Get the free Small Business Administration Loan Application Form and Checklist

Show details

The following is a copy of the items the SBA (Small Business Administration) requires to be submitted to complete a loan application. Also attached is the standard SBA Loan Application.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is small business administration loan

A Small Business Administration loan is a government-backed funding option designed to help small businesses access affordable capital for growth and operations.

pdfFiller scores top ratings on review platforms

Find it very easy to use. I have pre-filled forms - all I need to do is change the name and address of the client.

This is my first time using but it seems to be user friendly and easy to navigate.

It has worked great thus far. I am really satisfied with my user experience.

Its pretty busy. needs to have less things going on.

Very time consuming creating the custom form I needed and it still isn't right, but I'm making due with it. Other than that, it works perfect.

It was fast and easy to use thankyou so much

Who needs small business administration loan?

Explore how professionals across industries use pdfFiller.

How to fill out a small business administration loan form

What is the SBA loan process?

The Small Business Administration (SBA) loan process is vital for securing funding for small businesses. It typically involves several steps, including a comprehensive eligibility check and documentation submission. Understanding this process can significantly impact your success in obtaining a loan.

-

Applicants must meet specific financial and operational requirements to qualify for SBA loans.

-

Different SBA loan programs cater to varied business needs, such as 7(a), 504, and microloans.

What documents are essential for your SBA loan application?

A well-prepared SBA loan application requires several critical documents. The SBA Loan Application Checklist guides you through necessary submissions.

-

Provide personal identification like your driver’s license or Social Security number.

-

Include your business's balance sheets, profit/loss statements, and tax returns.

How should you fill out the SBA loan application?

Completing the SBA loan application form accurately is crucial. A step-by-step guide can streamline this effort.

-

Make sure to enter accurate names, addresses, and other personal details.

-

Watch for mistakes like mismatching figures or misrepresenting financial data.

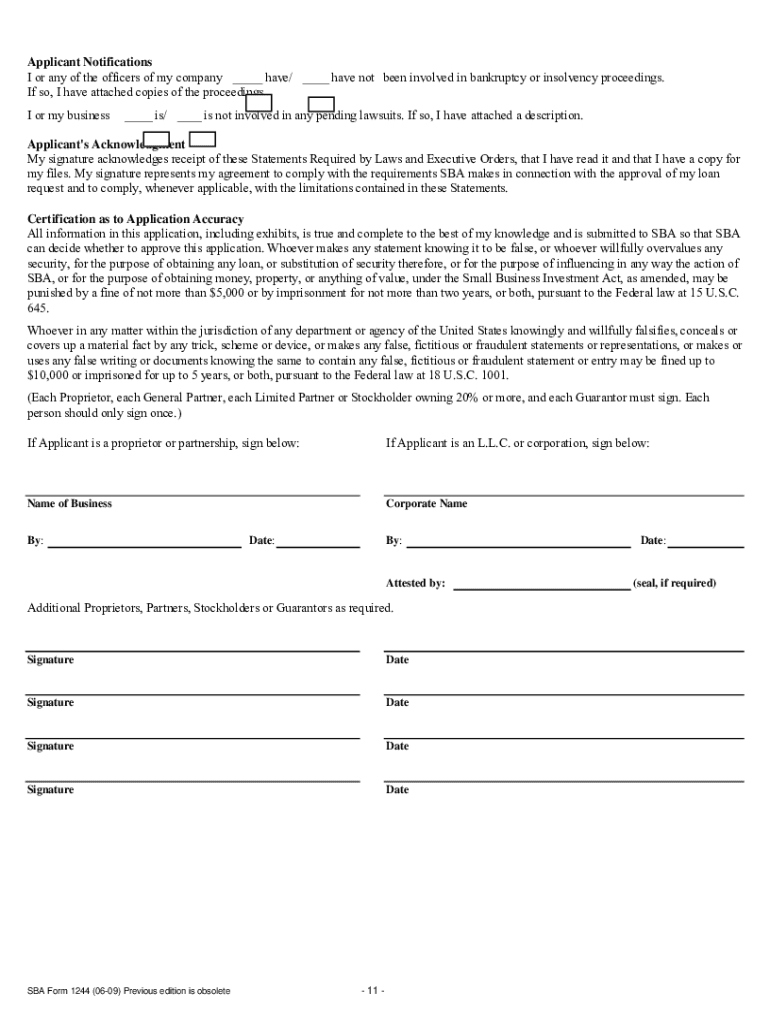

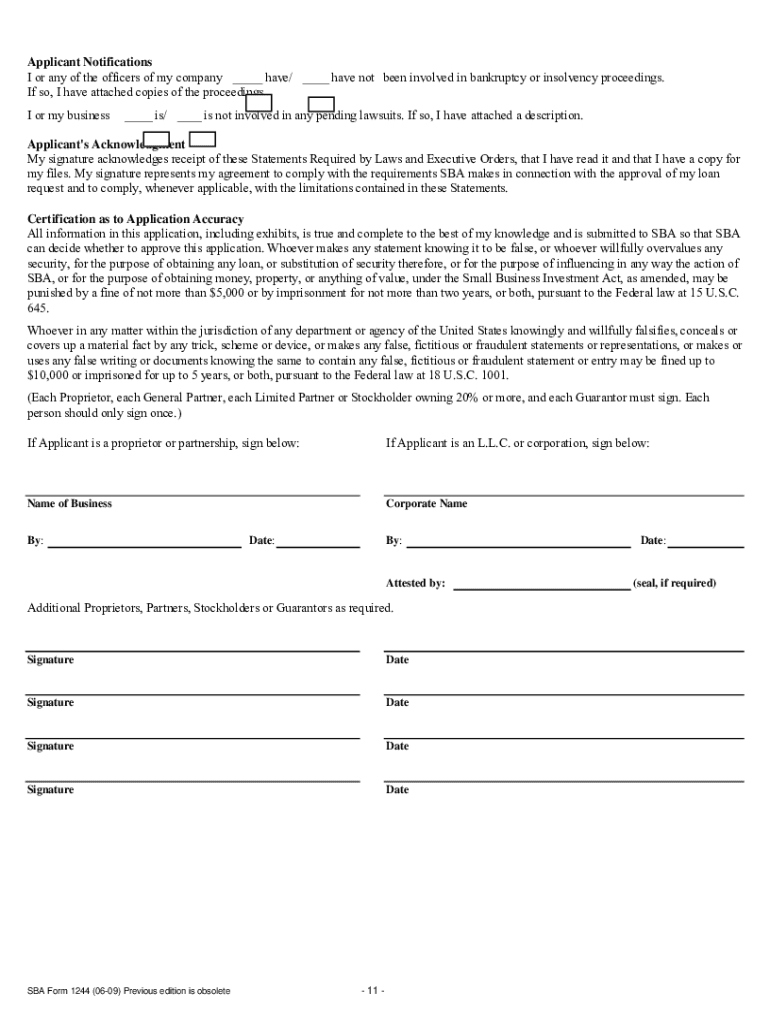

What are the required personal and financial statements?

Personal history statements and financial statements play a crucial role in your application. Understanding these elements is vital for approval.

-

This outlines your personal background and business experience, establishing credibility.

-

Ensure you have current tax returns and ample financial documentation to support your application.

What financial requirements must you meet for SBA loans?

Understanding financial documentation requirements is essential for any SBA loan applicant. These documents provide a comprehensive view of your financial health.

-

These documents snapshot your assets, liabilities, and equity, giving lenders an idea of your financial standing.

-

Include future financial projections to demonstrate your business's growth trajectory.

How to create cash flow statements for new businesses?

Cash flow projections are crucial for new businesses applying for loans. They illustrate how well your business manages its incoming and outgoing cash.

-

Prepare cash flow statements that reflect expected revenue and expenses on a monthly basis.

-

Outline current debts and obligations to showcase responsible financial management.

What is the process for submitting your SBA loan application?

Submitting your SBA loan application correctly is as important as filling it out. Follow specific channels and steps to ensure a smooth process.

-

Understand the available channels for submission, including online portals and physical locations.

-

Thoroughly check your application for missing documents, as incomplete applications may delay processing.

What should you expect post-submission?

After submitting your application, it is important to know what happens next. The typical timeline and outcomes can vary.

-

Expect a standard processing time which could take several weeks, depending on the lender.

-

Be prepared to answer any follow-up questions from your lender as they process your application.

How to fill out the small business administration loan

-

1.Gather necessary documents including financial statements, tax returns, and a business plan.

-

2.Visit the pdfFiller website and create an account if you do not have one.

-

3.Upload the Small Business Administration loan application PDF to your account.

-

4.Begin filling out the application by entering your personal information, including your name, address, and Social Security number.

-

5.Provide detailed information about your business, such as the name, type of business structure, and operational address.

-

6.Complete the financial section by entering your desired loan amount, estimated revenue, and other financial information as required.

-

7.Review the application for accuracy and ensure all required fields are completed.

-

8.Utilize the available tools on pdfFiller to save your progress and make edits if needed.

-

9.Once you are satisfied with your application, submit it electronically through the platform, or download it for mailing if paper submission is preferred.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.