Get the free Loan Agreement for Property template

Show details

A Loan Agreement is entered into by two parties. It lists the duties, obligations and liabilities of each party when entering into the loan agreement.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan agreement for property

A loan agreement for property is a legally binding document outlining the terms and conditions under which a lender provides funds to a borrower for purchasing real estate.

pdfFiller scores top ratings on review platforms

love it

I really rely on this program for…

I really rely on this program for documents and for editing. I can access it anywhere which saves me time.

Very pleased with the customer care

I was new to using pdf filler and had a small technical issue with text auto deleting, so I hopped onto the chat where Sam helped fix the issue using screen share via a Zoom call, he kept me informed of what he was doing and the issue was resolved quickly. Sam also took the time to explain to me how to resolve the issue if I ever had it again and was friendly to communicate with, I am very pleased with the customer care, thank you Sam,

Very good thank you

Live chat is very responsive and helped…

Live chat is very responsive and helped me through the process efficiently. Thank you!

A must have program!

PdfFiller has made things a lot easier to make or modify the forms I need for the Homeowners Association that I am Board President over. Very Thankful!Lesli K. Martin

Who needs loan agreement for property?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Loan Agreement for Property Forms

Filling out a loan agreement for property form can seem daunting, but it is a straightforward process if you understand the key elements involved. This guide will walk you through the structure of a loan agreement and provide actionable insights on how to fill it out accurately.

What is a loan agreement?

A loan agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of the loan. Understanding the importance of loan agreements in real estate transactions is vital, as they protect both parties and clarify expectations.

-

Definition of Loan Agreement: It specifies the amount borrowed, repayment terms, and any consequences of default.

-

Importance of Loan Agreements: They serve to mitigate risk in real estate transactions and establish trust.

-

Key Components: These include loan amount, interest rate, repayment schedule, and collateral.

What are the critical loan details?

Loan details dictate how the loan is structured and repaid. A deep dive into types of loans reveals that secured loans require collateral, whereas unsecured loans do not.

-

Types of Loans: Secured loans use assets as collateral while unsecured loans rely on the borrower's creditworthiness.

-

Reviewing Loan Terms: Borrowers should review all terms and conditions carefully before signing.

-

Understanding Interest Rates: It's critical to know how rates can affect overall repayments.

How is collateral defined in loan agreements?

Collateral refers to assets pledged as security for the loan. Proper documentation and compliance with national and local laws ensure that collateral is enforceable.

-

Defining Collateral: It includes property or assets that can be claimed by the lender in case of default.

-

Documenting Collateral: Accurate details in the loan agreement are essential for clarity.

-

Compliance: Awareness of locale-specific requirements, such as those in Mississippi, is crucial.

What are the insurance requirements?

Various types of insurance may be mandated for property loans, offering protection against unforeseen events. Including these details in the loan agreement safeguards both parties.

-

Types of Insurance: Homeowners insurance and mortgage insurance are common requirements.

-

Including Insurance in Agreements: Clear mention of this in the loan agreement avoids future disputes.

-

Regulatory Compliance: Documentation should align with specific state regulations, such as those applicable in Mississippi.

How to understand default conditions?

Default refers to the failure to fulfill the loan obligations. Understanding default clauses in agreements can guide borrowers on possible repercussions.

-

Defining Default: It occurs when a borrower fails to make required payments.

-

Consequences of Default: These may include foreclosure or damage to credit ratings.

-

Structuring Default Clauses: Clarity in these clauses helps protect both parties’ interests.

What are the legal fees and responsibilities involved?

Legal fees can arise during the drafting of loan agreements, and knowing what responsibilities each party holds is crucial for transparency.

-

Associated Legal Fees: Fees may include attorney charges and filing costs.

-

Allocating Legal Fees: The agreement should specify which party covers what costs.

-

Understanding Your Rights: Borrowers should be aware of their rights in concerning legal fees.

How to define governing law and jurisdiction?

The governing law outlines which legal system will apply to the agreement. Understanding jurisdictional implications is critical, especially in local contexts.

-

Identifying Governing Law: This typically corresponds to the lender's location.

-

Jurisdiction Considerations: Be mindful of local laws and customs, such as those unique to Mississippi.

-

Importance of Local Laws: Awareness helps in addressing potential legal obstacles.

How to plan for repayment completion?

Planning for repayment involves setting clear terms and adhering to schedules outlined in the agreement. Utilizing best practices for structuring these terms can ease the process.

-

Structuring Repayment Terms: Terms should be clear, and feasible to comply with.

-

Including Repayment Schedules: Incorporate easy-to-understand schedules in the agreement.

-

Consequences of Late Payments: It’s important for borrowers to understand the fallout of tardy payments.

What does it mean to document the entire agreement?

An entire agreement clause ensures that all discussions and agreements are captured in the written document, reducing the risk of misunderstandings.

-

Constitutes the Entire Agreement Clause: This section consolidates all terms agreed upon.

-

Drafting for Clarity: Clear wording is essential for enforcing the agreement fairly.

-

Integration of Related Documents: Use related documents to bolster the main agreement.

How to utilize pdfFiller for document management?

pdfFiller simplifies the document management process, allowing users to access and edit loan agreement templates seamlessly. Its collaborative features and cloud-based capabilities enhance efficiency.

-

Accessing Templates: Users can easily find loan agreement templates directly on pdfFiller.

-

eSigning and Collaboration: The platform facilitates easy collaboration and electronic signatures.

-

Cloud-Based Advantages: The cloud storage offers users accessibility from anywhere.

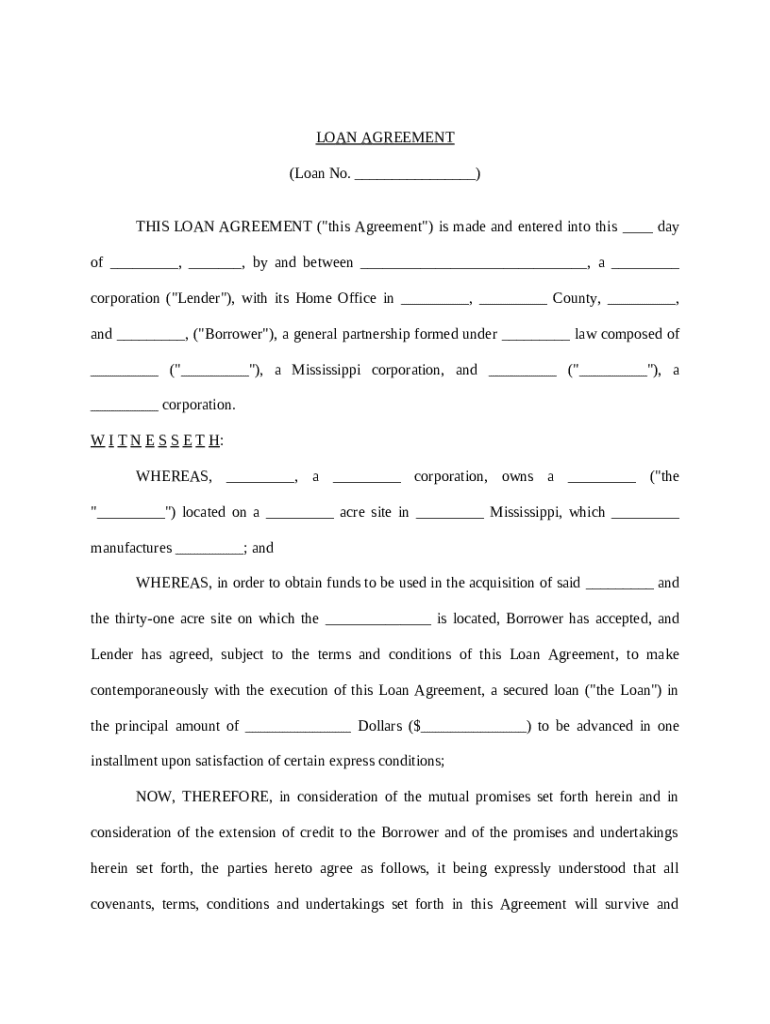

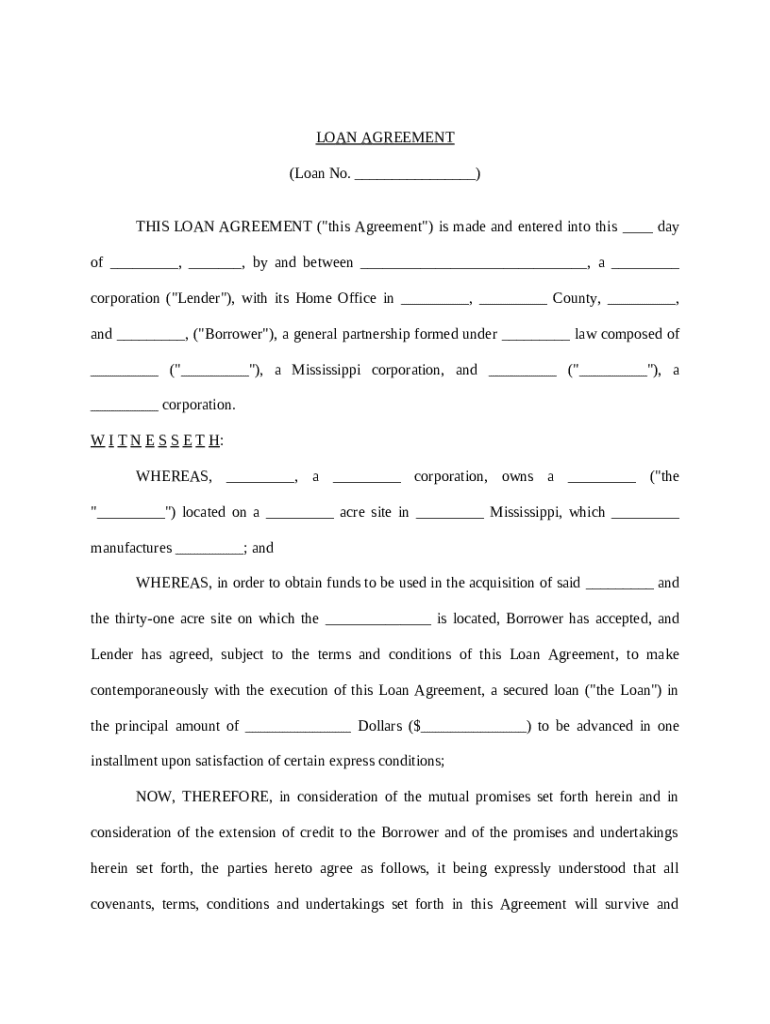

What are the steps to fill out your loan agreement form?

Filling out a loan agreement form correctly is essential for both parties. Following a structured approach will minimize errors.

-

Step-by-Step Instructions: Follow each section of the form carefully.

-

Common Mistakes: Awareness of common pitfalls can help in filling forms correctly.

-

Saving and Exporting: Ensure to save your work and export the completed document securely.

How to fill out the loan agreement for property

-

1.Start by obtaining a blank version of the loan agreement template from pdfFiller.

-

2.Open the document in pdfFiller and enter the date at the top of the page.

-

3.Fill in the names and contact information of both the lender and the borrower in their respective fields.

-

4.Specify the property address alongside any relevant legal descriptions to accurately identify the property being financed.

-

5.Indicate the loan amount to be borrowed and the interest rate agreed upon, ensuring both parties understand the financial terms.

-

6.Set the repayment term by noting the duration over which the borrower will repay the loan.

-

7.Detail the payment schedule, including due dates, frequencies, and any penalties for late payments.

-

8.Include any additional clauses, such as prepayment options and insurance requirements, as necessary.

-

9.Review all entered information for accuracy and completeness.

-

10.Save the document and share it with all parties for review before finalizing with signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.