Get the free Finance Lease of Equipment template

Show details

Finance leases, in which the person selling the goods is substituted for the lessor as the party responsible to the lessee for certain aspects of the transaction, such as warranties.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is finance lease of equipment

A finance lease of equipment is a contractual arrangement where one party leases equipment from another for a specified period, primarily for using it rather than owning it, with an option to purchase at the end.

pdfFiller scores top ratings on review platforms

Awesome! This is how automation is to work!!!! Thank you

Easy and so convenient! I use it frequently for both business and personal needs.

easy to fill out same form for my whole family

Confusing when I signed up -- wanted only 1 month and only choice was 1 year...used chat for refund.

It has been very helpful. The user interface is not difficult to navigate. I am cancelling only because I do not have the volume of documents to warrant the cost. But when this changes I will certainly return.

I give the pdf filler a 5 star rating easy to understand

Who needs finance lease of equipment?

Explore how professionals across industries use pdfFiller.

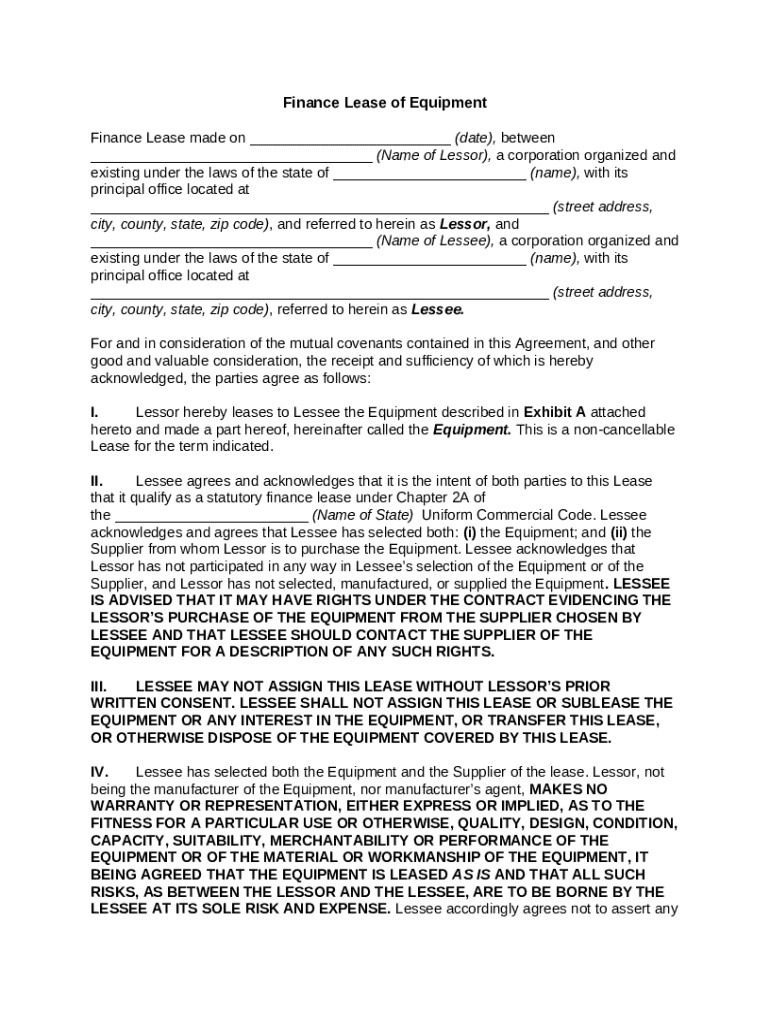

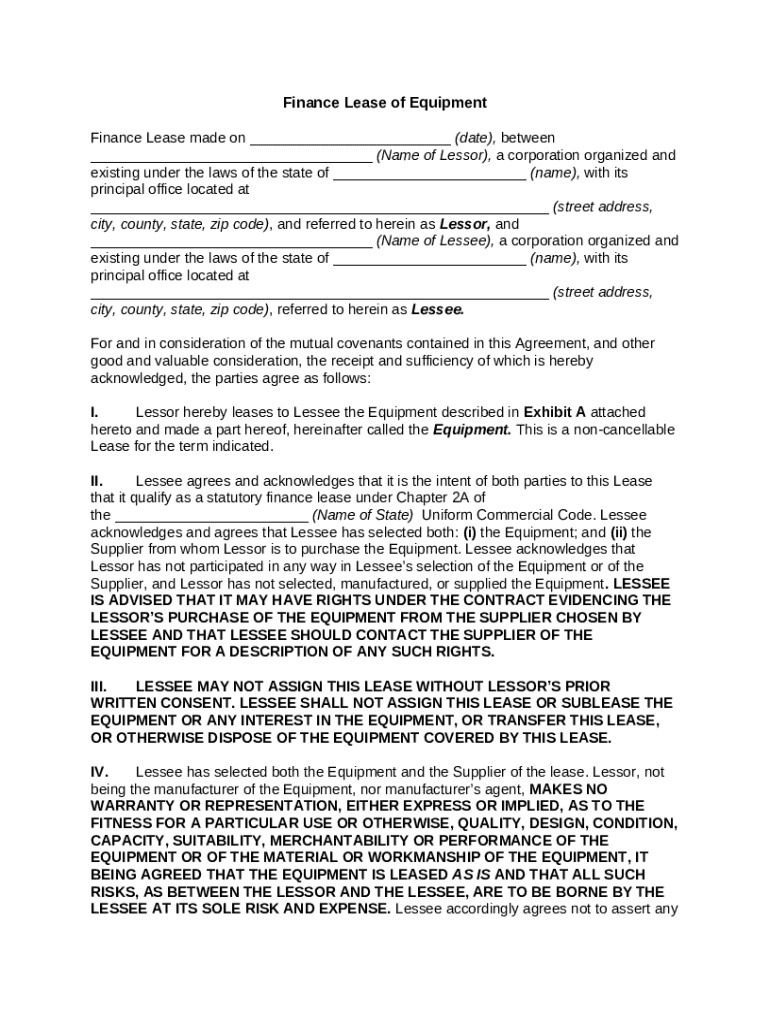

Comprehensive Guide to Finance Lease of Equipment Form

How does a finance lease work?

A finance lease is a long-term agreement allowing a lessee to use equipment while making monthly payments. Unlike rental agreements, finance leases often provide the lessee with the option to acquire the equipment at the end of the lease term. This arrangement can be particularly advantageous for companies looking to manage asset use without outright purchase.

-

A finance lease is essentially a loan for the use of equipment, where the lessee makes regular payments over a specified period.

-

Unlike operating leases which are short-term and do not typically offer ownership, finance leases provide options for purchase at the end of the term.

-

Benefits include improved cash flow management, tax benefits, and flexibility in acquiring high-value assets without large upfront costs.

What are the key components of the finance lease agreement?

Understanding the components of a finance lease is crucial for both lessors and lessees. A well-structured agreement should clearly outline rights, responsibilities, and the terms of use for the equipment involved.

-

This includes the lease duration, payment amounts, and details about warranties or maintenance responsibilities.

-

Including accurate names, addresses, and identifiers ensures that both parties are legally bound to the terms of the lease.

-

Exhibit A typically contains a description of the specific equipment covered under the lease, thereby avoiding any ambiguity.

How do fill out the finance lease of equipment form?

Completing the finance lease of equipment form requires careful attention to detail to avoid mistakes that could lead to legal issues. A correctly filled-out form sets the foundation for a successful lease.

-

Begin by entering the lessor and lessee information, followed by the details of the equipment and lease terms.

-

Double-check all entries for accuracy and ensure that all required fields are filled to avoid delays.

-

Be wary of forgetting to include signatures and dates, as these are critical for enforcing the lease agreement.

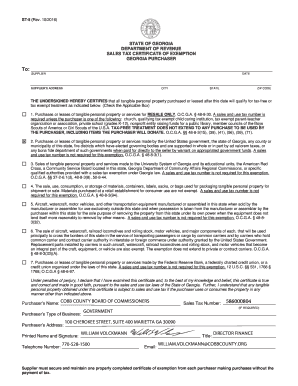

What should consider for legal compliance?

Navigating the legal landscape is essential when entering a finance lease. Understanding statutory requirements helps protect both parties' rights and ensures compliance with local and state regulations.

-

Different states have varying regulations, so it's imperative to consult local laws to ensure your lease is compliant.

-

Choosing the right equipment and reputable suppliers affects both the quality of the lease and potential legal outcomes.

-

Lessee rights should be clearly outlined to avoid misunderstandings and potential disputes down the line.

How can manage my finance lease agreement effectively?

Managing a finance lease agreement is vital to maximize its benefits. Adhering to best practices in document management ensures that all parties remain organized and informed.

-

Keep all documents unified in one place and utilize cloud storage solutions to ensure easy access.

-

Understanding whether you can assign or sublease equipment under your lease is crucial for future flexibility.

-

pdfFiller allows you to seamlessly edit, sign, and manage your lease documents from anywhere, providing a streamlined experience.

How to fill out the finance lease of equipment

-

1.Open the finance lease of equipment document in pdfFiller.

-

2.Begin with the 'Lessee' section by filling in your company name and address.

-

3.In the 'Lessor' section, enter the name and contact information of the leasing company.

-

4.Specify the 'Equipment' details by listing the type, model, and serial number.

-

5.Complete the 'Lease Term' section by indicating the start and end dates of the lease.

-

6.Fill in the 'Payment Terms' including monthly payment amount and payment due date.

-

7.Add any additional options, such as maintenance or insurance, as per your needs.

-

8.Review all entered information for accuracy.

-

9.Save the completed document and then download or print as required.

-

10.Sign the document at the designated signature lines.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.