Get the free Guaranty of Payment for Goods and Future Goods template

Show details

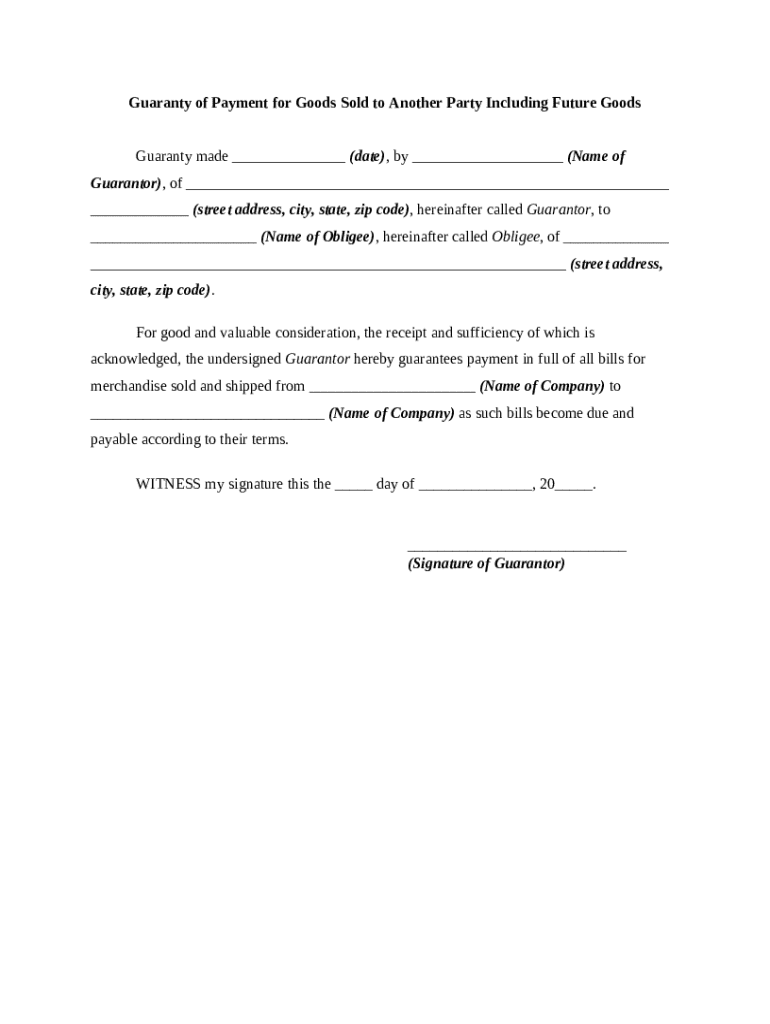

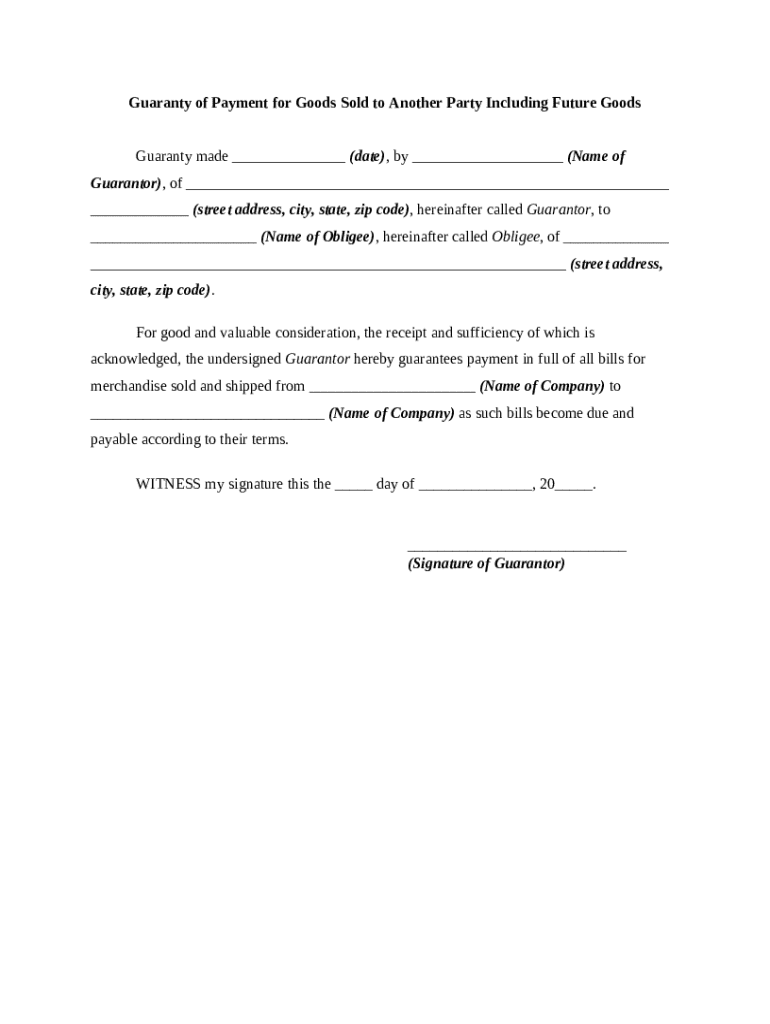

Guaranty of Payment for Goods Sold to Another Party Including Future Goods

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is guaranty of payment for

A guaranty of payment for is a formal agreement where one party agrees to pay a debt or fulfill an obligation on behalf of another if they default.

pdfFiller scores top ratings on review platforms

Very effective and resourceful program for completing documents legibly so reviewers may not have to strain or wonder about information communicated. It's vitally important for document reviewers ability to clearly understand all information communicated in order to make proper decisions. Within foregoing, PDF Filer enables users with ability to edit, save and electronically transmit documentation to wherever required. Inasmuch, the PDF Filer saves users valuable time and money.

Some of the fill ins didn't exactly fill in right, but this was my first time using PDF Filler, so maybe it is just part of the learning curve for me. Thanks.

IT SUPPLIED ME WITH THE FORMS I NEEDED AND COULD NOT FIND EASY AT OTHER SOURCES

GREAT TOOL, BUT A WORKSHOP WOULD HELP ME BE MORE EFFICENT

It was frustrating at first. Maybe if I used it more I could get used to it.

This comes in so handy for certain projects we do here at the office. I actually love it. Well worth the price! I would like to attend a webinar to learn more about the features and things I am probably missing out on.

Who needs guaranty of payment for?

Explore how professionals across industries use pdfFiller.

Guaranty of Payment for Form Form

How to fill out a guaranty of payment for form form

To fill out a guaranty of payment for form, ensure you accurately complete each section: include the agreement date, the names and addresses of both the guarantor and the obligee, a detailed description of the goods or services covered under the form, and the specific payment terms. Careful attention to these details will help avoid common pitfalls and ensure the guaranty is enforceable.

Understanding the guaranty of payment

A guaranty of payment is a legally binding agreement where one party, the guarantor, agrees to cover the financial obligations of another party if they default. Its primary purpose is to provide assurance to creditors that payment will be made, thus facilitating trust in financial transactions.

-

It establishes a legal duty to fulfill a payment obligation.

-

Helps secure transactions, enabling easier credit issuance.

-

Includes conditional guaranties, which can be voided under certain circumstances, and unconditional ones, which remain in effect regardless of the debtor's situation.

Key components of a guaranty agreement

A valid guaranty agreement must include several crucial elements to be enforceable. These components outline the responsibilities and expectations of the involved parties.

-

Establishes when the guaranty takes effect.

-

Identifies the individual or entity providing the guarantee.

-

Designates the party entitled to receive payment.

-

Specifies what obligations the guaranty covers.

-

Clearly outlines how and when the payment is to be made.

Understanding these elements is vital for creating a legally sound document.

How to fill out the guaranty of payment form

Completing the guaranty form requires careful attention to detail. Below is a step-by-step guide to ensure accuracy.

-

Use the correct format to avoid confusion.

-

Double-check spelling and details to prevent any legal complications.

-

Clearly include both parties to avoid ambiguity.

-

Use precise language to delineate payment expectations.

To minimize common mistakes, consider utilizing pdfFiller’s editing tools for real-time corrections as you complete the form.

Legal requirements and considerations

Creating a guaranty of payment involves adhering to legal implications, which vary regionally. Understanding these regulations is crucial.

-

Non-compliance could result in unenforceability of the guaranty.

-

Be aware of local laws that could impact your agreement's validity.

-

Maintain clear records and comply with legal norms for signing and documentation.

Using pdfFiller to manage your guaranty documents

pdfFiller simplifies the process of creating, editing, and signing your guaranty forms. It provides numerous features to enhance your experience.

-

You can easily design and modify guaranty forms with intuitive tools.

-

Facilitate quick signing processes, ensuring timely execution.

-

Allow multiple users to work on the document concurrently.

-

Ensure your completed documents are shared safely with authorized parties.

Integrating guaranty of payment with business operations

Businesses often use guaranties to enhance creditworthiness, attracting more favorable terms from lenders.

-

A guaranty can signal reliability to creditors and investors.

-

Guaranties can offer a layer of security when negotiating investments.

-

Companies across various sectors have leveraged guaranties to foster trust and secure funding.

Insights on recent developments in guaranty law

Staying informed about recent changes in guaranty law is essential for individuals and businesses alike.

-

Legislative updates can shift the landscape of guaranty agreements.

-

Adjustments in laws can alter the obligations for both guarantors and obligees.

-

Understanding these trends is key to leveraging guaranties effectively.

How to fill out the guaranty of payment for

-

1.Open the PDFfiller website and log into your account.

-

2.Select the 'Create New' button and upload the blank guaranty of payment form.

-

3.Use the editing tools to add text boxes and fields where necessary. Start by entering the date at the top of the form.

-

4.Fill in the names and addresses of both the guarantor and the debtor in the corresponding sections.

-

5.Clearly state the amount of the debt that is being guaranteed, ensuring accuracy.

-

6.Include any conditions or terms relevant to the guaranty, such as payment timelines or notices of default.

-

7.Review the document for completeness and accuracy, ensuring all parties' information is included.

-

8.Once satisfied, save your changes and download the completed document.

-

9.If needed, use the 'Send' option to share the document electronically with the parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.