Last updated on Feb 17, 2026

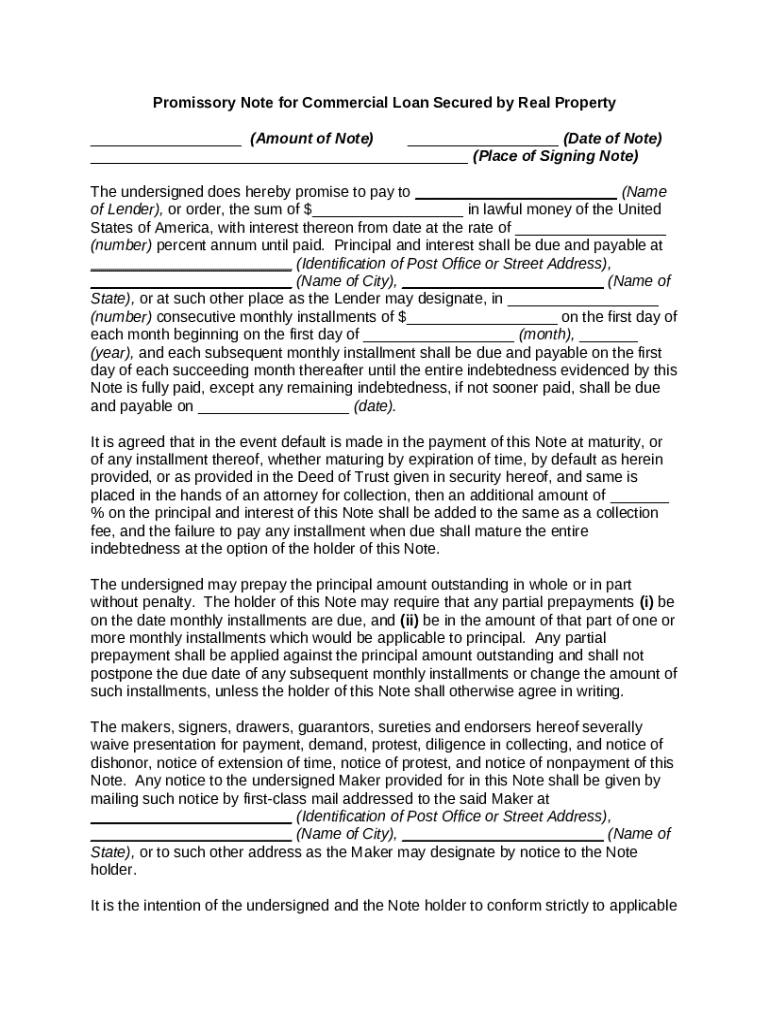

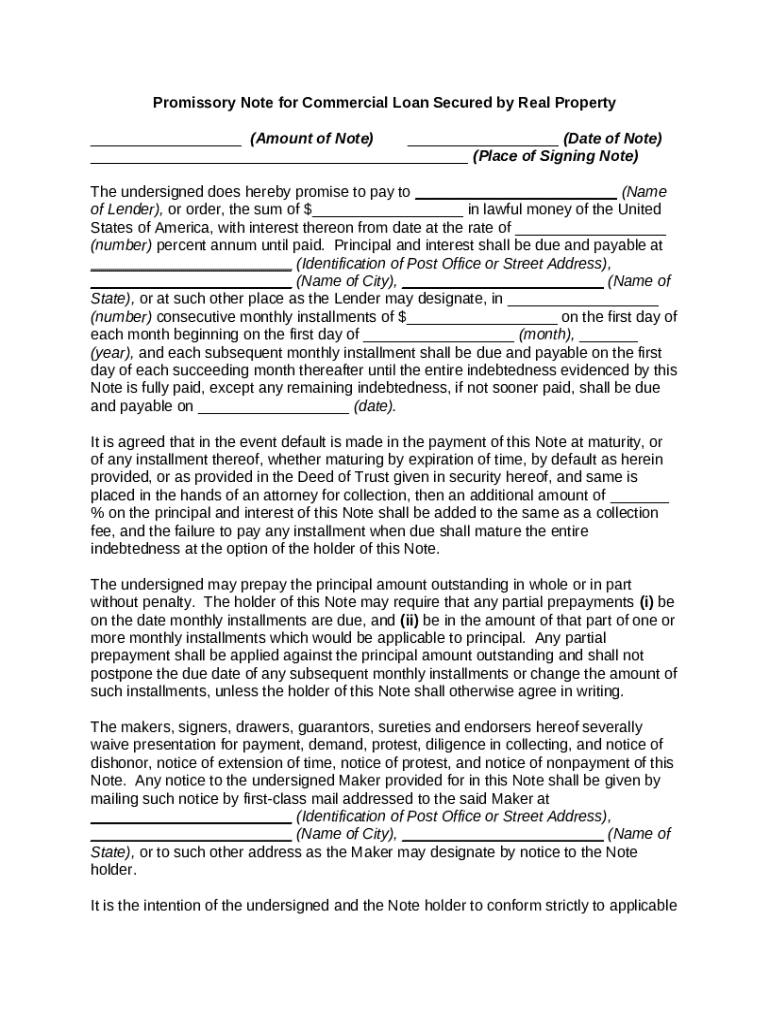

Get the free Promissory Note for Commercial Loan Secured by Real Property template

Show details

A promissory note is a written promise to pay a debt. It is an unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note for commercial

A promissory note for commercial is a financial instrument in which one party promises in writing to pay a specified sum of money to another party at a designated future date.

pdfFiller scores top ratings on review platforms

I love PDF filler. I can save a form and then type the information directly on the and make it look professional.

So far it has been simple to navigate and achieve overall goals

I just started, I also using Dochub for electronic signing.

Your features of creating folders and unlimited storage is great.

Sending documents to mobile phone is a great feature.

I haven't explore the rest. All the best to your team. Good Luck.

I used PDF filler to complete a URLA form because the one I was sent by a loan officer was so small I couldn't fit the information in it. PDFfiller made it very easy for me to see and complete the form. I feel that this service would be good for a small business owner because there are many documents available as well as documents that explain the documents you are completing.

I'm still learning to navigate this program but has made my job easiest

While attending Air Force SNCO Academy, this is a huge time saver while taking notes. So much easier to take notes on the document itself.

Who needs promissory note for commercial?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Promissory Note for Commercial Loans

A promissory note for commercial loans is a crucial document that outlines the terms of a loan between a borrower and a lender. This guide will provide you with step-by-step instructions to navigate the essential elements, legal compliance, and best practices related to using a commercial promissory note.

How to fill out a promissory note form: Start by gathering the necessary information about the loan, including the amount, interest rate, payment terms, and parties involved. After filling in these fields, review the document for any legal requirements and then ensure all signatures are collected.

Understanding promissory notes

Promissory notes serve as a written promise from the borrower to repay a specified sum of money to the lender under agreed-upon conditions. They can be secured, meaning backed by collateral, or unsecured, which typically carries higher risk for the lender. It’s essential to select the right templates, as they aid in legal compliance.

-

A promissory note is a financial instrument where one party promises in writing to pay a determinate sum of money to another party.

-

Secured notes involve collateral, reducing the lender's risk, while unsecured notes rely purely on the borrower's creditworthiness.

-

Using a compliant template safeguards against legal disputes by ensuring that all necessary information and clauses are included.

Key components of a commercial promissory note

-

This is the principal amount the borrower is receiving, which must be clearly stated.

-

The rate can be fixed or variable, and should be calculated based on market conditions and agreed terms.

-

These outline the frequency and amount of payments that the borrower needs to make.

-

Specifications of what occurs if the borrower fails to make the payments on time.

-

Details any conditions under which a borrower can pay off the loan early without penalties.

Step-by-step instructions for filling out a promissory note

Filling out a promissory note may seem complex, but following a structured approach simplifies the process. Begin by identifying all parties involved, then move to input the essential details regarding the loan amount, interest rate, and the repayment schedule.

-

Start by obtaining details like borrower and lender names, addresses, and any identification numbers required.

-

Accurately enter the loan amount, interest rate, and establish a payment schedule that both parties agree on.

-

Make sure all state-specific laws are adhered to, ensuring validity in the legal framework.

-

Identify all parties who need to sign the document and ensure the signatures are collected in the right sections.

Best practices for using pdfFiller

pdfFiller is an all-in-one solution that allows for easy edits and signatures on PDF documents. With its intuitive interface, users can efficiently edit their promissory note templates, eSign documents, and collaborate with stakeholders.

-

Utilize the editing tools to customize your promissory note template as needed.

-

Follow straightforward steps for collecting signatures electronically to streamline the process.

-

Engage legal teams or stakeholders by sharing documents for simultaneous input and review.

-

Organize and store signed documents securely in the cloud, ensuring easy access and retrieval.

Legal compliance and regulatory considerations

Understanding the legalities surrounding promissory notes is vital. Both federal and state laws govern their execution, and it’s important to remain compliant to avoid disputes. Depending on the jurisdiction, terms may vary, so it's crucial to familiarize yourself with local regulations.

-

Different states have varied rules governing the enforcement of promissory notes.

-

Promissory notes may need updates; follow proper protocols for modifying terms.

-

In the event of default, lenders have legal recourse for collection, which can include court involvement.

Common pitfalls and how to avoid them

While working with promissory notes, several common issues can arise that may complicate the lending process. Recognizing these pitfalls can save both parties from potential conflicts.

-

Clear communication regarding payment structures—interest versus principal—is key.

-

Failing to comply with local laws can invalidate the note and create legal issues.

-

Seeking professional advice can prevent complications and ensure all bases are covered.

How to fill out the promissory note for commercial

-

1.Open pdfFiller and upload or create a new promissory note document.

-

2.Begin by entering the date at the top of the document to indicate when the note is issued.

-

3.Fill in the name and address of the borrower, specified as the entity promising to pay.

-

4.Next, enter the name and address of the lender, the party providing the funds.

-

5.Specify the principal amount that is being borrowed in numerical and written form to ensure clarity.

-

6.Indicate the interest rate applicable to the loan, if any, which can be represented as a percentage.

-

7.Outline the repayment schedule, including due dates and payment amounts to be made periodically.

-

8.Add any prepayment terms if applicable, explaining whether the borrower can pay early without penalty.

-

9.Include any additional clauses that govern the terms of the note, such as default conditions.

-

10.Finally, ensure both parties sign the document and include the date of signing for validation.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.