Get the free Plan of Merger with Conversion of Shares of Absorbed Corporation into Shares of Surv...

Show details

A merger occurs when two corporations merge in that one absorbs the other. One corporation preserves its original charter and identity and continues to exist. The other corporation disappears, and

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is plan of merger with

A plan of merger with is a formal document outlining the terms and conditions under which two or more companies agree to merge into a single entity.

pdfFiller scores top ratings on review platforms

HELPED ME IN AN EMERGENCY WITH MY CLASS WORK.. LOVE IT!!!

It was easy to use, my one complaint would be exporting one document at a time was time consuming. Wish I could have selected all documents to export one time.

So good so far. I hope billing doesn't become an issue because this is a good product.

a little confusing but I think it will be useful for my docs

I would like to be able to edit text that is pre-printed in the doc in and ideal world.

I have been using PDFfiller for about a month now and it has served as a valuable part of what I do. My client's have found the new documents easy to open, download, or sign.

Who needs plan of merger with?

Explore how professionals across industries use pdfFiller.

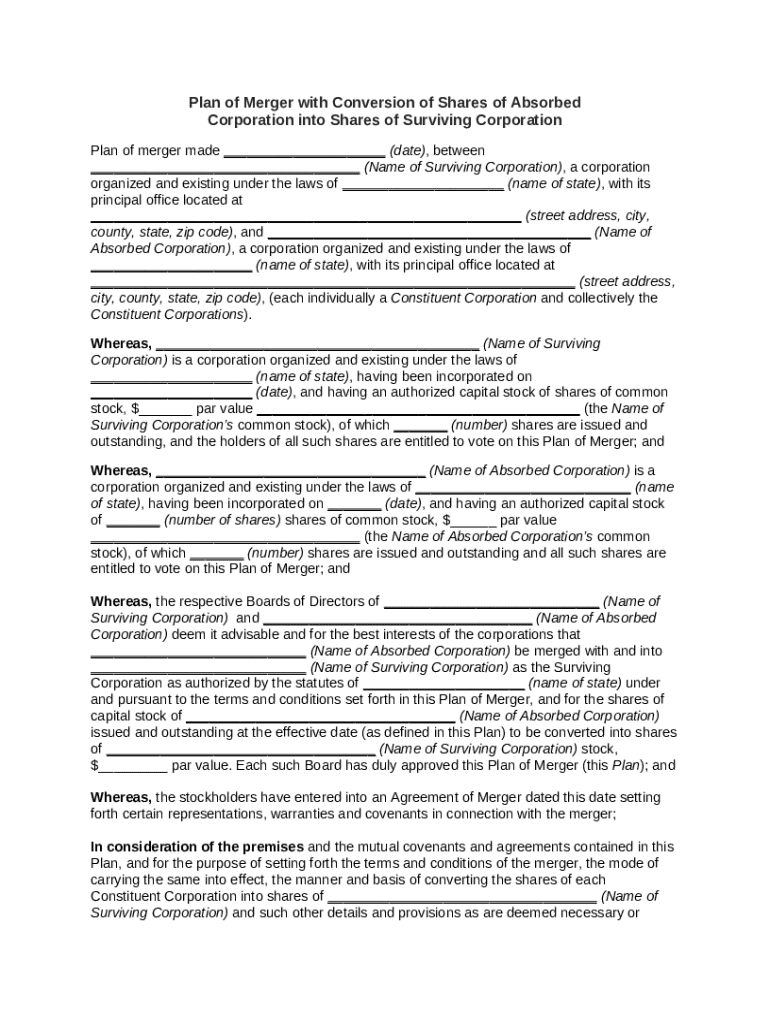

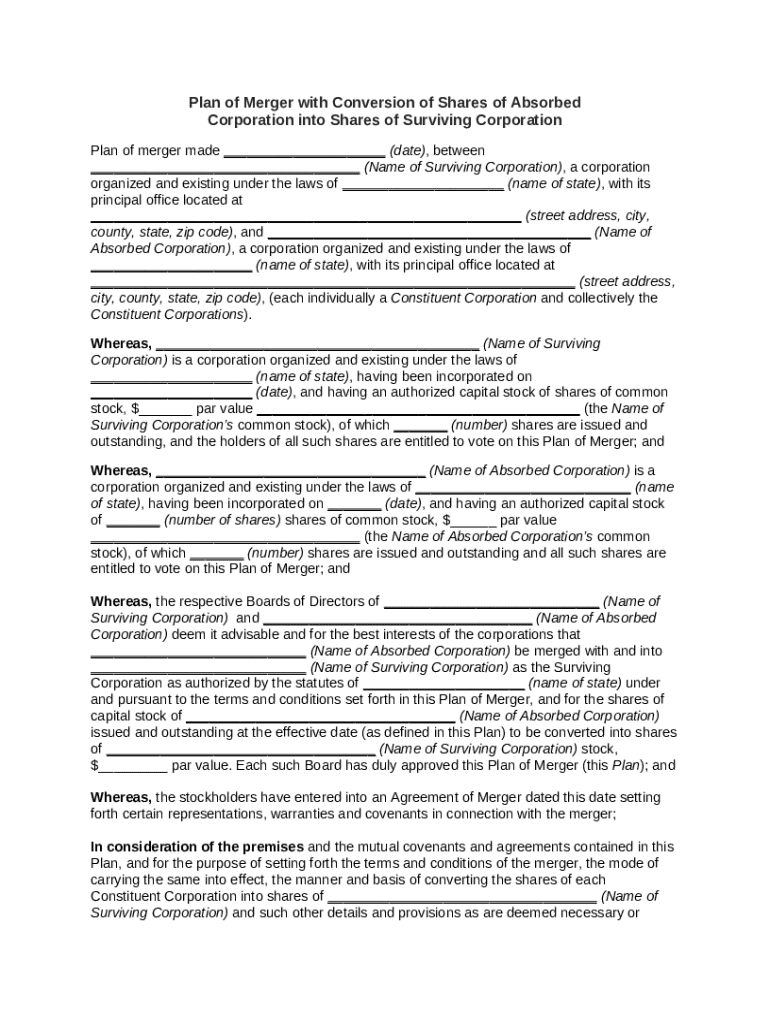

Comprehensive guide to the plan of merger with form form

Understanding the plan of merger

A plan of merger is a formal agreement that describes the terms under which two or more corporations consolidate into a single entity. The primary purpose of this document is to facilitate the merger process, enabling corporations to leverage shared resources for greater efficiency.

-

A legal document outlining the specifics of merging corporations, detailing the method and terms of the merger.

-

Mergers often aim for enhanced operational efficiencies, increased market share, and improved competitive positioning.

-

Each state has unique laws governing corporate mergers that dictate how plans must be drafted and what approvals are required.

Components of a plan of merger document

Crafting a solid plan of merger is critical to the process, covering all necessary legal and corporate elements.

-

Clearly identify all parties involved and specify the effective date of the merger, alongside the governing state law.

-

Detail how shares of the absorbed corporation will be treated, including conversion ratios and exchange procedures.

-

Include the structure of the authorized capital, including stock types and voting rights to ensure shareholder compliance.

Short form merger: An overview

A Short Form Merger allows certain parent corporations to merge with a subsidiary without extensive documentation or shareholder votes.

-

This is a streamlined process used primarily when a parent company owns a significant percentage of its subsidiary.

-

Unlike long-form mergers, which require detailed filings and approvals, Short Form Mergers are expedited with fewer legal hurdles.

-

Typically used when shareholders of the subsidiary are not adversely affected, allowing for a quicker process.

Steps to prepare a plan of merger

Preparing a plan of merger involves several pivotal steps to ensure compliance and readiness for execution.

-

Collect all relevant corporate records including bylaws, shareholder agreements, and current financial statements.

-

Create a detailed plan ensuring all legalities are observed and the interests of all stakeholders are protected.

-

Make sure that the plan meets all statutory requirements as outlined by the governing state’s corporate laws.

-

Securing necessary approvals from the corporate Board is essential before moving forward with the merger.

Benefits of merging: A sector perspective

Merging can lead to a variety of benefits, especially when companies strategically align.

-

Mergers can result in improved productivity by combining resources and eliminating redundant operations.

-

By merging, companies can expand their reach into new geographic regions or demographics.

-

Combining strengths allows merged entities to compete more effectively against larger firms.

Navigating regulatory requirements

Understanding the regulatory landscape is vital to ensure a seamless merger process.

-

Different states have various laws governing mergers; it's crucial to understand these to avoid legal pitfalls.

-

Corporate entities must file appropriate documents to various regulatory bodies to keep the merger legally binding.

-

Mergers must be scrutinized for competitive impacts, ensuring compliance with antitrust laws.

Legal considerations in mergers

Legal due diligence is an integral part of any merger, protecting all parties involved.

-

Mergers and Acquisitions (M&A) attorneys ensure that agreements are legally sound and compliant with all regulations.

-

Thoroughly analyzing the rights and obligations outlined in the agreement is vital for protecting interests.

-

It's essential to engage stakeholders in discussions to safeguard their interests throughout the merger process.

Utilizing pdfFiller for your plan of merger

pdfFiller offers an effective platform to manage your plan of merger documentation seamlessly.

-

Easily upload your legal document to the platform and make the necessary edits with user-friendly tools.

-

Utilize pdfFiller’s eSignature capability to sign documents electronically and collaborate seamlessly with other stakeholders.

-

Keep your documents safe and accessible by storing them securely in the cloud, ensuring you're prepared for review and audit.

Common pitfalls and solutions in mergers

Awareness of common challenges can mitigate risks associated with mergers.

-

Being cognizant of frequent misconceptions helps in promoting a smoother transition.

-

Implementing robust risk management strategies can help navigate challenges effectively.

-

Enhancing intra-company communication relieves anxiety and encourages cooperation among stakeholders.

How to fill out the plan of merger with

-

1.Access the pdfFiller platform and log in to your account.

-

2.Choose to create a new document and type 'plan of merger' in the search bar.

-

3.Select the appropriate template for a plan of merger from the options provided.

-

4.Fill in the required fields, including the names of the merging companies, details of the merger agreement, and any pertinent legal clauses.

-

5.Ensure to include financial terms, timelines, and responsibilities of each party involved in the merger.

-

6.Review the information carefully to avoid any errors or omissions.

-

7.Utilize the available editing tools to format the document as needed for clarity and professionalism.

-

8.Once completed, save your document and choose whether to download it or share it via email.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.