Get the free Request for Disclosure on Consumer Credit Investigation template

Show details

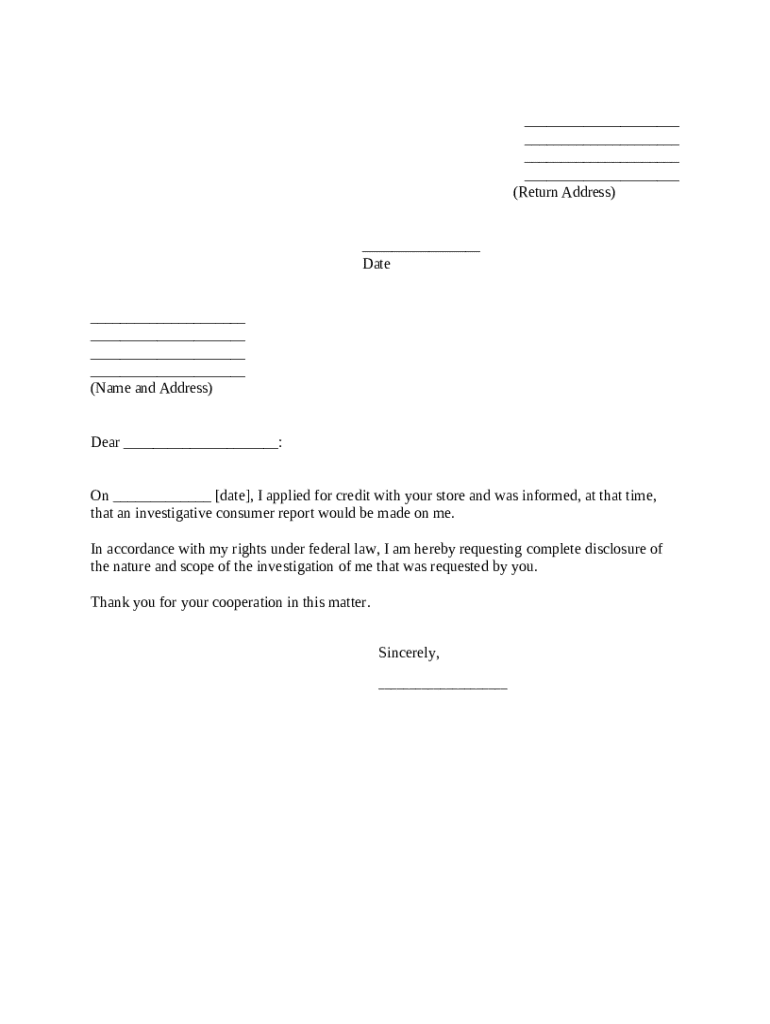

Request for disclosure on consumer credit investigation

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is request for disclosure on

A request for disclosure is a legal document that asks for specific information or evidence during legal proceedings.

pdfFiller scores top ratings on review platforms

The time it saves on filling out forms is unbelievable compared to before I started using PDFfiller.

A very handy application. I use it every time that I have to complete and sign an online document.

superb, a little slow perhaps. It'd be nice to fill in printed boxes precisely

My experience has been PDFfiller is an efficient way to conduct business.

I love it. It is very convenient for completing and signing documents required for both business and personal use.

Great software, time saving, user friendly

Who needs request for disclosure on?

Explore how professionals across industries use pdfFiller.

Navigating the Request for Disclosure on Form Form

Filling out a 'request for disclosure on form form' is crucial for individuals seeking transparency in their credit reports and privacy rights under federal law. Understanding how to accurately complete this form enables consumers to take control of their personal information.

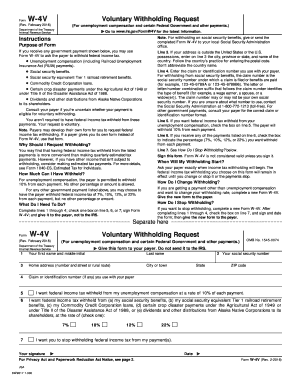

How do understand my rights under federal law?

Consumers have the right to request an investigative consumer report according to the Fair Credit Reporting Act (FCRA), which promotes transparency in how personal data is handled. Failure of creditors to disclose certain information can have serious implications, potentially affecting consumers' credit scores and financial security.

-

Consumers can obtain reports that outline their credit history and identify discrepancies.

-

The FCRA outlines protections for consumers, including the right to dispute inaccuracies on credit reports.

-

If creditors do not disclose necessary information, it can lead to penalties and might affect your creditworthiness.

What is the request for disclosure process?

Understanding the steps involved in the request for disclosure process is vital for successful submissions. This structured approach will reduce the risk of errors and lead to quicker responses.

-

Follow the provided instructions carefully to ensure each field is accurately completed.

-

Double-check your form for missing information that could delay the process.

-

Use any provided reference numbers or confirmation emails to follow up and confirm receipt.

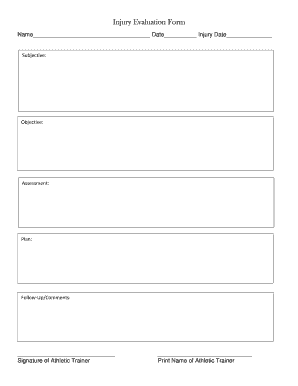

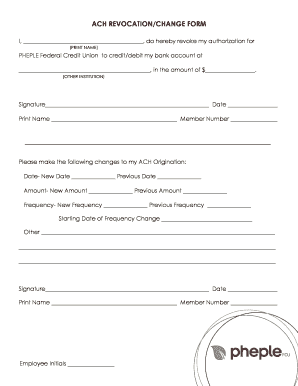

What are the key components of the disclosure form?

A well-constructed disclosure form is essential for effective communication with creditors. Each section must be completed with attention to detail to avoid processing delays.

-

Your appropriately formatted return address ensures that responses are sent to you without issues.

-

Always include the date on which you are submitting the request to document the timeline.

-

Your name and address help verify your identity and link it to the correct credit report.

How can pdfFiller help with form submission?

pdfFiller provides a range of features to optimize the form submission experience. Using their editing and cloud management services significantly eases the process.

-

Utilize pdfFiller to adjust fields and make necessary corrections with ease.

-

E-sign your completed disclosure form securely and share it directly with creditors.

-

Access your forms from anywhere and manage document sharing effortlessly with pdfFiller.

What are best practices for follow-up after submission?

Effective follow-up is crucial in ensuring your request for disclosure is processed timely. Understanding the necessary steps can help prevent ignored inquiries.

-

Reach out to the creditor via their preferred contact method to verify receipt of your request.

-

Know the average waiting time for disclosure requests and plan your follow-ups accordingly.

-

If you do not receive a response, escalate the issue by contacting consumer protection agencies or seeking legal advice.

What are case examples of successful requests for disclosure?

Real-life examples of successful requests can provide valuable lessons. They offer insights into how others navigated challenges during the process.

-

Learning from individuals who successfully received their disclosures highlights effective strategies.

-

Understanding reasons for denial can help improve your own request process.

-

Explore how specific regional laws may impact the request for disclosure and influence outcomes.

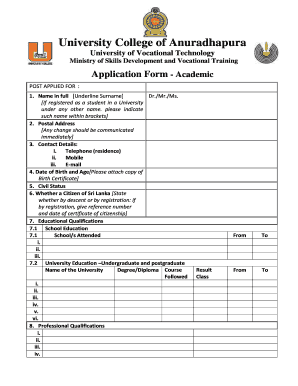

How to fill out the request for disclosure on

-

1.Start by opening the PDF filler software or website.

-

2.Locate the 'request for disclosure' template in the document library or search for it using keywords.

-

3.Once you have accessed the template, review the fields that need to be filled out.

-

4.Begin by entering your legal name and contact information in the designated spaces.

-

5.Fill in the opposing party's details, including their name, address, and relation to the case.

-

6.Under the requests section, clearly list each piece of information or document you are requesting.

-

7.Ensure that each request is specific and numbered for clarity.

-

8.Review and double-check all entered information for spelling and accuracy.

-

9.Save your progress regularly to avoid losing any information.

-

10.Once completed, download the document in your preferred format or send it directly through the platform as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.