Get the free Revocable Living Trust for Grandchildren template

Show details

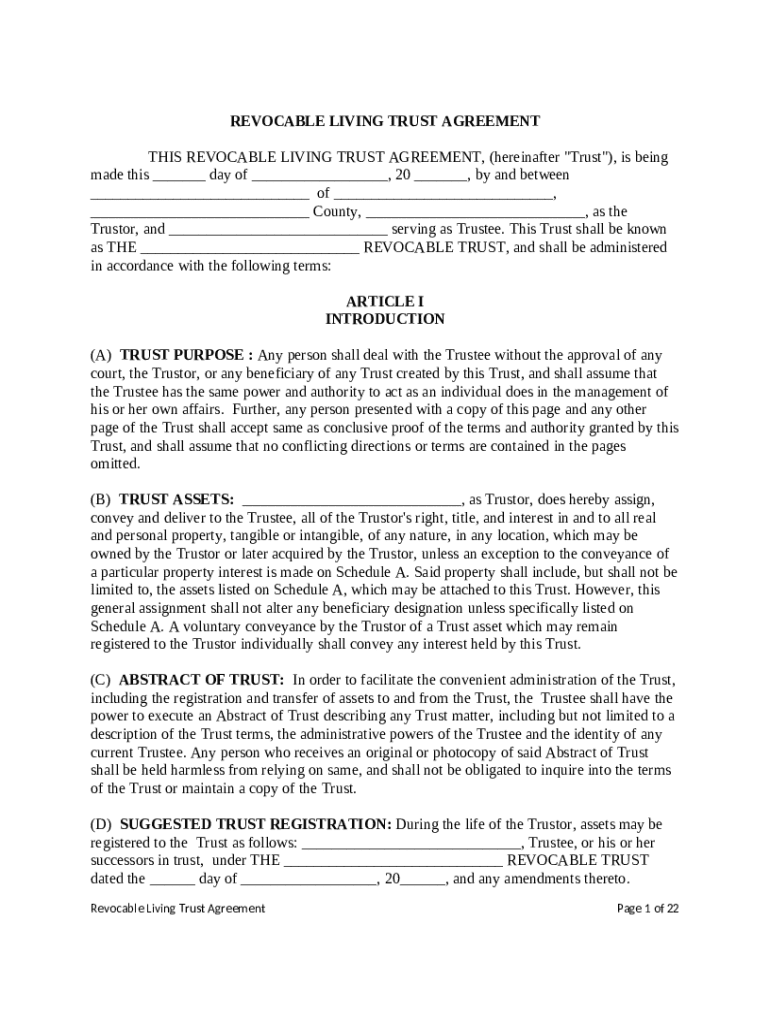

Trustor and trustee enter into an agreement to create a revocable living trust. The purpose of the creation of the trust is to provide for the convenient administration of the assets of the trust

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is revocable living trust for

A revocable living trust is a legal document that allows a person to place their assets into a trust during their lifetime, which can be altered or dissolved at any time before death.

pdfFiller scores top ratings on review platforms

I don't have to use PDF filler very often because of my Adobe product, but when I do need it, it is extremely useful! Easy to use and very efficient!

I have this to be very helpful and efficient.

Love how easy it was to find, type and print certificates.

Fantastic saver of time and additional technology!!

Excellent program! What else is there to say.

This is a wonderful service. I appreciate its ease of use.

Who needs revocable living trust for?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Revocable Living Trusts on pdfFiller

A revocable living trust is a powerful estate planning tool that allows individuals to manage their assets during their lifetime and dictate how those assets will be distributed after their passing. This comprehensive guide will walk you through everything you need to know about creating a revocable living trust form, from its purpose to essential components.

-

Understand the concept and function of a revocable living trust.

-

Learn about the differences between a revocable trust and a will.

-

See the importance of a trust in your estate planning strategy.

What are the advantages of setting up a revocable living trust?

A revocable living trust offers numerous advantages that make it an attractive option for estate planning. One significant benefit is the ability to avoid probate, which can be a lengthy and costly process. Additionally, a living trust ensures the privacy of your assets since, unlike a will, it does not go through public probate proceedings.

-

Avoiding probate and its associated costs.

-

Ensuring privacy of your assets.

-

Flexibility in managing trusts during the Trustor's lifetime.

-

Streamlined asset management for beneficiaries.

What are the limitations and disadvantages of a revocable living trust?

While revocable living trusts offer many benefits, they come with limitations and potential downsides. One primary concern is the ongoing maintenance required, including managing the assets and reviewing the trust as life circumstances change. Additionally, the trust does not provide protection against creditors during the Trustor's lifetime.

-

Ongoing maintenance requirements for the trust.

-

Potential costs involved in setting up and managing the trust.

-

No protection from creditors during the Trustor's life.

When should you consider establishing a revocable living trust?

Certain life events or circumstances may prompt you to consider setting up a revocable living trust. For instance, if you have recently married or had children, creating a trust can be a proactive step in ensuring their future. Additionally, complex family dynamics or health issues can impact your estate planning decisions.

-

Life events that may necessitate creating a trust (e.g., marriage, children).

-

Complex family dynamics and asset ownership considerations.

-

Long-term health issues and their impact on estate planning.

What are the steps to establish a revocable living trust?

Establishing a revocable living trust involves several critical steps. Firstly, you'll need to identify the Trustor, the person creating the trust, and choose a Trustee, who will manage the trust. Drafting a solid Trust Agreement is essential, including all necessary components to secure your wishes.

-

Identifying the Trustor and choosing a Trustee.

-

Drafting the Trust Agreement with essential components.

-

Funding the trust with assets and transferring ownership.

-

Regular reviews and updates to the trust.

What are the key components of a revocable living trust agreement?

A revocable living trust agreement must contain several key components to be valid. This includes identifying the Trustor and the Trustee, describing the trust assets, and outlining the rights and responsibilities of both the Trustee and beneficiaries. Additionally, revocation clauses will specify the conditions under which changes can be made.

-

Identification of the Trustor and the Trustee.

-

Description of trust assets and property - relevance of Schedule A.

-

Rights and responsibilities of the Trustee and beneficiaries.

-

Revocation clauses and conditions for changes.

How can you customize a revocable living trust template?

Using a template can streamline the process of creating a revocable living trust. At pdfFiller, you can find comprehensive templates that include essential sections found in a trust agreement. Customizing these templates is straightforward, allowing you to adapt the clauses to fit your specific needs.

-

Overview of the common sections found in a trust agreement.

-

How to customize a template using pdfFiller.

-

Examples of completed trust clauses for better understanding.

Who is involved in a revocable living trust?

Understanding the roles of individuals involved in a revocable living trust is crucial. The Trustor creates the trust, the Trustee manages it, and beneficiaries are those who will receive the assets. Outlining these roles clearly can prevent misunderstandings and ensure that everyone is aware of their responsibilities.

-

Roles of the Trustor, Trustee, and beneficiaries.

-

Responsibilities outlined for each party.

-

Potential alternate Trustees and their functions.

What state-specific considerations exist for revocable living trusts?

When planning your revocable living trust, it's essential to be aware of the state-specific laws that may affect its creation and management. Each state has variations in regulations governing trusts, which can impact the validity and enforcement of the trust. Compliance with local laws is crucial.

-

Variations in state laws that affect trust setup.

-

Importance of compliance with local regulations.

-

Resources for finding state-specific legal requirements.

How does a living trust differ from a revocable trust?

Clarifying terminology is important; while all living trusts are revocable, not all living trusts are the same. A revocable living trust allows flexibility during the Trustor's lifetime, while an irrevocable living trust does not allow changes once established. Understanding these distinctions can guide your estate planning choices.

-

Clarifying terminology and differences.

-

Situations where one might be preferable over the other.

-

Common misconceptions about living trusts.

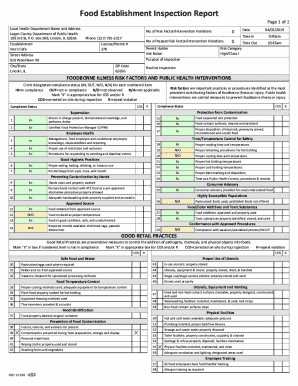

How to fill out the revocable living trust for

-

1.Access the pdfFiller website and log in or create an account.

-

2.Search for 'revocable living trust' in the document library.

-

3.Select the appropriate template from the search results.

-

4.Fill in your name and contact information in the designated fields.

-

5.List the assets you wish to place in the trust, including property and financial accounts.

-

6.Designate a trustee who will manage the trust, along with successor trustees if necessary.

-

7.Specify the beneficiaries who will receive the trust assets upon your death.

-

8.Review all entries for accuracy and completeness before finalizing the document.

-

9.Save the completed trust document and print it out for signatures.

-

10.Sign the trust in the presence of a notary, if required, to ensure its validity.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.