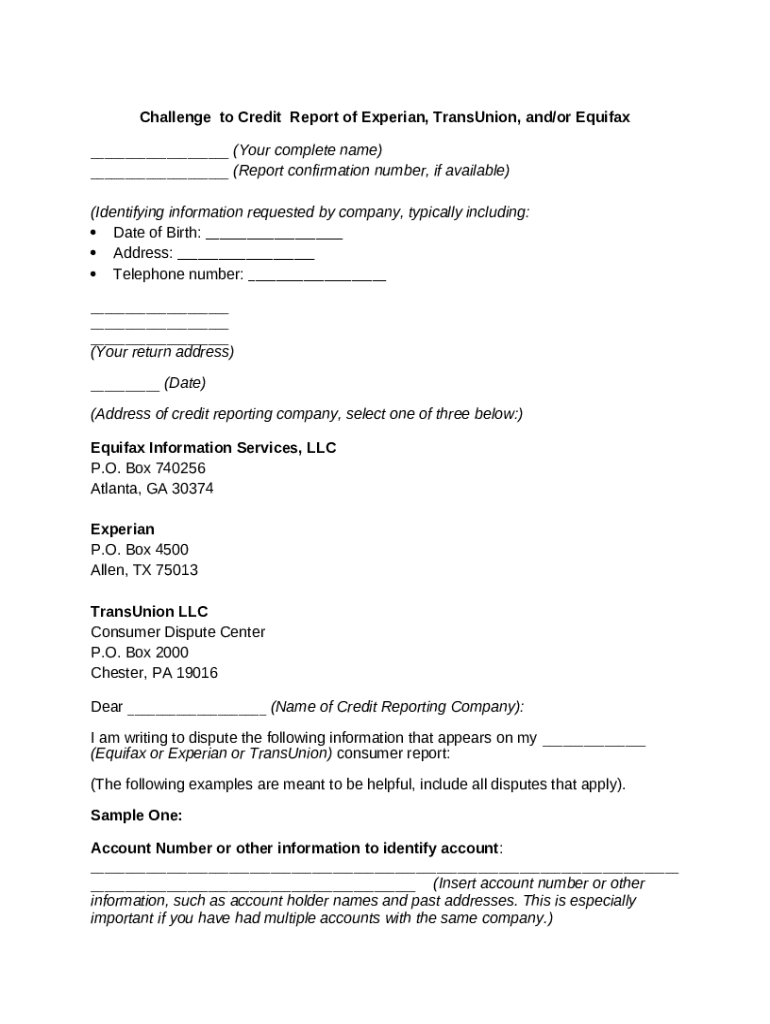

Get the free Challenge to Credit Report of Experian, TransUnion, and/or Equifax template

Show details

There are three credit reporting agencies, or credit bureaus, in the United States: Experian, Equifax, and TransUnion. Each of these credit reporting agencies compiles your credit information from

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is challenge to credit report

A challenge to a credit report is a formal dispute regarding inaccuracies or incomplete information on a consumer's credit report.

pdfFiller scores top ratings on review platforms

It's helping me get through school work quicker.

Works smoothly and easy to use. Customer support tried to help with a "glitch" I have still not resolved. Works on my iPad perfectly but pull my docs up on desktop just sits there thinking to no end. I've just used on iPad soley since problem came up.

The best and easiest way I've found to find and fill out standard business forms!

At first I did have problems figuring out how to use it. I don't see a "copy/paste" button and wish there was one. Overall, as I start to use it more and more I am liking it.

Regards.

This is something of a category killer. I'm really glad I signed up for this service. It's great for the property rental market. The UX is a little basic and could use some help but it is functional. (Kevin Kell, UX Architect)

My first day! As far away from tech savvy as you can get! With help on "Team Viewer" I learned how to solve all the problems I had getting started. I will certainly use tech support again but off to a fun start.

Who needs challenge to credit report?

Explore how professionals across industries use pdfFiller.

How to fill out the challenge to credit report

-

1.Obtain a copy of your credit report from a credit reporting agency.

-

2.Identify the inaccurate information you want to challenge.

-

3.Visit pdfFiller and create an account or log in.

-

4.Access the template for the credit report challenge letter from the library or upload your own.

-

5.Fill in your personal details including name, address, and credit report details in the appropriate sections.

-

6.Clearly describe the inaccuracies you wish to dispute in a concise manner, providing any supporting evidence if available.

-

7.Review your completed document for any errors or missing information.

-

8.Once satisfied, save your document and choose to print or directly send it to the appropriate credit reporting agency.

-

9.Retain a copy of the challenge letter for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.