Get the free pdffiller

Show details

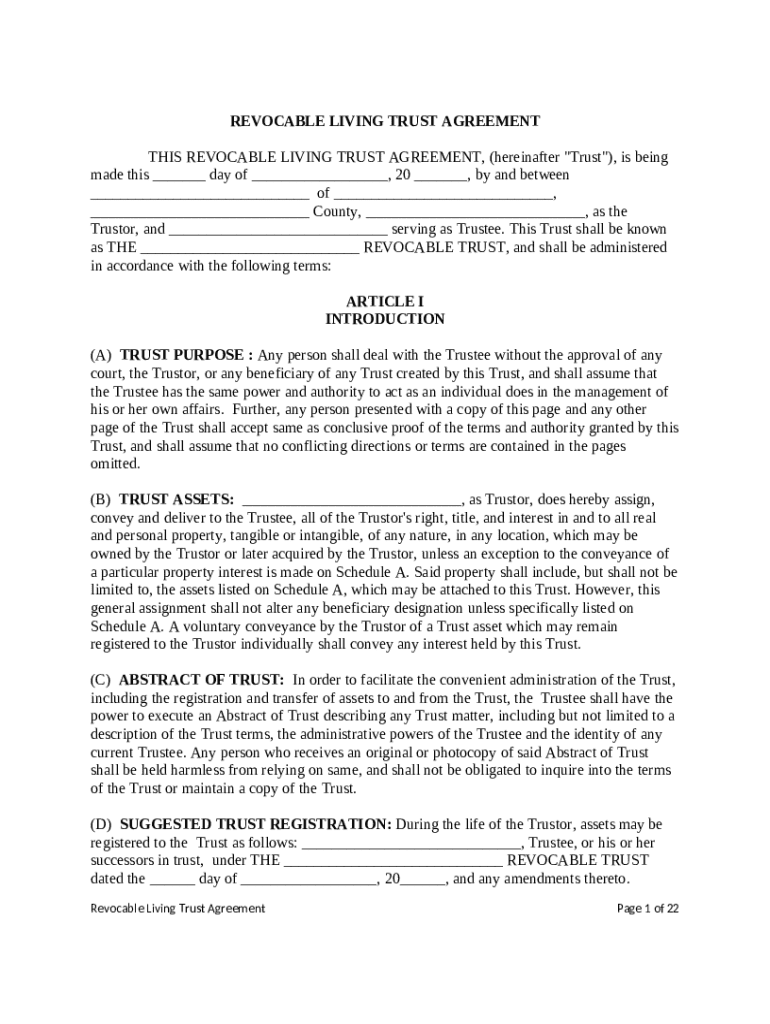

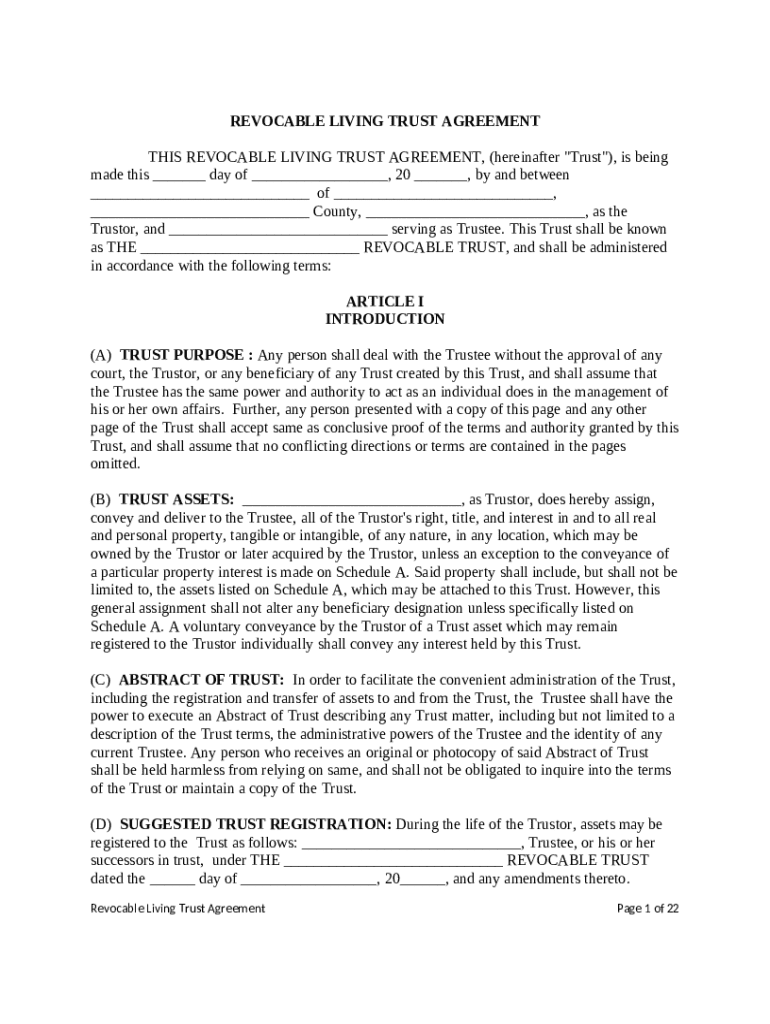

Trustor and trustee enter into an agreement to create a revocable living trust. The purpose of the creation of the trust is to provide for the convenient administration of the assets of the trust

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is revocable living trust for

A revocable living trust is a legal document that allows individuals to place their assets into a trust during their lifetime, which can be altered or revoked as long as they are alive.

pdfFiller scores top ratings on review platforms

Fast and interactive simple to use…

Fast and interactive simple to use panel.

The website is easy to use and I am…

The website is easy to use and I am able to continue to work where I left off.

Experience was excellent

Experience was excellent , Easy to use feautres

It actually converts pdf to word

Thank you, it was great, just used it once tho, but it did the job!

Its easy to use

Works great - well worth the money

separation certificate

Easy to Navigate and fill

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Revocable Living Trusts

A revocable living trust is an essential tool in estate planning, allowing individuals to place their assets into a trust during their lifetime. This guide on how to set up and manage a revocable living trust provides crucial insights for individuals and families looking to safeguard their finances from probate and manage their estate efficiently.

What is a revocable living trust?

A revocable living trust is a legal document that allows a person, known as the trustor, to place assets into a trust during their lifetime. This type of trust is termed 'revocable' because the trustor can change or revoke it at any time while alive, making it a flexible estate planning option. The primary purpose is to manage assets and ensure they are distributed according to the trustor's wishes after their death.

-

A revocable living trust is a legal document that designates a trustee to manage the trust assets for the benefit of the beneficiaries.

-

This trust is important for estate planning as it allows for asset management during the trustor’s lifetime and seamless transfer after death.

-

Unlike an irrevocable trust, a revocable living trust can be altered or revoked completely by the trustor at any point.

What are the advantages of establishing a revocable living trust?

Establishing a revocable living trust comes with several advantages that can make asset management easier and provide peace of mind for the trustor.

-

Trusts help the estate avoid the lengthy probate process, allowing beneficiaries quicker access to the assets.

-

Trustors retain the ability to amend or revoke the trust at any time, providing adaptability to changing circumstances.

-

Since trusts are not public documents, they provide a level of privacy to the estate, unlike wills which go through probate and become public record.

What are the disadvantages and limitations of revocable living trusts?

Despite their benefits, revocable living trusts come with certain drawbacks that potential trustors should consider before establishing one.

-

The initial setup and ongoing maintenance costs can be higher compared to a simple will, as legal fees and possible trustee fees may apply.

-

Assets in a revocable trust typically remain reachable by creditors, which can limit the protection offered to the beneficiaries.

-

Establishing a revocable trust can be complex, with potential tax implications and the need for detailed record-keeping.

When should you consider a revocable living trust?

A revocable living trust may be beneficial in various scenarios, particularly when there is a need for extensive estate planning.

-

Families with dependents, blended families, or those with specific wishes for asset distribution can find this trust particularly useful.

-

Individuals with substantial assets or property might benefit from the streamlined process of asset transfer without probate.

-

Different states have various laws regarding trusts and estates; consulting with a local attorney can guide the decision-making process.

How to set up a revocable living trust?

Setting up a revocable living trust involves several key steps that ensure the trust is valid and efficiently managed.

-

Begin by compiling all necessary documents, including asset lists, property deeds, and personal information to establish the trust.

-

Selecting a responsible and trustworthy person or institution as a trustee is crucial, as they will manage the trust assets and ensure distribution.

-

Employ legal assistance to draft the trust document, ensuring that it includes essential clauses regarding asset management and distribution.

What are the important components of a revocable living trust agreement?

A well-constructed revocable living trust agreement includes several vital components to ensure clarity and enforceability.

-

Clearly define the terms of the trust, including roles, responsibilities, and how assets should be managed and distributed.

-

A detailed list of the property and assets included in the trust is necessary for proper management.

-

Including legal language ensures the trust's enforceability and helps avoid disputes during asset distribution.

Where can you find a sample revocable living trust template?

Utilizing a template can effectively streamline the process of creating a revocable living trust, providing structure and legal language.

-

Access customizable templates on pdfFiller that can be modified for individual needs and situations.

-

Important sections typically include details about the Trustor, Trustee, and Asset assignments to ensure complete clarity.

-

Take advantage of pdfFiller’s user-friendly tools to edit, sign, and manage the trust document from any location.

Who is involved in a revocable living trust?

Understanding the various roles in a revocable living trust is essential for effective management and execution.

-

The trustor is the individual who creates the trust and oversees its directives during their lifetime.

-

The trustee manages the trust assets and executes distribution according to the trustor's wishes, making their role crucial.

-

Beneficiaries are those who are designated to receive the trust assets upon the trustor's death, and their rights need to be clearly defined.

How to navigate state-specific trust laws?

Understanding the variability in state-specific trust laws is essential when drafting a revocable living trust.

-

Research local laws governing trusts in your state, as these can significantly affect the structure and requirements of your trust.

-

Ensure that your trust document complies with state law requirements to avoid complications during trust administration.

-

Be aware of the consequences of non-compliance and stay informed about rectification methods, such as amending the trust.

What is the difference between a living trust and a revocable trust?

While the terms are often used interchangeably, there are subtle distinctions between living trusts and revocable trusts that should be understood.

-

A living trust can be revocable or irrevocable, while a revocable trust specifically allows changes and alterations by the trustor.

-

Both trusts can help avoid probate; however, the revocable trust has more flexibility throughout the trustor's lifetime.

-

Consider your individual needs and circumstances when deciding whether to implement a living or revocable trust.

How to fill out the pdffiller template

-

1.Begin by accessing pdfFiller and upload your blank revocable living trust form.

-

2.Fill in your name as the creator of the trust in the designated section.

-

3.Provide your address and other requested personal information.

-

4.List the assets you wish to include in the trust, itemizing real estate, bank accounts, investments, etc.

-

5.Designate a trustee who will manage the trust, which can be yourself or another trusted individual.

-

6.If desired, name a successor trustee to take over in case you become incapacitated or pass away.

-

7.Specify the beneficiaries who will receive the assets from the trust after your death.

-

8.Review the document to ensure all information is accurate and complete.

-

9.Sign the trust agreement in the presence of a notary public, if required in your jurisdiction.

-

10.Save, download, or print the completed trust for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.