Get the free Collection Report on Past Due Accounts template

Show details

Collection Report on past due accounts

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is collection report on past

A collection report on past is a document that summarizes and details the collection activities and status of overdue accounts within a specific period.

pdfFiller scores top ratings on review platforms

This program has been very user freindly

Made submission of required paperwork easy.

The only problem that I have is my forms won't print out, otherwise everything is great.

Really efficient, only thing I think it needs an undo option.

Fairly easy to use. Much better for me than Adobe DC

Again the produce is amazing. You do literally everything that is needed.

Who needs collection report on past?

Explore how professionals across industries use pdfFiller.

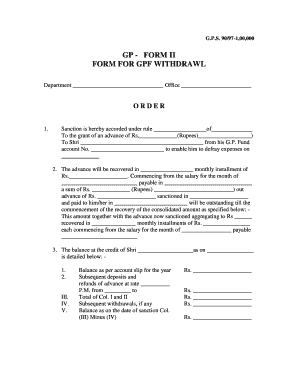

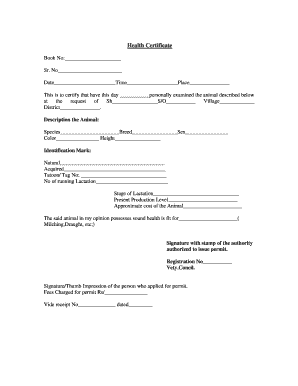

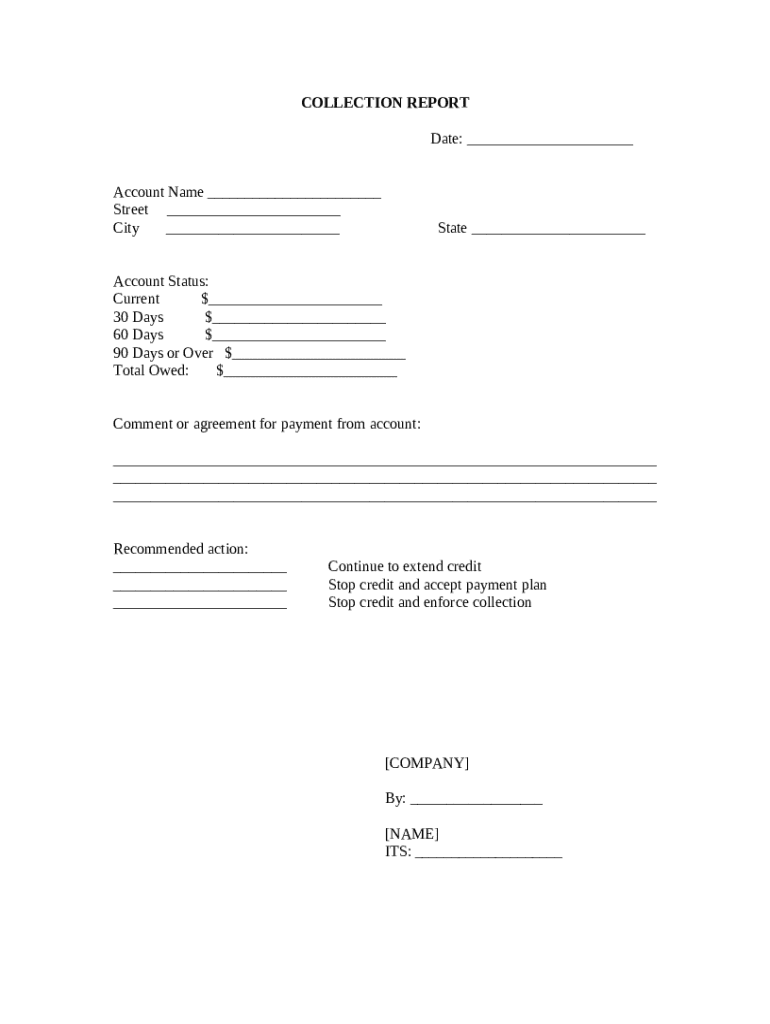

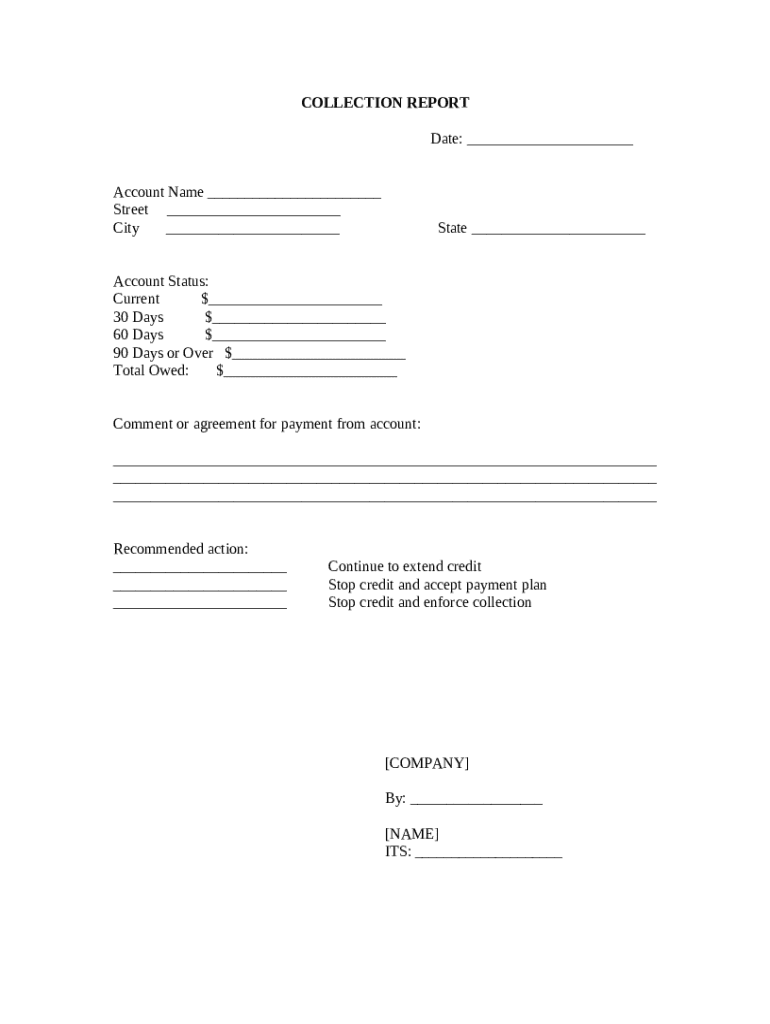

Collection Report on Past Form

How do you complete a collection report on past form?

Filling out a collection report on past form requires collecting detailed account information and reflecting current statuses for effective debt management. This guide walks you through the essential components and best practices of creating a comprehensive collection report, ensuring that your approach supports your overall credit management strategy.

-

Collect information about the debtors and their current account statuses.

-

Consider leveraging pdfFiller’s collection report templates for a structured entry.

-

Ensure all details are accurate before submitting the report.

What is a collection report?

A collection report is a document used in debt management, detailing accounts with unpaid debts and outlining required actions. It plays a crucial role in the overall credit management strategy by providing insights into outstanding debts and informing recovery approaches.

-

A collection report serves as both a record and a tool for strategizing debt recovery efforts.

-

It aids in tracking debts and ensures systematic follow-ups.

-

Utilizing pdfFiller allows for seamless creation and submission of collection reports.

What are the key components of a collection report?

A comprehensive collection report includes several essential components that provide a clear overview of the accounts in debt. Each component helps maintain clarity and aids decision-making processes.

-

Document when the report was prepared to track when actions were taken.

-

Include debtor names, addresses, and current statuses for transparency.

-

Summarize total debts to assess the impact and urgency.

-

Provide insight on any agreements or discussions had with the debtor.

-

Outline follow-up steps based on the evaluation of each account.

How do you fill out a collection report step by step?

Completing a collection report can be straightforward if you follow a step-by-step approach. Ensuring accuracy at each stage will help prevent issues later on.

-

Log the date of the report preparation for future references.

-

Gather and enter all necessary account information correctly.

-

Review the payment history to better understand what is owed.

-

Include actionable comments and recommendations for follow-up actions.

-

Make use of pdfFiller’s editing tools to enhance report quality.

What are best practices for managing collection reports?

Proper management of collection reports is critical for maintaining updated and actionable documents. Adhering to best practices helps ensure that your process aligns with effective debt management strategies.

-

Update reports to reflect the latest account statuses and interactions.

-

Keep an open channel with debtors and accurately document all discussions.

-

Take advantage of pdfFiller’s sharing tools for team collaboration.

-

Familiarize yourself with industry regulations governing debt collection practices.

How to leverage pdfFiller for document management?

pdfFiller offers essential features for effective document management, aiding in the creation and maintenance of collection reports. Utilizing these tools can significantly streamline your workflow.

-

Use pdfFiller’s cloud-based platform for easy editing and electronic signature.

-

Share reports with your team to enhance communication and workflow.

-

Track and manage different document versions to maintain updated records.

-

Incorporate pdfFiller with existing document workflows for seamless operations.

What are some examples of collection report use cases?

Collection reports are versatile and can serve various audience needs in debt management. Understanding specific use cases will help individuals and businesses optimize their collection strategies.

-

Individuals can manage their own debts effectively using collection reports.

-

Explore how small businesses have improved debt recovery by utilizing structured reports.

-

Analyze how teams manage collections for larger case volumes using collection reports.

How to fill out the collection report on past

-

1.Open the PDF file of the collection report template on pdfFiller.

-

2.Begin with filling in the header section, including the report date and the name of the individual or department preparing the report.

-

3.Enter the period for which the report is being generated, ensuring accuracy in the dates.

-

4.In the account summary section, list all overdue accounts, including the account names, amounts due, and due dates.

-

5.Utilize the built-in fields to calculate totals for overdue amounts as needed.

-

6.Document any collection actions taken for each account, detailing methods of communication and follow-up attempts.

-

7.Provide a summary section that highlights key insights, trends, or recommendations for managing overdue accounts.

-

8.Review all filled information for completeness and correctness before finalizing the document.

-

9.Use the 'Save' function to store the filled report and share it with relevant stakeholders as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.