Get the free Escrow Check Receipt for Real Estate Sale template

Show details

An escrow agreement involves the deposit of a written instrument or something of value (like funds from a check) with a third person (the escrow agent) with instructions to deliver it to another party

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is escrow check receipt for

An escrow check receipt is a document that acknowledges the receipt of funds held in escrow, typically for a real estate transaction.

pdfFiller scores top ratings on review platforms

This is my first experience with PDFfiller.

Great for completing forms - no more typewriter. This is so much easier than trying to line up, even using the Text feature in PDF.

Very convenient. Love the personalized signature option!

On the first day of use, I thought I had lost all the data I entered. I received help via a chat and verified my data was intact. This is going to be an extremely useful product for me as a consultant.

It is easy once that you get to it from your computer location...Microsoft word etc.

Went well once I learned the routine. The "marker" for typing is a bit clumsy at first and took a few trial and errors. Good site overal

Who needs escrow check receipt for?

Explore how professionals across industries use pdfFiller.

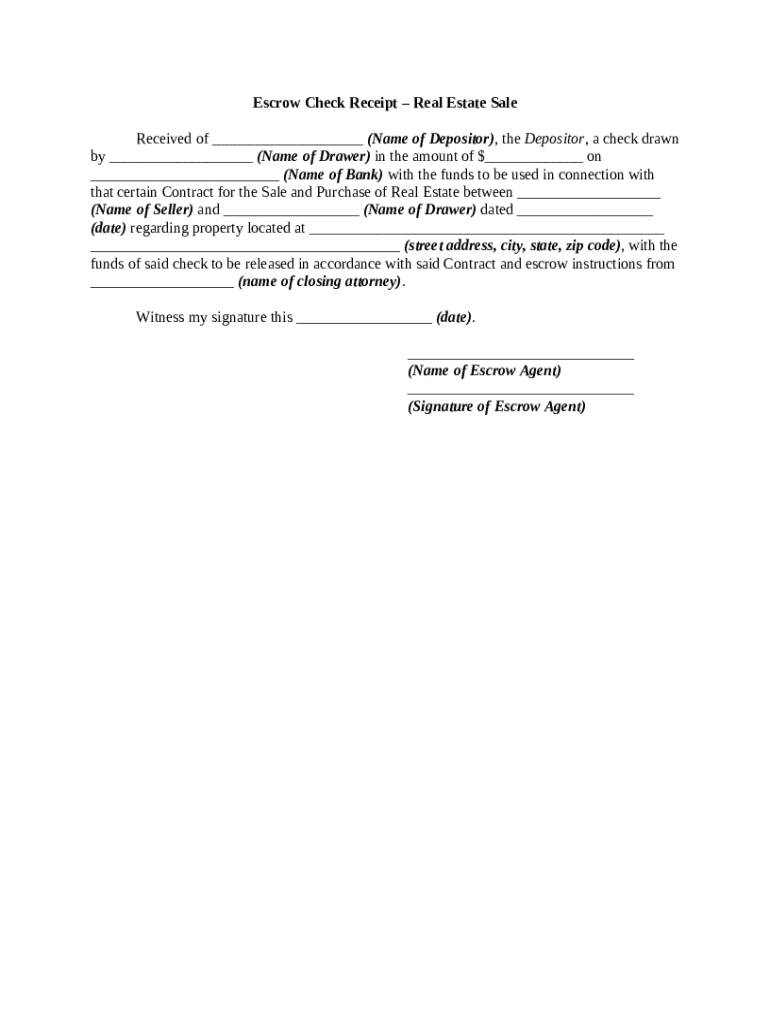

How to fill out an escrow check receipt for form form

What is an escrow check receipt and why is it important?

An escrow check receipt is a critical document in real estate transactions, serving as proof that funds have been deposited into an escrow account. This document is essential for maintaining transparency and trust among parties involved in the transaction, ensuring that the funds are handled securely until all conditions of the sale are met.

-

An escrow check receipt acts as confirmation that a deposit has been made.

-

It protects both the buyer and seller during the real estate transaction.

Where are escrow check receipts commonly utilized?

You will often encounter escrow check receipts during real estate purchases, lease agreements requiring security deposits, or even when funds are held for business transactions. In each case, this receipt formalizes the agreement between the parties involved.

-

Deposits for homes or commercial properties.

-

For rentals where the landlord requires an upfront assurance.

-

Holding funds for contractual agreements.

What are the key components of an escrow check receipt?

When creating an escrow check receipt, including specific details can make the document more effective. Key components include the names of the depositor and drawer, the amount of the check, relevant bank information, and specific escrow instructions.

-

Indicates who is making the deposit and their details.

-

Identifies the individual or entity issuing the check.

-

Clearly states the amount being deposited.

-

Connects the receipt to a particular real estate agreement.

-

Outlines how and when the funds will be released.

How to fill out the escrow check receipt form?

Filling out an escrow check receipt is straightforward if you follow a structured approach. Gather all necessary information, ensure accuracy when filling each field, and double-check before final submission. Being thorough can help avoid common mistakes.

-

Create a checklist of all details needed for the receipt.

-

Complete each section with the required information accurately.

-

Always review the receipt for errors or missing information.

How to edit and manage your escrow check receipt using pdfFiller?

pdfFiller provides an easy-to-use platform for editing and managing your escrow check receipt. You can access your documents from anywhere and utilize collaboration features to share them with relevant parties, such as your closing attorney.

-

Learn to edit and digitally sign documents online.

-

Access your receipt from any internet-enabled device.

-

Share documents with stakeholders easily for smooth transactions.

What are the compliance requirements for escrow check receipts?

Understanding the legal considerations and best practices for handling escrow check receipts is crucial. Accuracy is vital to ensure compliance with local laws and regulations, preventing potential disputes or delays.

-

Different regions may have specific laws regarding escrow transactions.

-

Implement secure handling and processing of receipts.

-

Avoiding oversights can ensure smoother transactions.

Can you provide examples of real-life applications of escrow check receipts?

By examining case studies and variations by region, we can see the tangible impact of properly managed escrow check receipts on real estate transactions. A well-managed receipt can streamline transactions and lead to successful outcomes.

-

Successful transactions that highlight the effectiveness of using escrow checks.

-

Understand how variations exist by industry and region.

-

Demonstrates the importance of maintaining proper documentation.

How to fill out the escrow check receipt for

-

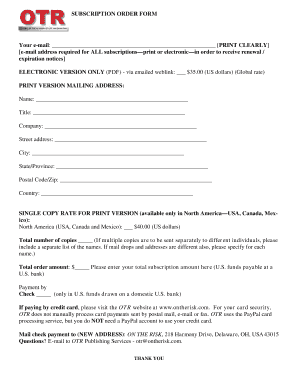

1.Open the PDF file of the escrow check receipt template.

-

2.Enter the date at the top of the document to indicate when the receipt is being issued.

-

3.Fill in the name of the buyer and seller in the designated fields.

-

4.Input the escrow account number associated with the transaction.

-

5.List the amount of the check received in the appropriate section, ensuring it is accurate.

-

6.Fill in the check number and the name of the bank from which the check was issued.

-

7.Include any relevant transaction details that clarify the purpose of the escrow check.

-

8.Review the filled-out information to confirm accuracy and completeness.

-

9.Save the document and print it if necessary for distribution to relevant parties.

-

10.Distribute the receipt to the buyer, seller, and other involved parties as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.