Get the free pdffiller

Show details

A purchase money security interest is a security interest or claim on property that enables a lender who provides financing for the acquisition of goods or equipment to obtain priority ranking ahead

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is general form of security

The general form of security is a legal document that outlines the terms under which collateral is provided to secure a debt or obligation.

pdfFiller scores top ratings on review platforms

Won't let me to save the document to my device

It is easy to fill out proposals with your template. I wish there was a way to make it easier to access it because I will be using that document many times and so far I have had to search for it.

PDFfiller makes it easy for me to quickly complete documents electronically. it is convenient and very easy to use.

excellent feathers and user friendly ,highly recommended .

I mistakenly signed up for the Pro level and paid for it and only wanted the Nasic.

I like the fact that instead of having a handwritten form, you have something completey finished that looks so much more professional.

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

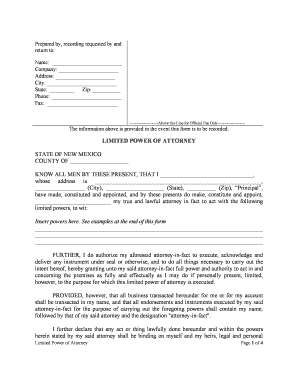

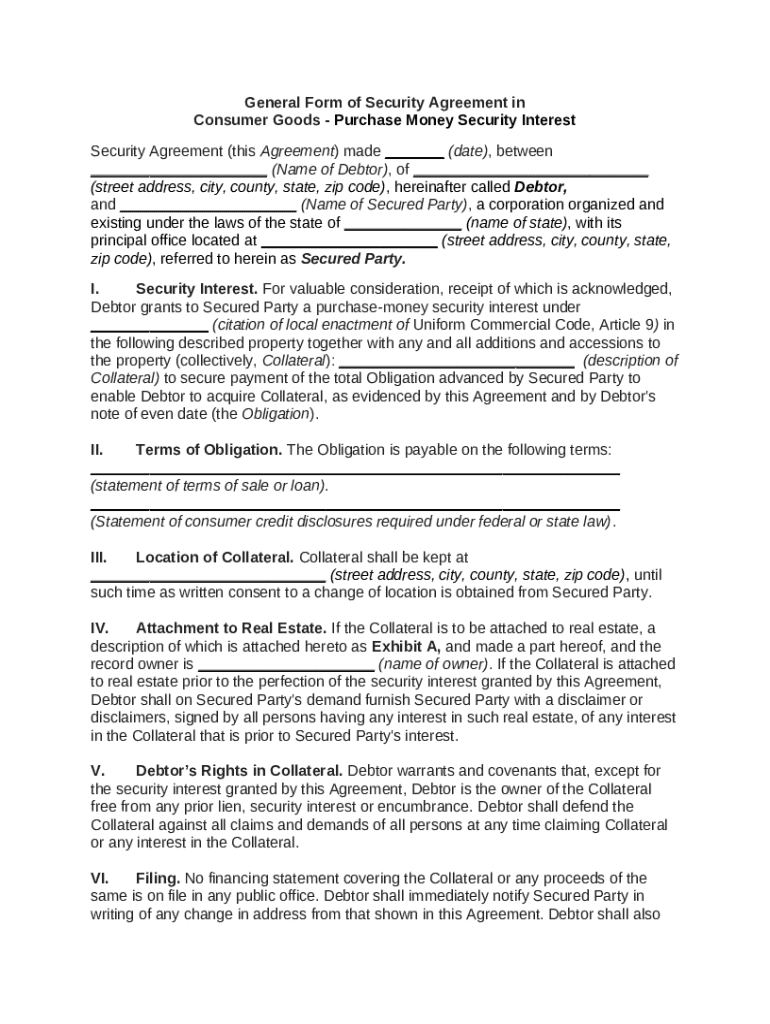

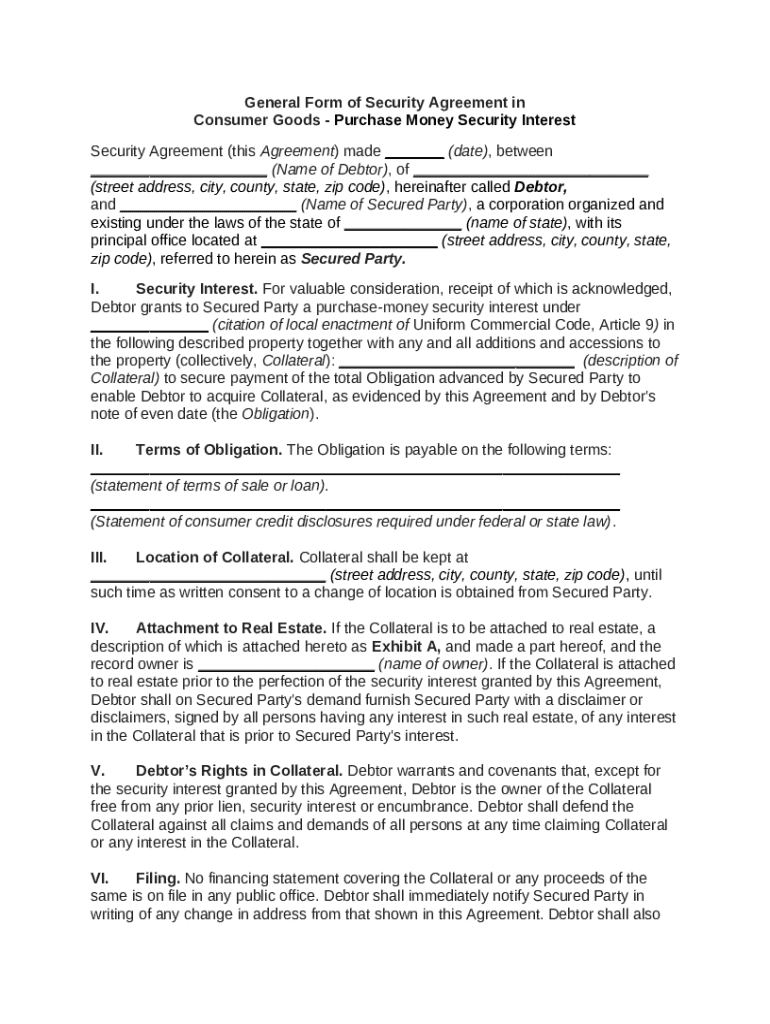

General form of security agreement in consumer goods

Filling out a general form of security agreement ensures legal protection for both debtors and secured parties in consumer goods transactions. This guide will outline the essential components, guidance on documentation, and practical tips for using tools like pdfFiller to enhance document management and eSigning.

Understanding the general form of security agreement

-

A Security Agreement is a legal contract that establishes a security interest in personal property. This agreement is crucial for ensuring that lenders can reclaim assets if borrowers default.

-

A PMSI occurs when a lender finances the purchase of consumer goods, granting them specific priority over other creditors in case of default.

-

The UCC governs security agreements in the United States, providing a standardized legal framework that simplifies transactions involving personal property.

-

Properly documenting the obligations of parties and identifying collateral strengthens a lender's legal position and aids in resolution should disputes arise.

Who are the key parties in the security agreement?

-

The debtor is the individual or entity that owes money or obligations. They must be clearly identified in the security agreement.

-

The secured party is usually a lender or creditor with a legal claim to specified collateral. Their rights and obligations must be explicitly defined.

-

Providing correct legal descriptions and contact details of both parties enhances the enforceability of the agreement.

-

Both individual and corporate entities have unique borrowing needs and implications when entering into security agreements, affecting the structure and enforceability.

How to structure the security interest?

-

Lenders must properly document the creation of a PMSI to ensure legal protections. This involves specifying the goods and their financing agreement.

-

Collateral typically includes tangible personal property, which must be described clearly to establish the security interest.

-

There are various methods to detail collateral in the agreement, including using serial numbers or descriptions that can accurately identify the items.

-

Collateral should be appropriately valued and insured to mitigate risks of loss or devaluation, protecting both parties involved.

What are the obligation terms?

-

It's important to specify what types of debts are covered under the agreement, including principal amounts and any associated fees.

-

Establishing unambiguous payment terms ensures both parties understand their responsibilities and helps prevent disputes.

-

These disclosures inform borrowers of their rights and obligations, aligning with regulatory requirements from both federal and state entities.

-

Any security agreement must adhere to relevant federal and state laws, ensuring it is enforceable and business practices remain sound.

What are the location considerations for collateral?

-

Debtors must disclose the physical location of collateral to safeguard interests and ensure transparency within the agreement.

-

When collateral is relocated, the secured party must provide consent to preserve their security interest.

-

Moving collateral without consent can lead to legal complications, potentially jeopardizing the secured party's claims.

-

Regional compliance with local laws is crucial to avoid vulnerabilities and ensure the security agreement remains effective.

How to attach collateral to real estate?

-

Specific conditions under which collateral can be attached to real estate must be met, including understanding the legal process.

-

The security agreement should contain a detailed description of the property to which the collateral is attached, enhancing its enforceability.

-

Disclaimers from interested parties may be required to prevent challenges to the security interest.

-

Using best practices such as comprehensive descriptions and compliance with local regulations solidifies the enforceability of the security agreement.

How to utilize pdfFiller for document management?

-

Users can fill out the general form of security agreement easily through pdfFiller's user-friendly interface.

-

The platform supports team collaboration, allowing multiple users to contribute to document accuracy and completeness.

-

pdfFiller allows for secure electronic signatures, ensuring transactions are legally binding without the need for physical presence.

-

Storing documents in the cloud provides easy access from anywhere, enhancing productivity for both individuals and teams.

What are some case studies on security agreements?

-

Case studies illustrate the practical application of PMSI in consumer goods, showcasing its effectiveness in protecting lenders' interests.

-

Robust security agreements have positive impacts on business operations by reducing risks and providing financial stability.

-

Exploring common pitfalls helps identify potential issues and how to strategically avoid them for future transactions.

-

Organizations can learn from case studies to implement best practices, enhancing future security agreements.

How to fill out the pdffiller template

-

1.Open the general form of security template on pdfFiller.

-

2.Begin by entering your personal or business information at the top of the document, including name, address, and contact details.

-

3.Fill in the details of the borrower, ensuring accuracy in the name and address fields.

-

4.Provide the specifics of the loan or obligation, including the amount and the interest rate if applicable.

-

5.Describe the collateral that is securing the loan, providing detailed information about its type, value, and location.

-

6.Review the terms and conditions outlined in the agreement, adjusting any clauses as necessary to fit your particular situation.

-

7.Sign the document in the designated area, making sure all parties required have acknowledged their agreement to the terms.

-

8.Save your completed form on pdfFiller and download a copy for your records, or share it directly through the platform with relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.