Get the free Employee Lending Agreement template

Show details

Employee lending has become a standard practice in many industries. It lets the Temporary Employer use Employees at will without having hiring, firing, and reporting requirements associated with

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is employee lending agreement

An employee lending agreement is a legal document outlining the terms under which an employee may borrow money or assets from their employer.

pdfFiller scores top ratings on review platforms

Keep it UP

FAIRLY EASY....NOT SURE I KNOW ALL THE CAPABILITIES AFTER 2 DOCUMENTS.

SPACING OF CHARACTERS IS SOMETIME TOO WIDE

good

the experience was mostly good, however, when coming from a google doc and putting the document here to convert into a pdf, the drop down tabs that were originally in the google doc did not work- in that way, it was tedious.

duplicate pages

I like being able to duplicate pages, that was super helpful. It was easy to add the text boxes where I needed them. The only trouble is in downloading the document to my regular google drive. Wish that was more straight forward.

I am not 100% satisfied reason being the…

I am not 100% satsfied reason being the whole document is not turning into Word, I want turn the whole document in word edit, retype as a word document and have it resaved

it as word document.

Who needs employee lending agreement template?

Explore how professionals across industries use pdfFiller.

Employee Lending Agreement Form - pdfFiller

How does an employee lending agreement function?

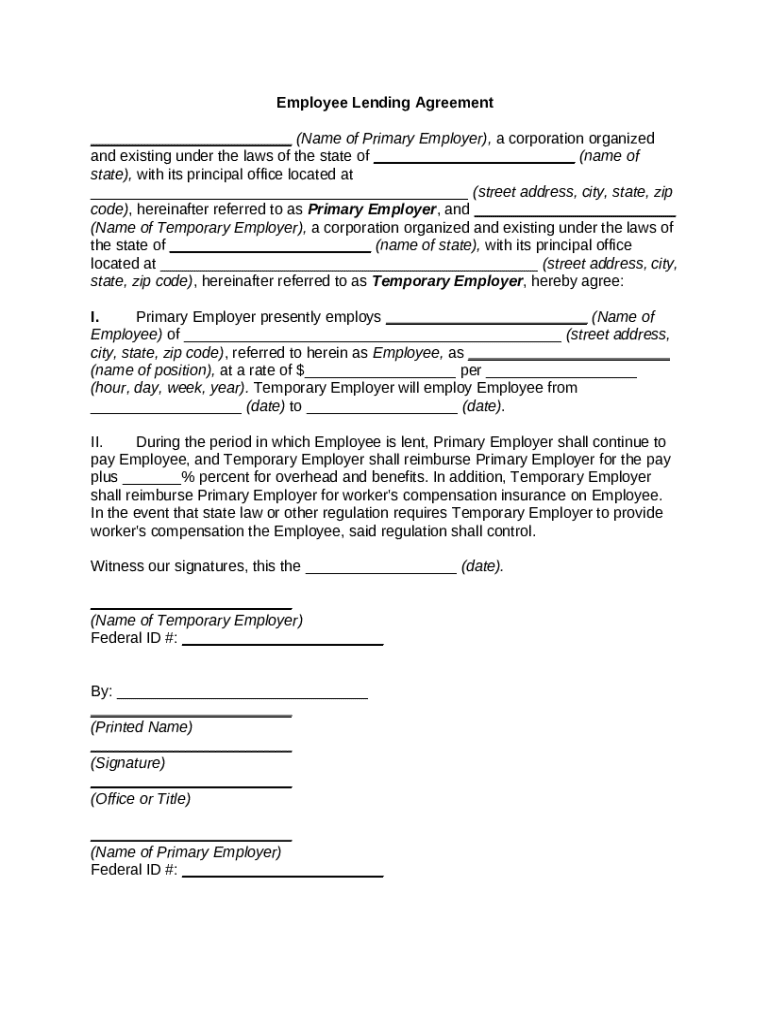

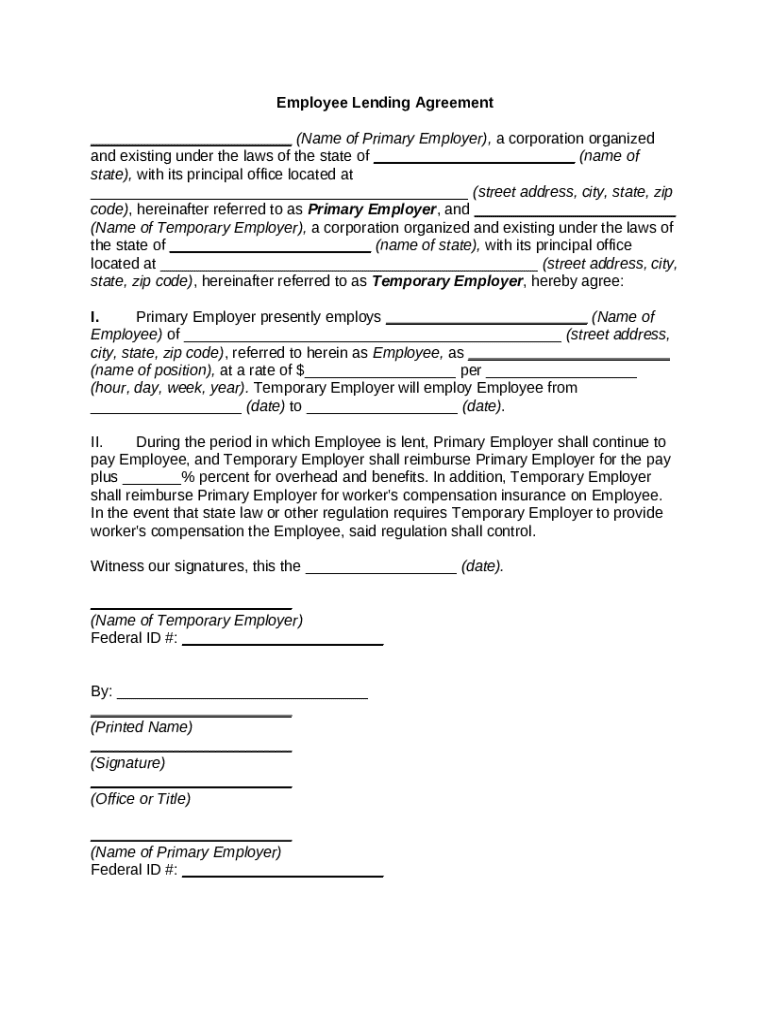

An employee lending agreement is a legal document that outlines the terms under which an employee temporarily works for a different employer (temporary employer) while still being officially employed by their primary employer. This arrangement can help organizations manage workforce needs without the complexities of formal layoffs or rehires. Understanding the intricacies of this form is crucial for both employers and employees.

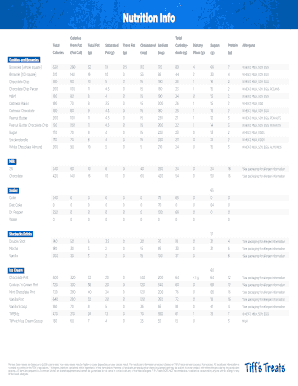

What are the key components of an employee lending agreement?

-

Identification of Parties Involved: Clearly states the primary employer and temporary employer.

-

Detailed Employee Information: Includes necessary details such as employee’s name, address, position, and salary.

-

Effective Dates of Loan Employment: Specifies the period during which the employee will work for the temporary employer.

-

Reimbursement Terms and Conditions: Outlines how and when the employee will be compensated.

-

Compliance with Worker’s Compensation Requirements: Ensures adherence to relevant worker's compensation laws and regulations.

How can you create an employee lending agreement?

Creating an employee lending agreement involves clear and precise steps. Begin by understanding the unique needs of your employee, ensuring both parties agree on the lending process. Establish the lending rate while accounting for overhead costs before drafting the agreement. Finally, finalize the document with signatures from both employers and the employee.

What are the pros and cons of lending to employees?

-

Increased employee loyalty and flexibility can lead to better morale and productivity within the organization.

-

However, there are risks such as potential defaults on loans and the possibility of employee discontent if terms are not clear.

How do you fill out the employee lending agreement form?

When using pdfFiller for this purpose, you can take advantage of interactive tools available for customizing your agreement. The platform allows easy eSigning and collaboration with all stakeholders involved, ensuring a seamless document creation experience. These features make managing your employee lending agreements more efficient.

What common mistakes should you avoid when drafting an employee lending agreement?

-

Leaving important fields blank can lead to legal complications and misunderstandings.

-

Not complying with state regulations can put both the employee and employer at risk of penalties.

-

Failing to clearly define terms may result in disputes between the parties involved.

What are the local compliance regulations for employee lending?

Each state has its specific regulations regarding employee loans, and it's essential to understand these before drafting an agreement. This includes compliance with worker’s compensation obligations and consulting legal requirements set by the ADA. Ensuring adherence can protect companies from legal repercussions.

How to fill out the employee lending agreement template

-

1.Open pdfFiller and upload the employee lending agreement template.

-

2.Begin by filling in the company name and address at the top of the document.

-

3.Enter the employee's full name and contact information in the designated fields.

-

4.Specify the loan amount being provided to the employee and the purpose of the loan.

-

5.Outline the repayment terms, including the repayment schedule and any interest rates.

-

6.Include any additional stipulations, such as consequences for non-repayment or conditions under which the loan may be forgiven.

-

7.Review all entries for accuracy and clarity before finalizing the document.

-

8.Use pdfFiller’s tools to add digital signatures from both parties to validate the agreement.

-

9.Once completed, save the document and share it with concerned parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.