Get the free Accredited Investor Representation Letter template

Show details

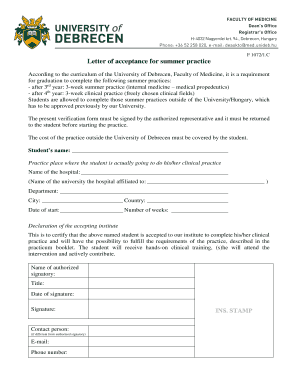

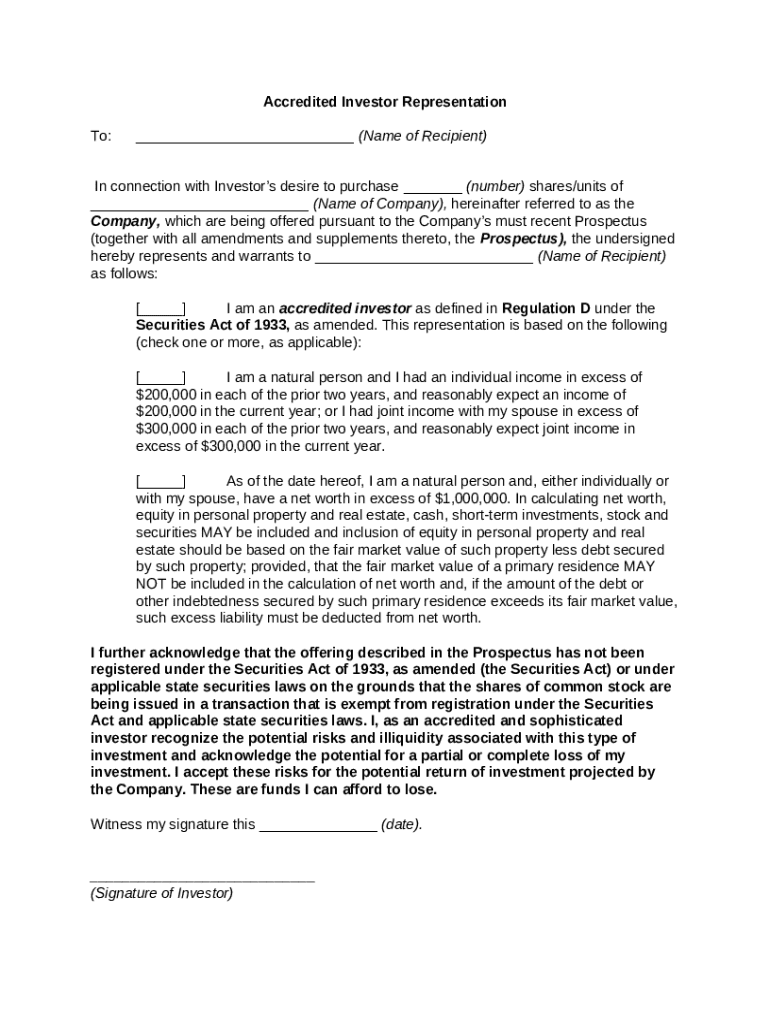

An accredited investor representation letter for a Rule 506(c) offering designed to help the issuer satisfy the requirement that it take reasonable steps to verify that each purchaser is an accredited

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is accredited investor representation letter

An accredited investor representation letter is a document confirming an individual's or entity's status as an accredited investor, typically required for compliance in investment opportunities.

pdfFiller scores top ratings on review platforms

pdf filler is filling to my needs i…

pdf filler is filling to my needs i love the site and program

PDF Filller Frendly Support Person

I had Anna, as a PDF friendly support person and she was extremely helpful. I had issues with the account and she was eager to fix it and then I had issues with the form and the same excellent response. She was not only knowledgeable, but fast and very, very helpful. She used many ways to explain the issued including screen shot. Thank you Anna.Carolina

Excellent

Excellent. I would recommend. It is easy to use.

works great a little confusing on set…

works great a little confusing on set up but works as indicated.

The truth is very friendly and easy to…

The truth is very friendly and easy to use

Meralis Acevedo

Meralis AcevedoI was able to find the form I needed. The only thing is that it was a little difficult figuring out how to use all the features it has. How to modify the text was not something I was able to do through erasing. Maybe using PDFfiller more often will help me maneuver the site with time.

Who needs accredited investor representation letter?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Accredited Investor Representation Letter Form

What is the accredited investor representation letter?

An accredited investor representation letter is a crucial document that certifies an investor's eligibility to participate in private securities offerings. It helps to assure the issuer of the securities that the investor meets the financial thresholds set under Regulation D of the Securities Act. Without this letter, investors may not be permitted to access certain investment opportunities.

Why is the letter important in securities offerings?

This letter plays a vital role in protecting both the issuer and the investor. It ensures compliance with regulatory requirements and mitigates risks associated with unqualified investors. By confirming their accredited status, investors can gain access to exclusive investment opportunities typically reserved for wealthier, more sophisticated investors.

Key terms associated with accredited investors

-

An individual or entity that meets specific financial criteria as defined by the SEC, allowing them to invest in private securities.

-

A regulation that provides exemptions allowing companies to offer and sell securities without having to register with the SEC.

-

The process through which an organization sells its securities to investors, often through a private placement.

Analyzing the form structure

The accredited investor representation letter form is structured to capture essential information. Each section holds specific relevance and plays a crucial role in verifying and documenting the investor's status.

-

Indicates the person or entity to whom the letter is addressed.

-

Details the specific number of shares or units the investor wishes to purchase.

-

Provides information about the company whose securities are being offered.

-

Requests information to verify the investor's income levels.

-

Outlines how the investor should calculate their net worth.

-

Confirms that the investor understands the regulatory exemptions applicable.

How to complete the accredited investor representation letter form?

Filling out the form correctly is essential for ensuring compliance and facilitating smooth transactions. Here’s a simple step-by-step guide.

-

Ensure that you provide the correct name to prevent miscommunication.

-

Clearly state how many shares or units you wish to acquire.

-

Provide accurate information about the company related to the investment.

-

Include the relevant income figures that reflect your accredited status.

-

Detail your net worth, including what counts and what does not.

-

Understand and confirm awareness of the relevant securities laws.

Common pitfalls to avoid when filing

Filing the representation letter can come with its own set of challenges. Avoiding these common mistakes can streamline the process.

-

Make sure all income is properly stated to avoid delays.

-

Ensure that property valuations are accurate to reflect true net worth.

-

Research and clarify any exemptions that may apply under local laws.

How to manage your representation letter effectively?

There are various tools available to ensure that your accredited investor representation letter is not only completed but also managed securely.

-

Edit and share your documents seamlessly using pdfFiller tools.

-

Ensure your letter is signed electronically and securely.

-

Use shared access features for efficient teamwork.

What legal considerations should you be aware of?

Navigating the legal landscape when preparing the representation letter is crucial to compliance and investor protection.

-

Ensure that you are aware of the laws and provisions included under Regulation D.

-

Keep your paperwork aligned with legal requirements in your jurisdiction.

-

Be aware of how securities laws impact your investment opportunities.

How to ensure a successful final review and submission?

Before submitting your accredited investor representation letter, taking the time for a thorough review is essential.

-

Carefully check all details for accuracy and completeness.

-

Make sure the letter is sent to the designated party.

-

Follow up on your submission to ensure it has been received.

How to fill out the accredited investor representation letter

-

1.Begin by opening the accredited investor representation letter template on pdfFiller.

-

2.Enter your personal information in the designated fields, including your name, address, and contact information.

-

3.Specify whether you are an individual or an entity; if an entity, provide the legal name and type of entity.

-

4.Indicate your net worth and income details in the appropriate sections, ensuring accuracy to meet accredited investor criteria.

-

5.Review the definitions of an accredited investor provided in the document for clarity.

-

6.Sign and date the letter electronically using pdfFiller’s signature tools.

-

7.Double-check all entered information for completeness and correctness.

-

8.Save the completed document in your preferred format or directly print it from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.