Get the free Credit Ination Request template

Show details

A Credit Information Request means either a Business Information Request or a Consumer Information Request in a Specified Form.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is credit information request

A credit information request is a formal document used to obtain an individual's credit history and financial information from credit reporting agencies.

pdfFiller scores top ratings on review platforms

love it, could of used this years ago thank you and God Bless you all

This app is so versatile, fast and easy to use. It's the best pdf editors out there by far.

I'm a new business owner and this has come in real handy.

So far so good. Impressed with how easy it was to get started.

IT HAS BEEN AWESOME. The only issue with it though...I had to go to Acrobat to edit a doc as I was unable to do it on your platform.

Little bit of trouble maneuvering screen but love the click and type feature!

Who needs credit ination request template?

Explore how professionals across industries use pdfFiller.

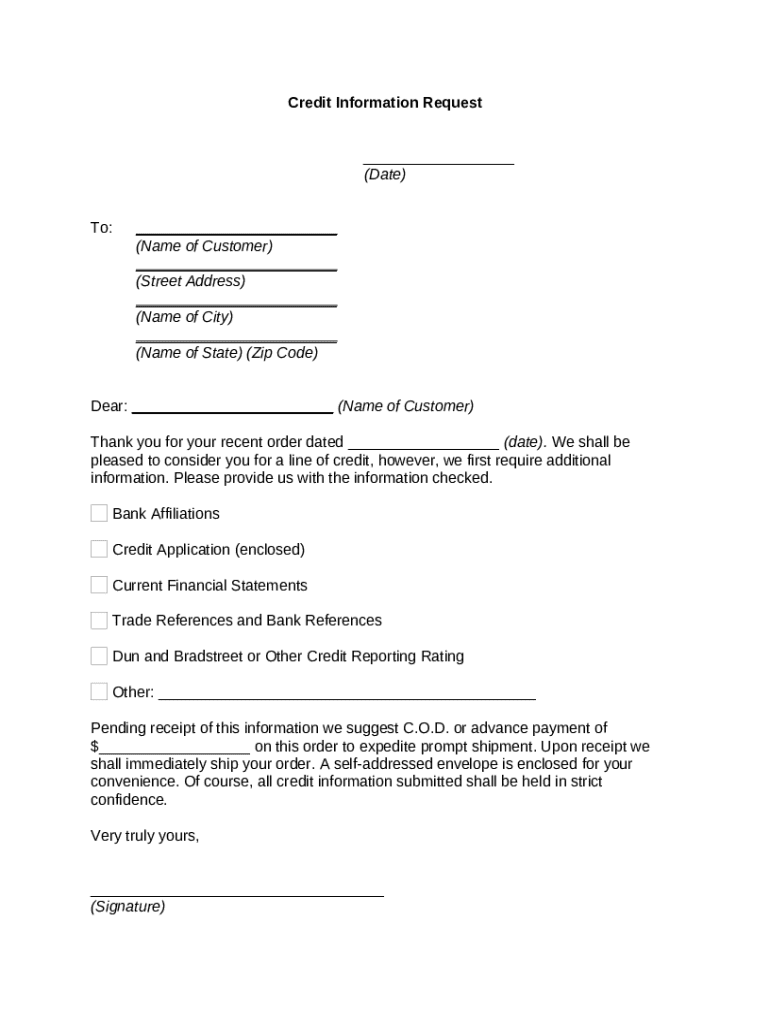

Comprehensive Guide to the Credit Information Request Form on pdfFiller

How do you fill out a credit information request form?

Filling out a credit information request form is a straightforward process that requires attention to detail. This guide provides a comprehensive overview of the steps and components involved in ensuring that your request is accurate and complete. Here, we will explore the form's purpose, key components, step-by-step filling instructions, and the benefits of using pdfFiller.

Understanding the purpose of the credit information request form

A credit information request form is crucial for businesses seeking to evaluate the creditworthiness of potential customers or partners. By formally requesting this information, businesses can reduce their financial risk and make informed decisions.

-

This form allows organizations to gather necessary credit information before extending credit or doing business.

-

It's essential for mitigating risks associated with extending credit based on reliable financial data.

-

Common use cases include loan applications, credit line assessments, or evaluating service contracts.

What are the key components of the credit information request form?

Every credit information request form includes specific sections that must be filled out to ensure completeness and accuracy. Each component serves a distinct purpose in the context of your request.

-

Always include the date of the request, formatted consistently, as it signals the timeliness of your inquiry.

-

Ensure that this section is filled out with the correct details of the person or entity from which you're requesting information.

-

A respectful and tailored greeting fosters goodwill, enhancing the response likelihood from the recipient.

-

Be specific about what information you need, including credit references, financial statements, or bank references.

How do you fill out the form?

Filling out the form correctly is vital to get a prompt and comprehensive response. Here’s a step-by-step approach to ensure accuracy.

-

Enter the date correctly using the MM/DD/YYYY format to avoid confusion.

-

Double-check that you have entered the recipient's name and address accurately, as this is critical for the request’s validity.

-

Create a friendly and respectful greeting, addressing the recipient appropriately.

-

Review each requested item to ensure complete and clear communication of what is needed.

-

Conclude the form by signing it and providing your contact information to facilitate any follow-up.

How can pdfFiller help manage your credit information request form?

pdfFiller enhances the form-filling experience with various features, ensuring you can manage your document smoothly and efficiently. It offers tools that make the process easier and more secure.

-

Easily customize your credit information request form with pdfFiller’s user-friendly editing tools.

-

Utilize e-signatures to sign and send documents securely, saving time and eliminating the hassle of paper.

-

Share the form easily with team members to gather feedback and finalize the document swiftly.

-

Access your document anytime and from anywhere, ensuring flexibility and efficiency in your business operations.

What are common challenges and solutions when using the form?

Handling a credit information request form may come with challenges that can disrupt the process. However, understanding these obstacles can help you navigate them effectively.

-

Ensure you double-check information before submission. Use reliable sources or databases to collect data.

-

Familiarize yourself with relevant laws and regulations related to data privacy such as GDPR or CCPA.

-

Follow up with recipients quickly if necessary information is missing to maintain a good relationship and keep the process moving.

How to fill out the credit ination request template

-

1.Open the PDF file for the credit information request.

-

2.Begin by entering your personal information at the top, including your full name, address, and contact information.

-

3.Provide your Social Security Number (SSN) or other identifying numbers, if required.

-

4.Fill in details about the purpose of the request, such as a loan application, rental approval, or employment verification.

-

5.Sign and date the document at the designated section to authorize the request.

-

6.If there are any specific sections or additional documents required, ensure they are attached according to the instructions.

-

7.Review the completed form to ensure all information is accurate and complete before submission.

-

8.Submit the filled-out request per the provided instructions, which may involve mailing, emailing, or submitting through an online portal.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.