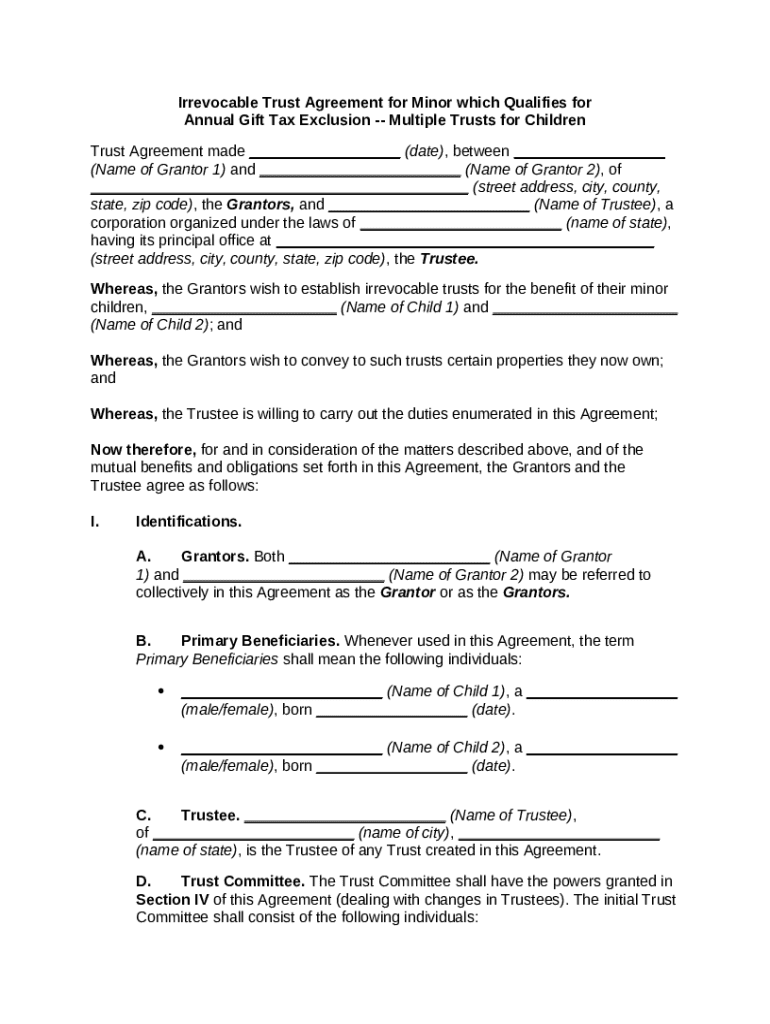

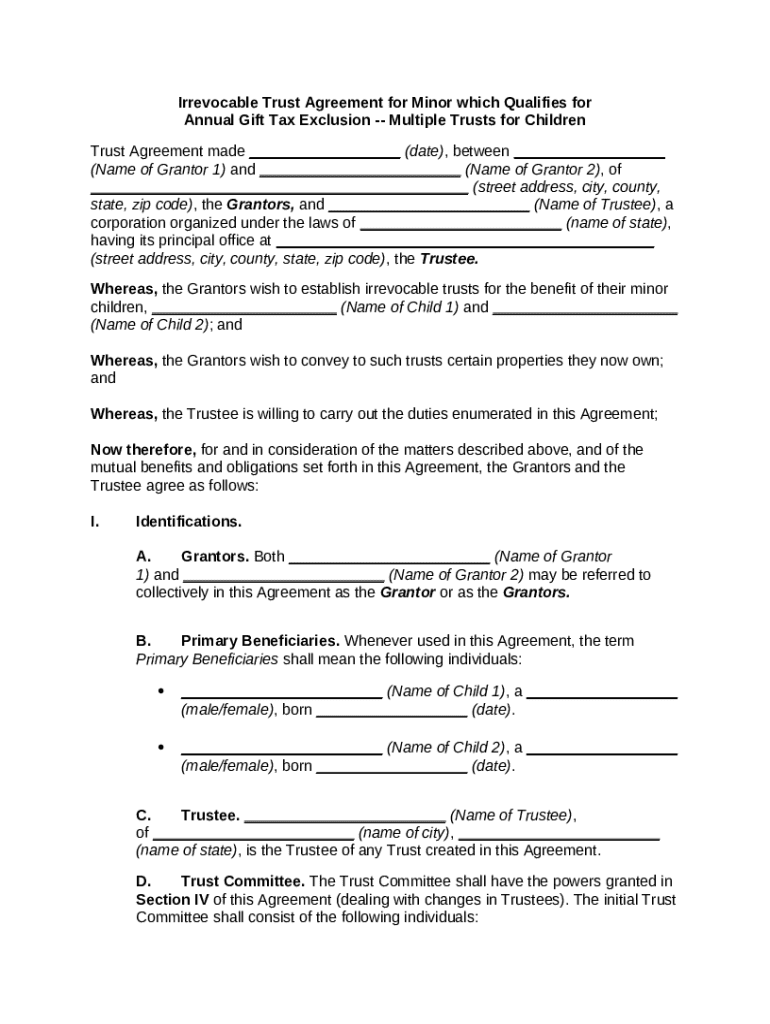

Get the free Irrevocable Trust Agreement for Minor which Qualifies for Annual Gift Tax Exclusion ...

Show details

Gifts in trusts to minors are quite common, both as a means of building up a child's estate and as a way to minimize federal gift, income, and estate taxes payable by the trustor or the trustor's

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is irrevocable trust agreement for

An irrevocable trust agreement is a legal document that permanently transfers assets into a trust that cannot be changed or revoked by the grantor once established.

pdfFiller scores top ratings on review platforms

I just got started and have encountered only one problem thus far.

Great so far, but there is no "undo" button, which is making some things difficult.

Came through for the forms that I needed. Highly recommend it.

It is the best PDF editor I have come across, great utility and features

It is everything that I needed and more. Thank you

great amazaing support staff karl is the best!!

Who needs irrevocable trust agreement for?

Explore how professionals across industries use pdfFiller.

Irrevocable Trust Agreement for Minors: Navigating Establishment and Compliance

How does an irrevocable trust function?

An irrevocable trust is a legal arrangement that cannot be altered or revoked after its creation without the consent of the beneficiaries. This ensures that the trust assets are permanently assigned to a designated purpose, providing financial security, particularly for minors. Understanding its structure and implications helps in making informed decisions about estate planning and asset protection.

What are the key differences between irrevocable and revocable trusts?

The primary difference between revocable and irrevocable trusts lies in control and flexibility. A revocable trust allows grantors to modify or revoke the trust during their lifetime, whereas an irrevocable trust locks in the terms once established. Irrevocable trusts provide benefits such as tax advantages and protection from creditors, making them preferable for certain legacy planning needs.

What are the common reasons for establishing an irrevocable trust for minors?

-

Assets in an irrevocable trust are shielded from creditors, ensuring financial safety for minors.

-

Such trusts can aid in handling annual gift tax exclusions, optimizing the financial benefits for minor beneficiaries.

-

Trusts ensure that the funds are used exclusively for the minor's benefit, promoting responsible financial management.

Who are the key players in an irrevocable trust agreement?

The primary parties involved in an irrevocable trust include the grantor, trustee, and beneficiaries. The grantor is the person who establishes the trust and transfers assets into it. The trustee manages the trust in accordance with its terms, ensuring that the beneficiaries receive their benefits as prescribed.

What components are included in the irrevocable trust agreement document?

-

The document must designate the names and roles of the grantors and trustees to ensure clarity in responsibilities.

-

It’s essential to specify the names of all beneficiaries who will eventually benefit from the trust assets.

-

Clauses regarding how assets should be allocated and managed are crucial for the operational function of the trust.

How do you draft the irrevocable trust agreement?

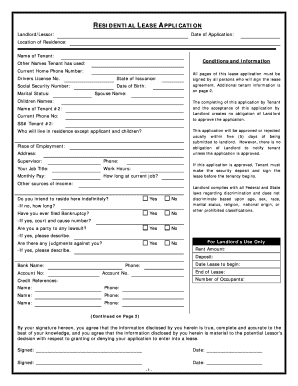

-

This includes obtaining necessary personal details of the grantors, trustees, and beneficiaries.

-

Fill in designated sections clearly to establish the framework of the irrevocable trust properly.

-

Ensure all management and administrative responsibilities are thoroughly analyzed and understood.

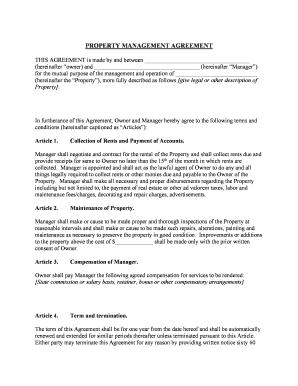

How can pdfFiller assist with the trust agreement process?

pdfFiller streamlines the process of creating and managing an irrevocable trust agreement by allowing users to upload and edit PDF templates conveniently. With options for eSignature and collaboration, users can ensure all parties are involved in the document revision process. The cloud-based management system keeps documents organized and accessible from anywhere.

What legal and compliance considerations should be aware of?

Each state has specific statutory requirements regarding irrevocable trusts. It's essential to be aware of these to avoid potential non-compliance penalties. Consulting with a legal professional can provide clarity on these regulations and assist in navigating the complexities of trust management.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

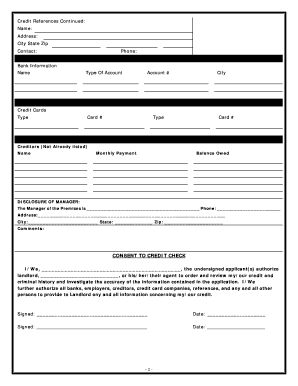

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.