Last updated on Feb 17, 2026

Get the free Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a...

Show details

A corporation whose shares are held by a single shareholder or a closely-knit group of shareholders (such as a family) is known as a close corporation. The shares of stock are not traded publicly.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is shareholders agreement with special

A shareholders agreement with special provisions outlines the rights and obligations of shareholders, including unique terms tailored to specific needs or circumstances of the business and its owners.

pdfFiller scores top ratings on review platforms

nw to otwr

Easiest to use

Easy to follow and organize.

Es una muy buena aplicación, cumple con todos los requerimientos

GREAT

I needed to file tax returns and was having a difficult time till I signed in to pdfFiller. I was able to accomplish my task. Thank you

Who needs shareholders agreement with special?

Explore how professionals across industries use pdfFiller.

Understanding a shareholders agreement with special allocation of dividends

How do we define a shareholders' agreement?

A shareholders' agreement is a contract among the shareholders of a company that outlines the rights, responsibilities, and obligations of the shareholders. It serves to establish boundaries and ensure the smooth operation of the business while protecting shareholder interests. In a special form of agreement, unique provisions can be included, such as special allocations of dividends.

This type of agreement is crucial for the governance of corporate finance and the distribution of profits among shareholders.

-

A binding contract between the parties involved.

-

These allocations can ensure fair profit distribution among varying shareholder classes.

-

Clarifies what each shareholder is responsible for, promoting accountability within the company.

What should be included in capital contributions and financing structure?

Capital contributions are critical as they lay the financial foundation of a business. Shareholders must detail their initial investments, evaluate if further financing is necessary, and understand how these contributions relate to special dividend allocations.

-

Deciding the initial investment amount from each shareholder is vital for future funding.

-

Consideration of potential additional investment to fuel growth or stabilize operations.

-

Special allocations can depend directly on how much capital each shareholder puts into the company.

How do dividend policies impact shareholders?

Dividend policies are rules that govern how profits are distributed to shareholders. When including special allocations in a shareholders agreement, clarity on how dividends are declared and affected becomes crucial for shareholder satisfaction.

-

Encompasses how and when profits are shared with shareholders.

-

Specific allocations can change who benefits most from distributions, affecting shareholder dynamics.

-

Details the procedural steps for declaring dividends, ensuring transparency.

What roles do officers play in a shareholders agreement?

Officers such as the President, Vice-President, Secretary, and Treasurer are essential in facilitating the agreement's implementation. Their defined roles help maintain organizational structure and effective governance.

-

Clearly establishing the functions and responsibilities of each officer.

-

Outlining conditions under which officers operate is vital for accountability.

-

Protects officers against personal liability arising from their role in running the business.

Why are confidentiality and non-compete provisions important?

Confidentiality clauses safeguard sensitive business information from being disclosed to outsiders. Non-compete provisions prevent former shareholders from entering into direct competition, protecting the company’s interests.

-

Keeps proprietary information secure within the shareholder group.

-

Defines what activities are prohibited post-termination of the agreement.

-

Clarifies legal repercussions if confidentiality is violated.

How are disputes resolved in a shareholders agreement?

Dispute resolution mechanisms provide a structured process to address disagreements that may arise. These may include mediation, arbitration, or litigation, depending on the agreement's stipulations.

-

Identifies conflicts that may occur, like financial disagreements or governance issues.

-

Mediation is often favored for its amicable nature, while arbitration offers a legally binding solution.

-

Details the steps required to initiate and resolve disputes efficiently.

What are share transfer restrictions?

Share transfer restrictions regulate how and when shares can be sold or transferred among shareholders. Clear conditions help maintain the integrity of corporate governance and protect minority shareholders.

-

May include approvals or offers of sale to existing shareholders before external parties.

-

Restricting transfers can ensure that special allocations remain equitable among the remaining shareholders.

-

Establishes formal steps and documentation required for transferring ownership.

What exit provisions and triggering events should be included?

Exit provisions outline how and when a shareholder can divest their shares. Establishing clear triggering events helps in managing expectations among shareholders.

-

Includes voluntary exits, forced exits due to circumstances like bankruptcy or dissent among shareholders.

-

Outlines conditions under which a shareholder can exit without detrimental consequences.

-

Ensures that all shareholders are aware of their rights and obligations during an exit.

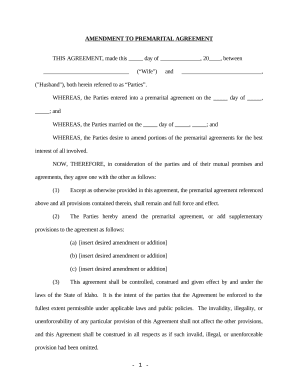

How to initiate an amendment process for shareholders' agreements?

Amending a shareholders' agreement requires a clearly defined process to ensure that all changes are agreed upon by shareholders. Typically, a voting mechanism is established for implementing amendments.

-

Involves drafting the proposed amendments and ensuring they are circulated among shareholders.

-

Specifies whether amendments need unanimous consent or a simple majority.

-

Clarifies how amendments impact existing agreements and shareholders.

What are termination clauses?

Termination clauses detail the conditions under which a shareholders' agreement can be dissolved. Understanding these conditions is vital, as they can have significant implications for the company and its stakeholders.

-

Common causes include the expiration of the agreement or failure to meet certain criteria.

-

Can result in the reorganization of shares and the operational structure of the company.

-

Establishes how much notice should be given to shareholders prior to termination.

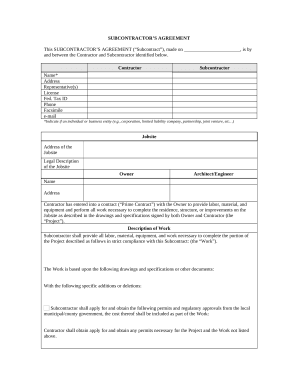

How to fill out the shareholders agreement with special

-

1.Obtain the template for the shareholders agreement with special provisions from pdfFiller.

-

2.Open the document in pdfFiller and begin by reviewing the pre-filled sections.

-

3.Fill in the names and addresses of all shareholders involved in the agreement.

-

4.Specify the special provisions that are applicable, such as buy-sell agreements or voting rights adjustments.

-

5.Detail the contribution of each shareholder, whether monetary or non-monetary.

-

6.Outline the procedures for decision-making, dispute resolution, and transfer of shares.

-

7.Ensure that all parties review the document for accuracy and completeness.

-

8.Once finalized, sign the document digitally using pdfFiller's e-signature feature.

-

9.Save and distribute copies of the signed agreement to all shareholders for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.