Get the free Agreement for Acquisition of Corporate Assets in Exchange for Stock (Type C Reorgani...

Show details

Unless the IRS waives the requirement, a targeted corporation must liquidate as a condition of a Type C acquisition plan, and target-corporation shareholders become shareholders in the acquiring company.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is agreement for acquisition of

An agreement for acquisition of is a legal document outlining the terms and conditions under which one party acquires assets or shares from another party.

pdfFiller scores top ratings on review platforms

This program is so easy to use for PDF documents

Works great and has all the features I required. I have found the customer support to be really prompt when I have had inquiries. Definitely going to keep this past my trial period.

so far so good! Did crash on me once but im giving it a second shot!

Preview image didn't change after I saved form with changes. Form has correct image so ok for now.

Love it. Makes sending government forms and documents so easy!

Serves my purposes so far Very simple to work with.

Who needs agreement for acquisition of?

Explore how professionals across industries use pdfFiller.

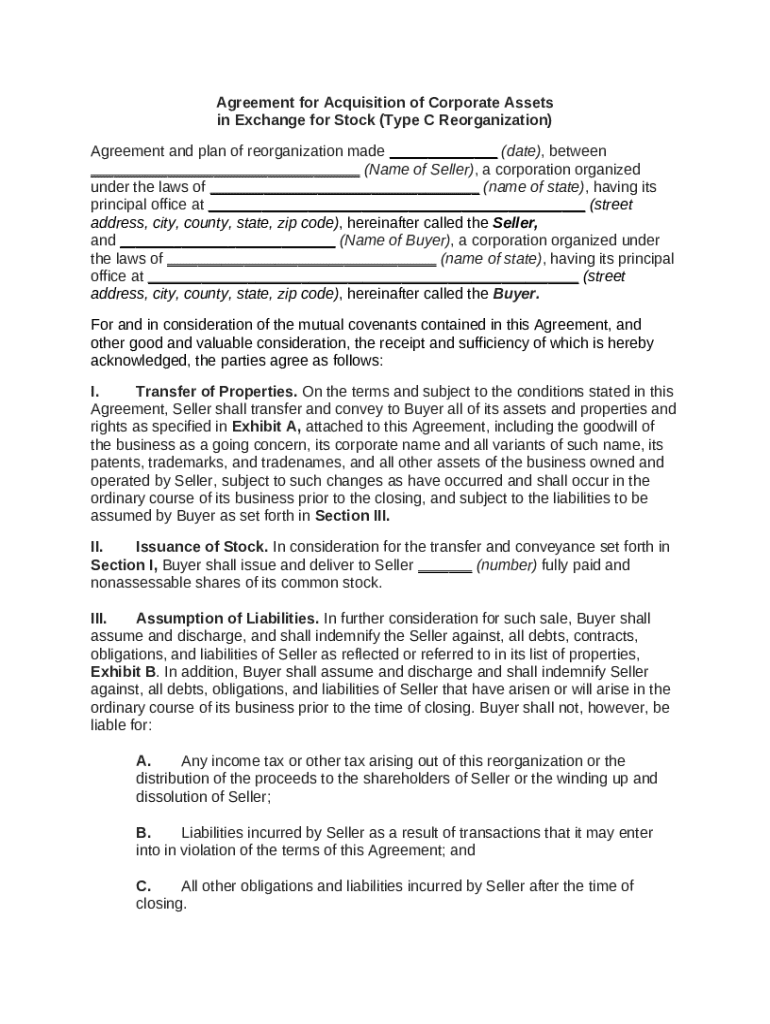

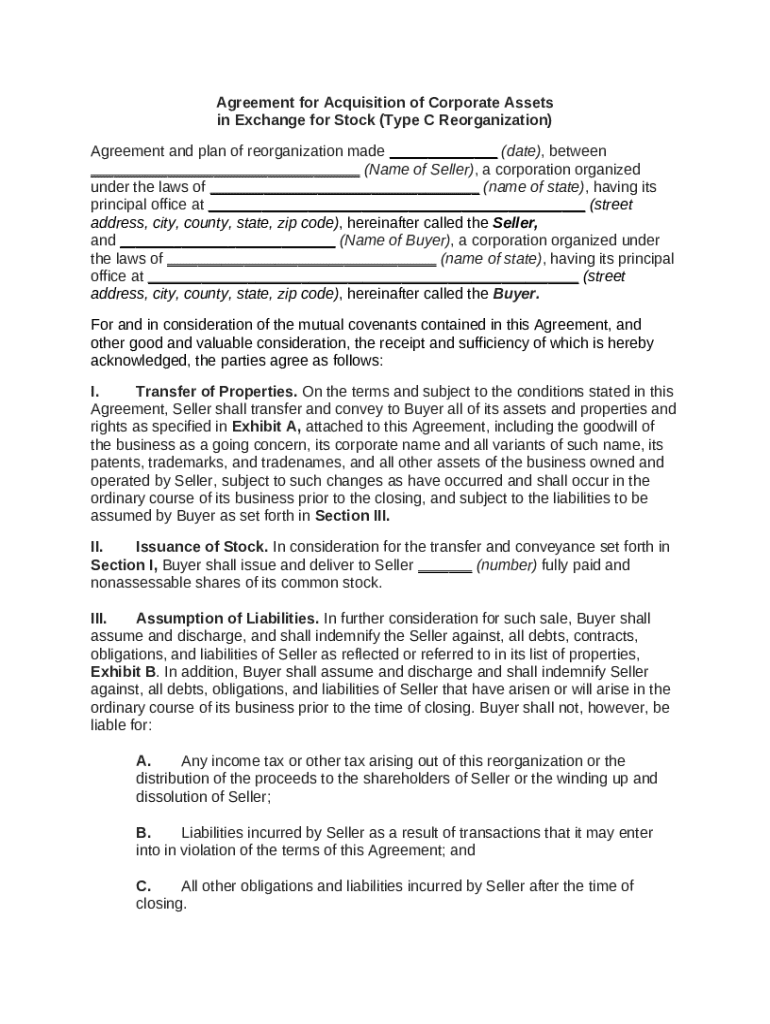

Agreement for Acquisition of Corporate Assets in Exchange for Stock

How do you structure an acquisition agreement?

Understanding the intricate structure of an acquisition agreement is crucial for ensuring a smooth corporate transaction. An acquisition agreement outlines the terms under which a buyer acquires corporate assets from a seller, usually in exchange for stock or other considerations. It typically consists of several components including definitions, representations and warranties, covenants, and terms of closing.

-

Acquisition agreements are essential in corporate transactions as they protect the interests of both parties and establish clear expectations.

-

Important components include the purchase price, asset description, liabilities assumed, and the obligations of the parties.

Who are the key parties in the acquisition agreement?

In any acquisition agreement, the two key parties involved are the Seller and the Buyer. Each party plays a significant role in the negotiation and execution of the agreement, as their responsibilities determine the terms of the asset transfer.

-

The Seller is responsible for disclosing all necessary information about the assets being sold, while the Buyer must perform due diligence.

-

Identifying the legal names and addresses of the parties involved ensures that the agreement is enforceable and clear.

-

Stating the principal office addresses helps establish jurisdiction and legal venues for any disputes.

What are the key considerations for transferring properties?

The transfer of assets is a pivotal part of the acquisition agreement. It's vital to specifically identify the assets being acquired, typically listed in an Exhibit A. Common items include goodwill, intellectual property, and physical assets.

-

The buyer needs to know exactly what assets they are acquiring, which is why detailed descriptions are crucial.

-

The agreement should also address any existing liabilities associated with the assets to ensure that the Buyer is fully aware of their responsibilities.

How does stock issuance work in this agreement?

Issuance of stock is often a central aspect of acquisition agreements, where the Buyer compensates the Seller with equity in the acquiring company instead of cash. Valuation of stock is critical, as it determines how much of the company the Seller will own post-acquisition.

-

Understanding how stock is valued can significantly affect both the buyer and seller’s interests.

-

Different payment structures, whether in common stock or other forms, can influence the overall acceptance of the agreement.

-

It's important to list the quantity of shares and the conditions under which they will be issued to avoid future disputes.

What liabilities does the Buyer assume?

In acquiring assets, a Buyer should be cognizant of the liabilities they are assuming as part of the deal. These liabilities can implicate financial responsibilities that may detract from the benefits of the acquisition.

-

Buyers should clearly understand which liabilities are being transferred to avoid unexpected obligations.

-

Including clauses that indemnify the Buyer against the Seller's obligations is crucial for protecting their interests.

-

Referencing specific liabilities in an Exhibit B makes the agreement clear and reduces ambiguity.

What steps should be taken to complete the acquisition agreement?

Finalizing the acquisition agreement involves several key steps to secure a legal and binding contract. These steps help ensure that all details are confirmed and that the document reflects the mutual agreement of both parties.

-

Create a checklist that includes reviewing terms, securing legal advice, and preparing the document for signatures.

-

Be aware of common pitfalls, such as neglecting due diligence or miscommunicating terms, which can derail transactions.

-

Utilize tools like pdfFiller for managing and organizing documents throughout the acquisition process efficiently.

How do you finalize and file your acquisition agreement?

Ensuring that the acquisition agreement is finalized and filed correctly is vital for compliance and legal enforceability. Best practices involve checking regional laws that may impact the validity of the agreement.

-

Follow best practices like double-checking all signed documents and storing them securely.

-

Be aware of specific laws in your region that may affect how acquisition agreements are treated.

-

Utilize pdfFiller’s platform for cloud-based management of documents to ensure ongoing accessibility and compliance.

What are the benefits of using pdfFiller for your agreement needs?

pdfFiller offers robust features that are invaluable for anyone using an agreement for acquisition of corporate assets. The platform provides tools for editing, signing, and managing documents in a secure, cloud-based environment.

-

pdfFiller provides diverse functionalities that streamline the process from editing to electronic signing.

-

Cloud-based access means that you and your team can work on documents from anywhere, improving productivity.

-

pdfFiller offers extensive support and resources to help users navigate their document needs effectively.

How to fill out the agreement for acquisition of

-

1.Open the PDF filler and upload the 'agreement for acquisition of' template.

-

2.Begin with the title section, ensuring it clearly states 'Agreement for Acquisition Of' and the date of the agreement.

-

3.Fill in the name and details of the acquiring party and the seller, making sure to include full legal names and addresses.

-

4.Specify the assets or shares being acquired in detail, including any relevant identifiers.

-

5.Outline the payment terms, including total amount, payment methods, and deadlines.

-

6.Include any contingencies or conditions that must be met for the agreement to be valid.

-

7.Review the terms carefully to ensure all necessary information is included and accurate.

-

8.Once completed, save the document and either print for signatures or send to involved parties electronically to sign.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.