Get the free Short Sale Affidavit of Seller template

Show details

In real estate, a short sale occurs when a bank or mortgage lender agrees to discount a loan balance due to an economic hardship on the part of the mortgagor (i.e., the seller). Circumstances determine

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

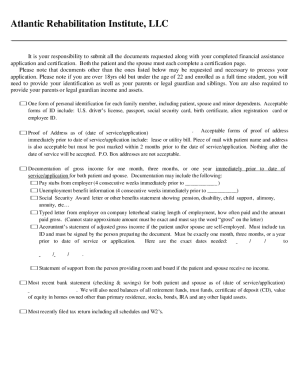

What is short sale affidavit of

A short sale affidavit is a legal document that verifies the seller's financial situation to facilitate the sale of a property for less than the amount owed on the mortgage.

pdfFiller scores top ratings on review platforms

I am very pleased with how easy it is to create impressive PDFs. PDFfiller offers all of the features that Adobe offers with acrobat - for about 1/2 the price.

The support team responded immediately when I had a problem (on a Sun night, I believe!) and the situation was resolved there and then. Impressive.

I love it. Now I can throw out my old typewriter. Sometimes I will like to tilt the pages a little bit.

i love this program, totally worth paying for it.

some of the forms could be easier to fill out

Used to use efax. I switched to PDF filler and love it. Affordability as well function. Good jo

make it easier to save and make changes on a form.

Who needs short sale affidavit of?

Explore how professionals across industries use pdfFiller.

How to fill out a short sale affidavit form

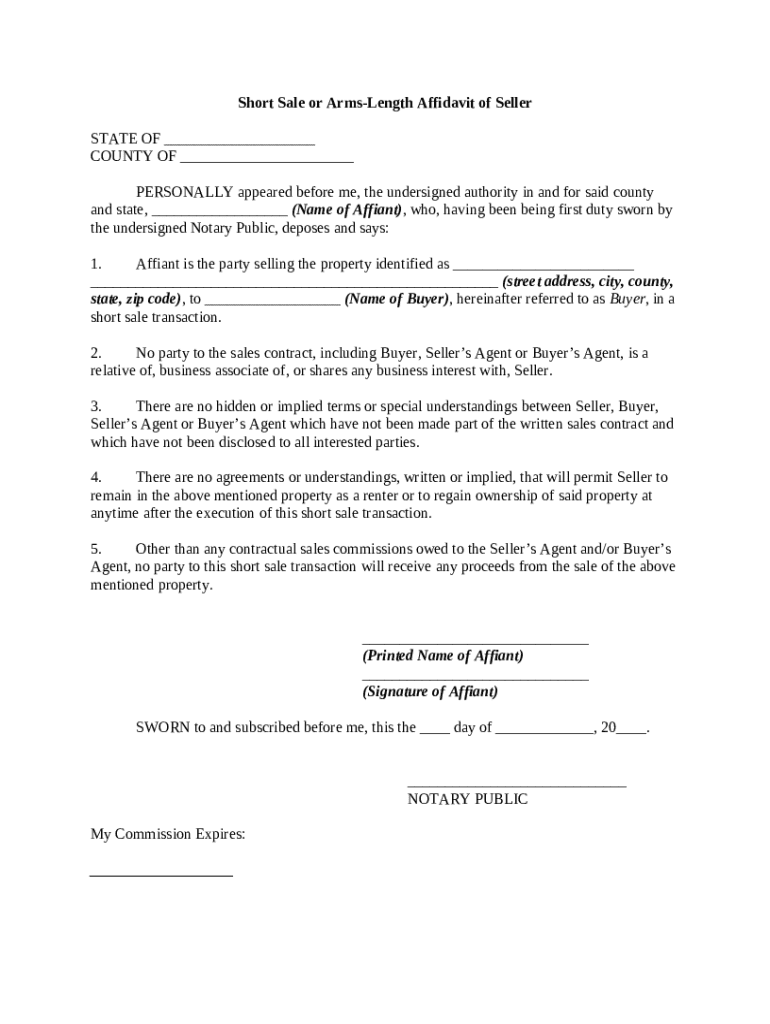

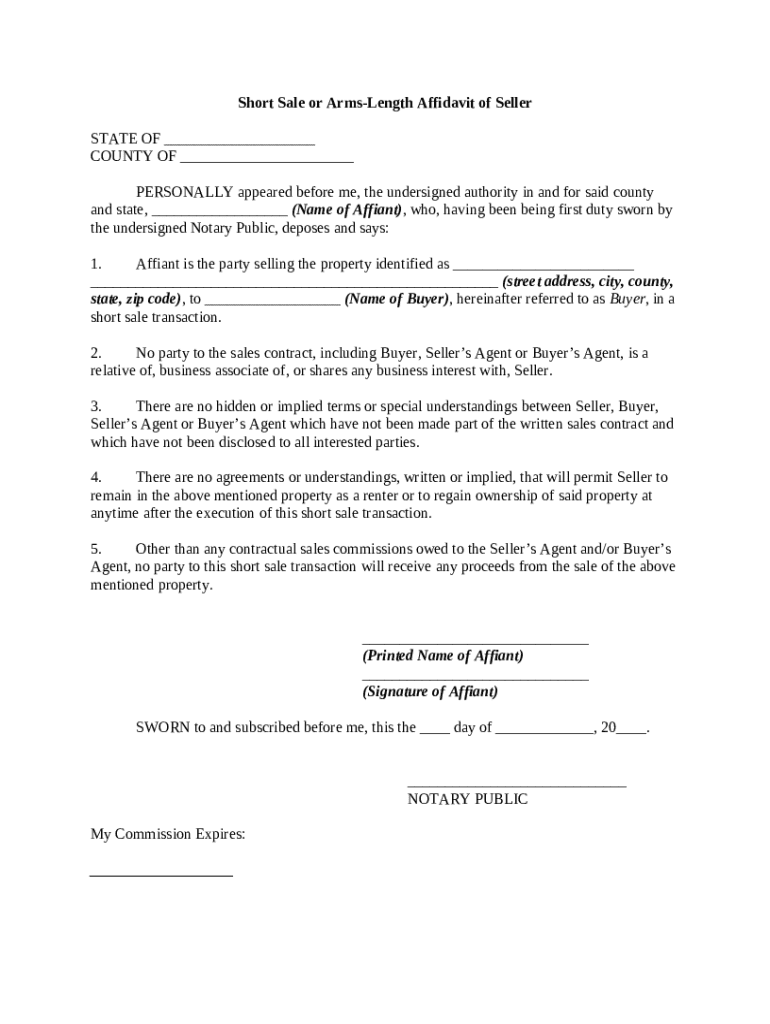

Understanding the Short Sale Affidavit of Seller

A short sale affidavit is a critical document in real estate transactions, specifically when a seller's property is under financial distress and the sale price is less than the amount owed on the mortgage. This affidavit confirms the seller's financial status and the necessity of conducting a short sale, helping to mitigate lender loss. Understanding its importance can help facilitate smoother transactions.

-

A short sale affidavit is a legal document that outlines the terms and conditions under which a short sale will occur, emphasizing disclosure of the seller's financial situation.

-

It provides lenders with assurance regarding the seller's financial difficulties and serves as a legal testament to the facts surrounding the sale, potentially expediting the process.

-

Failure to provide accurate information in the affidavit can lead to severe consequences, including charges of fraud or legal repercussions.

Key components of the short sale affidavit

No short sale affidavit is complete without several integral components that clearly articulate the involved parties' identities and circumstances. Collecting accurate information is essential to ensure compliance with legal requirements.

-

The affidavit must include the full legal name, contact details, and relationship of the affiant to the property and its transaction.

-

Essential details of the property, including the address, type, and any associated liens, must be disclosed for clarity.

-

The potential buyer's information, including name and contact details, should be accurately represented.

-

Statements regarding the affiant’s circumstances and the rationale for the short sale must be documented.

-

The short sale affidavit must be notarized to validate the affiant's identity and the accuracy of the information provided.

Process for filling out the short sale affidavit

Filling out a short sale affidavit can be a detailed process, but with clear step-by-step instructions, it becomes manageable. Here’s a guide to follow.

-

Begin by gathering necessary documents, such as bank statements and property details, before filling out the affidavit.

-

Watch for incomplete sections, inaccurate information or incorrect signatures, which can lead to delays or problems with the short sale.

-

Utilize pdfFiller's PDF editing tools to fill out the affidavit electronically, allowing for easy corrections.

-

After filling out the affidavit, you can use pdfFiller to eSign and share the document with relevant parties, enhancing collaboration.

State-specific variations of the affidavit

Different states may impose specific requirements on short sale affidavits, reflecting variations in legal standards and real estate practices. Familiarizing yourself with these differences is essential.

-

Each state has unique regulations that may affect the content and execution of the affidavit.

-

Understanding differences in disclosures and necessary supporting documents is crucial for compliance.

-

pdfFiller offers a range of templates and resources tailored to specific state requirements, ensuring compliance easily.

Understanding the role of notary public

A notary public fulfills a significant role in the short sale process by verifying the identity of the affiant and ensuring the affidavit's legality. Their involvement adds an extra layer of credibility.

-

A notary public is a state-appointed official authorized to witness the signing of legal documents and administer oaths.

-

Their primary role includes confirming the identities of signatories and ensuring documents are executed appropriately.

-

Users can connect with nearby notaries through pdfFiller’s resources, providing a seamless experience when finalizing the affidavit.

Avoiding common pitfalls in short sale transactions

Misunderstandings around affidavit terms can lead to complications during a short sale transaction. Recognizing common pitfalls can safeguard against potential issues.

-

Inaccuracies in understanding what each term means can lead to misrepresentation of facts, which could ultimately derail the transaction.

-

Failing to disclose relevant financial information can result in legal action from lenders or a higher risk of transaction failure.

-

By leveraging pdfFiller’s document management features, users can efficiently track and organize their affidavits and related transactions.

Finalizing the short sale affidavit

Finalizing the affidavit is a crucial last step that requires attention to detail. Ensuring everything is in order before submission will avoid delays.

-

Double-check all information and signatures before submitting the affidavit to minimize the chance of errors.

-

Be sure to file the affidavit with the appropriate local authorities to make it official and enforceable.

-

Keep an official copy of the completed affidavit for your own records, ensuring you have access to this document in the future.

How to fill out the short sale affidavit of

-

1.Download the short sale affidavit form from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by entering the property owner's full name in the designated field.

-

4.Provide the property address accurately, ensuring all details are correct.

-

5.Fill out the mortgage information, including the lender's name and loan number.

-

6.Detail the financial hardship that necessitates the short sale, clearly explaining the situation.

-

7.Include any other relevant information requested in the affidavit, such as income and expense details.

-

8.Review all entered information for accuracy and completeness before submitting.

-

9.Once satisfied, save the document and print it for signing if required by the lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.