Last updated on Feb 17, 2026

Get the free Direct Deposit for Stimulus Check template

Show details

Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a recipient of a government entitlement or benefit program such as social security,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is direct deposit form for

A direct deposit form is a document used to authorize an employer or agency to deposit funds directly into a bank account.

pdfFiller scores top ratings on review platforms

ok cost me money so my daughter can go to school for scholarships

Needs to have more intuitive directions. Overall satisfied.

Easy to use, fantastic for all your fill in needs.

I'm amazed at how well it does with filling and editing. There are sooooo many features that I am still learning. Great product.

I really like working with this program I am do my trial version buy I will be purchasing this one its reliable.

Just getting started, but so far so good!

Who needs direct deposit for stimulus?

Explore how professionals across industries use pdfFiller.

How to fill out a direct deposit form for your payroll

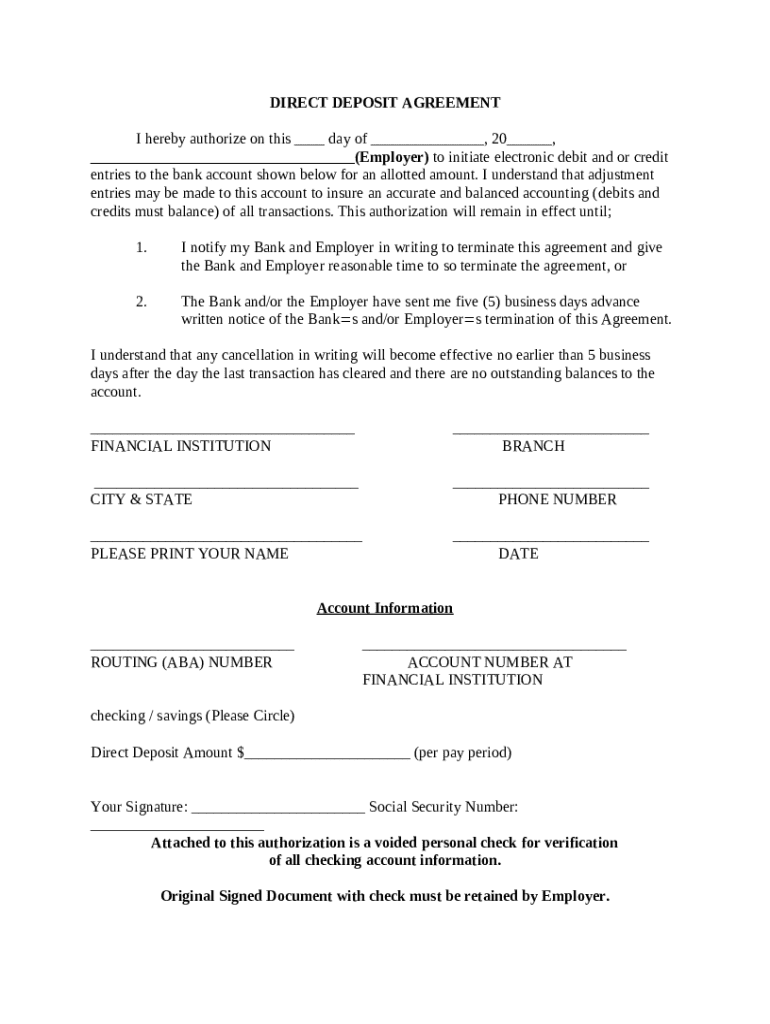

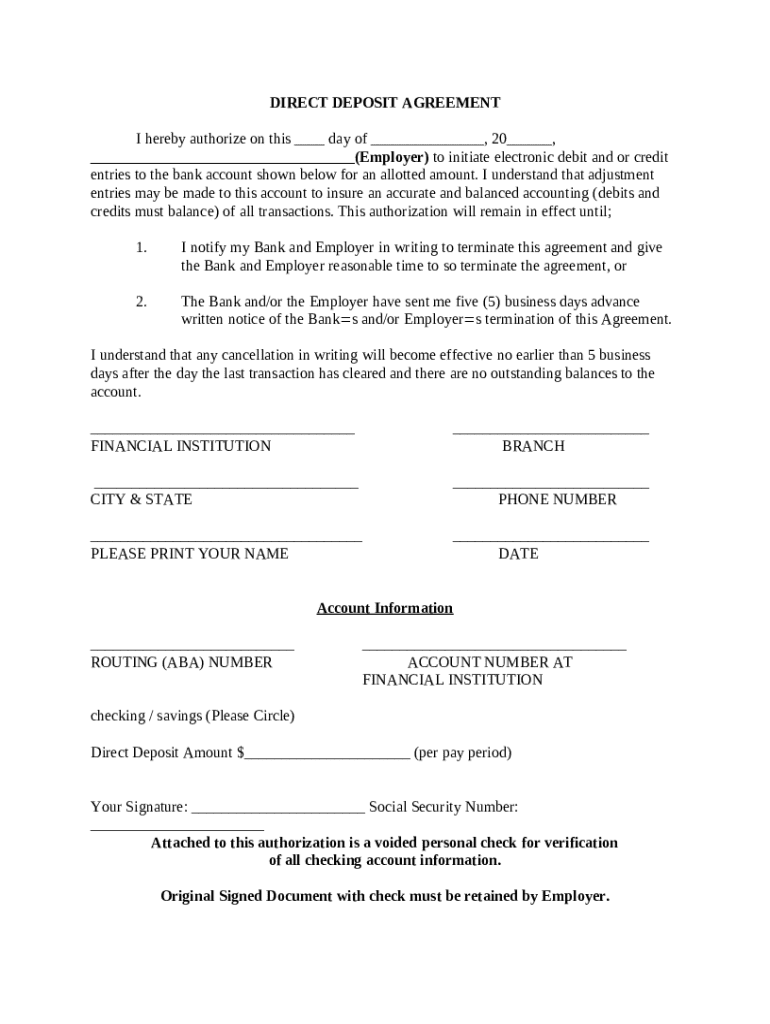

Understanding the Direct Deposit Agreement

A Direct Deposit Agreement is a legal document allowing employers to deposit funds directly into employees' bank accounts. This arrangement benefits both parties, as employees enjoy faster access to their earnings while employers streamline payroll processes. Ensuring the accuracy of information filled in the form is crucial to avoid any disruptions in payments.

-

The agreement facilitates electronic payment of salaries directly into employees' accounts.

-

Employees benefit from instant access to funds, while employers reduce administrative costs associated with checks.

-

Mistakes can lead to delayed payments, creating inconvenience for employees.

What are the key sections of the Direct Deposit Agreement?

The Direct Deposit Agreement usually includes several critical sections that outline the terms and conditions of the arrangement. Each section must be carefully understood and completed to ensure smooth processing.

-

This statement grants the employer permission to deposit payments directly into the employee's bank account.

-

These clauses specify how long the agreement is valid and how either party can terminate it.

-

Accurate bank account information, including bank name and account numbers, must be provided.

How to fill out the direct deposit form: A step-by-step guide

Filling out the direct deposit form may seem daunting, but following a structured process can make it easy. Here’s a detailed step-by-step guide.

-

Start by inputting your full name, address, and Social Security number.

-

Include your employer's name and payroll department contact details for reference.

-

Enter your bank's routing number and your account number. Ensure accuracy to prevent errors.

-

Decide if you want the entire paycheck deposited or a specific portion (if allowed).

-

Sign and date the form to validate your authorization.

What are common mistakes to avoid when completing the form?

Completing the direct deposit form requires attention to detail. Avoiding common mistakes can save you time and headaches.

-

Double-check these numbers as errors can prevent deposits into your account.

-

A missing signature renders the form invalid, causing delays.

-

Some employers may require a voided check to verify account ownership, so always check your employer's requirements.

How can pdfFiller help manage your Direct Deposit Agreement?

pdfFiller offers a user-friendly platform that simplifies the management of your Direct Deposit Agreement. The platform provides powerful tools suited for individuals and teams looking for seamless editing and collaboration.

-

You can easily fill out or modify your direct deposit form at any time online.

-

Sign documents electronically, ensuring a quick and secure process.

-

Share documents and communicate edits directly within pdfFiller for efficiency.

What are the compliance notes and regional considerations?

Direct deposit agreements must adhere to various regulations that can differ based on your region. Understanding these regulations is crucial to ensure compliance and proper management of the agreement.

-

Certain areas may have specific laws dictating how direct deposits should be handled.

-

Different industries can have additional requirements for direct deposits; it's essential to be aware of them.

-

Securely store your agreement and keep backups to protect against potential data loss.

What is the final checklist before submission?

Before submitting your direct deposit form, a final review is essential. This checklist helps ensure everything is in order.

-

Cross-check your information to prevent delays in payment processing.

-

Don't forget to attach any required documents that support your submission.

-

Make sure you understand how and where to submit your form correctly.

How to fill out the direct deposit for stimulus

-

1.Open the direct deposit form on pdfFiller.

-

2.Fill in the required personal information, including your name, address, and social security number.

-

3.Input your bank account details such as account number and routing number, ensuring they are accurate.

-

4.Select the type of account (checking or savings) that the funds will be deposited into.

-

5.Review the information for any errors and ensure all sections are filled out correctly.

-

6.Sign and date the form to authorize the direct deposit.

-

7.Save the completed form and submit it to your employer or the specified agency for processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.