Get the free Late Payment Cover Letter template

Show details

Late payment cover letter

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is late payment cover letter

A late payment cover letter is a formal document sent to notify a creditor of a delayed payment and to request leniency or a payment extension.

pdfFiller scores top ratings on review platforms

great service, convenient and easy to learn

Pretty easy to use and the free trial is a good way to see how it works.

easy to use BUT take time to learn more how to fill the various form.

Good experience so far, but just started using.

works well. not many ways to fill a pdf.

I find the little post notes that follow you through forms somewhat annoying. can they be turned off

Who needs late payment cover letter?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Late Payment Cover Letter Form

What is a late payment cover letter?

A late payment cover letter is a formal document used to address overdue payments. This letter serves multiple purposes, such as notifying clients of their outstanding balance, expressing apologies, and reaffirming one’s commitment to future payments. Effective communication through this letter is crucial to maintain professional relationships, especially when addressing sensitive financial matters.

-

It defines the reasons behind the delay in payment, outlining the account status.

-

It aims to politely inform recipients about their overdue payments while emphasizing the importance of settling debts.

-

Effective communication helps to avoid misunderstandings and preserves positive business relationships.

What are the key components of a late payment cover letter?

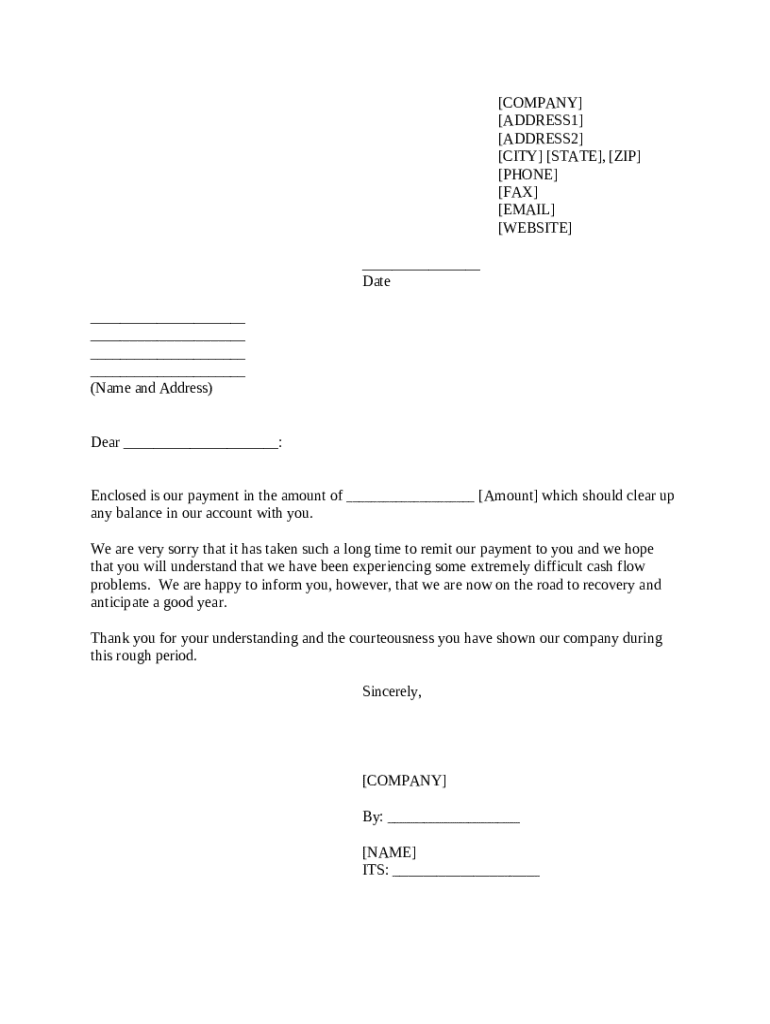

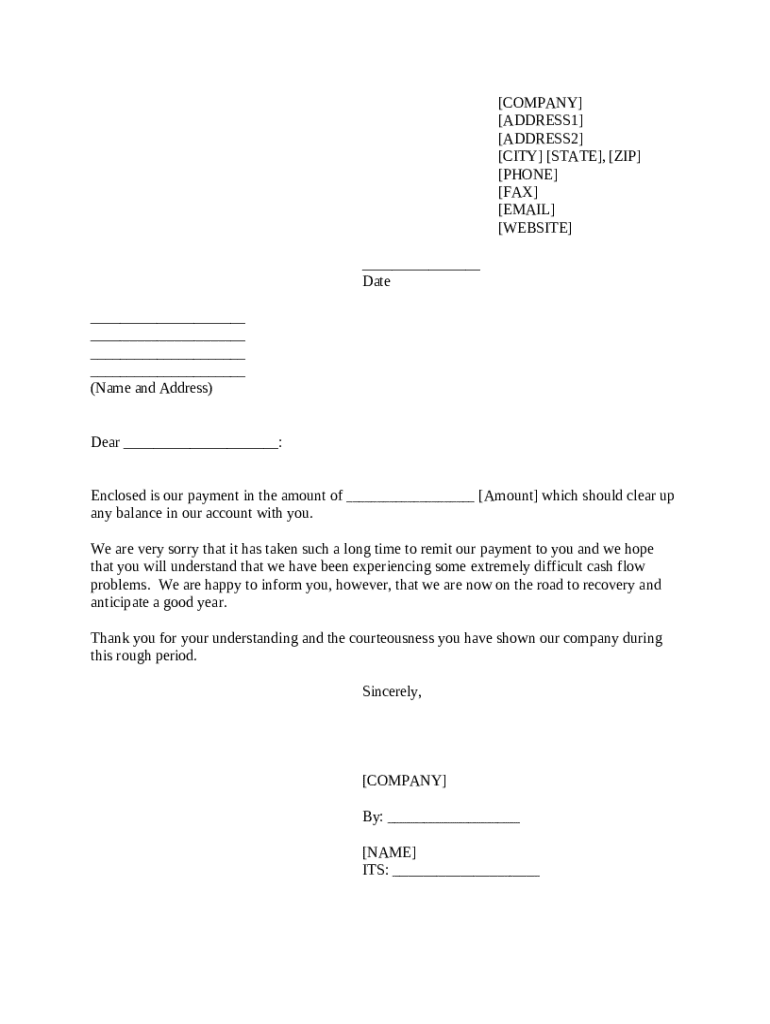

A late payment cover letter must include specific information to convey the message effectively. Essential elements include your company information, the recipient’s details, and a clear date at the top of the letter.

-

Include your company name, address, and contact details for clarity.

-

Accurate recipient information ensures that the letter reaches the intended individual.

-

The date indicates when the letter was drafted and is essential for record-keeping.

-

A clear subject line helps convey the letter's intent immediately.

-

A brief expression of apology shows professionalism and empathy.

How can pdfFiller aid in creating and editing your letter?

Using pdfFiller allows users to create, fill out, and edit their late payment letter templates easily. The platform's features streamline the process, providing users with user-friendly tools for customization and collaboration.

-

Start by visiting the pdfFiller website and creating an account.

-

Choose a late payment letter template from the extensive options available.

-

Utilize various editing tools to customize the letter as per your requirements.

-

Send the letter for digital signatures to ensure a timely response.

How to address common concerns in your letter?

Professionally addressing concerns within your late payment letter can help in mitigating potential misunderstandings. It’s essential to stay diplomatic and maintain a positive tone throughout.

-

Approach difficult financial scenarios with empathy and understanding.

-

Express your commitment to keep up with future payments to reassure the recipient.

-

Keep a professional tone to establish trust and respect.

What are the legal considerations when sending your late payment letter?

Understanding the legal aspects governing late payment letters is crucial for any sender. Compliance with local regulations ensures that your communication is appropriate and avoids legal complications.

-

Know your rights and obligations as a creditor when sending payment requests.

-

Ensure compliance with regulations regarding payment communications in your area.

-

Consult with legal professionals when unsure about the necessary steps.

What are some examples of late payment letters for different scenarios?

Tailoring your late payment letter to the specific circumstances can enhance its effectiveness. Consider these templates to streamline your communication.

-

Ideal for addressing overdue payments in a corporate setting.

-

Specialized for addressing late payments related to food services.

-

Useful for landlords communicating with tenants about overdue rent.

-

Explains the necessity of timely rent payments effectively.

What are best practices for effective late payment communication?

Implementing best practices in your communication is vital for improving the chances of payment recovery. Timing and follow-up are critical components of this process.

-

Send your letter as soon as a payment becomes overdue for effective communication.

-

Develop a follow-up schedule to remind recipients about pending payments.

-

Ensure that clients feel comfortable discussing their payment issues with you.

What tips can help manage late payments in your business?

Managing late payments effectively can secure your cash flow. By setting clear parameters, you can significantly reduce the occurrence of overdue payments.

-

Define expectations regarding payment timing at the outset of a project.

-

Maintain professionalism in invoicing to enhance payment compliance.

-

Effective reminders can prompt clients to settle dues on time.

How to fill out the late payment cover letter

-

1.Open pdfFiller and upload your late payment cover letter template or choose to create a new one.

-

2.Fill in the date at the top of the letter, ensuring it’s current.

-

3.Enter your name and address in the header section, followed by the recipient’s name and address.

-

4.Begin with a formal salutation, such as 'Dear [Creditor's Name]', to establish the context of your correspondence.

-

5.In the opening paragraph, clearly state the purpose of your letter—acknowledging the late payment.

-

6.Provide a brief explanation of the circumstances that led to the delay, emphasizing your usual timely payment history if applicable.

-

7.Politely request an extension or a payment plan, ensuring to outline any proposed dates for payment.

-

8.Conclude the letter with gratitude for their understanding and cooperation, and express your intent to resolve the situation promptly.

-

9.Sign the letter at the bottom and include your printed name, ensuring it's professionally formatted, before saving your work.

-

10.Download or print the completed letter to send it via email or postal service to your creditor.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.