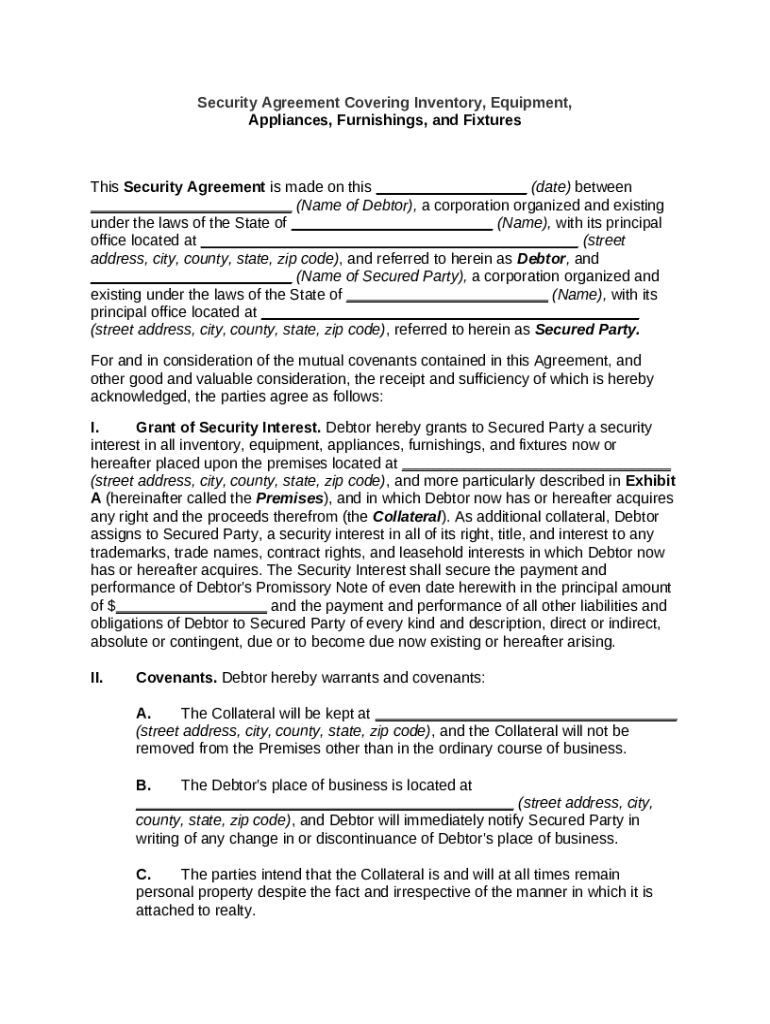

Get the free Security Agreement Covering Inventory, Equipment, Appliances, Furnishings, and Fixtu...

Show details

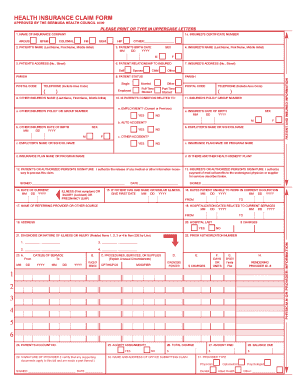

Most, if not all, major loans or credit sales involve creating a lien on the property. A lien on real estate would take the form of a mortgage or a deed of trust. A lien on all other property would

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

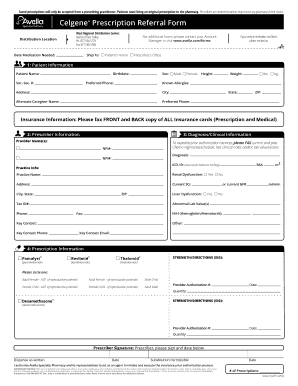

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

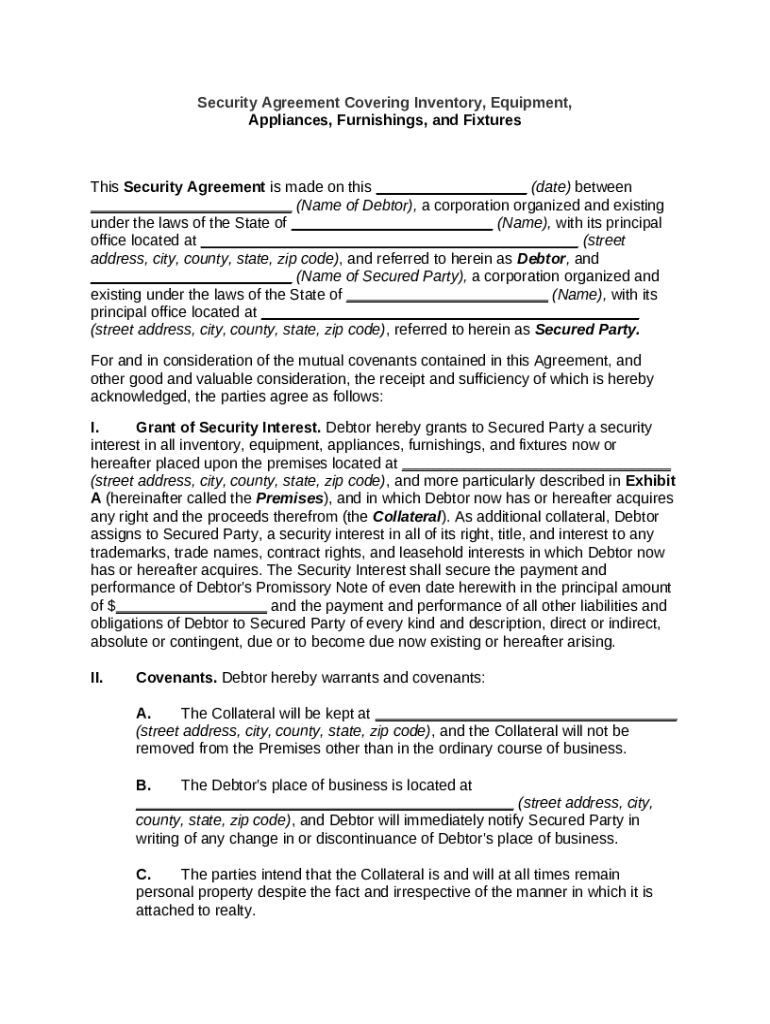

What is security agreement covering inventory

A security agreement covering inventory is a legal document that establishes a creditor's interest in a borrower's inventory as collateral for a loan or obligation.

pdfFiller scores top ratings on review platforms

The software is very user-friendly and FAST! I have purchased several PDF software programs through the year and many times Nuance Scansoft PDF (ver. 2, 3, 4, 5, 6, 7) and have purchased the Foxit (Phantom PDF) one.

I can say that the ease, the speediness of filling out PDF forms and its online platform make PDF Filler my number ONE PDF software now.

I have only one recommendation. If you could make a tryout period available for the Professional and Business versions, that would be awesome!

Works well when preparing documents from arogant property people

PDI filler allowed me to create a professional document in my home.

I found the pdf I was looking for quick and easy

Karl was very helpful when I was confused about some things. Thank you, Karl!

Having some trouble finding forms, but once located everything went smoothly.

Who needs security agreement covering inventory?

Explore how professionals across industries use pdfFiller.

Long-Read How-to Guide: Security Agreement Covering Inventory Form

A security agreement covering inventory form is an essential document used in various financing arrangements. This guide will provide a comprehensive overview, including how to fill out the form accurately, the involved parties, and legal considerations.

-

Define the purpose of the security agreement. This document ensures creditors have claims on the inventory if the debtor defaults.

-

Identify key parties like the Debtor and the Secured Party, understanding their roles and responsibilities.

Understanding the security agreement

Security agreements are vital in financing contexts, providing a legal way to secure loans with collateral. They typically cover a range of assets including inventory, equipment, appliances, furnishings, and fixtures, ensuring the lender’s interest is protected.

-

A security agreement is a contract that grants the lender a security interest in specific assets.

-

These agreements are crucial in establishing trust and legality between the Debtor and the Secured Party.

Who are the key parties involved?

Understanding the roles of the key parties is essential for a valid security agreement. The Debtor is the party that borrows money and provides collateral, while the Secured Party is the lender who receives a security interest in the collateral.

-

Responsible for providing accurate information and maintaining the collateral.

-

Holds the legal title to the collateral until the loan is repaid.

What are the components of the security agreement?

A security agreement typically consists of several components, each vital for its effectiveness. These include the Grant of Security Interest and Covenants made by the Debtor.

-

This section describes the collateral included, like inventory and equipment, demarcating what is secured.

-

Outlines required warranties, responsibilities, and duties to maintain the collateral in adequate condition.

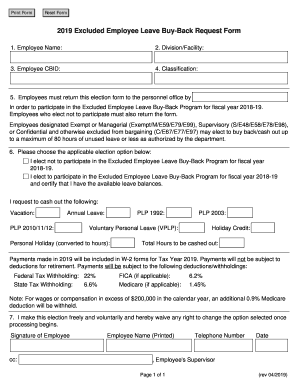

How do you fill out the security agreement?

Filling out the security agreement form requires careful attention to detail. Each field must be accurately completed to avoid legal complications later. Start by gathering necessary information such as debtor details and a description of the collateral.

-

List out the documents needed and the required fields in the security agreement.

-

Always double-check information, as inaccuracies can invalidate the agreement.

What legal considerations and compliance issues exist?

Securing a legal agreement requires awareness of jurisdictional regulations. Specific compliance notes are vital to understand how local laws may affect the validity of a security agreement.

-

Include information pertinent to your region to ensure compliance and legality.

-

Failure to comply can result in loss of security interests or legal disputes.

How can you edit and manage your security agreement with pdfFiller?

pdfFiller allows users to edit, eSign, and manage their security agreements conveniently on a cloud-based platform. This makes it easier to collaborate and ensure all necessary changes are finalized quickly.

-

Utilize pdfFiller's intuitive interface to modify agreements as needed.

-

Store and share your finalized documents securely.

How do you finalize the security agreement?

Finalizing a security agreement involves obtaining signatures from both parties. This completion step is crucial for the enforcement of the agreement, ensuring that both Debtor and Secured Party are legally bound to the terms laid out.

-

Ensure both parties review and understand the agreement before signing.

-

Store the finalized agreement in a secure location to prevent unauthorized access.

What common mistakes should be avoided?

Mistakes can lead to serious consequences, including invalidation of the agreement. Common errors include incomplete information or misunderstanding the obligations of each party.

-

Ensure that all sections are accurately completed to avoid legal disputes.

-

Seek legal advice if unsure about specific terms to ensure clarity.

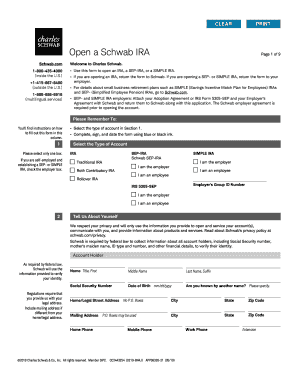

How to fill out the security agreement covering inventory

-

1.Start by gathering all necessary information about the parties involved, including names and addresses of the borrower and the lender.

-

2.Open the security agreement covering inventory template in pdfFiller.

-

3.Fill in the borrower’s details in the respective fields, ensuring accuracy in names and addresses.

-

4.Provide the lender's information similarly, ensuring correct spelling and contact information.

-

5.Describe the collateral: list the inventory items that will be covered by the security agreement, including any specific details like serial numbers, types, or quantities.

-

6.Outline the terms of the agreement: specify the loan amount, interest rate, payment schedule, and any relevant conditions.

-

7.Include any clauses related to default, rights upon default, and how the inventory will be handled in such cases.

-

8.Review the document for completeness and accuracy before saving or printing.

-

9.Once completed, have both parties review and sign the agreement, followed by proper notarization if required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.