Get the free Return of Check Missing Signature template

Show details

Return of check missing signature

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is return of check missing

A 'return of check missing' is a formal document used to report a check that was issued but has not been received or cashed.

pdfFiller scores top ratings on review platforms

Wonderful product! PDFfiller been very useful for me in my work and personal life. Very user friendly and little instruction required.

I absolutely love it, it's fast its easy and Im going to purchase a few of the tools you offer as well it's very cool.

Thank you...

I don't pay for PDFfiller so I can only say speak to the ease of use on features that I think are available.

I am not sure if creating a document that is editable in word is possible in every version. If so I can not figure it out. That is my only feedback. Otherwise using this website is a breeze.

WITH MORE USE I AM SURE IT WILL BE EASIER

This is a great service. Pricey, but great.

very very good application does exactly what is says

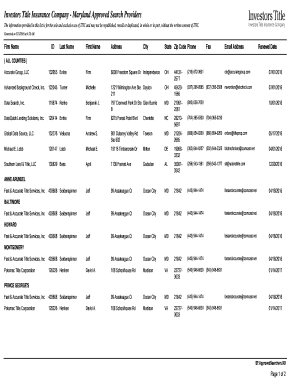

Who needs return of check missing?

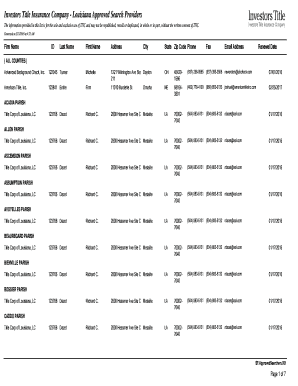

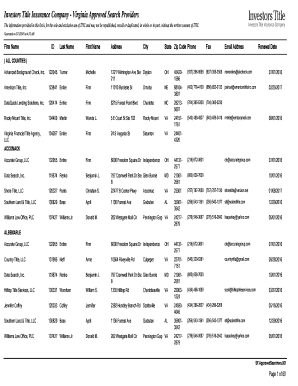

Explore how professionals across industries use pdfFiller.

Return of Check Missing Form: A Comprehensive Guide

How does a return of check missing form work?

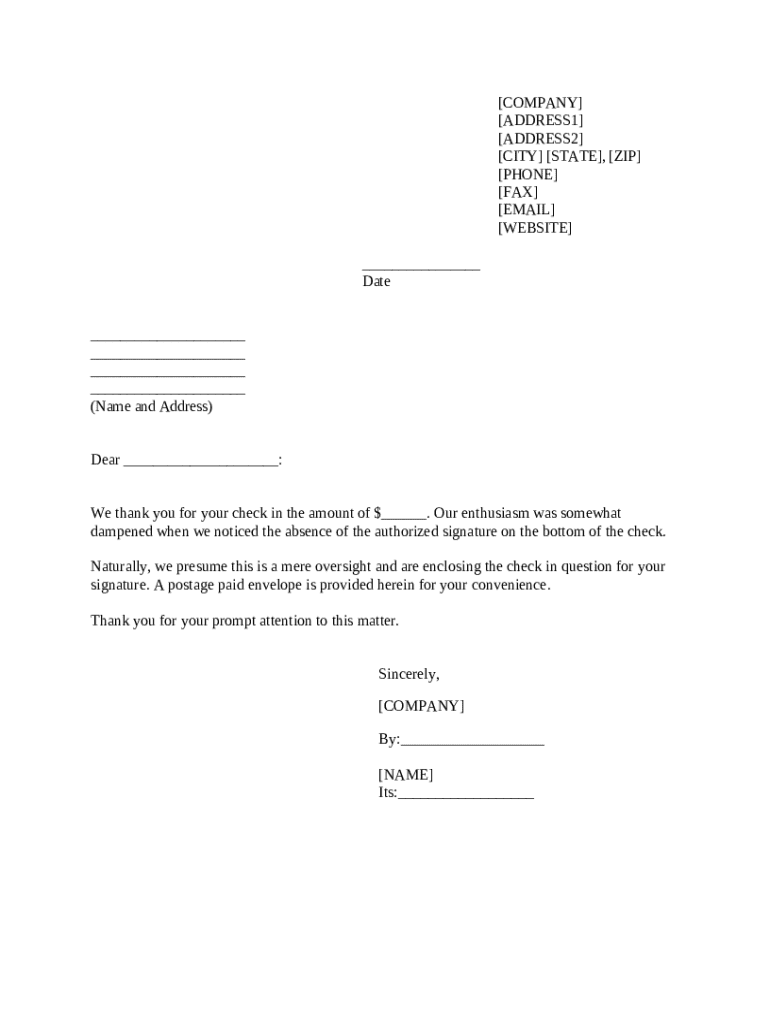

The Return of Check Missing Form is an essential document designed to help individuals and organizations reclaim funds from uncashed checks. This form plays a crucial role in tracking missing payments, ensuring proper funds allocation, and streamlining the process of handling uncashed checks.

Situations that necessitate this form typically include lost checks, checks that have not been deposited, or checks issued to deceased individuals. Understanding the process helps eliminate common challenges faced when dealing with uncashed checks, such as delays or denied claims.

What are the key sections of the return of check missing form?

-

This section requires detailed information about the company, including the name, address, and contact details for reference.

-

Accurate dating of the form is critical, as it determines the timeline for processing the request.

-

Ensure that the recipient's name and address are entered correctly to prevent mail mishaps.

-

Clearly specifying the check amount helps prevent disputes regarding the funds being claimed.

-

Securing an authorized signature validates the form and authenticates the claim for processing.

How can you complete the return of check missing form?

Filling out the Return of Check Missing Form requires attention to detail. Follow these step-by-step instructions:

-

Make sure all information is up-to-date and accurate to avoid any delays in processing.

-

Writing the correct date ensures your claim is processed in a timely manner.

-

Ambiguities in the check amount could lead to confusion or rejection of your claim.

Common mistakes to avoid include leaving blank fields, misspelling information, and failing to secure the necessary signature. Reviewing the form after completion can help mitigate these issues.

How do you submit the return of check missing form?

Submission of the Return of Check Missing Form can be done via mailing or electronic submission. Consider the pros and cons of each method.

-

When choosing to mail, ensure you enclose all necessary documents and use a properly addressed, postage-paid envelope.

-

This method can be quicker but may require specific formatting and secure submission methods.

Expect a timeframe for processing following your submission. This varies by organization but is typically within several weeks.

What are common issues with the return of check missing form?

After submitting your form, you may face certain issues. Most notably, if a check does not arrive after submission, it is essential to determine the next steps.

-

Contact the issuing authority to inquire about the request status and potential issues.

-

React promptly to requests for additional documentation to avoid further delays.

Following up effectively can help ensure your situation receives the necessary attention and can expedite the process.

What are alternatives to the return of check missing form?

In some instances, you might consider other forms that address uncashed and missing checks. When dealing with complex cases or larger amounts, seeking professional assistance can be prudent.

-

Other forms such as stop-payment requests or void checks can sometimes serve similar purposes.

-

Consult professionals when facing issues with reclaiming significant amounts or navigating legal complexities.

For easier management, consider utilizing pdfFiller's tools that empower users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform.

How to fill out the return of check missing

-

1.Open pdfFiller and log in to your account.

-

2.Search for 'return of check missing' in the template library.

-

3.Select the document template to start filling it out.

-

4.Enter your personal or business information in the required fields, such as your name, address, and contact details.

-

5.Specify the details of the check that is missing, including the check number, date of issue, and amount.

-

6.Provide any additional information or context that may be relevant, including why the check is believed to be missing.

-

7.Review the filled form for accuracy, ensuring all mandatory fields are completed.

-

8.Save the document to your pdfFiller account or download it as a PDF.

-

9.Print or electronically send the 'return of check missing' to the relevant financial institution or entity.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.