Get the free Accounts Receivable - Guaranty template

Show details

This form states that the guarantor unconditionally and absolutely guarantees to payee(s), jointly and severally, the full and prompt payment and performance of any and all account receivable charges

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is accounts receivable - guaranty

Accounts receivable - guaranty is a financial document that assures repayment of amounts due from customers by a third-party guarantor.

pdfFiller scores top ratings on review platforms

EASY TO USE, TRULY ALLOWS ONE TO EDIT PDFS. I WOULD LOVE TO SEE MORE FONTS AND THE ABILITY TO SET THE FONT SIZE MANUALLY, AND SMALLER THAN SIZE 8. OTHER THAN THAT, GREAT, USEFUL APP.

Makes my life so much easier with filling out HCFA's

I have tried numerous .pdf fillers and for managements applications and PDFfiller is the best I have ever used. I strongly recommend it to anyone looking for a reliable application.

App facile d'usage et vraiment pratique pour le travail des PDF et du Fax.

So far pleased; however actually thought there would be a charge every month as opposed to one lump charge; my fault should have looked into it furthe

Used it for two very important legal forms, it has worked very well to meet my needs.

Who needs accounts receivable - guaranty?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Accounts Receivable Guaranty Form

Understanding how to fill out an accounts receivable guaranty form can significantly streamline financial transactions and mitigate risks for creditors. This guide provides detailed insights into the components, required information, and best practices for completing these essential documents.

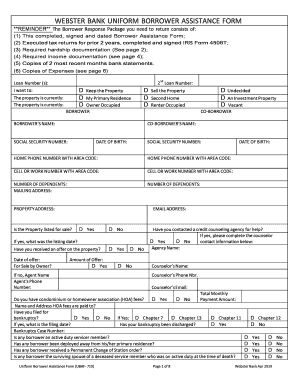

What is an accounts receivable guaranty form?

An accounts receivable guaranty form is a legal document where a guarantor agrees to fulfill the payment obligations of a debtor if the debtor defaults. This form is crucial for businesses extending credit, as it provides assurance that they will receive payment for goods or services rendered, even if the primary debtor cannot pay.

-

The guaranty form serves as a written commitment from the guarantor, outlining the terms of their responsibility.

-

For businesses, accounts receivable is vital for cash flow and financial health, making this form a protective measure.

-

Businesses that extend credit terms often require this form from clients to safeguard against non-payment.

What are the key sections of the guaranty form?

Understanding the layout and critical components of the guaranty form is essential for all parties involved. Each section plays a vital role in ensuring that the guarantor's commitments are clear and legally enforceable.

-

Details about the payee (creditor), guarantor, and customer ensure clarity on who is involved in the agreement.

-

This clause specifies that the guarantor is liable regardless of circumstances, fortifying the creditor's position.

-

Understanding presentment and notice requirements can alleviate potential legal disputes by clarifying notification responsibilities.

-

This section outlines the conditions under which the guarantor will assume responsibility for the debt.

-

Establishes how long the guarantor is committed to the guarantee, crucial for time-sensitive agreements.

-

Proper execution and notarization add a layer of legal validity to the document.

How do you fill out the guaranty form?

Filling out an accounts receivable guaranty form requires careful attention to detail and thoroughness. Here’s a structured approach to completing the form accurately.

-

Ensure you have all relevant details—including the identification of all parties, terms of the agreement, and supporting documentation.

-

Complete each section methodically, starting with identification, followed by guarantees and relevant details.

-

Double-check for errors in the names, numbers, and dates to prevent legal issues later on.

How can you review and manage your guaranty effectively?

Once the guaranty form is filled out, meticulous management is key to ensuring obligations are met and the document remains valid. Here are practical steps to optimize your review process and management.

-

Regularly review the guaranty for accuracy, completeness, and any changes in the financial status of the parties involved.

-

Use cloud platforms like pdfFiller for easy access and secure management of your files.

-

Utilize editing and signing functionalities to streamline updates and ensure compliance.

What are the legal considerations and compliance issues?

Legal frameworks governing guaranty forms can vary significantly depending on state regulations and consumer protection laws. Understanding these can help prevent potential legal challenges.

-

Each state may have different laws affecting the enforceability and contents of guaranty forms.

-

Ensure compliance with laws designed to protect consumers in credit transactions, which can impact guaranty agreements.

-

Consult with a legal expert to avoid potential risks that could arise from improperly drafted documents.

What are the additional benefits of using pdfFiller for guaranties?

Using pdfFiller's platform enhances the simplicity and effectiveness of managing accounts receivable guaranty forms. Here’s how.

-

Teams can collaborate on forms in real-time, reducing errors and increasing efficiency.

-

Users can access important documents on-the-go, ensuring you can manage your paperwork anytime.

-

Features provided by pdfFiller guarantee compliance and security for electronic signatures, which is essential for legal validity.

How to fill out the accounts receivable - guaranty

-

1.Begin by downloading the PDF version of the accounts receivable - guaranty form from pdfFiller.

-

2.Open the PDF in pdfFiller to start filling it out.

-

3.Enter the name and contact information of the primary debtor in the designated fields.

-

4.Provide the guarantor's name and contact details in the appropriate section.

-

5.Specify the amount of the receivables being guaranteed in the form.

-

6.Include the date of the agreement to document when the guarantee takes effect.

-

7.Review the terms of the guarantee and ensure both parties understand their obligations.

-

8.Sign the document electronically or print it for physical signatures.

-

9.Save the completed document in your pdfFiller account for record-keeping.

-

10.Share the signed document with relevant stakeholders or parties involved in the agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.