Get the free Promissory Note for Sale of Business template

Show details

This form is a Promissory Note. The borrower promises to repay the lender, with interest, on a particular loan. The payments will be made in monthly installments and there is no penalty for pre-payment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

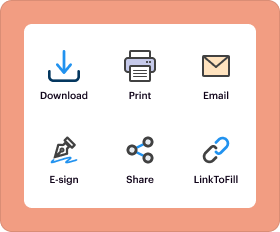

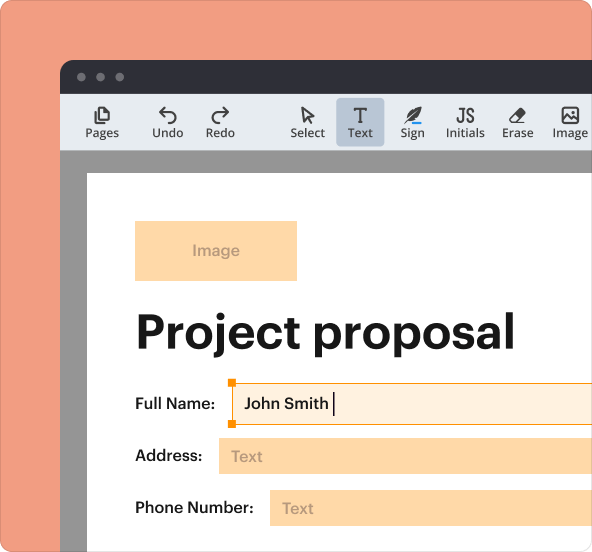

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note for sale

A promissory note for sale is a financial instrument wherein the seller agrees to sell a note that promises to pay a certain amount within a specified time frame.

pdfFiller scores top ratings on review platforms

I was hoping for more of an extension of my locally installed software so not to have to save in multiple folders.

its a great tool to edit pdf files that overwise cannot be edited!

It's ok. Don't know much about any other programs, frankly. ; ) Like the selections...

I find it very easy to use and of great benefit to me in my work.

Pretty good product. Couldn’t read some fields correctly.

great sit, wish I could use my mac computer to fill out this stuff though

Who needs promissory note for sale?

Explore how professionals across industries use pdfFiller.

A Comprehensive Guide to Promissory Note for Sale Forms

How can you fill out a promissory note for sale form?

Filling out a promissory note for sale form requires understanding its structure and the information you need to provide. Begin with a clear definition of the principal loan amount and the repayment terms. Ensure you include details on interest rates, payment schedules, and any potential penalties for late payments.

Understanding the promissory note

A promissory note is a written promise to pay a specified amount of money to a certain person or bearer. It serves as a legal document that outlines the parameters of a loan, including repayment terms and interest.

-

Promissory notes establish trust between lenders and borrowers by clearly stating the terms and conditions of the loan.

-

Secured promissory notes are backed by collateral, while unsecured notes are not, posing different risks for lenders.

-

Promissory notes are typically used in personal loans, real estate transactions, and business financing scenarios.

What are the key components of a promissory note?

-

Specify the amount loaned and the interest charged for repayment.

-

Detail how and when payments should be made, including due dates.

-

Outline any fees or penalties associated with late payments or defaults.

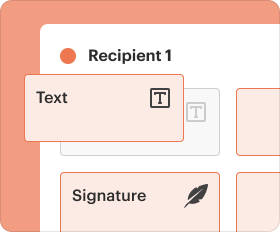

How to create your promissory note with pdfFiller?

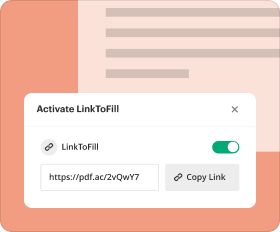

pdfFiller provides a straightforward, cloud-based approach to creating and managing your promissory note.

-

Start by selecting a template on pdfFiller, then fill in your details step by step.

-

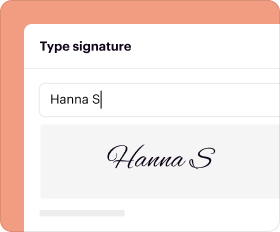

Use pdfFiller to edit your document, add your signature, and send it securely.

-

Access your documents anywhere, store securely, and collaborate with others seamlessly.

Filling out the promissory note form

-

Each section of the form must be filled out accurately to avoid legal complications.

-

Carefully enter your information, double-check figures, and ensure clarity.

-

Understand regional laws that may affect terms within the note.

Understanding payment terms and defaults

-

Clarify how payments will be broken down and when they are due.

-

Discuss the ramifications of late payments, including potential fees.

-

Explain how late fees work and the process for enforcing repayment.

What are the legal implications and rights?

-

Both borrowers and lenders have rights that are protected under the law.

-

Certain waivers may be included in the note to protect lender interests.

-

Know how state laws might impact the enforcement of your promissory note.

What are the essential compliance notes?

-

Ensure that all necessary compliance regulations are met for enforceability.

-

Review how your state laws can change the way you draft your note.

-

Gather any required documentation that supports the validity of the note.

Common mistakes to avoid

-

Mistakes in entering information can void the note or lead to disputes.

-

Neglecting to clarify terms may result in confusion between parties.

-

Always review your note thoroughly before signing to ensure accuracy.

How can pdfFiller's interactive tools enhance your experience?

-

pdfFiller promotes document collaboration through shared access and editing.

-

Securely sign your documents online to save time and ensure authenticity.

-

All your document management can be handled through pdfFiller, centralizing your workflow.

How to fill out the promissory note for sale

-

1.Step 1: Open the promissory note for sale template on pdfFiller.

-

2.Step 2: Input the seller's name and address in the designated fields.

-

3.Step 3: Enter the buyer's name and address as well.

-

4.Step 4: Specify the principal amount in the appropriate section.

-

5.Step 5: Fill in the interest rate that will be applied to the note.

-

6.Step 6: Include the due date for the repayment of the principal amount.

-

7.Step 7: Review any payment terms or schedules that need to be clarified.

-

8.Step 8: If applicable, add any late payment penalties or fees.

-

9.Step 9: Include a section for signatures from both the seller and the buyer.

-

10.Step 10: Save the completed document and download it for distribution.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.