up. Being aware of local laws and requirements ensures compliance and can help streamline the trust management process. pdfFiller facilitates this by providing customizable templates that comply with state standards.

-

Different states may have specific documentation or procedural requirements for revocable trusts.

-

Researching how state regulations differ can inform your approach and planning.

-

Utilizing compliant templates ensures your trust is legally sound and recognized in your state.

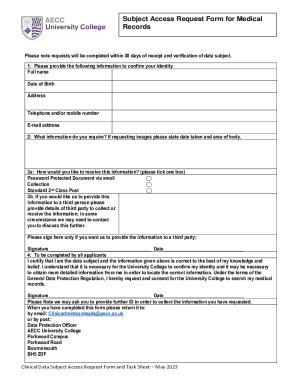

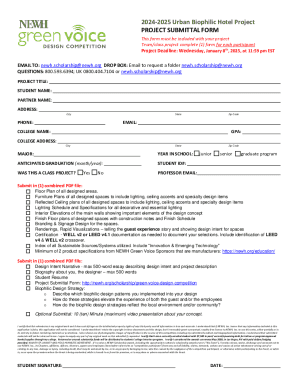

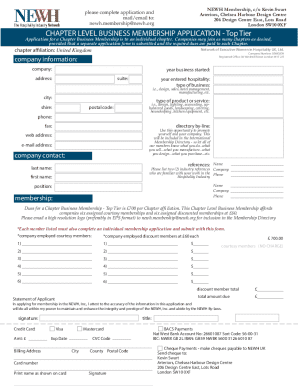

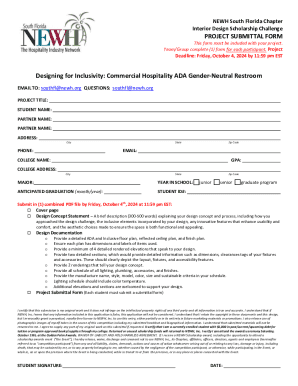

How to fill out the pdffiller template

-

1.Download the revocable trust template from pdfFiller.

-

2.Open the document in pdfFiller.

-

3.Begin by entering your full name and address in the designated fields.

-

4.Specify the trustee's name and address, typically yourself or a trusted individual.

-

5.List the beneficiaries, including names and relationships.

-

6.Detail the assets to be placed in the trust, including real estate, bank accounts, and personal property.

-

7.Set up any specific terms, such as conditions for distributions to beneficiaries.

-

8.Review the document for accuracy and completeness, ensuring all sections are filled correctly.

-

9.Use pdfFiller's tools to electronically sign and date the document.

-

10.Download a copy for your records and provide copies to the trustee and beneficiaries.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.