Get the free Nongrantor Charitable Lead Annuity Trust template

Show details

A non-grantor charitable lead annuity trust is a gift plan defined by federal tax law that allows you to transfer assets to family members at reduced tax cost while making a generous gift to a 501c-3

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

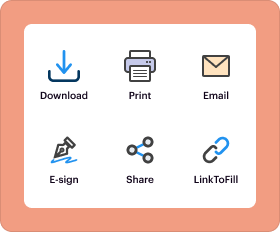

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is nongrantor charitable lead annuity

A nongrantor charitable lead annuity is a financial instrument that allows a donor to make a charitable contribution while also receiving annuity payments over a specified period, ultimately benefiting a designated charity without losing control of the assets.

pdfFiller scores top ratings on review platforms

like the software, but the filled documents are difficult yo use

Just beginning. Ask me again in about a week.

Program great, easy to use. Difficulty processing payment. Had to call/email support to get assistance. That was super frustration when I was ready to finish up.

As a new small business operator, this software has helped me with so many tasks without having to leave work. The only draw back is that many times, recipients can't open sent pdf files and another route has to be taken.

This is a very helpful alternative for pdf editing.

Actually, I quite like it. My only "complaint" is the inability to auto-fill repetative documents, and no bold or underling of font.

Who needs nongrantor charitable lead annuity?

Explore how professionals across industries use pdfFiller.

Nongrantor Charitable Lead Annuity Trust Guide

How to fill out a nongrantor charitable lead annuity form

Filling out a Nongrantor Charitable Lead Annuity Trust form involves several essential steps to ensure compliance and accurate representation of your intentions. First, you must define the trust's purpose and the assets involved. Next, you will need to select a charitable recipient and determine the annuity payment details. Make sure all the required documentation is completed and signatures obtained before submitting the form.

What is a nongrantor charitable lead annuity trust?

A Nongrantor Charitable Lead Annuity Trust is a financial instrument designed to provide a consistent income stream to a charitable organization while allowing the donor to retain their assets. This type of trust provides significant tax benefits, as it can reduce the taxable estate and potentially lower annual income taxes through charitable deductions.

-

The trust allows donors to give to charity while receiving annuity payments themselves.

-

The donor may receive an upfront charitable tax deduction based on the present value of the annuity.

-

This trust structure can benefit both donors looking for income and charities in need of support.

How is the trust agreement structured?

The structure of the Nongrantor Charitable Lead Annuity Trust Agreement is critical to its function and compliance with legal standards. Key components must include clear terms about the annuity amount, duration, and responsibilities of involved parties.

-

Include specifics such as the identity of the trust, terms of payment, and asset details.

-

The donor places assets into the trust, while the trustee manages the assets according to the agreement.

-

Ensure compliance with Internal Revenue Code to uphold tax benefits.

What are the steps for funding the trust?

Funding the trust involves transferring property assets to the trustee in a structured manner. It is vital to correctly document asset transfers to maintain clear ownership and ensure compliance with the trust's purpose.

-

Initiate the process by executing a transfer deed or title change.

-

Detailed accounts of assets must be provided for IRS documentation and compliance.

-

Post-transfer, the trustee must manage and disburse assets as outlined in the trust agreement.

How are annuity payments calculated?

Calculating annual payments is essential for both the donor and the charity. The method often uses a defined rate and can vary significantly based on the assets and performance.

-

The annuity payment is usually based on a percentage of the trust's initial value.

-

If the charitable recipient changes, you must adhere to the stipulations set forth in the trust agreement.

-

Several methods exist, including fixed and variable payments, which must be defined upfront.

How do choose the right charitable recipient?

Selecting the appropriate charitable organization as a recipient of the annuity payments is integral to the effectiveness of a Nongrantor Charitable Lead Annuity Trust. Key factors could include tax classifications and the organization’s mission and needs.

-

Evaluate organizations based on their operational needs, missions, and stability.

-

Be aware of IRS regulations regarding qualifying organizations to maximize tax benefits.

-

Ensure that the trust agreement permits modifications to the beneficiary if conditions change.

What are the management and administration responsibilities?

Regular management of the Nongrantor Charitable Lead Annuity Trust is necessary to ensure compliance and effectiveness. Ongoing responsibilities include accurate record-keeping and maintaining strong relationships with recipients.

-

Trustees must be diligent in maintaining the trust's assets and disbursing payments as defined.

-

Mandatory annual reports need to be prepared to comply with tax regulations.

-

Fostering communication between the trustee and charitable organizations helps assure transparency and trust.

How can pdfFiller enhance document management?

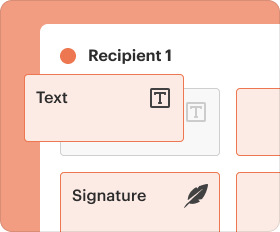

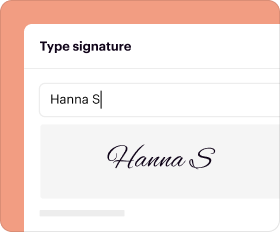

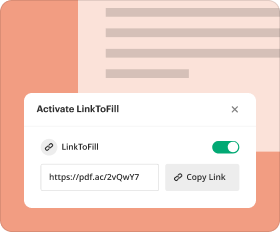

pdfFiller enhances the ability to manage all documentation associated with the Nongrantor Charitable Lead Annuity Trust. It empowers users to edit, sign, and collaborate from a single platform, ensuring efficiency and accuracy.

-

Easily modify trust documents with an intuitive interface that streamlines changes.

-

Securely sign documents electronically, adding confidence and compliance to the agreement.

-

Engage with teams or legal advisors for reviewing and finalizing documents seamlessly.

What are the compliance and best practices?

Ensuring compliance depends on navigating complex state and federal regulations. Best practices dictate organizational effectiveness and documentation retention to prepare for potential audits.

-

Every state may have unique compliance requirements that should be researched thoroughly.

-

It's crucial to maintain records of all transactions and agreements for legal and tax purposes.

-

Regular reviews and updates of documentation help in minimizing issues during audits.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.