Get the free Loan Agreement for Family Member template

Show details

A Loan Agreement is entered into by two parties. It lists the duties, obligations and liabilities of each party when entering into the loan agreement.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan agreement for family

A loan agreement for family is a legal document that outlines the terms of a loan provided by one family member to another.

pdfFiller scores top ratings on review platforms

great

great, easy and reliable!

GREAT APP

This is a good PDF editor, it ticks all the boxes. Great app, welldone.

i love it

i love it ! is very useful

Very convenient and easy to use

Very convenient and easy to use. Save a lot of time not having to print, fill manually and scan. Love it!

Just what I needed

Great

GreatIts awesome and easy

Who needs loan agreement for family?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Family Loan Agreements

What is a family loan agreement?

A family loan agreement is a formal document outlining the terms and conditions between a lender and a borrower within a family. Establishing this agreement helps avoid misunderstandings and provides clarity on repayment expectations. Despite common belief, informal loans among family members can lead to strife if expectations aren't clear, making a written agreement crucial.

-

A written legal document detailing the terms of a loan between family members.

-

Helps prevent conflicts by clearly stating expectations and responsibilities.

-

Many believe verbal agreements suffice, but a written document is essential for clarity.

What are the benefits of using a family loan agreement?

Using a family loan agreement formalizes financial interactions and provides a sense of professionalism in personal relationships. By documenting the terms and conditions, all parties involved can avoid miscommunication and have a clear understanding of their obligations. Additionally, there may be tax advantages when properly documented, which can benefit both the lender and borrower.

-

Creates a structured environment for lending and borrowing within the family.

-

Reduces the potential for disputes regarding repayment and interest rates.

-

Legal documentation may provide tax benefits under certain conditions.

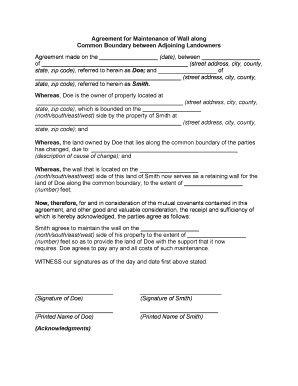

What are the essential components of a family loan agreement?

A comprehensive family loan agreement should include key components to ensure it is enforceable and clear. These components outline the roles of the lender and borrower, specify the loan amount, detail repayment terms, and clarify any interest rates. In some cases, collateral may also be required, adding an additional layer of security for the lender.

-

Identifies who the lender and borrower are, including their legal names.

-

Details the total amount borrowed and the schedule for repayment.

-

Specifies if interest will be charged and at what rate, ensuring transparency.

-

Describes any assets pledged against the loan as a form of security.

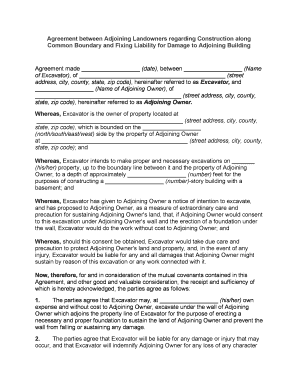

How do you create a family loan agreement?

Creating a family loan agreement begins with evaluating the pros and cons of lending. Understanding the implications of the loan is crucial before moving forward. Once you decide to lend, utilizing tools like pdfFiller's templates can simplify the drafting process. After drafting, review the terms with all involved parties, and finally, ensure everyone signs and stores the document securely.

-

Consider the impact of lending on your relationship and financial situation.

-

Use pdfFiller’s templates to ensure comprehensive coverage of necessary terms.

-

Discuss the agreement openly to avoid any potential disputes later.

-

Ensure all parties sign and that the document is stored in a secure location.

Where can you find a family loan agreement template?

You can find a structured family loan agreement template through platforms like pdfFiller. These templates often include standardized clauses that ensure clarity and enforcement of the agreement. Additionally, you have the option to customize these templates to suit your unique loan conditions, making it easier to address individual needs.

-

A family loan agreement template should have sections for all essential components.

-

Standardized clauses can provide clarity for both parties.

-

Utilize pdfFiller for personalized adjustments to meet the family's needs.

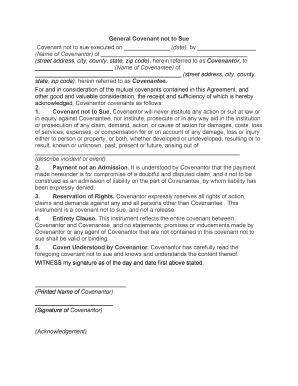

What legal considerations should you keep in mind?

It’s crucial to be aware of the state laws governing family loans, as they differ significantly across regions. Each state's regulations can affect the enforcement of your family loan agreement, especially regarding interest rates and documentation requirements. Consulting with a lawyer can help ensure compliance and mitigate potential legal repercussions if the loan terms are not upheld.

-

Research local laws to understand limitations and guidelines.

-

Be aware that failing to adhere to the terms can have legal consequences.

-

Ensure your agreement is structured legally sound to protect all parties.

How to manage family loans effectively?

Managing family loans efficiently requires thorough tracking of payments alongside a scheduled repayment plan. Establishing clear communication channels is essential to maintain harmony, especially if any repayment issues arise. Implementing strategies that encourage openness can help preserve family relationships while ensuring financial transactions remain smooth.

-

Map out when payments are due and how much is owed to ensure clarity.

-

Use spreadsheets or apps to monitor outstanding amounts and payment statuses.

-

Keep the dialogue open to address issues early and maintain positive relations.

How does pdfFiller assist with family loan agreements?

pdfFiller offers numerous features that streamline the process of creating, signing, and managing family loan agreements. Users can easily edit templates to fit their specific needs, eSign documents to ensure legal acceptance, and securely store agreements in the cloud. This all-in-one platform simplifies document management, making it ideal for busy individuals and families.

-

Modify any aspect of an agreement to meet family requirements.

-

Legally sign agreements from anywhere, adding security to commitments.

-

Ensure that all agreements are accessible but safe from loss or damage.

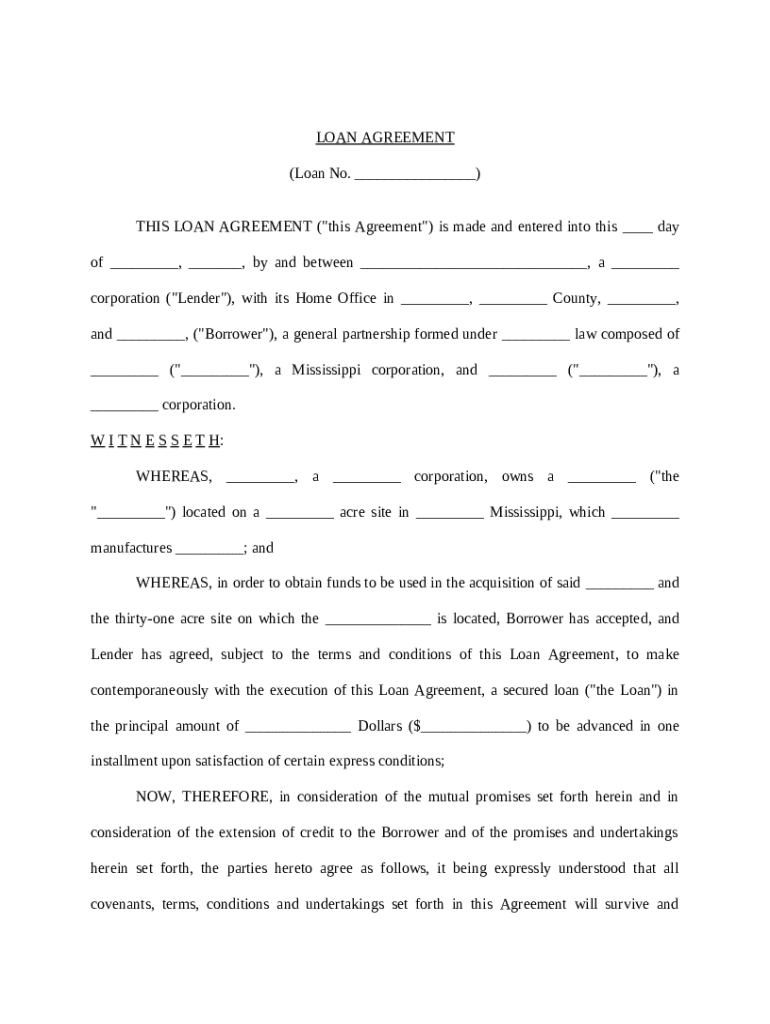

How to fill out the loan agreement for family

-

1.Open the loan agreement template in pdfFiller.

-

2.Fill in the date at the top of the document.

-

3.Enter the names and contact information of the lender (the family member providing the loan) and the borrower (the family member receiving the loan).

-

4.Specify the loan amount in the designated section.

-

5.Outline the interest rate, if applicable, and note whether it is fixed or variable.

-

6.Detail the repayment terms, including the schedule and due dates.

-

7.Include any late fees or penalties for missed payments if necessary.

-

8.Indicate the purpose of the loan and any specific conditions attached to it.

-

9.Have both parties sign and date the agreement to legalize it.

-

10.Save and download the completed loan agreement for both parties' records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.