Get the free Request for Credit Info on New Account template

Show details

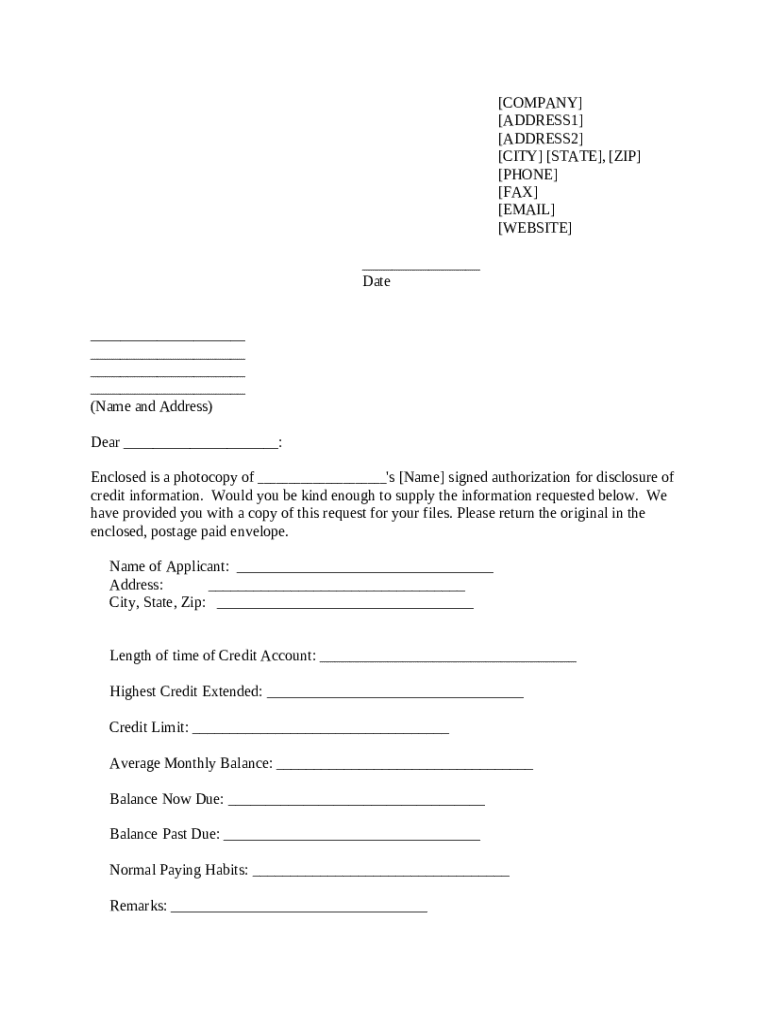

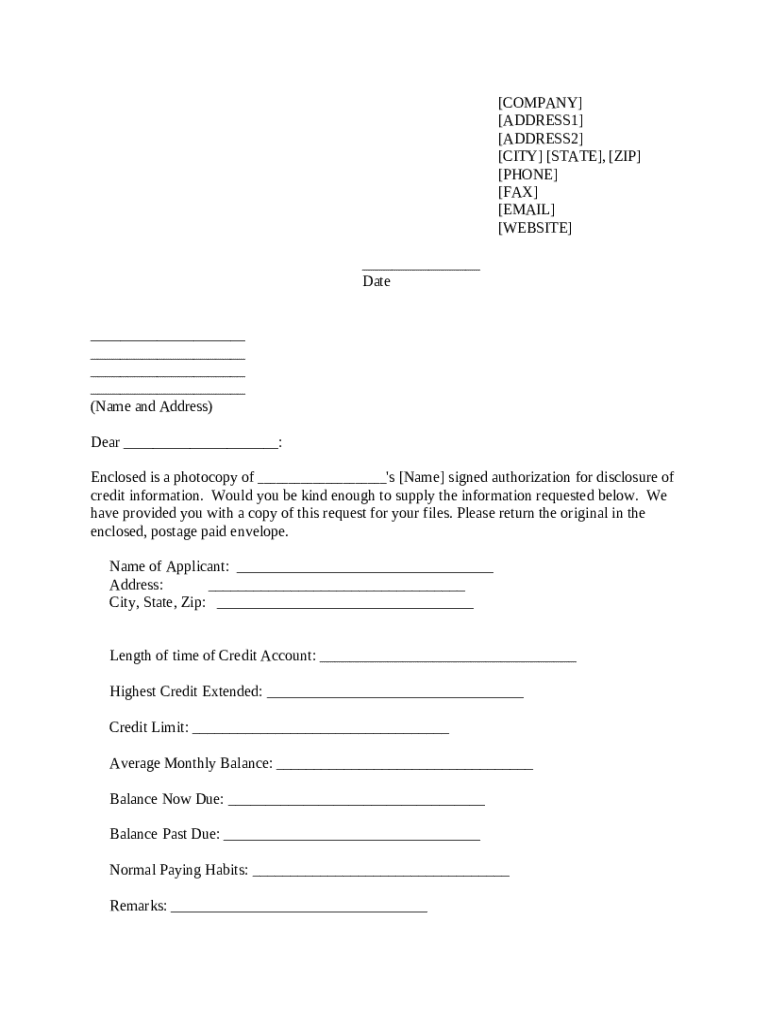

Request for credit info on new account

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is request for credit info

A request for credit info is a formal document used to obtain an individual’s or organization’s credit report from a credit bureau.

pdfFiller scores top ratings on review platforms

good

Excelente herramienta de trabajo, solucionaron mis dudas en cuestin de horas.

I signed up with pdffiller. I needed to cancel my subscription and dealt with *** at the support team. Service was excellent, they gave quick attention to my issue and promptly cancelled my account with no hassle. Very impressive professional service. Highest marks for the INTEGITY of AirSlate company.

It is user friendly.

Easy to manage

Easy to use

Who needs request for credit info?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to requesting credit information

How to fill out a request for credit info form?

Filling out a request for credit info form is straightforward if you follow the right steps. Begin by gathering the necessary documents, such as your ID and previous credit reports. This guide will take you through the essential steps for correctly completing this form.

Understanding the importance of credit information requests

Credit information requests are crucial for maintaining your financial health. A credit report contains detailed information about your credit history, including open accounts, payment history, and any public records such as bankruptcies.

-

Credit information is the data used by lenders to determine your creditworthiness. It helps them make informed decisions.

-

Your credit report influences loan approvals and interest rates, making it important to monitor.

-

Individuals may request their credit information for loan applications, disputes, or identity theft concerns.

What should you prepare before filling out the request form?

Getting ready to fill out the request form can save time and eliminate potential issues. It's essential to ensure that you have all necessary documentation in hand.

-

Having identification and past credit reports ready will streamline the request process.

-

Make sure that anyone involved in the credit report request has given you consent, if required.

-

Different agencies may have varying processes; knowing the right one is critical.

How do you correctly fill out the request for credit information form?

Completing the request form accurately is vital for a successful application. Errors can delay your access to information.

-

This information helps the agency properly address your request.

-

Use the current date to avoid any confusion about when the request was made.

-

Keep the letter professional and clear; avoid jargon and use simple language.

How can you submit your request effectively?

Submitting your request correctly ensures it reaches the right department without delays. Knowing the best practices can be beneficial.

-

Choose the method that is quickest for your situation and provides a tracking option.

-

Keep a record of what you sent and when, and follow up with the agency if necessary.

-

Typically, you will receive your credit report within a designated timeframe, depending on the agency.

What should you do after receiving your credit report?

After receiving your credit report, it is essential to review it thoroughly. This step is particularly important to ensure that all information is accurate.

-

Review it immediately for discrepancies or unfamiliar accounts.

-

If you find errors, contact the reporting agency to dispute them.

-

Understand the Fair Credit Reporting Act, which provides rights and protections for consumers.

Why use pdfFiller for document management?

pdfFiller stands out by making the document management process simpler and more efficient. With its cloud-based tools, it addresses many of the challenges associated with filling out forms.

-

This platform enables users to fill forms digitally, saving time and reducing errors.

-

Teams can work together seamlessly on shared documents and improve productivity.

-

Access your documents from anywhere, giving you the flexibility to manage requests when it’s convenient.

How to fill out the request for credit info

-

1.Visit pdfFiller and log in to your account or create a new account if you don’t have one.

-

2.Search for the template labeled 'Request for Credit Info' using the search bar or by browsing the templates.

-

3.Once located, click on the template to open it in the editor.

-

4.Fill in the required information, such as your name, address, Social Security number, and any identifiers needed by the credit bureau.

-

5.Review the authorization section to ensure you grant permission for the credit bureau to release your information.

-

6.If applicable, include specific information about why you are requesting the credit info or any deadlines for processing your request.

-

7.After completing all required fields, double-check your entries for accuracy to avoid delays.

-

8.Once satisfied, click on the 'Save' button to store your document, and then select 'Send' to deliver it via email or print it out for mailing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.