Get the free Security Agreement in Accounts, Contract Rights, and Inventory template

Show details

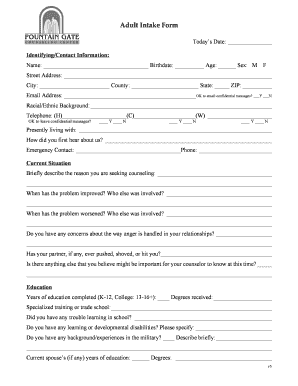

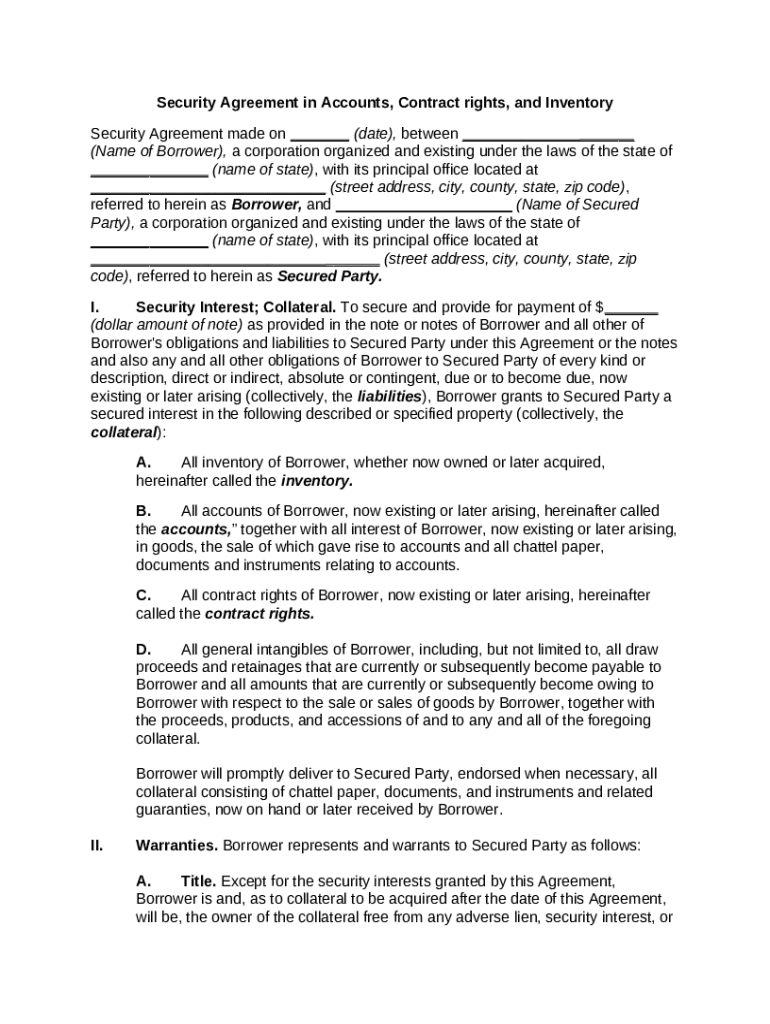

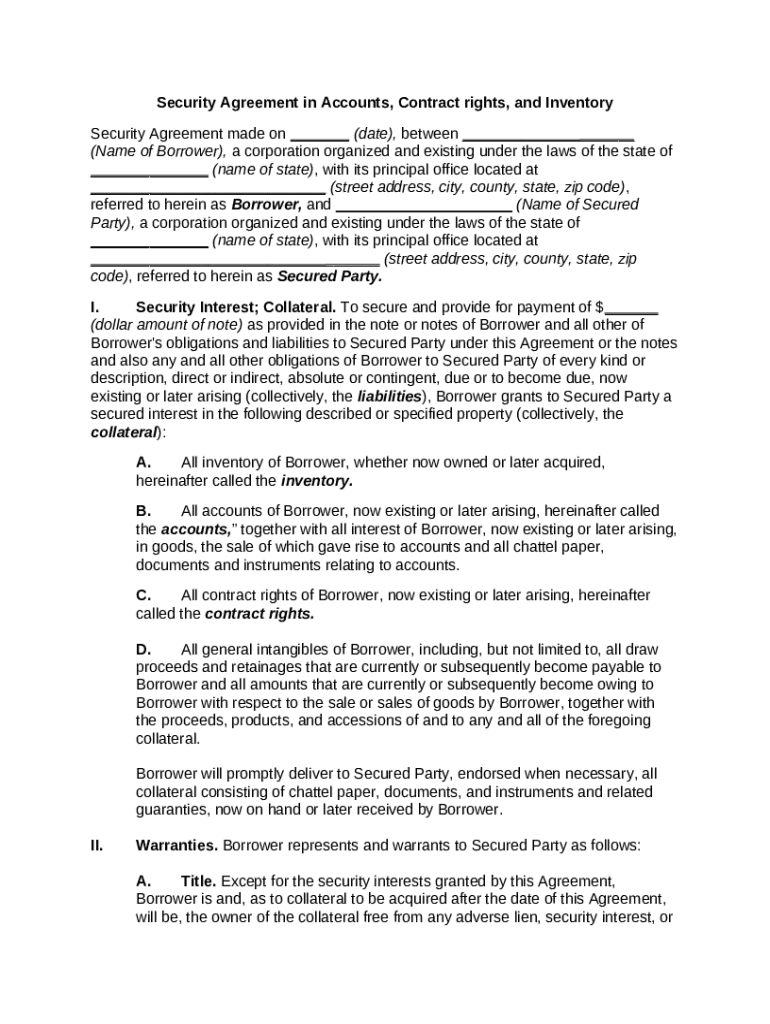

This form grants a security interest in accounts, contract rights, and inventory which refers to the property rights of a lender or creditor whose right to collect a debt is secured by property. A

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is security agreement in accounts

A security agreement in accounts is a legal document that grants a lender a security interest in a borrower's accounts receivable as collateral for a loan.

pdfFiller scores top ratings on review platforms

Easy, excellent edit console, nice solution...

I honestly find this to be the most by far easiest PDF filler on the market. The tools are simple to use no guessing games and you can get started right away. I also love that your documents are easily accessible. Great pro

This is a great and highly useful application.

This is amazing. I am always struggling with these forms- this is easy to use.

It worked like a charm, but although I figured it would be a paid service, but it would have been nice to know it was and how much before I got started.

Nice program. Too expensive for minor or occasional home use.

Who needs security agreement in accounts?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Security Agreement in Accounts Form

How to fill out a security agreement in accounts form

Filling out a security agreement in accounts form involves several key steps. First, gather all necessary information about the borrower, secured party, and collateral. Then, using a platform like pdfFiller, you can efficiently enter this information into the form, ensuring clarity and compliance with legal standards.

What is a security agreement?

A security agreement is a legal document that outlines the relationship between a borrower and a lender regarding collateral. It serves to protect the lender by establishing rights over certain assets during the borrowing process.

-

It specifies the rights and obligations of both parties involved.

-

Understanding its purpose can help businesses manage financial risks effectively.

Common use cases include loans for vehicles, equipment financing, or inventory purchases.

What are the components of a security agreement?

Security agreements typically include three essential components: the borrower, secured party, and collateral.

-

The individual or entity obtaining the loan and providing collateral.

-

The lender or entity securing the loan against collateral.

-

Assets pledged to secure the loan, such as inventory, accounts, or contract rights.

Specifying collateral types is crucial for clarity. This can include tangible property like inventory or intangible assets like accounts receivable.

How to fill out the security agreement form

Completing a security agreement form can be streamlined with platforms like pdfFiller.

-

Follow a step-by-step guidance to enter borrower and secured party details.

-

Utilize interactive tools to avoid common mistakes, enhancing accuracy.

-

Review for clarity and compliance with your specific legal jurisdiction.

What are the document management features on pdfFiller?

pdfFiller provides a cloud-based solution for efficient document management, especially for security agreements.

-

Edit, sign, and collaborate on documents easily.

-

Ensure all parties can access necessary forms securely from any device.

Utilizing pdfFiller tools allows for a seamless experience in document creation and management.

What compliance considerations should be kept in mind?

Legal compliance with local laws is crucial when drafting security agreements.

-

Ensure the agreement aligns with relevant industry regulations to avoid legal pitfalls.

-

Periodic reviews and updates are recommended to maintain compliance as laws evolve.

What are the potential risks and how can they be mitigated?

A poorly drafted security agreement can lead to significant risks, including financial loss for the lender.

-

Legal ramifications arise from non-compliance, jeopardizing the enforceability of collateral rights.

-

Best practices include having legal professionals review agreements to ensure adequate protection.

What can we learn from case studies?

Examining successful implementations of security agreements reveals valuable insights.

-

Many businesses have leveraged security agreements to secure financing for growth.

-

Learning from various case studies helps in crafting more effective agreements.

How to fill out the security agreement in accounts

-

1.Step 1: Begin by downloading the security agreement template from pdfFiller.

-

2.Step 2: Open the template in pdfFiller and review the sections to understand what information is required.

-

3.Step 3: Enter the name and address of both the borrower and the lender at the designated spaces.

-

4.Step 4: Specify the details of the accounts receivable being secured, including account numbers and any relevant identifying information.

-

5.Step 5: Clearly define the terms of the agreement, such as repayment schedules, interest rates, and any contingencies.

-

6.Step 6: Review all entries for accuracy and ensure compliance with any applicable laws.

-

7.Step 7: Consult with a legal advisor if necessary to ensure the document meets all legal requirements.

-

8.Step 8: Once completed, save the document and proceed to print or share it electronically as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.