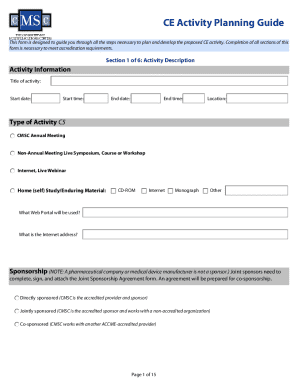

Get the free Authority of Partnership to Open Deposit Account and to Procure Loans template

Show details

The partnership is authorized to establish a deposit and checking account. If any other persons become interested in the business as co-partners or relations with the bank are altered in any way,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is authority of partnership to

The 'authority of partnership to' document outlines the powers and responsibilities of partners within a business partnership.

pdfFiller scores top ratings on review platforms

Love Love this Program

Amazing thank you!

been easy to use so far!

Excellent app

Thank you so much for understanding and…

Thank you so much for understanding and being helpful God bless.

Saved me the trouble of filling out Social Security Disability Forms

I was grateful to find this page. They had all the forms I needed to fill out for my SSDI claim. Saves me the hassle of trying to write things out. Thank you.

Who needs authority of partnership to?

Explore how professionals across industries use pdfFiller.

Understanding the Authority of Partnership to Form a Deposit Account

How to fill out a partnership form?

To fill out a partnership form, ensure you gather all necessary documentation, including partnership agreements, tax ID numbers, and identification for all partners. Clearly specify the roles and responsibilities of each partner regarding account access and signing authority. Follow the guidelines provided by your financial institution to complete the application accurately.

What are the fundamental principles of partnership authority?

Partnership authority pertains to the legal ability of partners to act on behalf of the partnership in business operations. This authority is critical for maintaining smooth operational flow and preventing disputes. It exists under a legal framework that outlines the rights and responsibilities of each partner.

-

Partnership authority allows designated partners to make decisions and bind the partnership legally.

-

Partnerships are governed by state laws which dictate the authority partners have and how they can exercise it.

-

A well-drafted partnership agreement clearly defines the scope of authority, helping to mitigate risk and misunderstandings.

How do you establish a partnership account?

Opening a deposit account as a partnership requires specific documentation and careful planning. Partners must collectively decide on the account's structure, and each must understand their potential liabilities and obligations.

-

Prepare your partnership agreement, tax ID, and valid identification for all partners.

-

Identify which partners have the authority to open and manage the account, including signing checks and accessing funds.

-

If your partnership operates under a trade name, ensure it is registered to facilitate account opening.

What types of authorization exist within a partnership?

Authorization within a partnership can vary based on the structure of the partnership and the specific roles assigned to each partner. It's important to differentiate between individuals with full authority and those with limited signing capabilities.

-

Most partnerships designate specific individuals who can act in the best interest of the partnership.

-

Only authorized partners may sign checks, documents, and drafts, thereby limiting liability.

-

Some decisions may require collective signatures to ensure full agreement amongst partners.

How is signing authority managed on partnership accounts?

Managing signing authority involves understanding how checks, drafts, and other financial instruments can be signed. This understanding is crucial to avoid disputes regarding financial transactions.

-

Partnership accounts often have specific protocols for signing checks and documents.

-

Endorsements can be executed in writing or with stamps, impacting legal liability.

-

Special considerations are necessary to ensure legality when endorsing checks to personal bank accounts.

What are the compliance requirements and best practices for partnerships?

Compliance demands vary by region and type of business. Keep up-to-date with local regulations and avoid common pitfalls by implementing best practices.

-

Ensure that your partnership adheres to local laws regarding taxes and business operations.

-

Mistakes such as neglecting to update your partnership agreement can lead to unauthorized actions.

-

Regularly review and update your financial records and signing authorities to avoid discrepancies.

When should partnership agreements be modified?

Modifications to partnership agreements are often necessary to reflect changes in the partnership's structure or authority. It's crucial to navigate these changes carefully to maintain legal compliance.

-

Amendments may be needed when partners leave or when roles within the partnership change.

-

Changes may affect how authority is defined, necessitating updates to ensure all partners are informed.

-

Consult with legal advisors when making changes to ensure the modifications are enforceable.

What liabilities are associated with partnership authority?

Understanding the liabilities tied to partner actions is essential. Each partner should be aware of the risks that unauthorized actions may pose to the partnership's integrity and finances.

-

Liabilities can arise from any actions taken by a partner on behalf of the partnership, including debts.

-

Actions taken without proper authorization can lead to personal liability for the partner acting outside their designated authority.

-

Poor management of partnership funds can result in bitter disputes and lawsuits among partners.

How to fill out the authority of partnership to

-

1.Open pdfFiller and upload the 'authority of partnership to' form.

-

2.Begin by filling in your partnership's name at the designated field.

-

3.Next, provide the names and titles of the partners who will be authorized in the document.

-

4.Clearly specify the nature of authority each partner holds, such as signing contracts or making financial decisions.

-

5.If required, state any limitations or specific terms regarding the authority granted to the partners.

-

6.Review the document for any missing information or errors before proceeding.

-

7.Once satisfied with the details, select 'Save' to keep your changes, or 'Print' if you need a hard copy.

-

8.Finally, share the document with partners or relevant parties following your partnership agreements.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.