Get the free Bank Withdrawal or Draft Agreement template

Show details

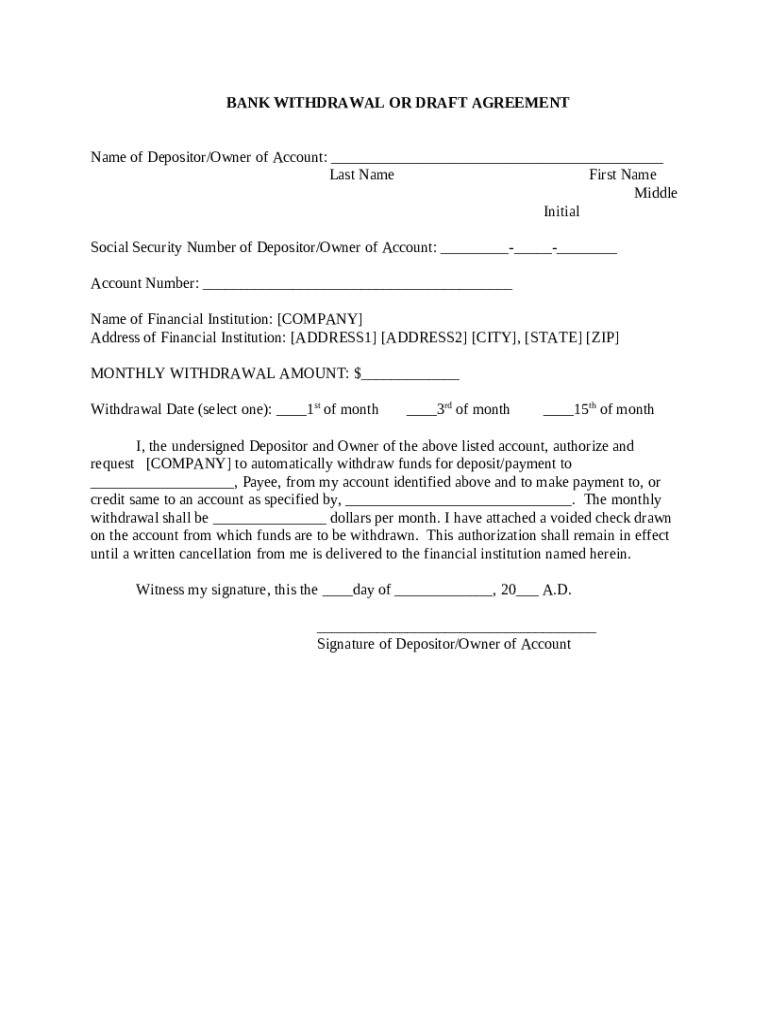

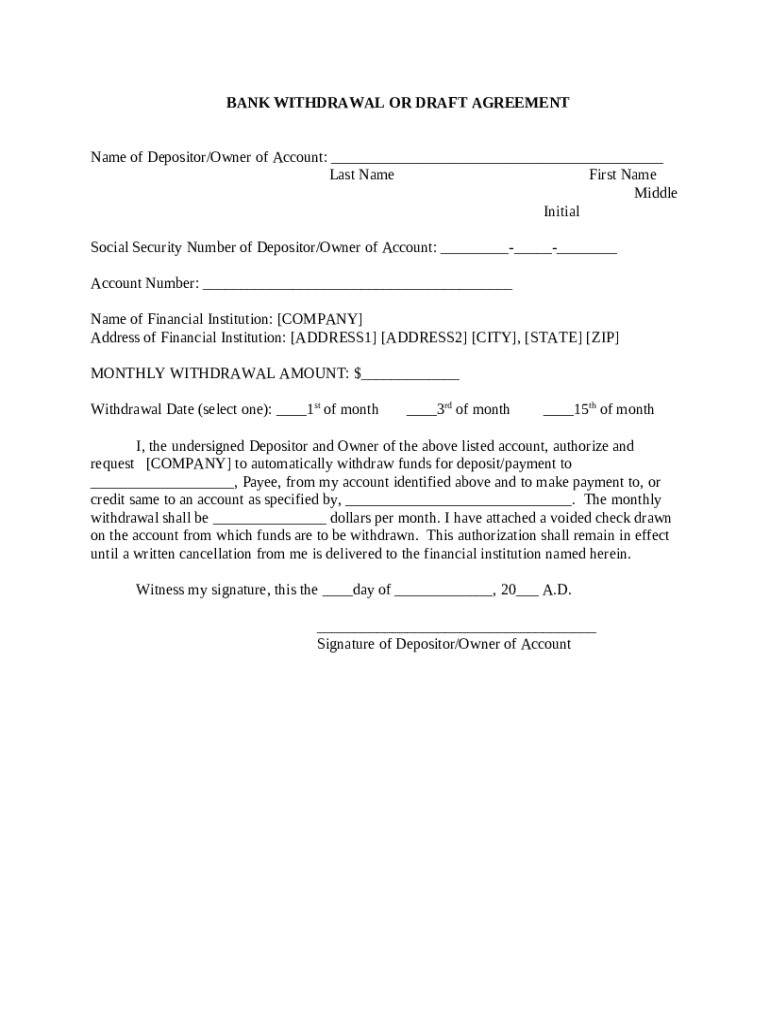

This form authorizes the withdrawal of funds from the payors account to be deposited to the payee.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is bank withdrawal or draft

A bank withdrawal or draft is a written order directing a bank to pay a specified amount from a person's account.

pdfFiller scores top ratings on review platforms

good

thx

quite easy to use and convenient but i'm only using it for one time, there are no other needs right now

great app

Makes me more useful working from home

Makes me more useful working from home. I can fill in forms that have been faxed to the office from home. Love it.

Awesome

Awesome was able to create with ease

Who needs bank withdrawal or draft?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Bank Withdrawal or Draft Forms

How to fill out a bank withdrawal or draft form

Filling out a bank withdrawal or draft form is a straightforward process that enables individuals to authorize specified withdrawals from their bank account. It's vital to understand the required information and the significance of each section to avoid common pitfalls. This guide will walk you through all the necessary steps and details.

Understanding the bank withdrawal or draft form

A bank withdrawal or draft form is a document used to authorize a bank to withdraw funds from your account on a scheduled basis or upon request. Its significance lies in facilitating transactions without the need for manual intervention each time a withdrawal is necessary. This form can be used by individuals or teams for regular payments such as rent, utilities, or subscriptions.

-

A bank withdrawal form sets the legal groundwork for automatic or manual withdrawals from your bank account.

-

This form streamlines financial transactions, making them more efficient and reducing the need for frequent direct contact with the bank.

-

Common scenarios include managing monthly bills, facilitating salary payments, and personal budgeting.

What are the key elements of a bank withdrawal or draft agreement?

Understanding the key elements of a bank withdrawal or draft form is crucial for creating an accurate and effective document. Each required element serves a specific purpose to ensure compliance and facilitate smooth transactions.

-

You need to provide your full legal name as it appears on your bank documents to ensure correct account handling.

-

This number verifies your identity and helps prevent fraud, making it essential in any financial agreement.

-

It's critical to accurately include the account number from which funds will be withdrawn to avoid transaction errors.

-

This includes the bank's name and address, ensuring the bank can process the request accurately.

-

Specify the amount to be withdrawn at each interval; this could be a fixed amount or a variable one based on your needs.

-

Choosing the right date is essential to align withdrawals with your financial planning and cash flow management.

How do you fill out the bank withdrawal or draft form?

Completing the bank withdrawal form accurately is key to ensuring timely and efficient transactions. Below are some essential steps to guide you.

-

Begin by carefully entering your personal information, ensuring that data matches your official documents.

-

Documents such as voided checks may be necessary to verify your account information and support your application.

-

Double-check all entries for accuracy and completeness to prevent validation issues that could delay processing.

What is involved in managing your bank withdrawal or draft authorization?

Once you've authorized a bank withdrawal or draft, managing this authorization becomes essential to ensure your financial planning remains intact. Understanding how to navigate cancellations or modifications is key.

-

Your authorization allows the bank to withdraw funds based on the parameters set in your form, which is valid until canceled.

-

If your financial situation changes, you can contact your bank to alter or cancel the withdrawal authorization, ensuring funds are not withdrawn in error.

-

Always keep copies of your agreements and monitor your account statements to quickly spot any discrepancies.

How can interactive tools help with bank withdrawal forms on pdfFiller?

pdfFiller offers several features that simplify the editing and signing process for your bank withdrawal forms. Utilizing these tools can greatly enhance your document management.

-

pdfFiller allows users to edit forms easily, whether entering text, making corrections, or appending signatures.

-

Teams can collaborate in real-time, making it easier to gather input and finalize documents quickly.

-

Integrating e-signatures into your documents streamlines the approval process, reducing the need for physical paperwork.

What compliance considerations should you be aware of for bank withdrawal or draft forms?

Compliance with legal regulations is important when using bank withdrawal forms. Being aware of these regulations helps protect your interests and ensures adherence to legal guidelines.

-

Understand federal and state regulations that govern banking transactions to ensure compliance.

-

Some regulations may vary by region; familiarize yourself with local laws that may impact your authorization.

-

Protecting personal information is crucial, so ensure you use secure platforms when filling out and submitting forms.

Where can you find additional samples of withdrawal forms?

Having access to various withdrawal form templates can provide you with additional options and insights into what's available. Here's how you can find them.

-

Visit pdfFiller to access a variety of withdrawal forms that meet different needs and contexts.

-

Evaluate different form templates to choose the one that best suits your specific circumstances.

-

Consider your unique needs such as frequency of withdrawal and accuracy of details when selecting a form.

How to fill out the bank withdrawal or draft

-

1.Open the bank withdrawal or draft form in pdfFiller.

-

2.Begin by entering your full name at the designated section.

-

3.Fill in the date on which you are making the withdrawal or draft.

-

4.Enter the account number from which the funds will be withdrawn.

-

5.Specify the amount of money you wish to withdraw, ensuring it matches the available balance.

-

6.Add any additional details required by your bank, such as the purpose of the withdrawal if needed.

-

7.Sign the document in the signature field to authorize the transaction.

-

8.Review all the information for accuracy and completeness.

-

9.Once confirmed, save the document and either print it or submit it electronically depending on your bank's requirements.

-

10.Keep a copy of the completed withdrawal or draft for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.