Last updated on Feb 17, 2026

Get the free Consumer Loan Application - Personal Loan Agreement template

Show details

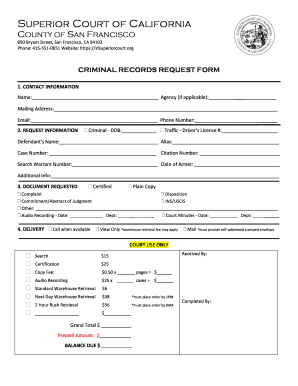

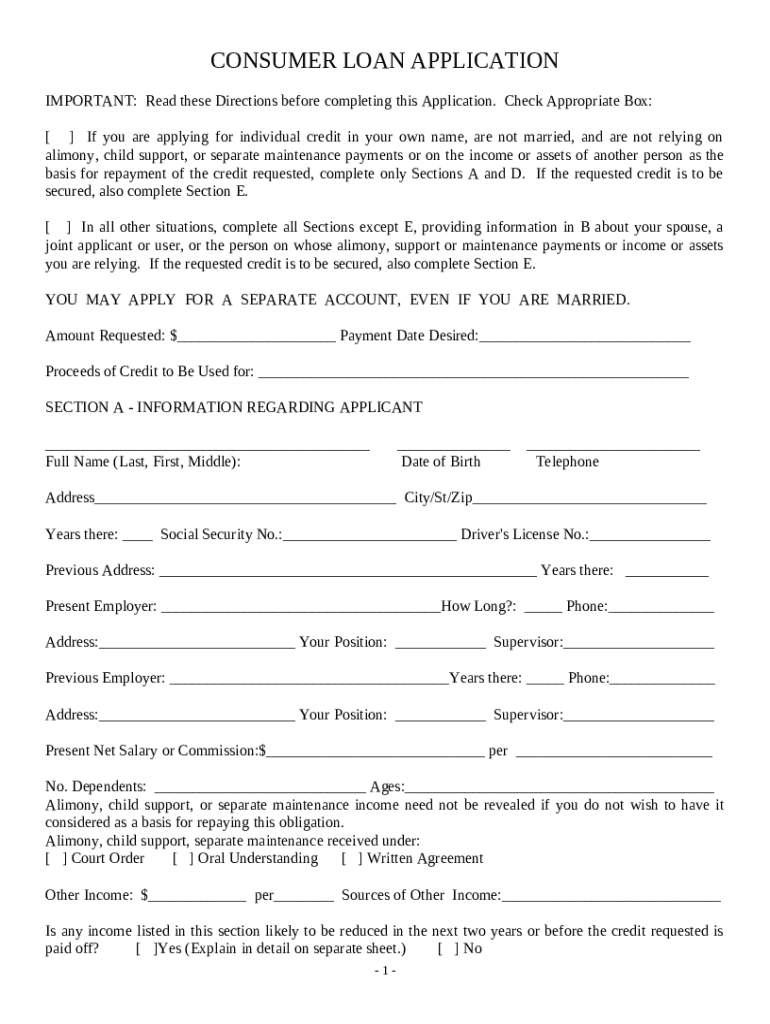

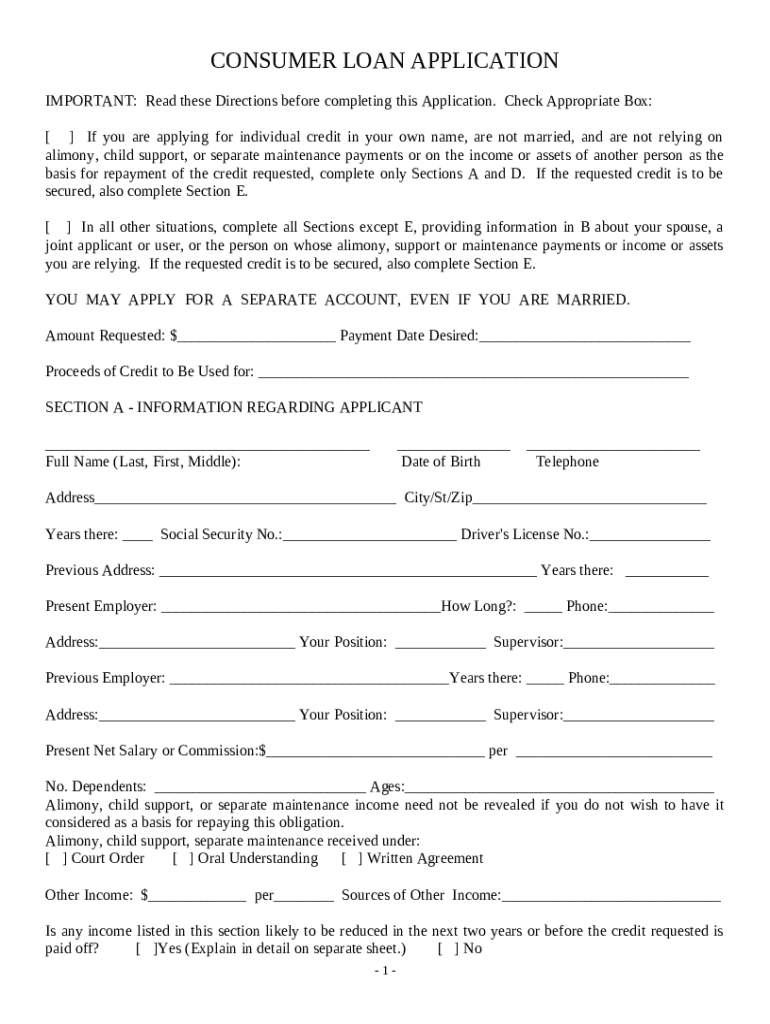

This form is a Consumer Loan Application. The form provides sections for: information regarding applicant, marital status, and asset information.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is consumer loan application

A consumer loan application is a formal request submitted by an individual to a financial institution to borrow money for personal use.

pdfFiller scores top ratings on review platforms

If you ever happen to chat with Support for a technical issue --- Hope you get ****.**** worked with me for nearly and hour trying to figure out why my form got skewed.I shared out my screen with him -- he diligently and carefully figured out the problem and got it fixed.Saved the day!Kudos to ****!!

Love it

It's the easiest app I've used when it comes to filling in forms. Simply save your form in your files and export or attach to the App and it's self explanatory

No cons

It's point click and fill in. Can't go wrong

i really enjoy to sign my documents

Very positive

Very satisfied!!!

Very helpful

Who needs consumer loan application?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Consumer Loan Application Form

How does the consumer loan application process work?

The consumer loan application process involves several key steps that must be followed for successful submission. Initially, individuals must gather and provide accurate personal information relevant to the application. This includes details about income, employment, and any other financial obligations. Ensuring that the information is accurate and complete is crucial in order to avoid delays in approval.

What are the key sections of the loan application form?

The loan application form typically has specific sections that require detailed information from the applicant. Each of these sections plays an important role in the approval process.

-

This section captures essential personal details like your full name and date of birth. It also includes contact information such as telephone numbers and addresses, along with employment history including your current and past job positions.

-

If the loan application includes a co-applicant, this section will request necessary details about them. It’s important to provide accurate information regarding spouses or joint borrowers to avoid complications.

-

Applicants need to disclose their sources of income. This includes salaries, commissions, and potential alimony. Accurate income representation is critical for determining loan eligibility.

-

This section outlines what the applicant is using as collateral for the loan. Understanding these requirements can prevent misunderstandings with lenders.

What are common mistakes to avoid when filling out the form?

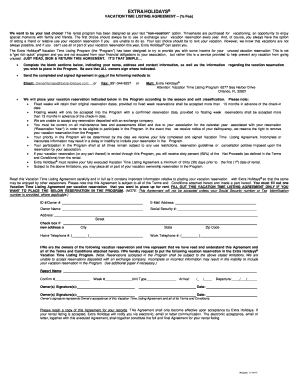

Filling out a consumer loan application can be straightforward, but several common errors can hinder your approval chances. One significant mistake is leaving sections incomplete, which can lead to application rejection.

-

Always fill out all required fields to ensure your application is considered complete.

-

Any false information can result in denial of the application or even legal repercussions.

-

Be mindful of any areas that enhance your chances of approval; leaving them out can be detrimental.

How can you improve your application submission?

Submitting an application doesn’t just mean filling out the form; it requires precision and tools to boost efficiency. Double-checking your competition and providing thorough documentation can yield better results.

-

Always review your data to confirm accuracy before submission.

-

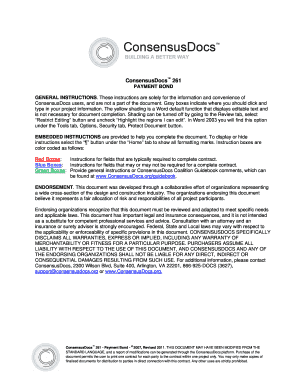

These tools assist in editing and signing the application seamlessly, ensuring a professional presentation.

-

Make sure you're submitting your application through secure online methods for additional protection.

What should you know about maintaining your loan application and tracking progress?

Once your application is submitted, managing your documents effectively is vital. Using a platform like pdfFiller to track submissions can reduce anxiety and improve communication.

-

pdfFiller provides a comprehensive way to track all documents submitted, ensuring you're always updated.

-

Collaborate with financial advisors or co-applicants to keep all stakeholders informed throughout the process.

-

Familiarize yourself with what to expect post-submission; knowing the timeline can lead to better planning.

What are the post-application considerations and next steps?

After applying, several considerations will dictate your next steps. Understanding the approval timeline can help you remain proactive.

-

Expect to wait for a certain period; knowing this can ease the waiting period.

-

Be prepared to provide more details if your lender requires clarification.

-

Understand what's needed during the loan closing process to ensure a smooth experience.

How to fill out the consumer loan application

-

1.Begin by downloading the consumer loan application form from pdfFiller.

-

2.Open the application in pdfFiller’s editor.

-

3.Enter your personal information, including your name, address, and contact details in the designated fields.

-

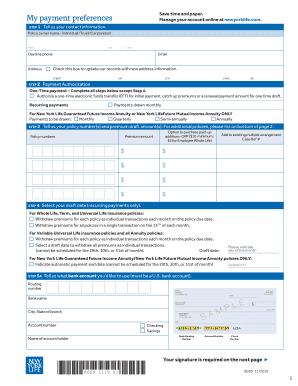

4.Provide your financial information, including your income, employment details, and any existing debts.

-

5.Review any additional sections that might ask about your credit history or purpose of the loan.

-

6.Complete the consent and disclosure agreements as required.

-

7.Double-check all entered information for accuracy and completeness.

-

8.If applicable, attach necessary documents such as proof of income or identity verification.

-

9.Submit the completed application through pdfFiller’s submission options, ensuring to save a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.