Get the free Simple Promissory Note for Family Loan template

Show details

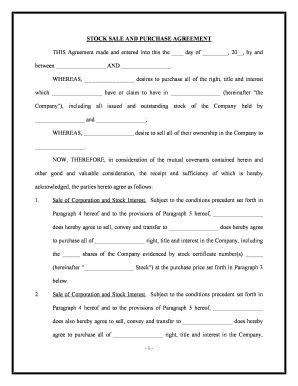

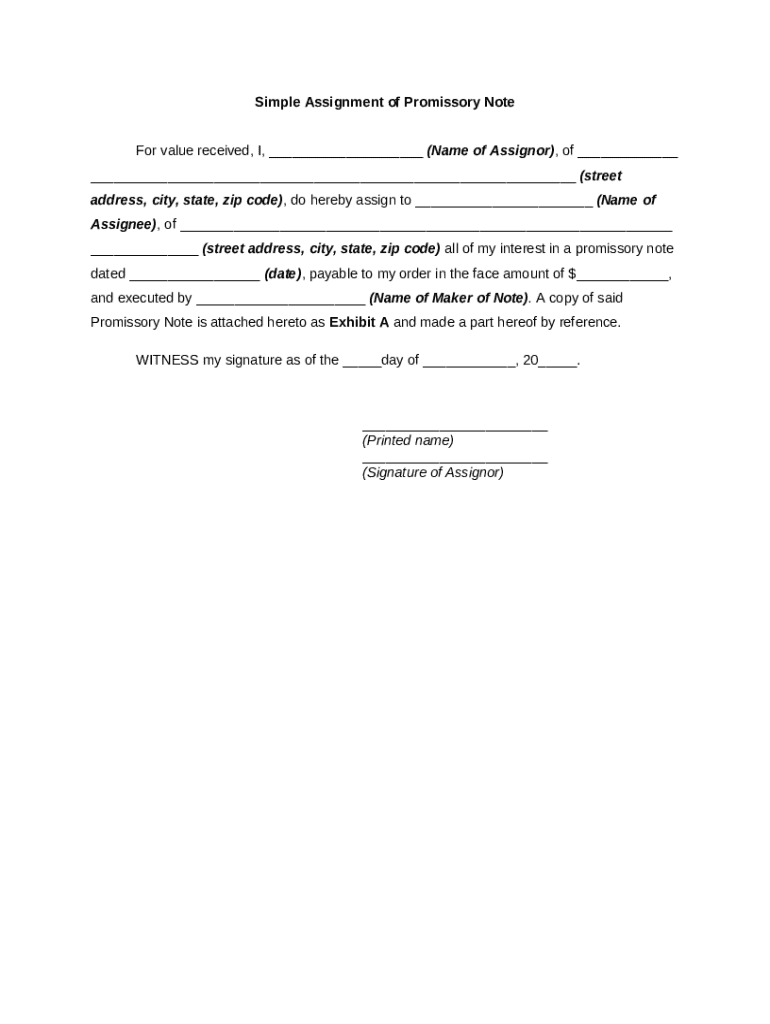

An assignment means the transfer of a property right or title to some particular person under an agreement, usually in writing.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is simple promissory note for

A simple promissory note is a written promise to pay a specific amount of money to a designated party at a specified time or on-demand.

pdfFiller scores top ratings on review platforms

Works awesome!

most of it is pretty simple and works wonderfully

I have just begun using pdfFiller. It appears very user-friendly and just what I have needed.

Convenient and easy to convert docs

EXCELLENT I LOVE IT.

i FOUND IN CONVENIENT AND EASY TO NAVIGATE THROUGH THE DOCUMENT PROCESS

Who needs simple promissory note for?

Explore how professionals across industries use pdfFiller.

How to fill out a simple promissory note for form form

Understanding simple promissory notes

A simple promissory note is a financial document that outlines a borrower's promise to pay a specific amount to a lender at a defined future date. This document serves essential purposes in many financial transactions, providing clarity and legal backing.

-

They are used to formalize loans between individuals or businesses.

-

It simplifies the borrowing process by offering clear terms and a straightforward format for documentation.

-

You may encounter simple promissory notes in family loans, informal business transactions, and peer-to-peer lending.

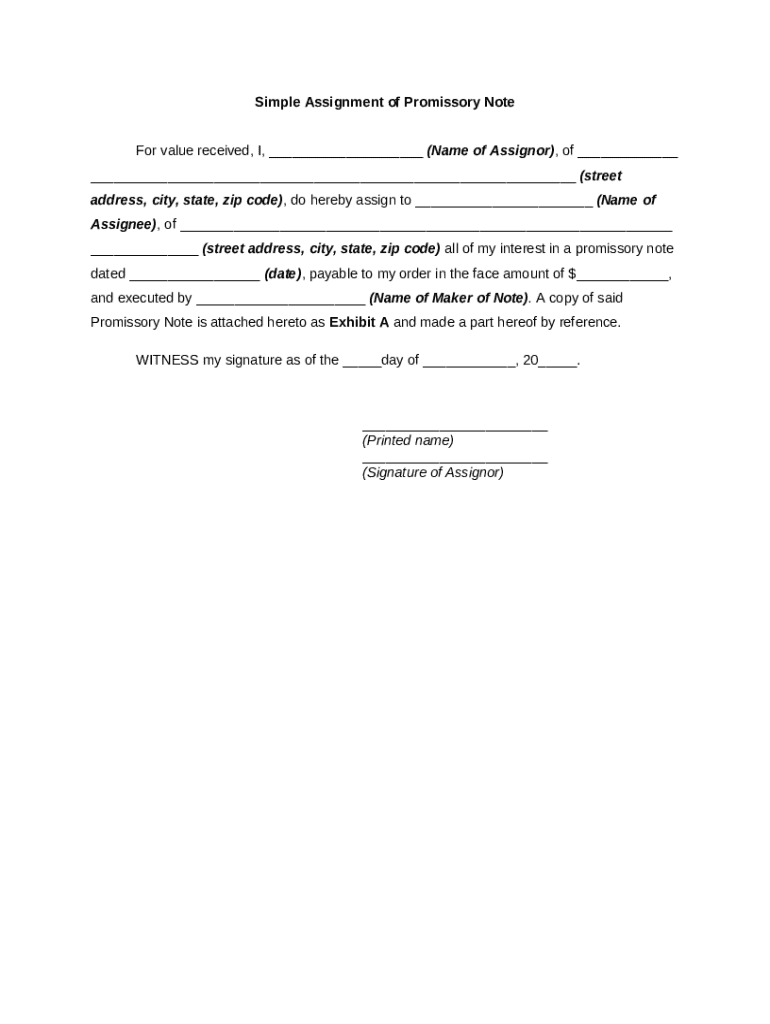

Key components of a simple promissory note

Understanding the components of a simple promissory note is crucial for both drafting and signing one. These essential elements ensure that the document is complete and legally enforceable.

-

The Assignor, or borrower, must provide their name, address, and signature.

-

The Assignee, or lender,'s name and address should also be clearly outlined.

-

Include important details like the date of the agreement, the total amount borrowed, and the name of the Maker of the Note.

Step-by-step instructions for filling out the simple promissory note

Filling out a simple promissory note can be straightforward if you follow the correct steps. This section provides a clear guide to ensure accuracy and compliance.

-

Start by clearly writing the names and addresses of both parties.

-

Document the date the note is issued and the amount being borrowed.

-

The Maker is typically the Assignor—write their name as it appears above.

-

Review the document to ensure that all details are included and compliant with local laws.

Utilizing pdfFiller for your promissory note needs

pdfFiller offers a comprehensive solution for creating and managing your promissory notes efficiently. The platform's features enhance the document handling experience.

-

You can easily modify existing templates or create one from scratch, tailored to your specific needs.

-

Leverage eSignature capabilities for securely signing your promissory note electronically.

-

Work with others within pdfFiller, allowing multiple users to contribute to the document's creation.

-

Store all your paperwork safely in a cloud-based system, making it accessible from anywhere.

Legal considerations for simple promissory notes

Understanding the legal landscape surrounding promissory notes is vital for ensuring that you are protected as either a borrower or lender. Different states may have varying regulations.

-

Always check with local laws to ensure compliance with any specific state stipulations.

-

Be cautious of vague terms and unclear repayment obligations, as they can lead to legal complications.

-

Make sure the note adheres to any required financial regulations to maintain enforceability.

Alternatives to simple promissory notes

While simple promissory notes are useful, they may not always be the best choice. Several alternatives could be better suited based on the situation.

-

Secured notes provide collateral against default, offering increased protection for lenders.

-

Formal agreements can be more thorough but may involve extensive legal jargon and costs.

-

In larger transactions or those requiring more security, consider exploring options like business contracts.

Case study: successful usage of a simple promissory note

By examining a real-world example, we can illustrate the practical application of a simple promissory note and assess its effectiveness.

-

Consider a neighbor lending $5,000 to another neighbor without complications using a straightforward promissory note.

-

The clear documentation of the agreement led to timely repayment and maintained their personal relationship.

-

Documentation helps avoid disputes, and both parties understand their obligations clearly.

How to fill out the simple promissory note for

-

1.Open the simple promissory note template in pdfFiller.

-

2.Fill in the date at the top of the document.

-

3.Enter the name and address of the borrower in the designated field.

-

4.In the next section, fill in the name and address of the lender.

-

5.Specify the principal amount to be borrowed in both numerical and written form.

-

6.Indicate the interest rate applicable to the borrowed amount, if any, and clarify whether it is fixed or variable.

-

7.Define the repayment terms, including the due date and any payment schedule (e.g., monthly, quarterly).

-

8.Include a section for the borrower’s signature, ensuring they sign and date the document to validate it.

-

9.Optionally, add any additional terms or conditions that apply to the agreement before finalizing the document.

-

10.Review the completed notes for accuracy, then save and download the filled form.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.