Get the free Security Agreement involving Sale of Collateral by Debtor template

Show details

Debtor grants to the secured party a security interest in the property described in the agreement to secure payment of debtors obligation to the secured party. Other provisions within the agreement

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is security agreement involving sale

A security agreement involving sale is a legal contract that establishes a security interest in collateral to secure an obligation or loan in connection with the sale of goods.

pdfFiller scores top ratings on review platforms

Amazing I do all of my important documents on here and it is so user friendly

so sad so good, it's just a bit hard to put every letter in the centre of the boxes in application forms

The features are great. It would be nice to have the option to combine PDF documents. I also have an issue when entering text where the text box disappears and I have to click on the document again to enter text. Aside from that, he existing features are great and I would like to see how PDFfiller can improve in the future.

PDFfiller saved me a lot of frustration today. I was having a difficult time editing a pdf. document. You saved the day.

The App is clunky and not easy to use and annoyed that when trying to combine different documents have to upgrade to the next level.

So overall good product on laptop, poor app and disappointing capabilities v price.

I'm still waiting for customer service to explain why it is $20 per month when the signup page said $6.

Who needs security agreement involving sale?

Explore how professionals across industries use pdfFiller.

How to Create a Security Agreement Involving Sale

How does a security agreement work?

A security agreement is a legally binding document that lays out the terms and conditions under which a secured loan is to be repaid. It provides creditors the right to seize certain assets if the borrower defaults on their obligations. Understanding the purpose of a security agreement is crucial for anyone involved in financial transactions, particularly in sales where specific collateral is provided as security.

-

Definition of a security agreement.

-

Key parties involved are the debtor (borrower) and the secured party (lender).

-

Advantages of creating such an agreement include enhanced trust and clarity between parties.

What information is essential in a security agreement?

To draft a valid security agreement, specific details must be included. This ensures clarity and protects the rights of both parties. Gathering accurate debtor and secured party details is crucial in preventing future disputes.

-

Debtor’s information: Name, Address, Contact details.

-

Secured Party's information: Name, Address, Contact details.

-

A detailed description of the collateral involved in the agreement.

How can you draft your security agreement?

When drafting a security agreement, following a structured approach can be beneficial. This typically includes a step-by-step process to ensure all necessary clauses are incorporated. Utilizing tools like pdfFiller can streamline this process, allowing you to fill out and edit the form seamlessly.

-

Step-by-step instructions help guide the drafting process.

-

Incorporate essential clauses that outline all critical aspects.

-

Explore pdfFiller’s tools for easy form completion.

What should you know about payment terms and conditions?

Establishing clear payment terms is essential in a security agreement. This includes outlining the total amount due, interest rates, and the payment schedule. A well-defined payment structure can help both parties understand their obligations and avoid conflicts.

-

Clarification on the amount owed, interest rates, and due dates.

-

Detail potential consequences of defaulting, such as acceleration clauses.

How are default and acceleration clauses explained?

Understanding what constitutes a default in the context of your security agreement is vital. This area of the document outlines the steps the secured party can take if the debtor fails to meet their obligations. Clarity around these clauses ensures both parties know the ramifications of failing to comply.

-

Define default within the agreement parameters.

-

Outline steps for the secured party in the event of default.

-

Detail the implications of acceleration upon specified events.

Why is signing and finalizing the agreement important?

The signing of a security agreement by both parties lends it legal weight. Utilizing pdfFiller's eSigning functionality allows for a simple and effective online experience. Once both parties sign, managing and storing the document becomes essential for future reference.

-

Signatures from both parties validate the agreement.

-

Complete the agreement easily online with pdfFiller.

-

Manage and store the signed document efficiently using the platform.

How can you effectively manage your security agreement post-creation?

Effective document management is crucial after creating your security agreement. The ability to make edits, renew, or update terms is essential. pdfFiller provides features for collaboration and tracking, allowing users to ensure compliance with payments and obligations.

-

Use pdfFiller's editing tools for ongoing management.

-

Take advantage of collaboration features for team efficiency.

-

Leverage payment tracking tools to stay on top of obligations.

What legal compliance and considerations should you be aware of?

Remaining compliant with local regulations is critical when drafting a security agreement. Various laws govern these agreements in different regions, so familiarity with local regulations is essential. Additionally, being aware of common pitfalls can help prevent legal issues down the road.

-

Familiarize yourself with local regulations regarding security agreements.

-

Identify common legal pitfalls to avoid during drafting.

-

Seek legal advice when necessary before finalization.

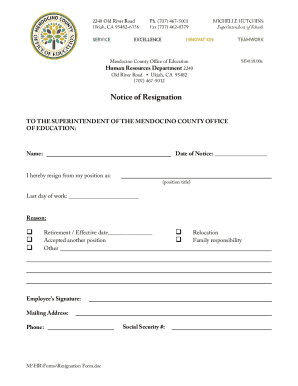

How to fill out the security agreement involving sale

-

1.Open pdfFiller and upload your security agreement document.

-

2.Begin by entering the date at the top of the document in the specified field.

-

3.Fill in the names and contact information of both the seller and the buyer in the designated sections.

-

4.Clearly describe the goods being sold, including their value and condition, in the description area.

-

5.Indicate the terms of sale including payment methods, due dates, and any other special conditions.

-

6.Specify the collateral attached to the agreement to secure the obligation, detailing its location and ownership.

-

7.Review all entered information for accuracy and completeness.

-

8.Add a signature field at the bottom for both parties to sign and date the agreement.

-

9.Save the document and choose the option to download or share it as needed.

-

10.Ensure each party receives a copy of the signed agreement for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.