Get the free Company Credit Card Denial Letter template

Show details

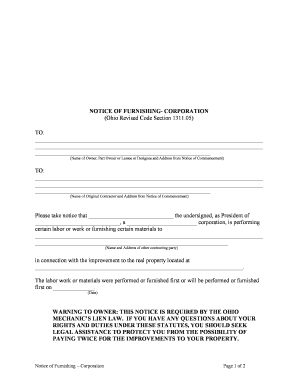

company credit card denial letter

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is company credit card denial

A company credit card denial is a formal notice indicating that an employee's request for a corporate credit card has been rejected.

pdfFiller scores top ratings on review platforms

My experience was very good. However there should be no charge to use this.

I didn't think it would be so easy....very happy with your service!

PDF filler has been a life-saver for me!!!

Interesting site, just a trial would encourage people to subscribe

love it I wish I have knew about it a little soone

Great program for all my form filling needs.

Who needs company credit card denial?

Explore how professionals across industries use pdfFiller.

How to Fill Out a Company Credit Card Denial Form

Understanding the Company Credit Card Denial Form

A company credit card denial form serves as a formal notification issued by a credit card issuer explaining the reasons behind the denial of a credit application. Understanding its purpose is crucial, as it helps applicants address specific issues that may hinder their ability to secure credit. Knowing the common reasons for denial can provide insight into what corrective actions might be necessary in future applications.

-

The denial form outlines the specific reasons for rejecting an application, which is vital for applicants to understand.

-

Denials can occur due to insufficient credit history, low credit scores, or inaccuracies in information provided.

-

The Equal Credit Opportunity Act (ECOA) protects applicants from discrimination in credit decisions.

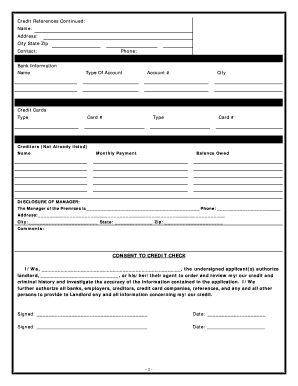

Essential Components of the Denial Form

Accurate completion of the denial form is essential for ensuring a smooth application process in the future. The key components of the form are critical as they organize the applicant’s personal details and the reason for denial.

-

This section includes the name and contact details of the issuing company, crucial for communication purposes.

-

These fields require accurate identification details to ensure that correspondence reaches the correct individual.

-

It's necessary to include the submission date and any relevant correspondence details for record-keeping.

-

This section provides the reason for denial and any guidance on how the applicant can improve their chances in the future.

Step-by-Step Guide to Filling Out the Denial Form

Completing the denial form correctly is crucial for future applications. A systematic approach can help ensure that no information is neglected.

-

Read each section thoroughly to ensure all required fields are filled out correctly based on your personal and business information.

-

Double-check each entry against your records for errors in spelling or number discrepancies to avoid additional complications.

-

Avoid leaving any fields blank, as this can lead to further delays or denials.

Interactive Tools to Enhance Your Experience

Utilizing digital tools can significantly improve your experience while filling out the company credit card denial form. Tools such as pdfFiller streamline the process.

-

These tools allow you to edit your forms easily, ensuring all information is accurately captured.

-

Seamless electronic signing options facilitate quick submission and collaboration with team members.

-

Cloud management provides easy access to different versions of your documents and allows for secure storage.

The Impact of Credit Rejection: What You Should Know

A credit rejection can have significant consequences on a business’s financial standing and future opportunities. Understanding these implications is key to navigating the financial landscape.

-

Denials can hinder your ability to secure necessary financing, affecting operational capabilities.

-

Exploring alternative financing options can provide interim solutions while you work on improving your credit standing.

-

When reapplying, ensure that all errors in the previous application have been rectified and that you meet credit requirements.

Checklists for Preparation and Submission

Before submitting the denial form, it’s essential to prepare adequately. A detailed checklist ensures that all required documents and information are at hand.

-

Ensure you have all supporting documents ready, including previous denial letters, financial statements, and identification.

-

Review the completed form against your checklist to confirm that no information is missing or incorrect.

-

Plan for follow-ups with the credit issuer to confirm receipt and inquire about the next steps.

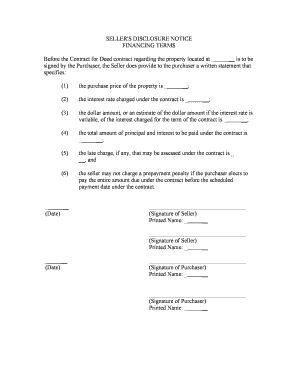

Local Compliance and Regulatory Notes

Understanding the regulatory landscape is essential when applying for business credit. Compliance with local laws and federal acts like ECOA can significantly affect application outcomes.

-

Familiarize yourself with local regulations that could affect your application process or criteria.

-

This ensures you are treated fairly during the credit evaluation process and helps protect against discrimination.

-

Different states may have variations in their credit application processes, so ensure you understand local requirements.

How to fill out the company credit card denial

-

1.Open the pdfFiller website and log in to your account.

-

2.Search for the 'company credit card denial' form in the template library.

-

3.Select the appropriate document from the search results and open it.

-

4.Review the pre-filled sections and make any necessary corrections, such as the company's contact information and date of denial.

-

5.Fill in the employee's information, including their name, position, and department.

-

6.Provide a clear reason for the denial in the designated section, ensuring it adheres to company policy and is documented properly.

-

7.Include any additional comments or instructions that may help the employee understand the denial.

-

8.Double-check all the information for accuracy and completeness before submission.

-

9.Once satisfied, save the completed document and select the option to send or print it out as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.