Get the free Rule 144 Seller's Representation Letter Non-Affiliate template

Show details

When you acquire restricted securities or hold control securities, you must find an exemption from the SEC's registration requirements to sell them in a public marketplace. Rule 144 allows public

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is rule 144 sellers representation

Rule 144 sellers representation is a legal document that verifies compliance with the conditions of the SEC's Rule 144 for selling restricted securities.

pdfFiller scores top ratings on review platforms

I was so glad I was able to retype an updated letter, which I couldn't do trying other software.

Nice very easy to navigate but a little expensive

I found this by accident trying to find a 1500 free medical form but wasn't looking forward to filling it out by hand. We are a dental office just starting to use medical coding for new procedures. Plus I'd like to put our new patient forms on our website for patients to fill in electronically! Thank you!

I used several similar services before but, when I found PDFfiller it was about time and it is the best choice ever.

Very easy to use and had all the forms I needed

The experience before I purchased a license was not so good. The chat session I was on kept ending. The CSR said because I was not logged into an account was the reason. At that point, I was trying to determine if I even wanted to purchase PDFfiller or not so why would I need an account. I finally ended up purchasing the product.

Who needs rule 144 sellers representation?

Explore how professionals across industries use pdfFiller.

How to fill out a rule 144 sellers representation form form

What is Rule 144?

Rule 144 is a regulation established by the SEC that governs the sale of restricted and control securities in the United States. This rule is significant for ensuring that sellers comply with necessary provisions and requirements, thus maintaining market integrity and investor protection. It delineates the conditions under which parties may sell various security forms, distinguishing the obligations for affiliates—who may influence management decisions—versus non-affiliates.

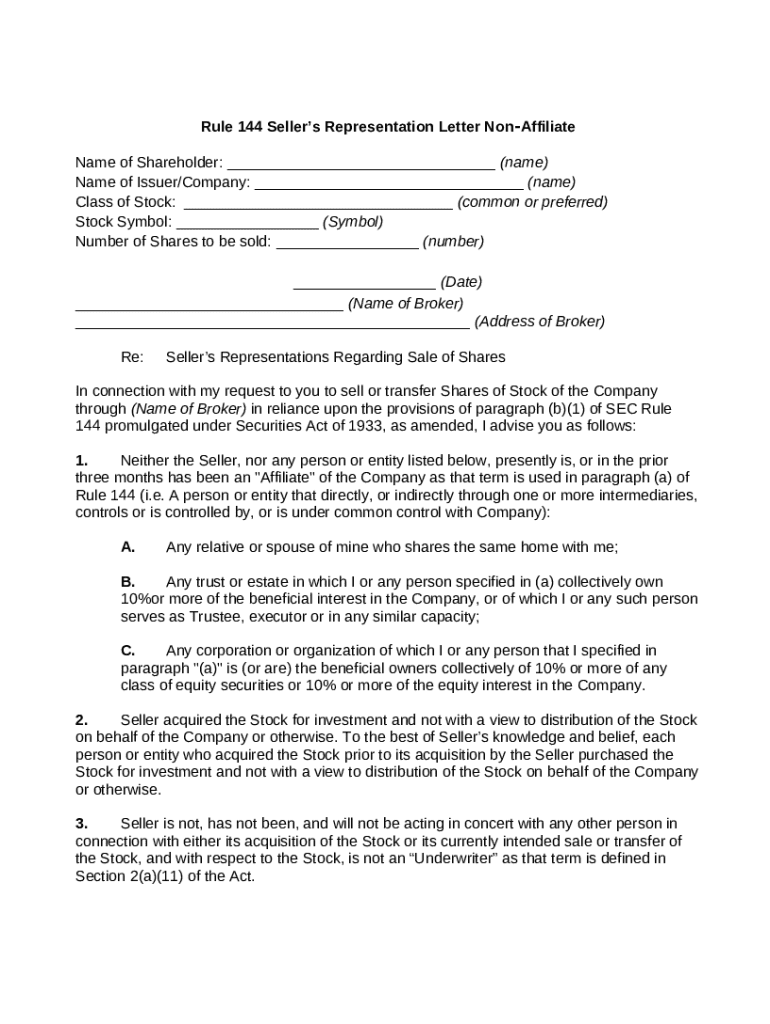

What are the components of the Seller's Representation Letter?

A Seller's Representation Letter is critical for compliance with Rule 144, comprising essential fields that must be accurately filled. Each field serves a specific purpose, ensuring transparency and legality in securities transactions.

-

The individual or entity selling the securities, requiring accurate identification.

-

The company whose stock is being sold, helping to clarify the specifics of the security.

-

This identifies the type of shares owned, which may have different rights and restrictions.

Filling out these fields with precise information is vital, as inaccuracies can lead to compliance issues and transaction delays.

How do you complete the Seller's Representation Form?

Completing the Seller's Representation Form can be straightforward if you follow a structured approach. Each section requires specific information that conveys relevant details about the seller and the transaction.

-

Begin with the Shareholder's Name and Issuer information, crucial for proper identification.

-

Indicate the Class of Stock and Stock Symbol, which identifies the type and trading symbol of the shares.

-

Detail the Number of Shares to be sold and the Date of the transaction, ensuring clarity in the selling terms.

-

Provide the Name and Address of the Broker handling the sale, facilitating communication with involved parties.

It's essential to emphasize your representations regarding any affiliations with the issuer to avoid legal complications.

What legal and compliance considerations are involved?

The Seller's representations contain significant legal implications, especially in terms of individual accountability and compliance with Rule 144. Non-affiliates, for instance, enjoy streamlined processes but must still comply with specific regulatory requirements to validate their eligibility for selling.

-

Accurate representations are necessary to avoid penalties and protect against legal claims.

-

Non-affiliates have fewer restrictions but must ensure their selling practices adhere to all relevant rules.

-

Any inaccuracies or misrepresentations can lead to serious repercussions, including fines or disqualification from future transactions.

How can pdfFiller assist with document management?

pdfFiller provides an accessible platform for editing and managing the Seller's Representation Form. Its features simplify the document handling process, making tasks like eSigning seamless and enhancing collaboration among teams.

-

Users can easily upload and edit the form to ensure accuracy before submission.

-

The platform enables secure electronic signatures, streamlining approval processes.

-

Multiple users can work on the document simultaneously, enhancing productivity and reducing errors.

Following easy steps to upload, fill, edit, and send the form via pdfFiller will enhance the overall document management experience.

What common mistakes should be avoided?

Many individuals encounter pitfalls when filling out the Seller's Representation Letter, leading to unnecessary complications. Recognizing these common mistakes can ensure smoother transactions.

-

Incorrect naming of the shareholder or issuer can invalidate the form and delay the transaction.

-

Failing to include critical information such as stock details or transaction specifics can lead to compliance issues.

-

Consulting with a legal professional for complex situations is advisable to ensure all possibilities are covered.

Double-checking entries before submission will help mitigate errors and improve your compliance with Rule 144.

How to fill out the rule 144 sellers representation

-

1.Access the PDF document for Rule 144 Sellers Representation through pdfFiller.

-

2.Begin by entering your name and contact information in the designated fields detailed at the top of the document.

-

3.Next, clearly state the number of shares or amount of securities you are planning to sell.

-

4.Proceed to fill in the details regarding the issuer of the securities, including the name and current address.

-

5.You must then provide information about when the securities were acquired, specifying the date of purchase and the acquisition details.

-

6.If applicable, include any additional information regarding the nature of the securities or any agreements related to the sale.

-

7.Sign and date the document at the bottom, confirming that all information provided is accurate to the best of your knowledge.

-

8.Finally, review the document for any errors or omissions before submitting it to the appropriate parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.