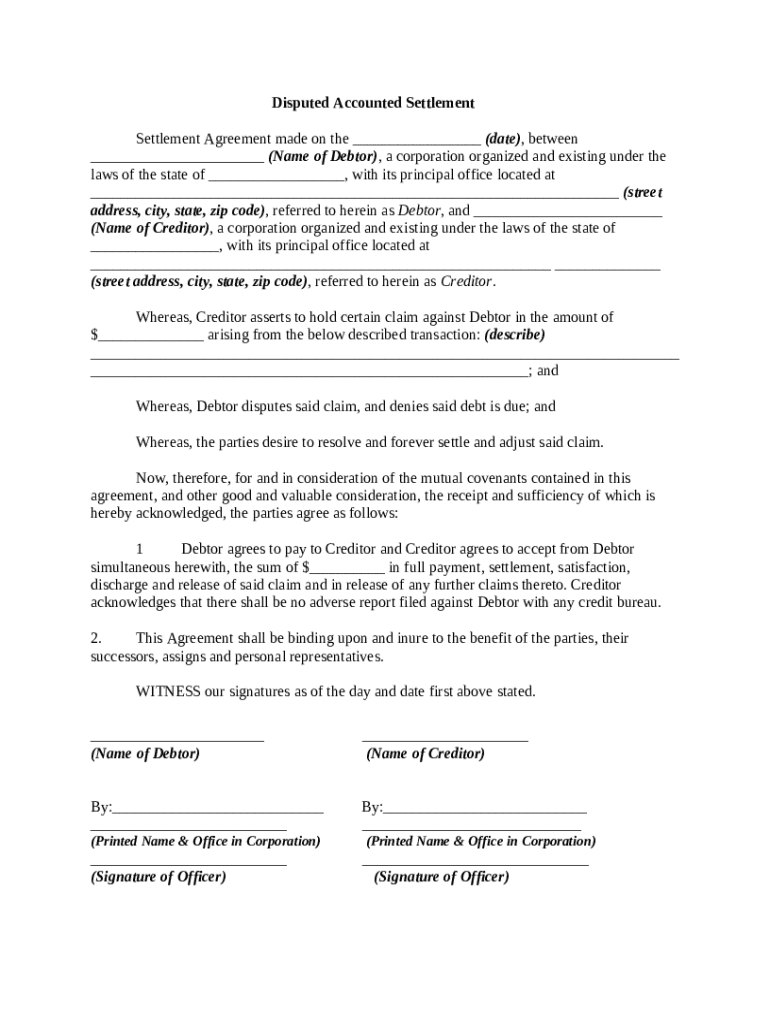

Get the free Disputed Account Settlement template

Show details

Parties may agree to a different performance of a contract This is called an accord. When the accord is performed, this is called an accord and satisfaction. The original obligation is discharged.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

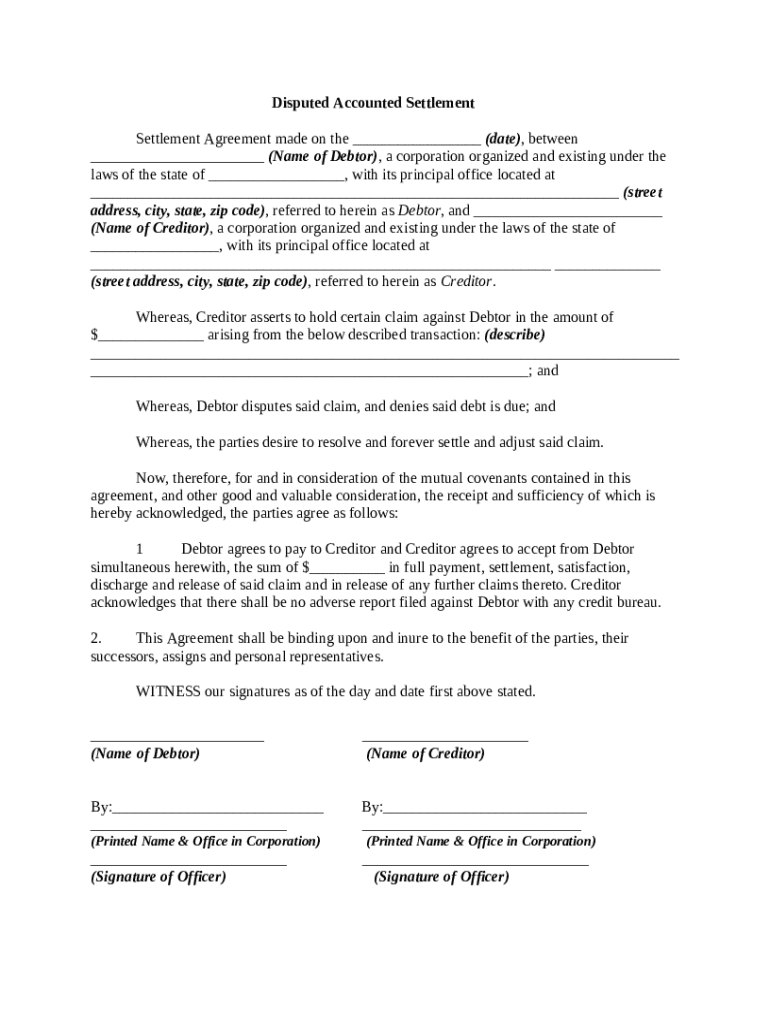

What is disputed account settlement

A disputed account settlement is an agreement between a creditor and a debtor to resolve a disagreement over an outstanding account balance.

pdfFiller scores top ratings on review platforms

great

great easy to view

EXCELLENT SERVICE

EXCELLENT SERVICES

Too expensive for casual users

It's too expensive for third world countries. I just need to remove some watermarks. I need it to use it once a month

Very user-friendly and useful tips. Better than Adobe Acrobat in my opinion. Thanks!

Very user-friendly.

They have a very good service

ease of use and easy to find the help…

ease of use and easy to find the help you need when you get a little stuck.

Who needs disputed account settlement template?

Explore how professionals across industries use pdfFiller.

Disputed Account Settlement Form Guide

How to fill out a disputed account settlement form

To fill out a disputed account settlement form, start by gathering all relevant information regarding the debt, including the amount owed and parties involved. Ensure accurate details are provided for the debtor and creditor, while documenting the nature of the dispute. Follow the step-by-step instructions carefully to avoid common mistakes, and double-check your entries before submission.

Understanding the disputed account settlement agreement

A disputed account settlement agreement is a formal document that outlines the terms of resolving a debt disagreement between a debtor and a creditor. The primary objective is to reach an amicable settlement that mitigates the impact of unresolved debts. Swift resolution is critical to avoid further legal complications and possible negative credit reporting.

-

A settlement agreement serves to clarify the obligations of both parties and creates a mutual understanding regarding the debt in question.

-

Prompt resolutions can prevent escalated legal actions that could be costly and damaging to credit scores.

-

Unsettled disputes can lead to court actions, garnishments, or even bankruptcy, severely impacting financial health.

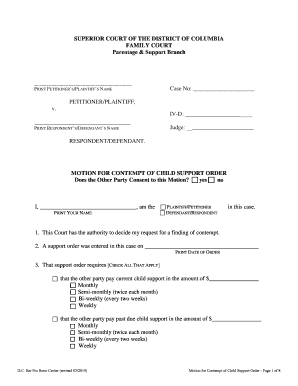

What are the essential elements of the settlement agreement?

Key elements of a settlement agreement must be clearly defined to avoid ambiguity and ensure enforceability. These include identifying the parties involved as well as clearly outlining the details of the claim, including the amount and basis of the dispute.

-

Correctly listing the names and contact information of both the debtor and the creditor is crucial for the validity of the settlement.

-

Include the total debt amount and succinctly explain the transaction that led to the dispute.

-

The agreement should clearly indicate the acknowledgment of the dispute by both parties which forms the basis for the settlement.

How do fill out the settlement agreement form?

Filling out the settlement agreement form requires attention to detail. Begin with accurate details for both parties and follow a structured approach to complete each section of the form.

-

Utilize the specific sections of the form as a checklist: start by entering parties' information, followed by claim details, and finally, terms of the agreement.

-

Ensure all names are spelled correctly, and use the most current contact information to avoid delays or issues.

-

Double-check for missing signatures, incorrect amounts, and ambiguities in the agreement that could result in disputes.

What should know about reviewing the terms of the agreement?

Reviewing the terms of the agreement is fundamental before signing. Understanding the payment conditions and their impact on your credit status is vital to effectively managing your obligations.

-

Clarify how and when the payments should be made, including any provisions for late payments.

-

Ensure the agreement includes terms that protect you from negative credit impacts provided payments are made timely.

-

Recognize that any signed agreement is legally binding; thus, both parties must adhere to the terms stipulated.

What are the steps for signing and executing the agreement?

The signing of the settlement agreement formalizes the understanding between debtor and creditor. Each party must adhere to specific signing requirements to ensure the document’s enforceability.

-

Both parties must provide their signatures to validate the agreement, confirming their acceptance of the terms.

-

Depending on local laws, having a witness or acquiring notarization may be necessary for enforceability.

-

Familiarize yourself with state regulations that may affect the terms of the agreement and its legal standing.

How do manage future implications of the settlement?

Post-agreement, effective record-keeping and monitoring are crucial to manage the aftermath of the settlement. Maintain open communication with relevant entities, such as credit bureaus, to mitigate future disputes.

-

Keep copies of agreements and payment records; regularly review your credit report to ensure the settlement terms are reflected accurately.

-

If there are any discrepancies, proactively reach out to the credit bureaus for necessary adjustments to your credit report.

-

Document any new claim thoroughly and consider consulting an attorney if new disputes occur regarding settled accounts.

How can pdfFiller assist with disputed account settlements?

pdfFiller offers a streamlined solution to access and fill the disputed account settlement form efficiently. With interactive tools, document management, and collaborative features, users can simplify the process of settling disputes.

-

Users can easily navigate to the disputed account settlement form on pdfFiller, ensuring they have the latest version of the document.

-

Take advantage of eSignature tools, collaborative features for multi-user input, and comprehensive document management functionalities.

-

pdfFiller prioritizes security, safeguarding submissions with encryption and secure document storage to protect sensitive information.

How to fill out the disputed account settlement template

-

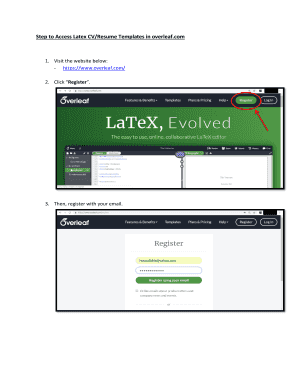

1.Access the pdfFiller platform and log in to your account.

-

2.Select 'Create New Document' and search for 'Disputed Account Settlement' template.

-

3.Once you find the correct template, click on it to open in the editor.

-

4.Fill in the debtor's details such as name and account number at the top of the document.

-

5.Provide the details of the disputed charges or accounts in the designated section.

-

6.Include any supporting evidence, like transaction records or correspondence, if required.

-

7.Specify the proposed settlement terms and conditions clearly in the relevant sections.

-

8.Review the filled document for accuracy, ensuring all information is correct and complete.

-

9.If necessary, add any additional comments or notes in the comments section of the document.

-

10.Once satisfied, save your document and then proceed to download or send for signature as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.