Get the free Consumer Credit Application template

Show details

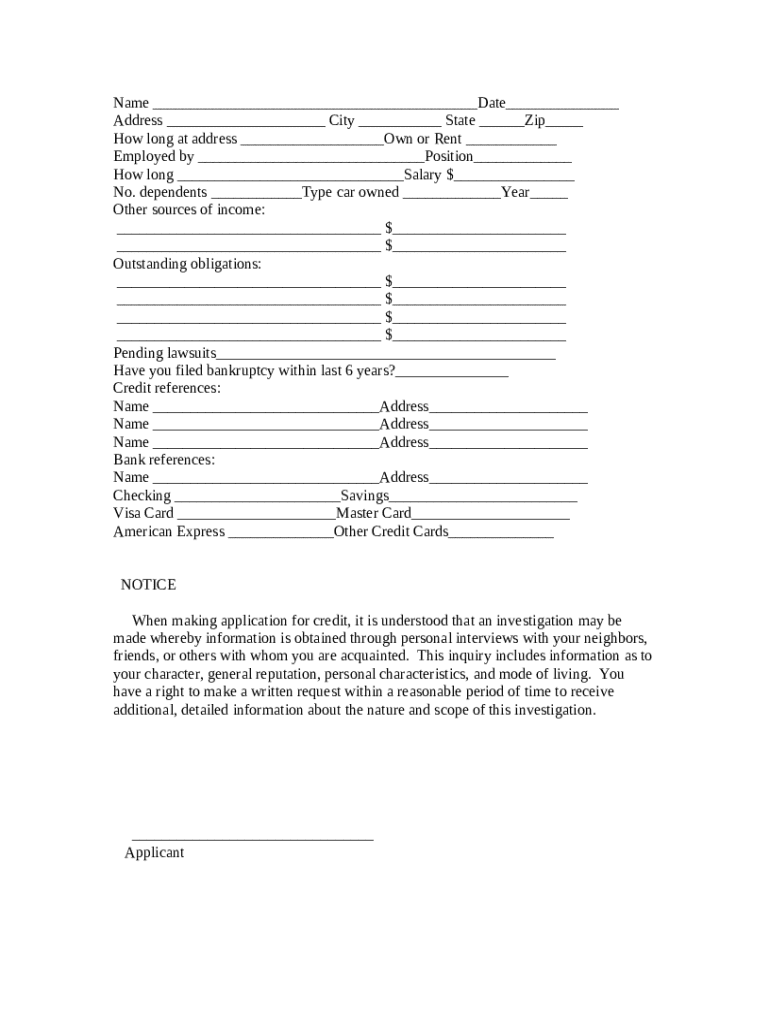

Consumer Credit Application form

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is consumer credit application form

A consumer credit application form is a document used by individuals to apply for credit, outlining their personal and financial information.

pdfFiller scores top ratings on review platforms

So far so good!!

Thank

Easy to use - multiple functions

this is great awesome tool. I wish to see more editable options like insert different shapes from local or online, alignment, fonts, paragraph etc.

I have been using the service for over 3 years now and I love several things about the service. definitely worth EVERY penny!!

excelent

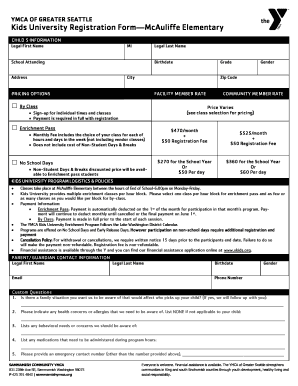

Who needs consumer credit application template?

Explore how professionals across industries use pdfFiller.

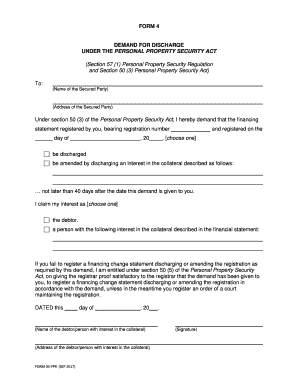

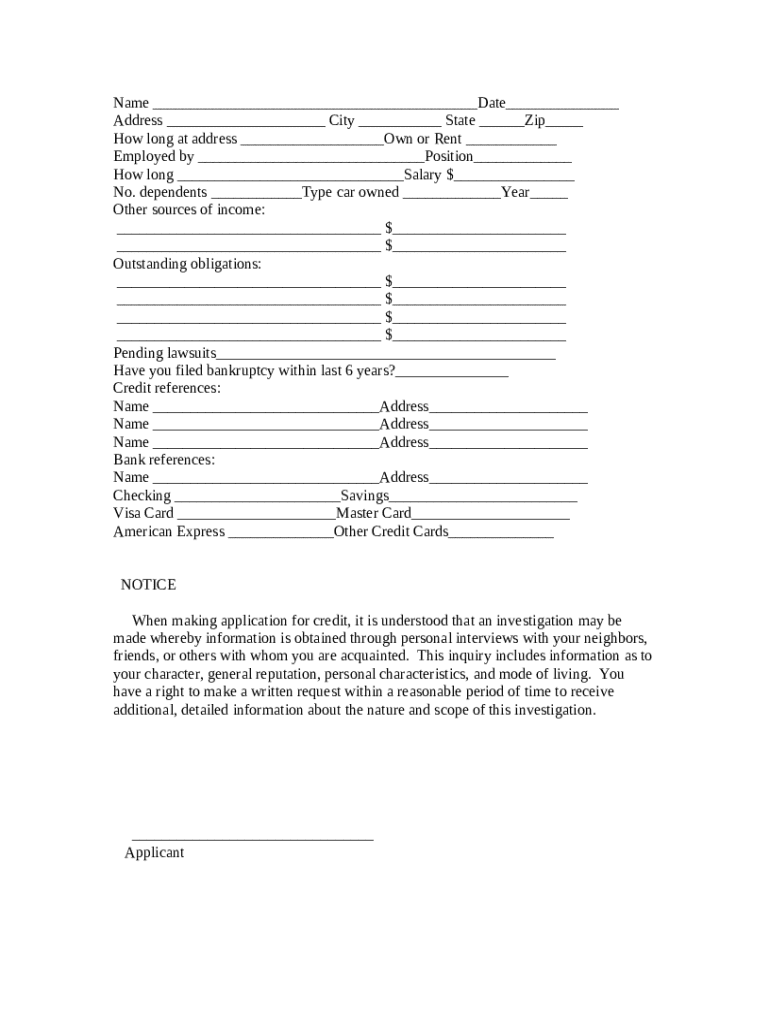

Comprehensive Guide to Filling Out a Consumer Credit Application Form

What is a consumer credit application form?

A consumer credit application form is a document that individuals fill out to request credit, whether for a loan, credit card, or any other type of financing. This form serves multiple purposes, including gathering essential details about the applicant's financial situation to assess eligibility for credit. Providing accurate and complete information is crucial as it directly impacts the chances of credit approval.

How important is accurate information for credit approval?

Accurate information on your consumer credit application form is critical. Lenders actively assess the data provided to determine your financial stability and repayment capacity. Inaccuracies can lead to denial of credit or unfavorable terms, making it essential to present truthful and complete information.

What do lenders assess during the application process?

During the assessment of your consumer credit application form, lenders evaluate several factors, including your credit history, income level, debts, and employment stability. These elements help them determine your creditworthiness and the associated risks of lending to you.

What are the key sections of the consumer credit application form?

The consumer credit application form typically comprises several essential sections. Each section is designed to collect specific information necessary for evaluating your credit application.

-

This section requests personal details, including your name, address, date, and contact information. Accurate information in this section establishes your identity.

-

Lenders require details about your employment, including your employer’s name, your job position, and how long you've been working there. This helps assess your job stability.

-

You must disclose your salary, any additional income sources, and dependents. Listing debts is also crucial, as this provides lenders with insight into your financial obligations.

-

This section entails providing credit references and your banking information, such as accounts and credit card details, to substantiate your financial reliability.

What are the best practices for filling out the application?

Filling out a consumer credit application form accurately can improve the chances of approval. Start by ensuring you fill in all required fields correctly.

-

Go through the application and make certain all fields are completely filled to avoid processing delays.

-

Prepare supporting documents such as pay stubs or tax returns in advance to streamline the information you provide.

-

Make sure to disclose accurate information about your financial history—misleading lenders can lead to serious repercussions.

What methods can use to submit my application?

You can submit your consumer credit application form through various methods, including online submissions, in-person visits at bank branches, or by mailing the completed forms. Each method has its advantages, and choosing one that suits your needs will help facilitate the process.

What happens after submit my application?

After submitting your consumer credit application form, your application will undergo a credit evaluation process. Lenders will review your submission to decide on approval or denial.

What should expect from the credit evaluation process?

The credit evaluation process typically takes a few days to a few weeks. Upon evaluation, you will receive a notice of approval, denial, or the option to appeal a denial. Understanding these outcomes is essential for managing your credit history effectively.

What legal notices apply to credit applications?

Credit applications must include legal notices regarding credit investigations and disclosure of your rights concerning personal data. You have the right to know how your information will be utilized and can request more information if required.

How does pdfFiller assist with consumer credit application forms?

pdfFiller simplifies the process of filling and managing consumer credit application forms online. It provides collaborative features that allow teams to share and edit documents securely, ensuring that you can access your forms anytime from anywhere.

How can pdfFiller empower my credit application journey?

Utilizing pdfFiller for your consumer credit application can enhance your documentation experience. It allows for interactive tools that help ensure accuracy and compliance during your application process, ultimately streamlining the entire experience.

How to fill out the consumer credit application template

-

1.Open the PDF document in pdfFiller.

-

2.Locate the personal information section and enter your name, address, and contact details accurately.

-

3.Fill in your Social Security number and date of birth as required for identification purposes.

-

4.Provide your employment details including your employer's name, your job title, and your income information.

-

5.Disclose any additional income sources if applicable, ensuring to list them clearly.

-

6.Review the financial information section and detail your monthly expenses and outstanding debts accurately.

-

7.Check all the boxes related to your credit preferences and any applicable acknowledgments.

-

8.Double-check all entered information for accuracy.

-

9.Submit the form electronically through pdfFiller once all sections are completed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.