Get the free Revocable Trust for House template

Show details

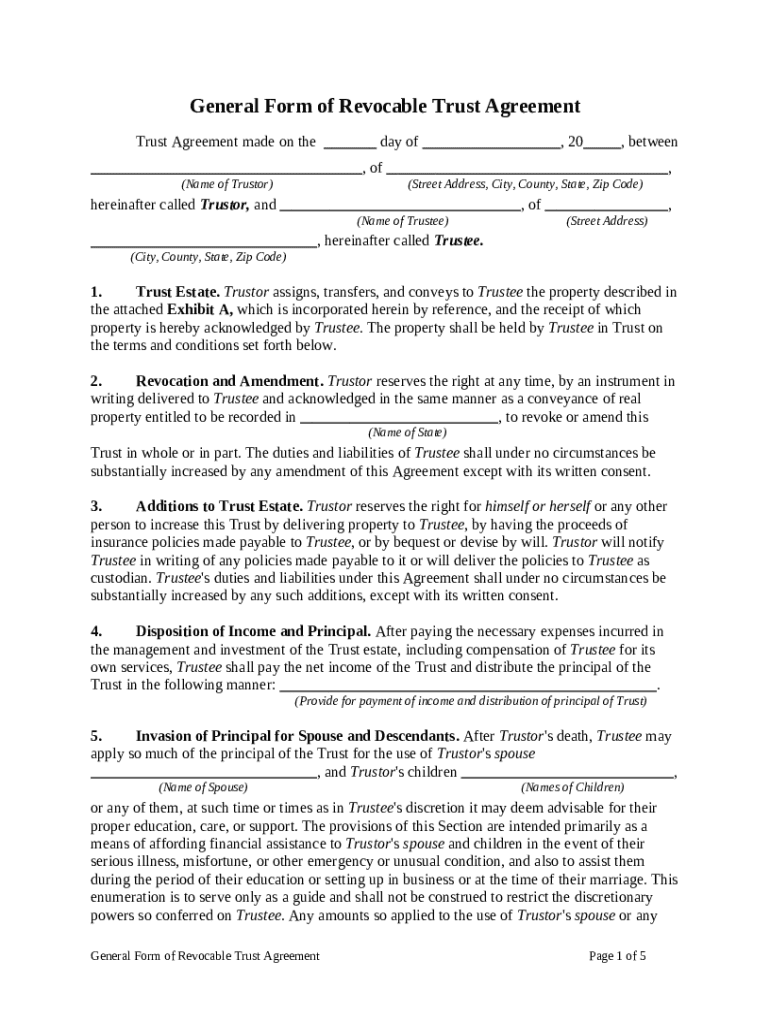

This form is a general form of a revocable trust agreement. Trusts can be revocable or irrevocable. The revocable trust can be amended or discontinued at any time. An irrevocable trust cannot be modified

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is revocable trust for house

A revocable trust for a house is a legal arrangement allowing the trustor to retain control over their property during their lifetime while facilitating the transfer of ownership upon death without the need for probate.

pdfFiller scores top ratings on review platforms

I found that PDFfiller helped me with my taxes

Fast and efficient way of getting legal Framework documents to Support you in all Business matters.

very easy to use. im very glad i found you guys. keep up the good work. thanks alot for helping us contractors all ovee

I have tried other PDF fillers before - they were not user friendly and for the most part, did not work. This one is awesome...

some forms like tax qtrter 941 is not editable in pdf filler, I had to go outside to IRS website , fill ,then save here.

Bit of inconvenience

Taking a free online webinar might be great for me and my administrative team. Thank you.

Who needs revocable trust for house?

Explore how professionals across industries use pdfFiller.

Long-read how-to guide for a revocable trust for house form

Creating a revocable trust for your house may seem daunting, but it's a streamlined process when guided correctly. This comprehensive guide will help you understand the essential aspects of a revocable trust, providing practical steps for setting up your form successfully.

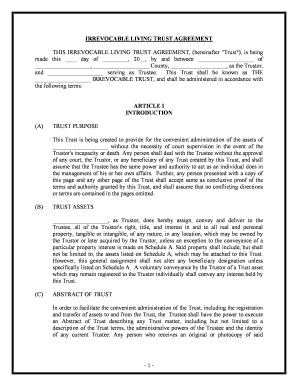

What is a revocable living trust?

A revocable living trust is a legal document that enables you to place your assets, including a house, into a trust during your lifetime. It allows you, as the trustor, to retain control over these assets, making modifications as needed. Unlike irrevocable trusts, revocable trusts can be altered or dissolved by the trustor at any time.

-

It is a flexible financial tool designed to manage assets while allowing the trustor to maintain ownership.

-

Revocable living trusts help avoid the probate process, simplifying the transition of assets to beneficiaries.

-

Essential elements include the trustor's name, trustee designation, and assets involved, documented in an agreement.

-

Unlike irrevocable trusts, which cannot be modified after establishment, revocable trusts offer the flexibility of change.

What are the benefits of creating a revocable living trust?

A revocable living trust comes with various advantages that many homeowners find appealing, particularly regarding estate management and privacy.

-

Establishing a revocable trust helps your heirs skip the lengthy and costly probate process, allowing for quicker distribution of assets.

-

The trustor can make adjustments to the trust throughout their lifetime, accommodating changes in circumstances or preferences.

-

Unlike wills, which become public records during probate, a revocable trust maintains confidentiality about the assets and their distribution.

What are the potential drawbacks of revocable living trusts?

Despite their benefits, revocable living trusts are not without limitations. It is crucial to understand these drawbacks before proceeding.

-

Initial setup and ongoing maintenance of a trust can be costly compared to simpler estate planning tools.

-

Some believe that revocable trusts protect assets from creditors; this is not true, as assets remain under the trustor's control.

-

Having a revocable trust can affect your qualifications for Medicaid assistance due to the asset evaluations involved.

When should you consider establishing a revocable living trust?

Recognizing when to develop a revocable living trust can simplify estate planning significantly. Key situations may necessitate this move.

-

When you have significant assets or children, a revocable trust can ensure organized distributions and continued management.

-

Consider your family dynamics, possible future health issues, and the complexity of your financial situation in your choice.

-

Life changes like marriage, divorce, or the birth of children can prompt the need for trust establishment.

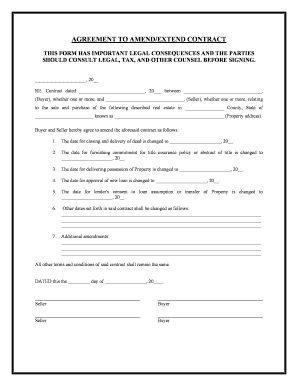

How do you set up a revocable trust?

Setting up a revocable trust is a systematic process that involves several deliberate steps to ensure accuracy and legality.

-

Prepare a list of names, addresses, and details regarding the property you wish to include in the trust.

-

Make use of templates available through platforms like pdfFiller to create a legally sound trust document.

-

Ensure proper signing and notarization to validate the trust agreement; this typically requires witnesses.

-

Move your house and other assets into the trust, fulfilling legal requirements and ensuring the paperwork is correct.

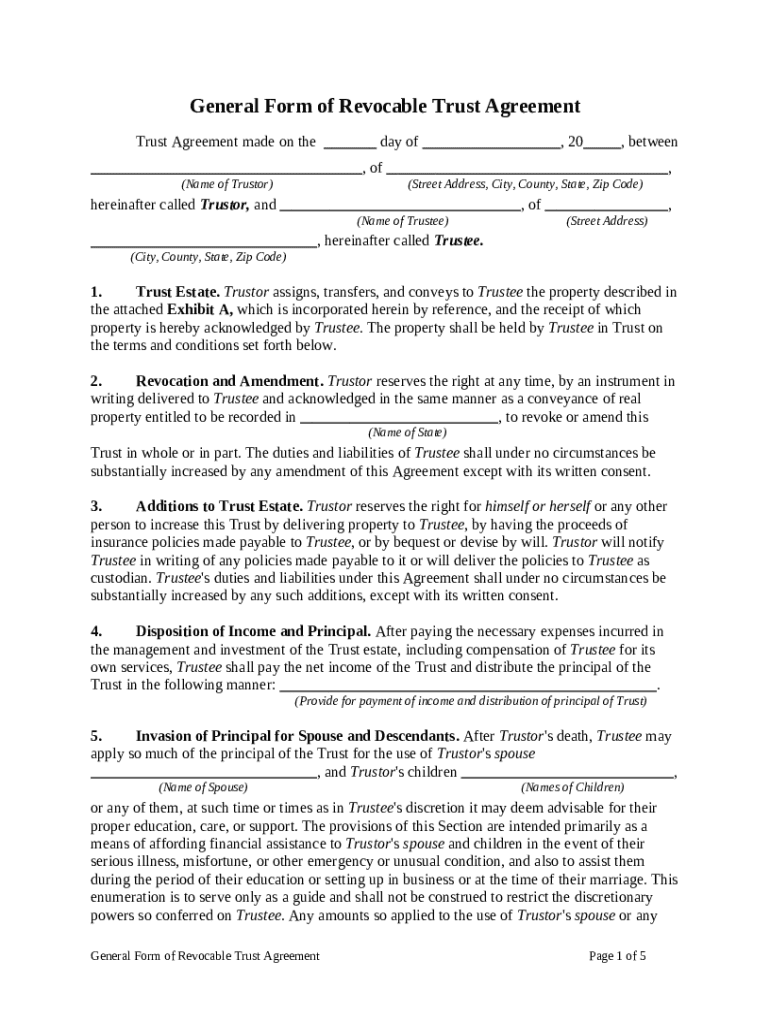

Which key form fields should you pay attention to?

Completing the revocable trust form accurately is essential for establishing valid legal authority and intent.

-

This is the person creating the trust; it’s vital to ensure correct spelling and identification.

-

List the primary residence and ensure it matches public records to avoid legal conflicts.

-

Clarify who will manage the trust, executing stipulations according to your wishes.

-

Use this section to itemize specific assets being transferred into the trust for clarity.

-

Include clear statements about conditions leading to possible changes or dissolutions of the trust.

How to manage trusts using pdfFiller?

pdfFiller provides a user-friendly interface for creating and managing trust documents. Leveraging this cloud-based platform can streamline your planning process.

-

Easily edit trust documents to reflect changes in your estate planning or personal circumstances.

-

Utilize pdfFiller's eSign function to ensure the trust document is legally binding without the hassle of printing.

-

Enable discussions within teams about trust management or estate planning through real-time sharing and commenting.

What should you know about state-specific trust laws?

Understanding the local laws regarding trusts in your region is essential. Every state has specific regulations that could influence your revocable trust.

-

Familiarize yourself with how local legislation impacts the establishment and management of revocable trusts.

-

Check regulations on how property can be owned and transferred within the trust, as this varies significantly by state.

-

Evaluate the potential taxes incurred on assets held in trust, especially if significant property transfers are involved.

What’s the difference between living trusts and revocable trusts?

Understanding the distinctions between living trusts and revocable trusts can help homeowners make better estate planning decisions for their unique circumstances.

-

Living trusts are typically revocable by nature, but not all living trusts have the same capabilities as a revocable trust.

-

Revocable trusts offer greater control over modifications, whereas living trusts can sometimes incorporate additional terms and stipulations.

-

Consider scenarios of homeowners needing flexibility versus those requiring strict asset management, guiding your choice.

In conclusion, a revocable trust for house form is a vital document that can simplify estate planning. By understanding how to set it up, its benefits and drawbacks, and using tools like pdfFiller for management, you can create a sustainable estate plan tailored to your needs.

How to fill out the revocable trust for house

-

1.Open pdfFiller and upload the revocable trust form for the house.

-

2.Begin by entering your name and address in the designated fields.

-

3.Fill in the details of the property, including the address and legal description.

-

4.Designate a trustee by providing their name and contact information.

-

5.Specify any co-trustees or successor trustees, if desired.

-

6.Outline your wishes regarding property management and distribution upon your death.

-

7.Review all entered information for accuracy and completeness.

-

8.Save the completed form and either print it for signatures or send it electronically for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.