Get the free Simple Promissory Note for Tutition Fee template

Show details

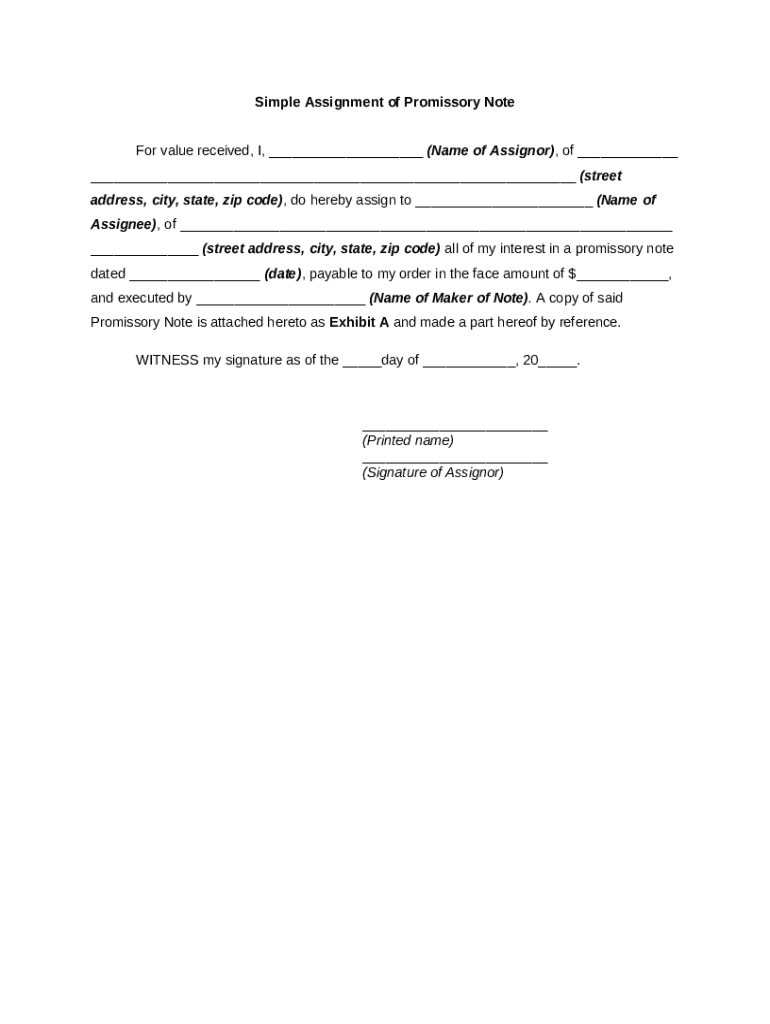

An assignment means the transfer of a property right or title to some particular person under an agreement, usually in writing.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is simple promissory note for

A simple promissory note is a financial document in which one party promises to pay a specific amount of money to another party at a specified time.

pdfFiller scores top ratings on review platforms

na

I cannot save this file as PDF on my own system. Plus I cannot copy and save in your system as my partners copy. I have to redo the form again.

Work got so much easier with pdfFiller

The format

Does way better than I expected

Works way better than any other ones I have tried. Will not use anything else. Allows me to make changes to any document I have scanned in so far.

Fast, easy and friendly

Who needs simple promissory note for?

Explore how professionals across industries use pdfFiller.

Ultimate Guide to Creating a Simple Promissory Note

Creating a simple promissory note can be straightforward with the right guidance. This document serves as a legally binding agreement between a borrower and a lender, detailing the terms under which the borrower promises to repay the loan.

In this guide, you’ll not only learn how to fill out a simple promissory note form, but you’ll also explore its components, legal considerations, and how to use tools like pdfFiller to manage your documents efficiently.

Whether you need basic insights or detailed instructions, this comprehensive guide is tailored for individuals and teams seeking a user-friendly, cloud-based document management solution.

What is a promissory note and why is it important?

A promissory note is a written promise to pay a specified sum of money to a designated party on a particular date or on demand. They authenticate financial transactions and ensure trust between involved parties.

-

Promissory notes are legally recognized, establishing obligations for both borrowers and lenders.

-

They outline the terms of the loan, including interest rates and repayment schedules, minimizing disputes.

-

In case of default, a promissory note can serve as vital evidence in court.

Understanding the distinction between secured and unsecured promissory notes is crucial. A secured note is backed by collateral, while an unsecured note relies solely on the borrower's creditworthiness.

What are the essential components of a simple promissory note?

A well-structured promissory note has several key components that should not be neglected. These elements ensure clarity and legality.

-

Clearly list the borrower and lender, including their names and addresses.

-

State the exact amount being borrowed.

-

Define the interest rate charged, if any.

-

Specify the date by which the loan must be repaid.

-

Include any clauses regarding the assignment of the note.

-

Ensure signatures for both parties along with the date the note is executed.

How can you effectively fill out a simple promissory note form?

Filling out your promissory note form can be simplified by following clear, step-by-step instructions. Ensure that all sections are accurately completed to avoid any legal pitfalls.

-

Start by entering the names and addresses of both the borrower and lender clearly.

-

Input the principal amount and the negotiated interest rate.

-

Specify the repayment due date and any conditions for late payments.

-

Check the document for accuracy and have both parties sign it with the date.

Avoid common pitfalls such as overlooking signatures or failing to define interest rates. As a helpful tool, using an example format with placeholders can reinforce understanding when filling out your note.

What legal considerations should you take into account for promissory notes?

Engaging in the issuance of a promissory note involves various legal considerations. Understanding these can protect you from potential legal challenges.

-

Ensure you comply with local and state laws governing promissory notes, which may include interest rate caps.

-

Familiarize yourself with terms like 'assignor' and 'assignee' for a smooth transaction.

-

Consider consulting a legal professional to navigate the complexities of promissory notes.

How can pdfFiller assist in managing your promissory notes?

pdfFiller offers a powerful platform for creating and managing your promissory notes efficiently.

-

Utilize features such as document editing, eSignature capabilities, and cloud storage.

-

Collaborate with other parties directly within the platform to make edits and finalize terms together.

-

Store your promissory notes in a secure, easily accessible cloud environment.

The ability to manage such documents from anywhere enhances the user experience, allowing you to take meaningful action quickly.

What are some examples of simple promissory notes?

When looking for practical manifestations of a simple promissory note, analyzing examples can be insightful.

-

A classic example might stipulate a loan amount without collateral, and could demonstrate a simple repayment plan.

-

Healthcare financing often uses similar but tailored agreements reflecting industry needs.

-

Review various scenarios to assess how terms would change based on different interest rates and collateral.

In conclusion, understanding and accurately filling out a simple promissory note is crucial for establishing trust in financial transactions. By utilizing effective tools such as pdfFiller, both individuals and teams can manage documents securely and efficiently.

With the right knowledge, a simple promissory note can serve as a reliable method for managing loans and ensuring compliance.

How to fill out the simple promissory note for

-

1.Start by opening pdfFiller and selecting 'Create New Document.'

-

2.Search for 'Simple Promissory Note' template from the library.

-

3.Choose the correct template and click 'Edit' to begin filling it out.

-

4.Enter the borrower's name and address in the designated fields.

-

5.Fill in the lender's name and address next.

-

6.Specify the principal amount being borrowed in numbers and words.

-

7.Indicate the interest rate, if applicable, and the payment due date.

-

8.Include a specific payment schedule if needed, detailing installment amounts.

-

9.Add any additional terms or conditions relevant to the loan agreement.

-

10.Review the document for accuracy, ensuring all information is correct.

-

11.Save your changes regularly during the process.

-

12.Once complete, download the finalized document in your preferred format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.