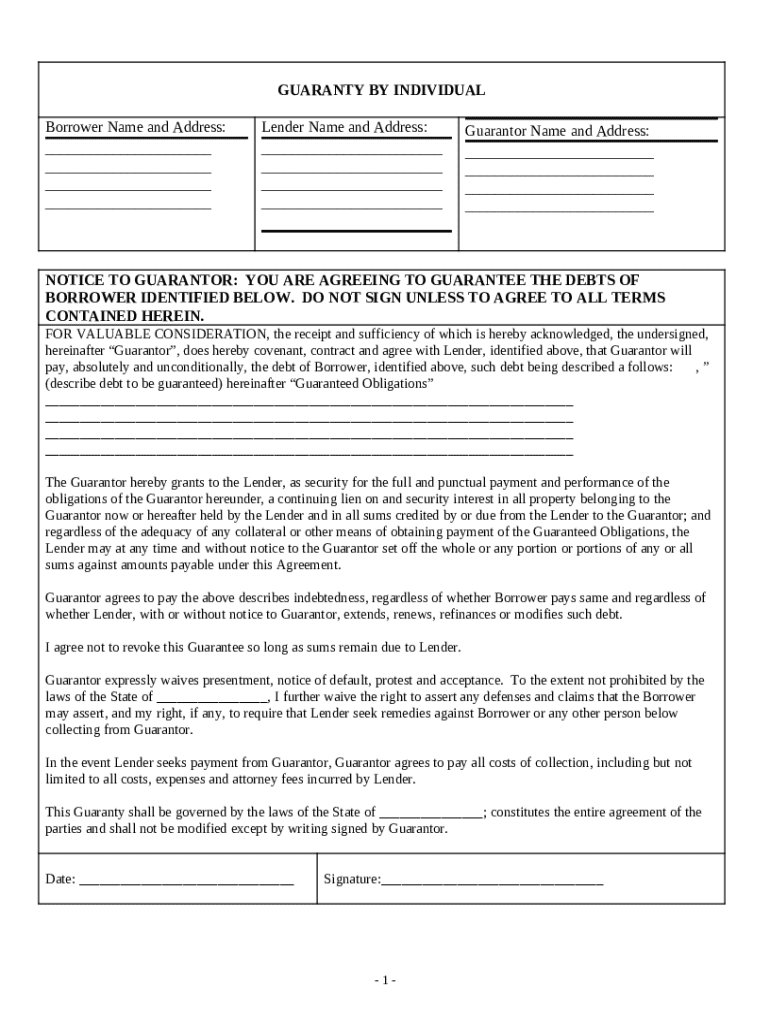

Get the free Guaranty by Individual - Complex template

Show details

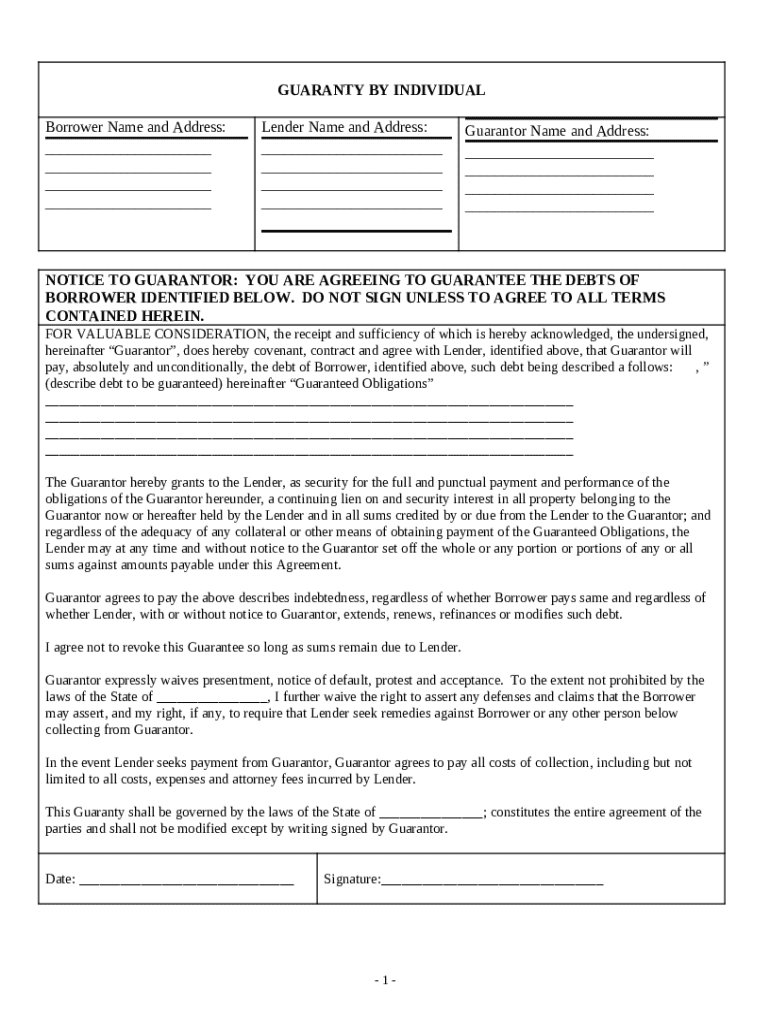

This form states that for valuable consideration, the guarantor contracts and agrees with the lender, that the guarantor will pay, absolutely and unconditionally, the debt of the borrower.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is guaranty by individual

A guaranty by individual is a legal document in which one person agrees to be responsible for the debts or obligations of another individual.

pdfFiller scores top ratings on review platforms

great

awesome

Great new and easy!!

easy

works great so far!

awesome

Who needs guaranty by individual?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Guaranty by Individual Form

How to fill out a guaranty by individual form?

Filling out a guaranty by individual form involves a series of precise steps to ensure compliance with legal requirements and protect the interests of all parties involved. This guide provides detailed instructions to streamline the process of completing this important document.

Understanding the guaranty by individual form

A guaranty agreement is a legally binding document where one party, the guarantor, agrees to take responsibility for a debt or obligation incurred by another party, known as the borrower. It provides security for lenders, ensuring that they have a backup source for repayment if the borrower defaults on their obligations.

This form is particularly useful for individuals who may not have significant credit histories or guarantees. Understanding the key terms and responsibilities involved is essential for anyone considering a guaranty.

-

The guaranty by individual form serves to formalize the agreement between the borrower, the lender, and the guarantor, clarifying details about the debt involved.

-

Individuals who are looking to support a loan or obligation for someone else should consider this form to legally acknowledge their guarantee.

-

Terms like 'borrower', 'guarantor', and 'lender' are critical to understand as they dictate the roles and responsibilities within the agreement.

Who are the key participants in the guaranty agreement?

Understanding the roles of different participants in a guaranty agreement is crucial for its effectiveness. Each party has specific rights and responsibilities that must be clearly defined.

-

The borrower is the individual or entity seeking the funds or debt. Their obligations under the agreement need to be clearly outlined to protect all parties.

-

Lenders must understand how the guaranty protects them in case the borrower defaults. This form solidifies their position for recourse against the guarantor.

-

The guarantor assumes responsibility for the debt if the borrower fails to fulfill their obligations, thus it’s vital for the guarantor to be aware of their legal responsibilities.

How to fill out the guaranty by individual form

Completing the guaranty by individual form requires attention to detail and accuracy. Here’s a step-by-step guide to ensure the document is filled out correctly:

-

Accurate information about the borrower is essential for identifying the party responsible for the primary obligation.

-

Including lender details ensures that all parties involved in the agreement are well documented. It also protects the lender's interests.

-

The guarantor’s information must be clear and precise, as they assume responsibility for the debt.

-

Clearly outlining the nature and amount of the debt provides clarity and prevents future disputes about obligations.

-

It is crucial to read and comprehend all terms and conditions in the form so that all parties are aware of their responsibilities.

What are the key considerations while filling out?

Ensuring accuracy and understanding of the terms used in the guaranty by individual form is essential to prevent misunderstandings and disputes. Double-checking all details before finalizing the form is a best practice.

-

Familiarizing yourself with legal jargon can simplify the process and minimize potential issues later.

-

Accurate information helps avert disputes regarding the roles, responsibilities, and commitments of each party involved.

What are the legal notices and agreements involved?

Legal notices play a vital role in the guaranty process. They inform all parties of their rights and obligations under the agreement.

-

This notice ensures that the guarantor is fully aware of the risks associated with signing the guaranty, especially regarding defaults.

-

Signing a guaranty form has legal ramifications; if the borrower defaults, the lender can pursue the guarantor for repayment.

-

Knowing which rights are waived upon signing can protect the guarantor’s interests in case of a dispute.

What does liability under a guaranty look like?

Liability in a guaranty form can impact a guarantor's financial situation significantly. Thus, understanding this liability is crucial before signing.

-

By signing, the guarantor commits to repaying the debt should the borrower fail to do so, which can lead to severe financial repercussions.

-

The guarantor may face unexpected financial strain if the borrower defaults, so it's vital to assess the risk involved.

-

Considering revocation may be necessary in circumstances where a borrower is at high risk of default.

How can pdfFiller tools assist with your guaranty form?

Using pdfFiller’s tools makes editing and managing your guaranty form a breeze. The platform provides several features tailored to enhance your experience.

-

pdfFiller offers user-friendly editing tools that allow you to modify your form as needed, ensuring all information is current and accurate.

-

The eSign feature enables compliant signing of documents, ensuring legal recognition of the agreement.

-

pdfFiller’s collaborative tools facilitate easy sharing and communication between all parties involved, optimizing the completion process.

What is the final review and submission process like?

Before submitting your guaranty by individual form, a thorough review is essential to identify any errors or omissions.

-

Mistakes can lead to legal complications or disputes, making it critical to perform a final check of all details.

-

Storing documents securely and preparing for possible audits are essential practices for anyone managing important legal documents.

-

pdfFiller provides robust security features to protect your documents throughout the submission process, enhancing peace of mind.

How to fill out the guaranty by individual

-

1.Open pdfFiller and upload the guaranty by individual document.

-

2.Read through the document to understand all sections needing completion.

-

3.Start by filling in the personal details of the guarantor, including name, address, and contact information.

-

4.Next, enter the details of the individual for whom you are guaranteeing obligations, including their name and relationship to you.

-

5.Specify the terms of the guarantee, including the amount guaranteed and any conditions that apply.

-

6.Review the document carefully to ensure all provided information is accurate and complete.

-

7.Sign the document in the designated section, and ensure it is dated appropriately.

-

8.If required, have the document notarized to validate your guarantee before submission.

-

9.Save your changes and download the completed document in your preferred format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.