Get the free Direct Deposit for Payroll template

Show details

Direct deposit is a process where someone who is going to be paid on a recurring basis, such as an employee, or a recipient of a government entitlement or benefit program such as social security,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is direct deposit form for

A direct deposit form authorizes an employer or financial institution to deposit funds directly into a specified bank account.

pdfFiller scores top ratings on review platforms

What do you like best?

I enjoy the ability to amend docs without having to print.

What do you dislike?

There are many buttons to navigate, perhaps a simpler layout

What problems are you solving with the product? What benefits have you realized?

I complete many Acord insurance applications on PDF. Benefits are submitting clean looking professional apps.

What do you like best?

Fill In, Signing and Saving to Computer and to all

What do you dislike?

I dislike nothing with the system it is all great!

Recommendations to others considering the product:

Yes to all of my colleagues

What problems are you solving with the product? What benefits have you realized?

All good here...I use it weekly for my workflows and I recommend it to my colleagues....

What do you like best?

All of the additional functions such as adding signature, contributors, and multiple ways to share documents.

What do you dislike?

There’s nothing I dislike about program u

Recommendations to others considering the product:

Get it quickly

What problems are you solving with the product? What benefits have you realized?

Adding text, certified signatures, and being able to send.

What do you like best?

We have used PDFFiller for years. I like the ability to use editing tools other apps charge extra for. The ability to use the mobile app was especially useful when we were in a bidding war for the purchase of our home. We were able to edit and sign purchase agreement on the fly.

What do you dislike?

User interface has not been updated in a while and feels a little clunky.

What problems are you solving with the product? What benefits have you realized?

We have clients sign documents and contracts. We are able to edit PDFs directly rather than scanning or retyping documents in a word prove easier.

What do you like best?

Able to quickly modify documents and create professional presentations.

What do you dislike?

Can't really think of any negatives. Maybe wish it were free.

What problems are you solving with the product? What benefits have you realized?

Easily convert invoices into delivery tickets. Cuts down on time spent creating documents.

What do you like best?

It is so easy to upload a document and make any edits to it. It saves you work so you can continue to use the same document! You can email, print or save PDF. Super helpful for property management when you have several notices!

What do you dislike?

Sometimes it's hard to make everything set up perfectly

What problems are you solving with the product? What benefits have you realized?

We are able to reuse the same document over and over!

Who needs direct deposit for payroll?

Explore how professionals across industries use pdfFiller.

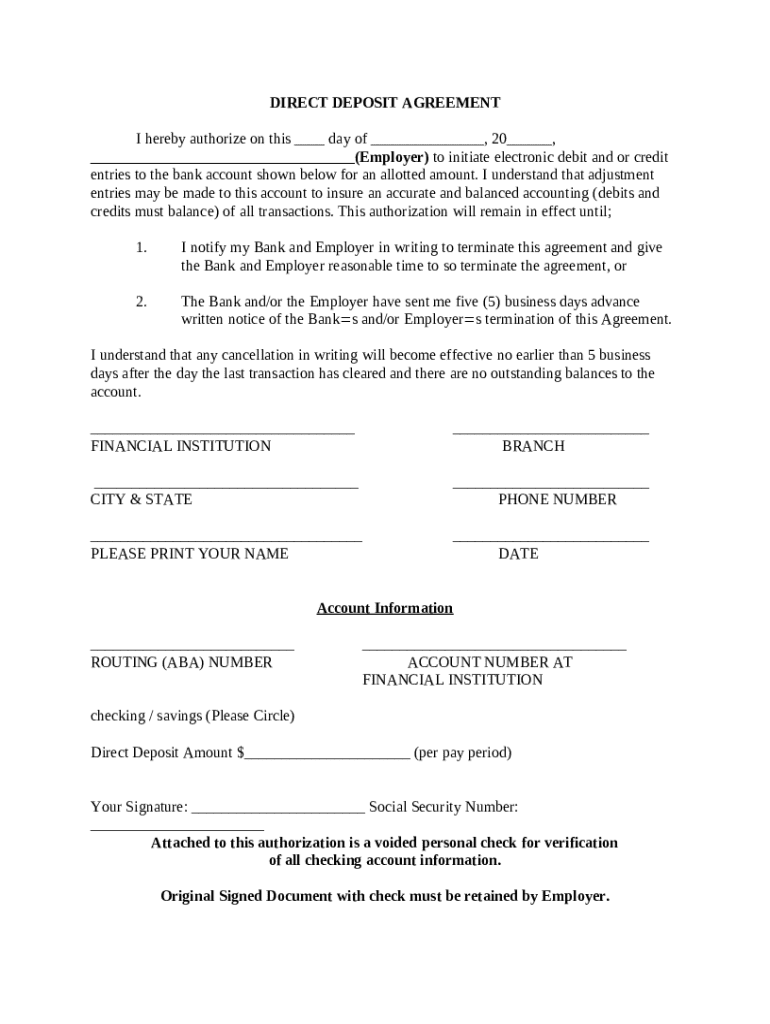

Comprehensive Guide to the Direct Deposit Form

How does direct deposit work?

Direct deposit is a method of electronically transferring your paycheck directly into your bank account, bypassing traditional paper checks. Employees authorize their employers to deposit funds directly into their bank accounts, providing a secure and timely paycheck delivery.

-

Direct deposit eliminates the need to visit the bank, making funds accessible immediately on payday.

-

With fewer checks in circulation, the risk of theft or forgery is reduced, providing a safer way to receive your earnings.

-

Most banking apps allow users to view payment histories easily, streamlining financial management.

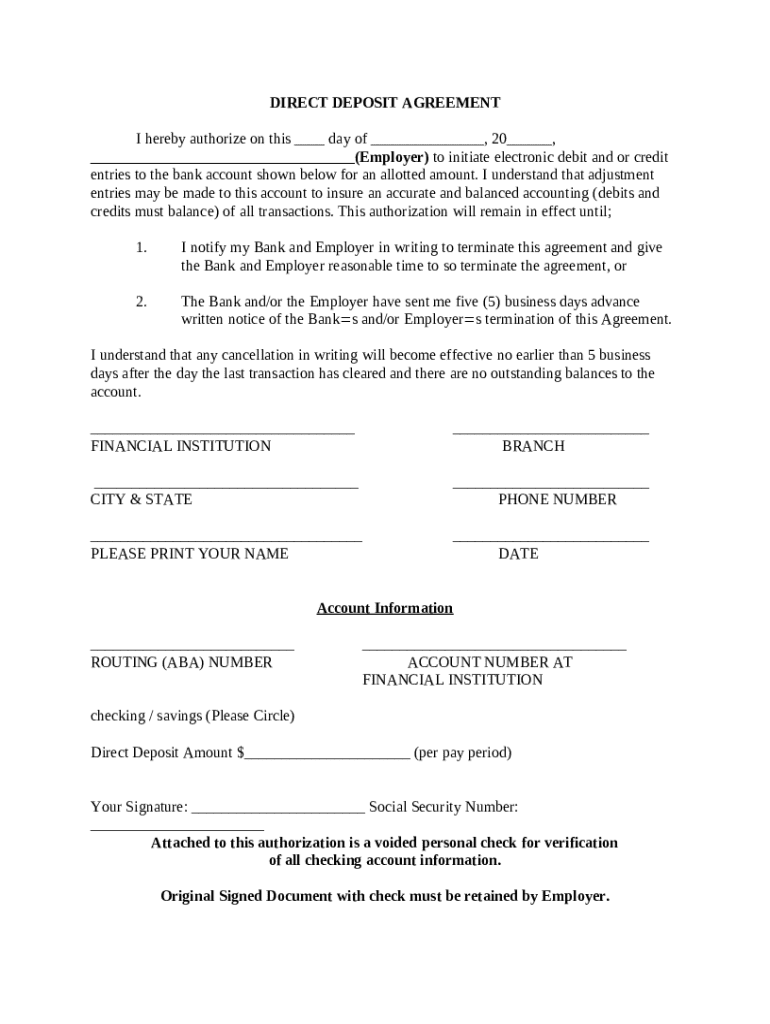

What are the key components of the direct deposit agreement?

-

This section specifies when the direct deposit is authorized and contains essential employer information.

-

Accurate details about your bank account, including account number and routing number, are needed to ensure proper deposits.

-

Adjustment entries refer to changes made to correct any discrepancies in previously deposited amounts.

-

Clarifies how and when either party can terminate the direct deposit agreement, ensuring clear communication.

How do fill out the direct deposit form?

Filling out a direct deposit form may seem daunting, but it follows a simple process. Start by gathering the necessary information, including your name, address, bank details, and employer information.

-

Take your time to fill out the form, ensuring each field is accurately completed.

-

Ensure that you enter your account number and routing number correctly to avoid errors.

-

Double-check the entered data to avoid errors in bank account information or missing signatures.

What are the signature and verification requirements?

-

A signature is essential as it serves as your approval for the direct deposit arrangement.

-

Generally, you may need to provide identification documents to verify your identity during the process.

-

Ensure your bank statements align with the information provided on the deposit form to prevent errors.

What legal considerations and compliance issues should be aware of?

-

A deep understanding of existing laws ensures that employers set up direct deposits according to regulatory requirements.

-

Both parties must be informed about their rights and obligations to promote a transparent relationship.

-

Regular audits and training for employees ensure adherence to direct deposit practices and prevent non-compliance.

How can manage my direct deposit setup?

-

Contact your employer’s HR department immediately should any changes be necessary for more effective management of your deposits.

-

Regularly review your account details and promptly report any address or bank changes to your employer.

-

Keep a copy of the completed form for your records and monitor your bank account for the first deposit.

How can pdfFiller assist with my direct deposit form needs?

-

pdfFiller allows users to easily edit direct deposit forms as needed, simplifying the management process.

-

Utilize pdfFiller’s eSigning feature to sign and share your documents, promoting rapid completion.

-

The platform offers secure storage options for your documents, making retrieval straightforward whenever needed.

How to fill out the direct deposit for payroll

-

1.Obtain the direct deposit form from your employer or financial institution.

-

2.Ensure the form is correctly titled as 'Direct Deposit Authorization' or similar.

-

3.Fill in your personal information, such as your name, address, and Social Security number.

-

4.Provide your bank details, including the name of the bank, account number, and routing number.

-

5.Choose the type of account (checking or savings) for the deposit.

-

6.Indicate the amount to be deposited (full amount or a specific percentage).

-

7.Review all the entered information to ensure accuracy.

-

8.Sign and date the form to confirm your authorization.

-

9.Submit the completed form according to your employer's or bank's instructions.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.