Get the free Direct Deposit for OAS template

Show details

Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a recipient of a government entitlement or benefit program such as social security,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is direct deposit form for

A direct deposit form is a document that authorizes an employer or organization to deposit funds directly into a bank account.

pdfFiller scores top ratings on review platforms

I find pdfFiller to work amazing for me…

I find pdfFiller to work amazing for me through covid-19. It is the ultimate online experience and help for online to-do's :) Genuinely and honestly, everything in one place, quick and tidy and professional. Thank you

So far it has been a good deal

great program

very helpful

so useful!

So useful for my job: I can correct pdf, put my signature and save them.

quick and easy

Who needs direct deposit for oas?

Explore how professionals across industries use pdfFiller.

A guide to completing your direct deposit form

What is direct deposit?

Direct deposit is a secure and efficient way for employees to receive their paychecks electronically. Instead of paper checks, funds are directly deposited into an employee's bank account, ensuring timely payment without the hassle of going to the bank. The benefits include faster access to funds, reduced risk of check loss or theft, and the convenience of automatic deposits.

How does direct deposit work with payroll?

Employers initiate direct deposits through payroll software that calculates wages and generates electronic funds transfers to employees' accounts. This process often operates on a predetermined schedule, ensuring employees receive their paychecks on time, whether weekly, biweekly, or monthly.

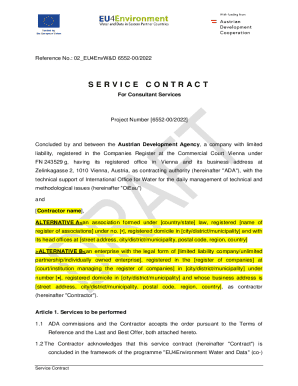

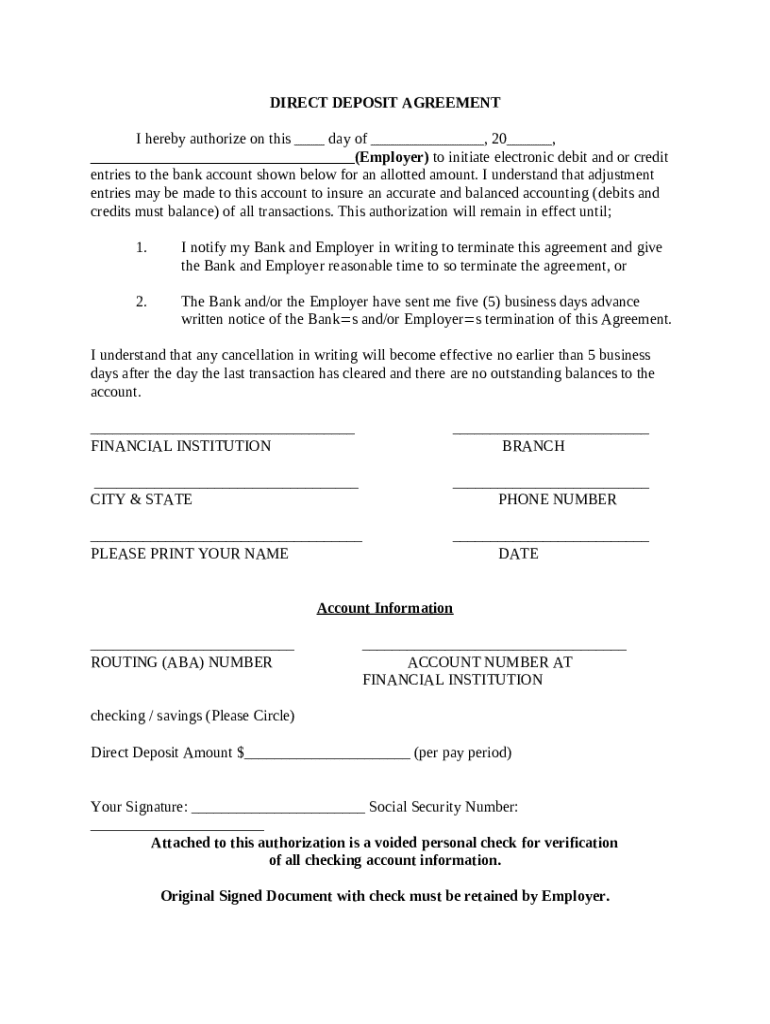

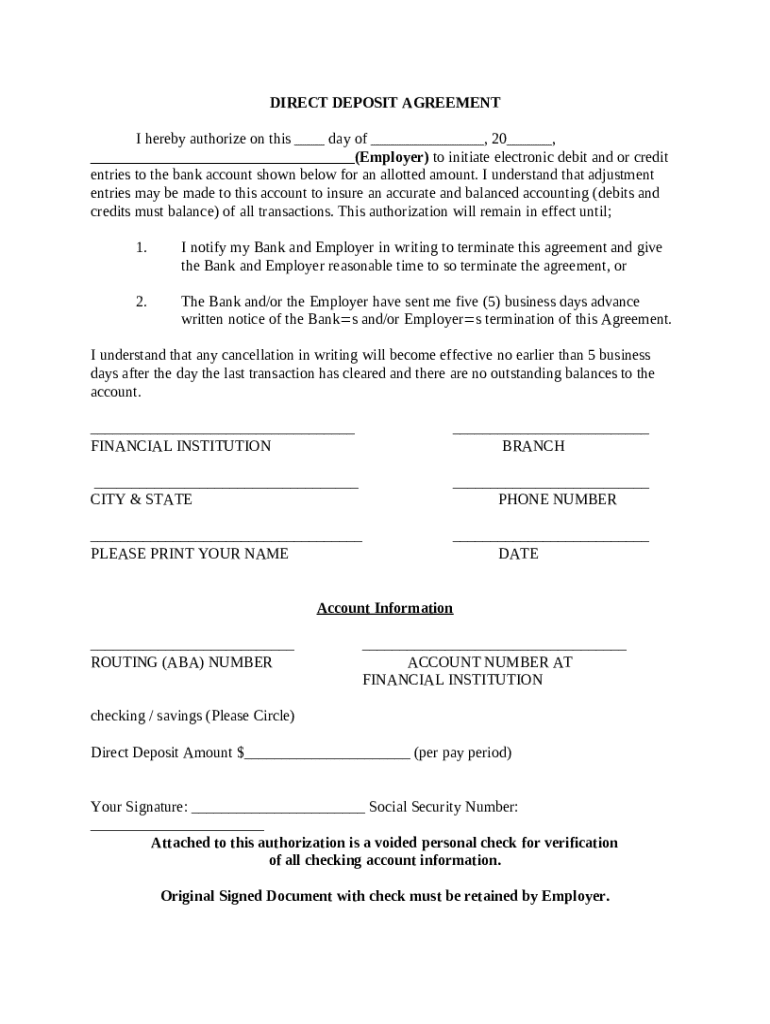

What are the key components of a direct deposit agreement?

A direct deposit agreement typically includes several important components designed to formalize the employee's consent to receive payments electronically. Critical sections often authorize the employer to deposit funds and outline the details about debit and credit entries that will occur as part of the transaction.

-

This section grants the employer permission to deposit funds electronically.

-

This includes bank account numbers and routing numbers necessary for transactions.

-

Clarifies the need for potential adjustments in case of payroll errors.

How do you fill out a direct deposit agreement?

Filling out a direct deposit agreement requires careful attention to detail. It involves entering essential details such as your employer's information, your financial institution's details, and your own bank account information accurately. Pay special attention to routing and account numbers to avoid delays in payment.

-

Include your employer's name and address for verification.

-

Provide details for your bank, including its name and address.

-

Accurately enter these numbers to ensure proper deposit channels.

How to terminate a direct deposit agreement?

To terminate a direct deposit agreement, you must notify both your employer and your bank in writing. It's important to check the required notice period, which can vary by employer, to avoid any unexpected interruptions in pay. During this process, you may need to fill out a termination form provided by your employer or bank.

What account information is required?

When setting up direct deposit, you may need to consider whether to use a checking or savings account, as each has its own pros and cons regarding access and interest. Most importantly, ensure that your bank account is able to handle direct deposits, and provide a voided check for verification. Also, specify how much of your pay should be deposited.

-

Decide based on convenience and your needs; checking accounts are often preferred for direct deposits.

-

Indicate what portion of your pay checks you want deposited into the account.

-

A voided check can serve to confirm your account details.

How do you sign and submit the agreement?

The signing and submission of the direct deposit agreement is crucial—it must be done carefully to avoid errors. The original signed document is often required for validity, so ensure you submit it to your employer directly or through a secure method. Keep a copy for your personal records as proof of your agreement.

What are your rights under the direct deposit agreement?

As a consumer, you have specific rights concerning electronic payments and direct deposits. If discrepancies arise or if there are issues with your deposits, you can file a complaint with your bank or employer. Knowing these rights helps protect your financial transactions.

What does the direct deposit agreement form look like?

The direct deposit agreement form includes several sections that require attention before submission. Familiarize yourself with highlighted areas where you need to input specific details. Using tools like pdfFiller can facilitate document management and ensure changes can be made easily.

Using pdfFiller for your direct deposit agreement

pdfFiller is an excellent platform for managing your direct deposit agreement. With its editing and e-signing features, navigating the completion of your form becomes straightforward and efficient. Additionally, the cloud-based nature allows you to access your documents from anywhere, streamlining your forms management process.

How to fill out the direct deposit for oas

-

1.Open the direct deposit form on pdfFiller.

-

2.Enter your name and contact information at the top of the form.

-

3.Provide your bank account details, including account number and routing number.

-

4.Select the type of account (checking or savings) for the deposit.

-

5.If applicable, indicate the amount to be deposited per paycheck.

-

6.Review the form for accuracy, ensuring all information is complete and correct.

-

7.Sign and date the form to authorize direct deposit.

-

8.Submit the completed form electronically or print it, and then submit it to your employer or the relevant organization.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.