Get the free Trust Agreement for Pension Plan with Corporate Trustee template

Show details

A Trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

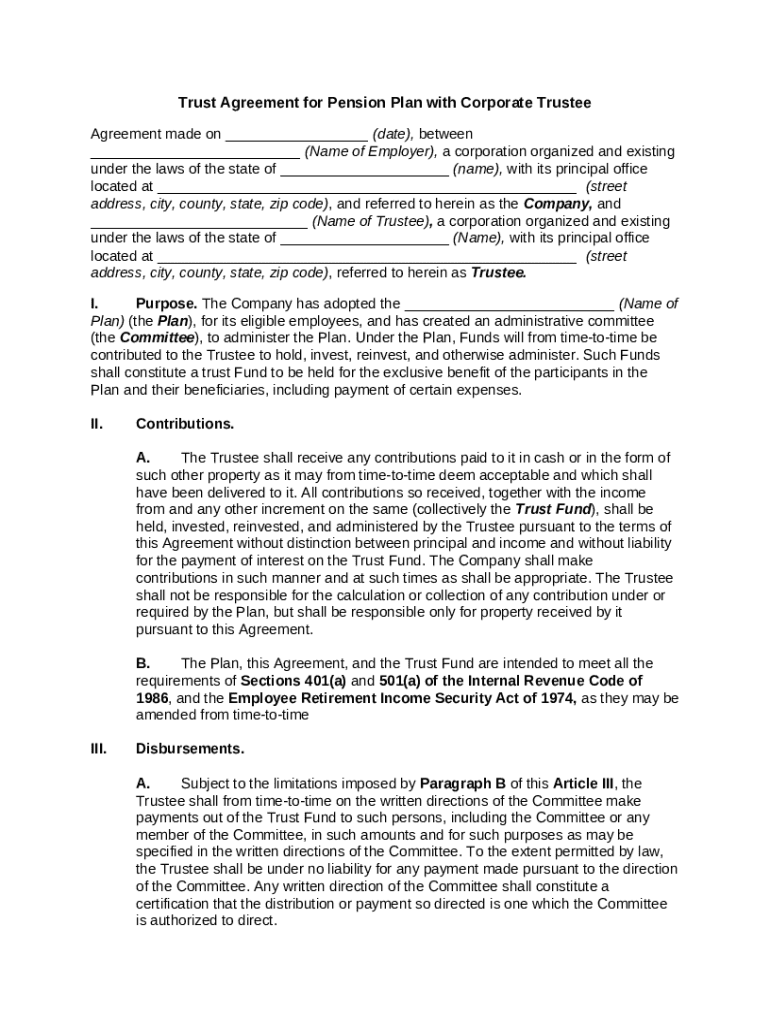

What is trust agreement for pension

A trust agreement for pension is a legal document that establishes a trust to manage pension funds for beneficiaries.

pdfFiller scores top ratings on review platforms

Rapid processing

AWESOME SOFTWARE!!!!

very good

good

I love it, new user though and could learn more

This is a must-have for anyone running a business online!

Who needs trust agreement for pension?

Explore how professionals across industries use pdfFiller.

Trust Agreement for Pension Form Guide on pdfFiller

How does a trust agreement for pension plans work?

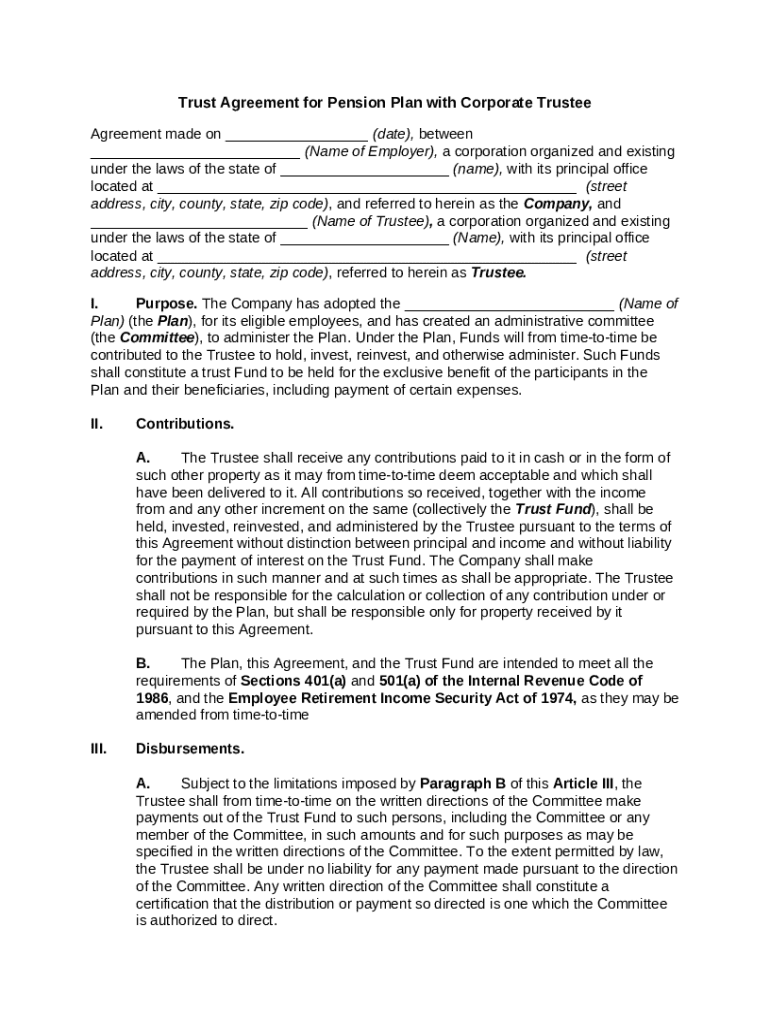

A trust agreement for pension plans is a legal document that outlines the terms under which a pension trust operates. It specifies the rights and obligations of the involved parties, including the company, trustees, and beneficiaries. Establishing a trust agreement is vital for ensuring that corporate trustees manage pension assets in compliance with legal regulations.

-

It serves to protect the interests of employees and beneficiaries by defining how contributions are managed.

-

Having a clear agreement enhances the accountability of trustees in managing the trust assets.

-

The document must align with pension plan regulations to ensure legal compliance.

What are the key components of the trust agreement?

-

Clearly states the objective of the trust and its legal standing.

-

Details about how contributions will be made, including examples of both cash and property.

-

Defines the specific responsibilities and authority of both parties in managing trustee obligations.

How do you fill out the trust agreement form?

Completing the trust agreement form requires careful attention to detail. Start by reading the instructions thoroughly and follow a structured approach.

-

Follow each section in order, ensuring all required fields are filled out accurately.

-

Use legal names and addresses to avoid any issues with the form's legitimacy.

-

Be mindful of missing signatures or incomplete sections that could delay processing.

What steps are involved in managing contributions to the trust fund?

Effective management of trust fund contributions is crucial for maintaining the fund’s integrity. Understanding the types of contributions and the related responsibilities helps comply with regulations.

-

Familiarize yourself with cash and property contributions as both have distinct handling requirements.

-

Establish systematic reporting and handling protocols to ensure accurate tracking of contributions.

-

Trustees must ensure that assets are managed prudently and in the best interests of the beneficiaries.

How can pdfFiller assist with your trust agreement needs?

pdfFiller provides a cloud-based platform for managing your Trust Agreement documents efficiently. Users can easily access and edit forms while collaborating with others in real-time.

-

Users can edit the Trust Agreement form directly within pdfFiller, ensuring that all information is up-to-date.

-

Enhanced collaboration features allow multiple users to work on a document simultaneously.

-

eSignatures streamline the process of completing the Trust Agreement, making it more efficient and legally binding.

What are the compliance and legal considerations?

Compliance with legal requirements is essential for the proper functioning of a trust agreement in pension plans. Organizations must adhere to both federal and state regulations.

-

Understand the various legal obligations that govern Trust Agreements under pension plan laws.

-

Regularly review and update the Trust Agreement to address any changes in state or federal regulations.

-

Seek legal counsel when circumstances change, ensuring that your Trust Agreement remains compliant.

How to fill out the trust agreement for pension

-

1.Visit pdfFiller's website and log in to your account or create a new one if you haven’t already.

-

2.Search for 'trust agreement for pension' in their template library and select the appropriate document.

-

3.Download the template to your device or open it directly in pdfFiller.

-

4.Start by filling in the details about the trust creator, including name, address, and other identifying information.

-

5.Proceed to input the details of the trust beneficiaries, ensuring all names and relations are accurate.

-

6.Include details about the trustees, specifying who will manage the trust and their responsibilities.

-

7.Fill out the terms of the trust, clearly stating how the pension funds should be managed and distributed.

-

8.Review all entered information for accuracy and completeness before finalizing the document.

-

9.Once completed, save your document within pdfFiller and consider exporting it into your preferred format if needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.