Get the free Will with Marital Deduction and Bypass Trust template

Show details

A marital deduction is an estate tax deduction that allows one spouse to transfer upon death an unlimited amount of property to his/her spouse without creating liability for estate or gift tax. The

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

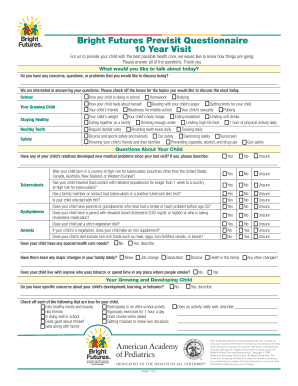

What is will with marital deduction

A will with marital deduction is a legal document that allows a spouse to inherit an estate without incurring estate taxes up to a certain limit.

pdfFiller scores top ratings on review platforms

GREAT resource, and easy to use. The product is good, which is why they offer a free trial.

Worked like a charm

So far, so good. I haven't had time to explore the whole app.

Very easy to use

BEST

easy to use

Who needs will with marital deduction?

Explore how professionals across industries use pdfFiller.

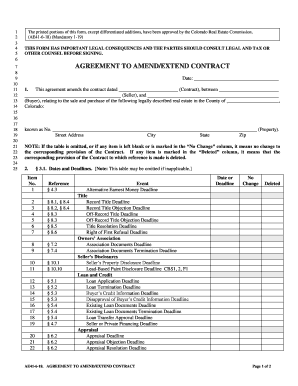

Will with marital deduction form guide

How does the estate tax marital deduction work?

The estate tax marital deduction allows a spouse to transfer an unlimited amount of assets to their surviving spouse without incurring federal estate tax. This is crucial for estate planning, as it ensures that married couples can pass their wealth to each other without a significant tax burden. By utilizing this deduction, couples can reduce their overall estate taxes, maximizing the inheritance received by the surviving spouse.

What qualifies spouses for the marital deduction?

Eligibility for the estate tax marital deduction hinges on specific criteria. Primarily, the spouses must be legally married, and the surviving spouse must be a U.S. citizen at the time of the decedent's death. This deduction is particularly important for couples engaged in estate planning, as it can significantly affect tax liabilities.

-

Only U.S. citizens can take advantage of the unlimited marital deduction.

-

Spouses must be legally married for the marital deduction to apply.

-

Collaborative estate planning can optimize tax benefits associated with the marital deduction.

What are the key considerations when using the marital deduction?

Using the marital deduction requires careful consideration of tax implications for the surviving spouse. While it provides significant benefits, potential limitations and exclusions exist that can affect overall estate plans. Understanding these factors allows couples to plan strategically, possibly utilizing structures like bypass trusts to enhance their estate management.

-

The surviving spouse may face different tax obligations once they inherit the estate.

-

Certain exclusions may apply, limiting the effectiveness of the marital deduction.

-

Using bypass trusts can ensure that part of the estate avoids estate tax upon the second spouse's passing.

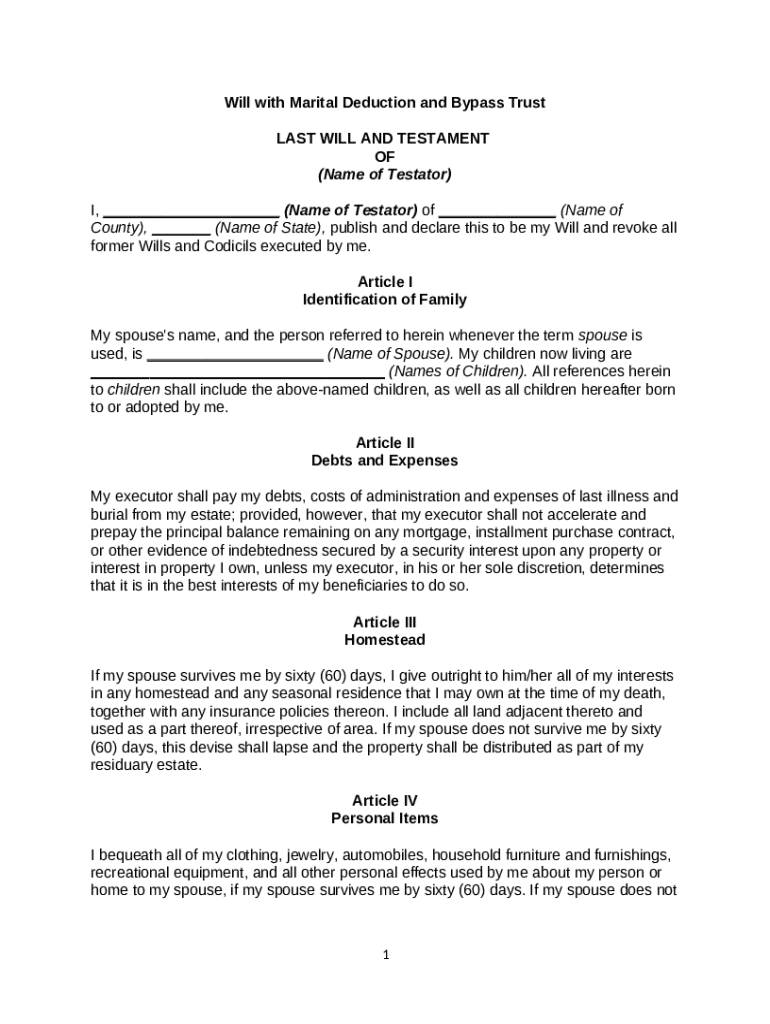

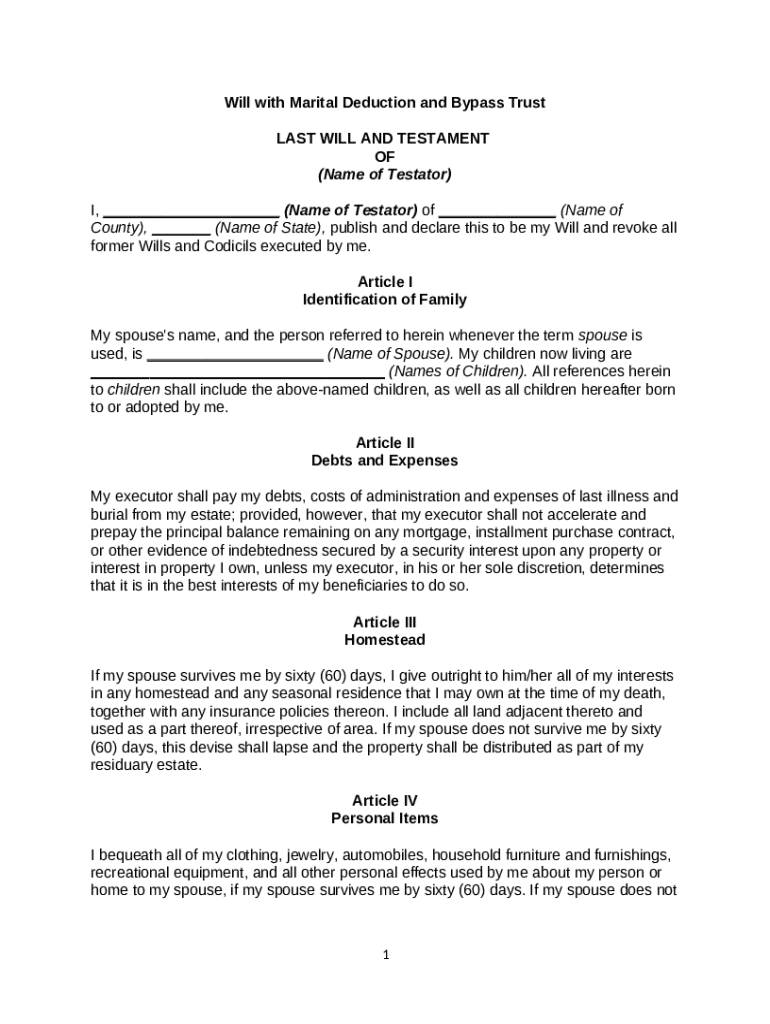

How do fill out the will with marital deduction form?

Filling out the will with marital deduction form requires clear identification of family members and outlined debts and expenses. Each article within the will serves a distinct purpose, ensuring that all assets and obligations are accounted for in the estate plan. Following a systematic approach can facilitate this process.

-

Clearly outline who your beneficiaries are to avoid confusion later.

-

List any debts and financial obligations that should be taken into account.

-

Specify how the family home will be handled within the estate.

-

Detail how personal property should be divided among beneficiaries.

How can utilize pdfFiller for managing my documents?

pdfFiller offers an intuitive platform for creating, editing, and managing PDFs, including your marital deduction form. Users can easily sign documents electronically and collaborate with family members or legal advisors remotely. This cloud-based solution ensures that your important documents are always accessible and up-to-date.

-

Easily create new PDFs from scratch or upload existing documents for editing.

-

Use eSigning features to sign documents electronically from anywhere.

-

Invite others to review or edit documents, simplifying family consultations.

What common mistakes should avoid when filing for the marital deduction?

Filing for the marital deduction can be complicated; thus, avoiding common mistakes is essential. Failing to meet legal requirements or misnaming beneficiaries can result in delays and challenges after death. Regularly updating your will also plays a critical role in ensuring that your estate plan remains aligned with your current family status.

-

Ensure compliance with all legal stipulations to avoid penalties.

-

Verify that all names and details are correct to facilitate smooth asset distribution.

-

Regularly review and update your will to reflect any changes in family dynamics.

What are some final thoughts on the estate tax marital deduction?

Accurate documentation and timely notifications to family members are crucial in leveraging the estate tax marital deduction effectively. It's not just about reducing taxes; it's also about ensuring your wishes are fulfilled posthumously. Consulting with a professional when necessary can help navigate complexities and ensure your estate plan remains comprehensive.

-

Accurate completion of documents can significantly impact the estate's tax liabilities.

-

Maintaining your will will reflect the latest life changes and wishes.

-

Consult professionals for tailored advice, especially in complex situations.

How to fill out the will with marital deduction

-

1.Open the will with marital deduction document on pdfFiller.

-

2.Begin by entering your name and contact information in the designated fields.

-

3.Provide information about your spouse, including full name and relationship details.

-

4.List your assets, such as properties and financial accounts, ensuring you indicate ownership percentages if applicable.

-

5.Identify any contingent beneficiaries who will receive assets if the primary spouse does not survive.

-

6.Fill in the section regarding the marital deduction, specifying the amount you wish to be exempt from estate taxes.

-

7.Review any additional clauses or sections that may modify how assets are distributed.

-

8.Add your signature and the date at the end of the document, ensuring compliance with local laws.

-

9.Once completed, use the save option to store your document, and consider printing it for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.